The difficulty faced by former President Donald Trump in securing a $464 million appeal bond has led to a public dispute between Rep.

Ted Lieu and billionaire Mark Cuban, with the former accusing Trump of financial deceit.

Trump’s Financial Dilemma

Following a civil fraud judgment in New York, Trump’s legal team has expressed that obtaining the necessary appeal bond is practically unfeasible, sparking debates over his financial status.

Lieu’s Accusation

Rep. Ted Lieu publicly doubted Trump’s billionaire status due to his inability to meet the judgment requirement, suggesting mathematical inconsistency in Trump’s claims.

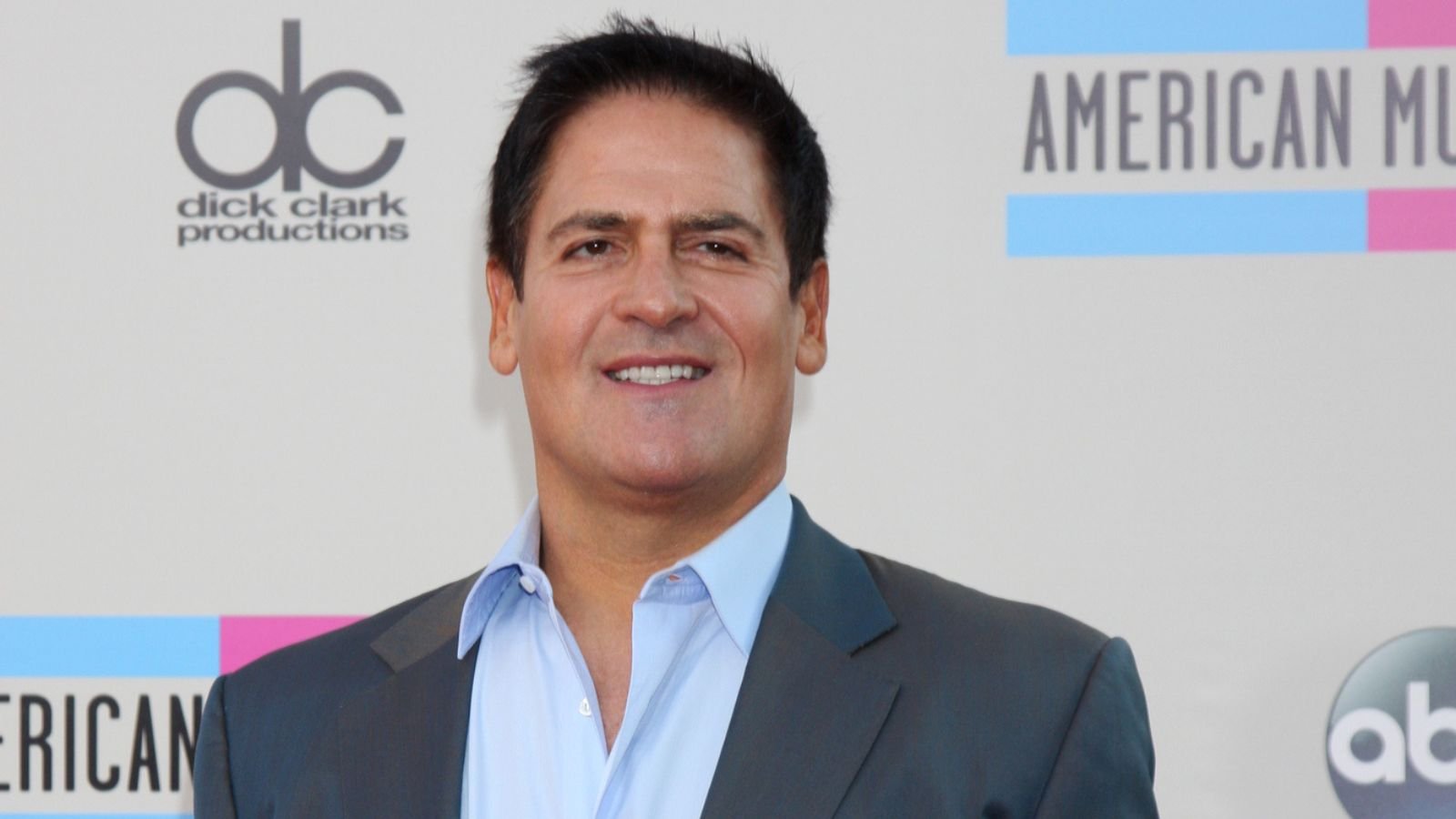

Cuban’s Counterargument

Mark Cuban intervened, arguing that Lieu’s assessment was flawed. He explained the difference between net worth and liquidity and emphasized the challenges in the current economic environment.

Zero-Interest Rate Environment

Cuban highlighted how the prolonged period of low-interest rates discouraged keeping large cash reserves, challenging Trump’s expectation of quickly securing the bond.

Net Worth vs. Liquidity

Explaining further, Cuban pointed out the impracticality of maintaining significant liquid assets against total net worth, especially regarding Trump’s real estate and foreign holdings.

Bond Market Realities

Cuban also noted the reluctance of bond companies to loan against Trump’s asset types, particularly in a volatile commercial real estate market.

Trump’s Legal Efforts

Trump’s team reported extensive efforts to engage numerous surety companies, underscoring the unprecedented bond requirement for a private entity.

The Appeals Court Ruling

A New York Appeals Court’s decision mandates Trump to post the total bond amount, adding another layer to the ongoing legal saga.

The Fraud Allegations

The controversy stems from allegations against Trump of inflating asset values and committing fraud, which led to a significant judgment against him and calls for a compliance director’s appointment.

Read More From The Stock Dork

Tags:

Tags: