Luke Lango is one of the leading tech investing experts on the planet, and his latest presentation is dropping jaws all over the internet. My Innovation Investor review will introduce you to Lango’s latest message and explain why it could be one of the biggest tech investment opportunities ever.

What Is Innovation Investor?

What Is Innovation Investor?

Luke Lango’s Innovation Investor is a research service and monthly newsletter published by InvestorPlace that features Lango’s latest research, analysis, and stock picks.

The research service targets innovative tech companies at the earliest phases of their growth, so each stock pick has enormous upside potential.

Lango’s approach offers members the best possible chance at massive growth. Some of his stock picks have come from industries such as blockchain, self-driving cars, and even quantum computing.

The service’s investment strategy ranges from moderate to aggressive on the risk-reward spectrum, and it primarily focuses on mid to large-cap stocks, although he sometimes recommends small-cap stocks as well.

Innovation Investor is one of the most successful research services for tech stocks on the market, and its success is largely due to Lango’s keen eye for growth opportunities and stock-picking prowess.

Who Is Luke Lango?

Luke Lango is a growth-focused equities investor with a long track record of winning stock picks, and he’s the lead editor for Innovation Investor.

Currently, he works as a senior investment analyst with InvestorPlace, one of America’s most respected investment research firms and the publisher of his Innovation Investor newsletter.

Luke Lango is best known for his legendary ability to hone in on game-changing growth stocks and super trends, and he has earned huge praise from his followers over the years.

He developed a vast network of Silicon Valley contacts over his years as a tech analyst, and he has virtually unmatched insights into many tech-focused growth stocks as a result.

>> Access Luke Lango’s latest research HERE <<

Is Luke Lango Legit?

Lango Lango has a deep understanding of the factors that move markets, and his knack for spotting trends has made him a market legend.

There’s no disputing that Luke Lango is legit. His background in tech startups offers him a unique perspective in the industry compared to many of his peers.

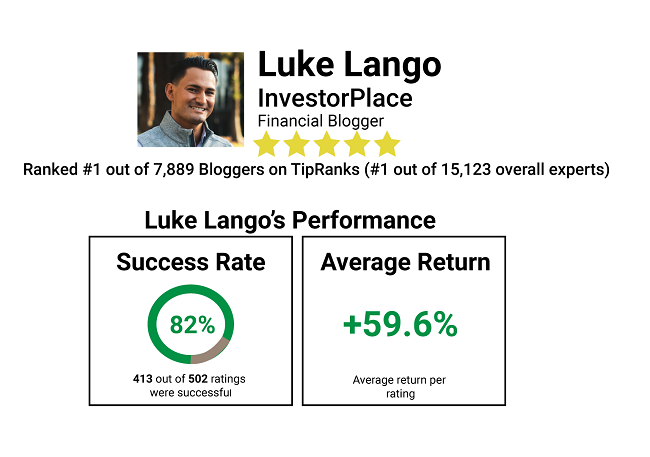

In 2020, TipRanks, a community of more than 15,000 investing experts, named Luke as its “#1 Stock Picker” for the year, cementing his status as a leading growth stocks guru.

As mentioned, he picked many breakout opportunities—including AMD, Shopify, and Tesla—well before the broader market caught on1.

Luke Lango is a smart analyst with a finger on the pulse of the market, and he has everything I look for in a guru.

He has an impressive, analytical mind and a penchant for picking winners, so you know you’re in great hands if you decide to get started with Innovation Investor.

Luke Lango’s Innovation Investor Presents: xAI

Lango currently has his sights set on what he calls Elon Musk’s ChatGPT, which he believes has the fastest innovation rate of any internet company in history.

It could surpass the huge gains brought in by Google, Facebook, or even Amazon during their rise

Some of the biggest names in the investing world are getting behind this privately held project, but the public wouldn’t normally be able to get a piece of this opportunity.

Fortunately, Luke’s identified a promising, publicly trading investment opportunity that could give you direct exposure to Elon’s revolutionary technical innovations.

Next, I’ll get you caught up on what Luke Lango had to say in his latest presentation and show you why this stock could be the best way to tap into the explosive potential behind “the everything app.”

>> Access Lango’s xAI research here <<

Elon Musk’s ChatGPT

Most people thought Musk was crazy when he bought Twitter in 2022. Jaws dropped further when he laid off 80% of the staff and changed the company’s name to X.

However, Elon had big plans for the struggling social media app when he acquired it, and he’s been quietly transforming the company ever since.

Musk’s grand vision is an “everything app”2 that would completely revolutionize the industry by creating an all-in-one source for news, social media, payment processing, and much more.

Why Is “The Everything App” a Game-Changer?

In China, an app like this already exists. Tencent’s WeChat has more than one billion users, and the app is a crucial part of day-to-day life for most people living in China.

If X could capture a similar user base as WeChat, it could experience explosive growth from its current valuation and see its daily active user counts skyrocket.

Elon is quietly working towards this goal behind the scenes. The X app has already acquired licenses to facilitate money transfers in 18 states3, and national approval could be coming soon.

If Elon’s successful, it would be the first all-in-one app like China’s WeChat to become available to the American market, and it could also see a tremendous influx of users from many global markets as well.

Skyrocketing users could allow for bigger audiences, increased ad revenue, additional opportunities for cash flow—like transaction fees on payment processing—and much more.

The Best Way to Play xAI

X is still a private company right now, meaning you can’t invest directly through the public market. However, Luke Lango has discovered a compelling option for gaining exposure to X’s growth.

Elon’s xAI requires sophisticated chips capable of powering AI operations, and Lango believes he’s identified a company that has an excellent chance of becoming X’s top chip supplier.

This company has already been supplying Musk with, as Lango describes it, “a key piece of AI technology that makes self-driving cars possible.”4

Lango believes this smaller company could have superior growth potential compared to other more established options, like NVIDIA. To back up his claim, he points to several examples:

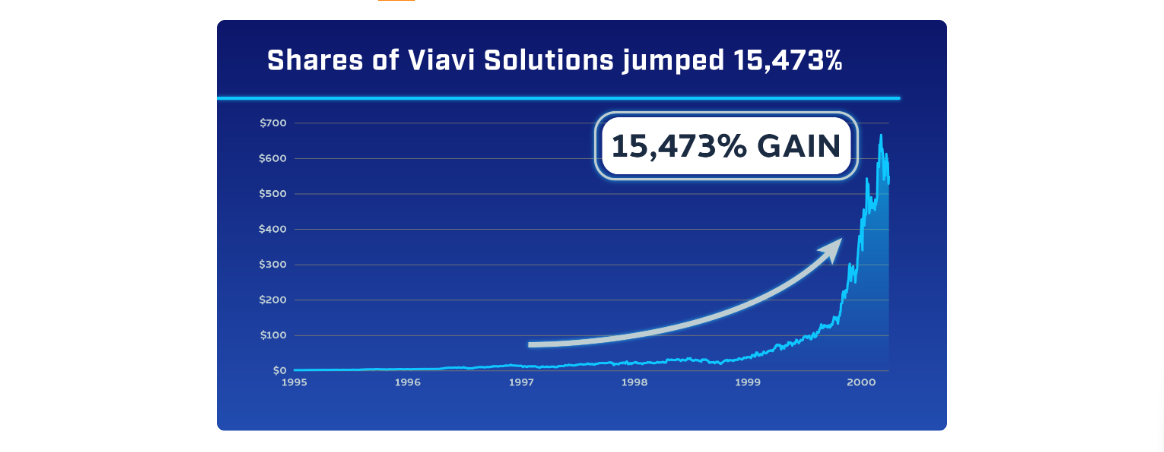

A tiny stock called Viavi Solutions outperformed IT industry giant IBM by a 26-to-1 ratio during the 1990s internet boom.

This is just one of many examples cited in the presentation, but I think you get the point.

The growth prospects for this tiny company could be much greater than what any of the more prominent AI chip stocks have to offer at this point.

Lango is making all his research into this promising stock and other AI opportunities available to members of his Innovation Investor research service.

Right now, he’s offering a special bundle deal to raise awareness about this promising opportunity. Here’s what you get when you join:

>> Cash in on the “everything app” revolution—sign up today! <<

Innovation Investor Review: What Comes With the xAI Deal?

The latest Innovation Investor deal includes a treasure trove of in-depth research, stock picks, and more.

Innovation Investor Monthly Newsletter

The monthly Innovation Investor newsletter is your direct line to the latest research, trade ideas, and stock picks from Luke Lango.

Each issue includes new research from Luke Lango and his team, along with expert analysis of the latest market conditions, and other valuable insights.

Best of all, the newsletter keeps you supplied with a steady stream of promising stock picks, so you’ll always have new opportunities to explore.

I was given access to Luke’s service as part of my research process for this Innovation Investor review, and I have to admit I was pretty impressed with his research and analysis.

You’ll get a new stock pick in every special report, plus Lango’s analysis of the latest stock market moves and trends.

You’ll also get daily notes giving you an update on the markets.

I found Luke’s macro analysis to be particularly valuable, so I recommend you don’t overlook this valuable aspect of the service. The stock picks are great too, but Luke’s insights can help you navigate the market’s ups and downs much more effectively.

Luke’s writing style is also entertaining and accessible for beginners, so you don’t have to be an investing expert to garner valuable insights from his research.

Model Portfolio

Like most research services, Innovation Investor maintains a model portfolio so subscribers can follow along with the latest picks.

The model portfolio includes a list of active stock picks, along with their price, current recommendation, current performance, and more.

This is the perfect place to get a bird’s-eye view of every Luke Lango stock recommendation, and, although it’s not a particularly unique feature, the dashboard is exceptionally functional and user-friendly.

All in all, the model portfolio is an undeniably useful tool, and it makes it much easier to follow the latest trade recommendations.

>> Explore the opportunities with Innovation Investor today! <<

Luke Lango’s xAI Bonus Reports

The latest deal from Luke Lango includes an impressive collection of bonus research reports and other extras.

How to Profit From Elon Musk’s New AI Venture

As explained in Luke Lango’s presentation, Elon Musk recently founded xAI to compete, and hopefully overtake, OpenAI’s ChatGPT and other generative AI platforms.

Like its parent company X, xAI is still privately owned at this time. Fortunately, Lango has discovered a small company he believes could become a crucial supplier for Musk’s xAI venture.

This special report includes extensive research and analysis on this under-the-radar company, so you can form your own view on whether or not it’s a good play.

I’ve read this report, and, although I can’t give away all the goods, I can tell you that this stock looks very promising. Also, it’s definitely “under the radar,” so you’ve probably never heard of it.

The Next Nvidia: The Company Building AI’s Backbone

We all know how incredible Nvidia is doing right now, but could you imagine getting in when it was a fraction of its current price?

In the midst of the artificial intelligence boom, Luke Lango believes he’s found the next company to reach Nvidia-level greatness.

He likens it to Cisco during the rise of the internet in the 90s. Cisco’s products and services were everywhere during that time, resulting in a 67,491% share increase over a handful of years.

Lango’s “next Nvidia” has the same promise for the AI industry, and it’s currently only 1/10th the size of the tech giant.

Should its shares climb to Nvidia’s current valuation, you could easily 10x your money or more.

That’s why Vanguard, BlackRock, and JPMorgan have already invested billions.

This short read reveals the name of this mysterious company, its ticker symbol, and Lango’s full analysis so you can go in prepared.

>> Get all xAI bonus reports free when you join NOW <<

Three AI Losers to Avoid

Artificial intelligence has the potential to turn the world upside down and create tons of wealth along the way.

Still, some companies that fail to adopt AI5 will fall by the wayside. It reminds me of what happened with Blockbuster and Borders at the onset of e-commerce.

iRobot and its Roomba vacuums are one current example. The firm failed to safeguard user privacy while adapting its products with advanced AI, and shares are down significantly as a result6.

You don’t want to be left holding onto these companies when their valuations start to tank. As important as it is to pick the winners, it’s even more important to avoid these losers.

In this special report, Lango draws attention to three big-name stocks likely to go under as AI continues to take over. As popular as they are, you may have them in your portfolio right now.

Luke explains his reasoning behind each pick so you can make educated decisions about your finances.

The AI Moonshot

Experts anticipate AI creating some $15.7 trillion in new wealth, which is more than the stock market alone can hold. Some of that money’s spilling over into crypto and the tokens that power the blockchain.

This bonus report contains the name of one AI crypto trading for less than 50 cents that could skyrocket as AI continues to grow.

If Luke’s right, this could be one of the biggest plays highlighted in this bundle. I read this report cover to cover when I got access to it, and I have to admit this is a pretty compelling opportunity.

“Moonshot” might sound like a lofty goal, but this is one instance where the stock lives up to the hype. If you decide to take the leap with Innovation Investor, I recommend checking this report out ASAP.

90-Day 100% Satisfaction Guarantee

New memberships are backed by a 90-day satisfaction guarantee, so you have roughly three months to “test drive” it.

If you feel the service isn’t a good fit, you can get a refund on the subscription cost.

Considering that the industry standard for similar services is about a month, this is a huge step up from the norm.

It might also provide a long-enough window to see some investment ideas through to their conclusion, which a month usually does not afford.

Overall, I’m impressed with this refund policy. It shows the team stands by its work.

>> Take advantage of Luke’s guarantee NOW. <<

Pros and Cons

Innovation Investor has a lot to offer, but there are a few drawbacks to consider.

Pros

- Great price with 60% discount

- Excellent 90-day refund window

- Investment strategy focuses on high-upside growth stocks

- New stock picks in every special report

- Daily notes on the market

- Easy-to-use model portfolio for tracking stocks

- 4 research reports featuring several promising opportunities

- Legendary guru research from Luke Lango

- Respected publisher in InvestorPlace Media

- Features in-depth artificial intelligence research

Cons

- No community chat room or message boards

- Doesn’t cover options or shorts

Is Innovation Investor Right for Me?

Innovation Investor is best suited for folks in search of ground floor opportunities in tech.

As the name indicates, Luke targets innovative companies, many of which come from the tech sector, so the service is a good fit if you favor a growth investment philosophy.

The service is also extremely affordable, so it’s an excellent entry-level option for anyone looking to get a leg up in the stock market at minimal cost.

Luke’s style is fresh and engaging, and he keeps things interesting from month to month. You’re sure to learn a lot just by reading his research and analysis every month.

Ultimately, Innovation Investor appeals to a wide audience, and it’d be a great fit for beginners, market veterans, tech fans, and growth enthusiasts, to name a few.

Luke’s Innovation Investor Performance and Track Record

Over the years, Luke has shown a knack for hitting home runs in the stock market.

Let’s look at some of his past picks across his services.

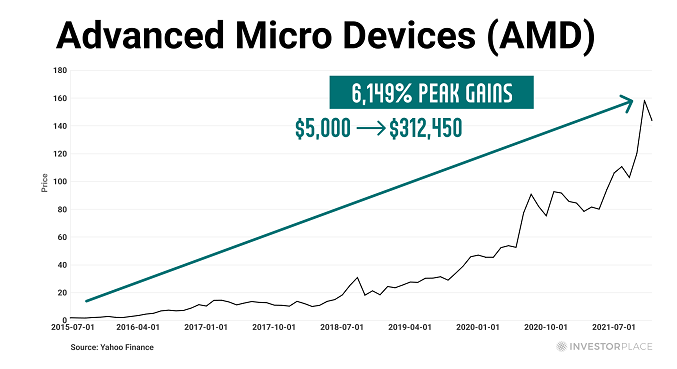

Here’s Advanced Micro Devices (AMD), which produced the opportunity for a gain as high as 6,149% following his recommendation.

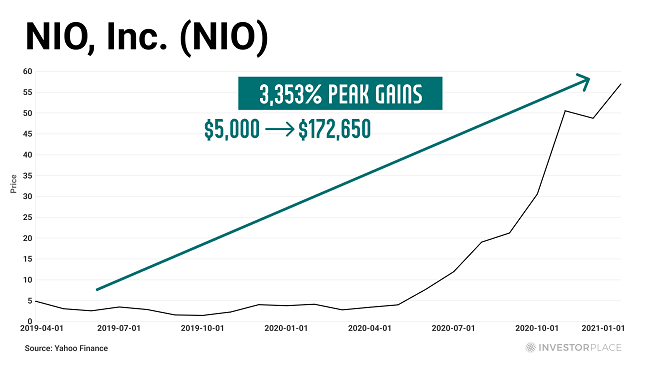

Another one of his most notable picks is NIO, a China-based EV stock, which soared as high as 3,353% after he made his call.

That’s only a small sampling of his winning picks, but you get the idea.

He’s a highly rated guru for a reason.

It’s important to remember, however, that past permanence is not an indicator of future results.

>> Get Luke’s latest recommendations. <<

Innovation Investor Reviews by Real Users

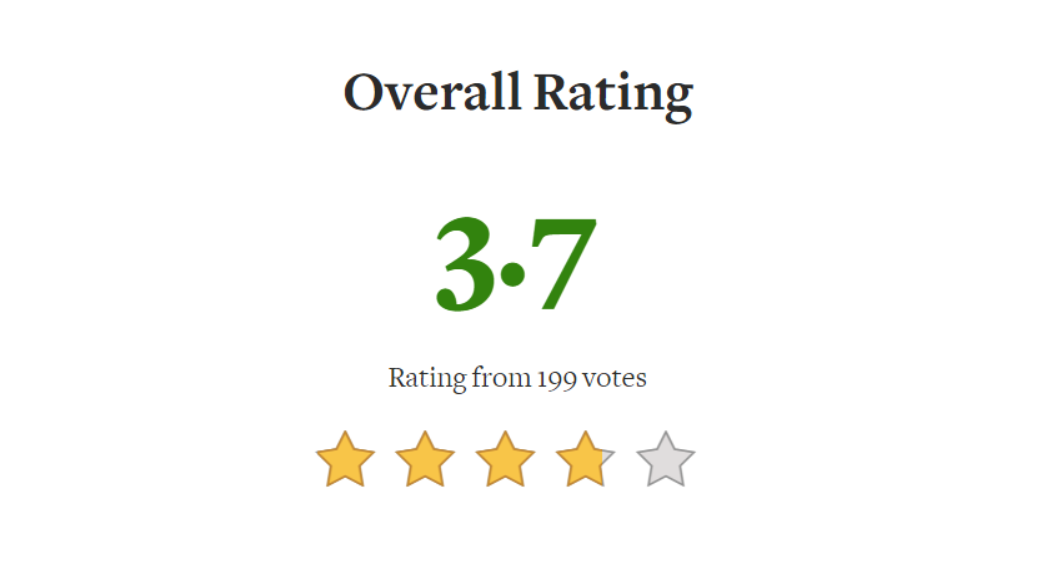

As I write this, Luke Lango’s Innovation Investor has earned an overall rating of 3.7/5 on Stock Gumshoe.

This is out of around 200 reviews, which is a solid sample size in the investment research space. Here’s a snapshot of its Stock Gumshoe rating:

There is one caveat, however. These Innovation Investor reviews come from a third-party review site, so I cannot verify whether these ratings come from genuine customers.

That said, it’s a good sign that the service appears to have earned a positive reception since its launch.

>> Find out why so many trust Luke Lango’s insights. <<

How Much Does Innovation Investor Cost?

A one-year subscription to Innovation Investor typically costs $499, but the team is offering a massive discount along with the xAI opportunity.

For a limited time, you can join with a one-year membership for just $199. At that rate, you’re saving roughly 60% on the full sticker price.

With the discount, your average cost comes out to about $4 per week.

In return, you get everything mentioned in this review, including the bonus reports and the 90-day guarantee.

Is Innovation Investor Worth It?

After a thorough Innovation Investor review, I can confidently say this is a great newsletter, and it’s an excellent value at its full price of $499.

But the 60% discount makes this service a downright bargain at just $199. The deal includes a full membership, plus several additional stock picks and other bonuses.

Luke Lango is an absolute legend with incredible stock picking ideas. I’ve perused his research on many occasions and I’m always impressed with his insights and analysis.

You’ll also get a full report on what could be the biggest winners to come out of Elon Musk’s artificial intelligence project, xAI, which may prove to be the biggest growth opportunity in the modern era.

Best of all, your membership is covered with a 90-day satisfaction guarantee, so you can get your money back at any time during the first three months of your subscription if you’re unsatisfied.

Luke is one of the most talented young gurus in the game today, and I appreciate his research insights and relatable writing style.

If you’re looking for promising growth stocks from a rock-star guru, you can’t go wrong with Luke Lango and Innovation Investor.

>> That’s it for my review. Sign up for 60% off TODAY! <<

Footnotes

- This is backed in his top-picks spreadsheet on the wiki

- https://www.reuters.com/technology/artificial-intelligence/musk-discuss-5-billion-xai-investment-with-tesla-board-2024-07-25/#:~:text=Musk’s%20xAI%20raised%20%246%20billion,he%20bought%20for%20%2444%20billion.

- https://www.socialmediatoday.com/news/x-formerly-twitter-secures-money-transmitter-licenses/721049/

- Luminar: https://www.reuters.com/technology/luminar-says-tesla-is-biggest-customer-its-lidar-sensors-2024-05-07/

- https://www.technologyreview.com/2023/01/10/1066545/download-irobot-privacy-scandal-ai-images/

- https://finance.yahoo.com/quote/IRBT/

Tags:

Tags: