Gold has been a store of value for generations, especially when confidence in markets starts to crack. Matt Weinschenk believes that still matters today.

The idea behind The No. 1 Gold Stock focuses on gaining exposure to gold in a unique way, but does it really pan out?

In this The No. 1 Gold Stock review, I break down the claims so you can decide if it deserves a closer look.

>> Get Commodity Supercycles’ No. 1 Gold Stock <<

What Is Commodity Supercycles?

Commodity Supercycles is Stansberry Research’s long-term research service built around one simple idea: major commodity trends don’t move in months, they unfold over years.

Commodity Supercycles aims to identify early-stage cycles in areas like metals, energy, and real assets, then positions before those trends become apparent.

Subscribers receive ongoing research that highlights specific companies, themes, and sectors that the team believes are set up to benefit from supply constraints and rising global demand.

The service also includes a curated model portfolio, regular commentary, and updates that help put each recommendation into context without overwhelming you.

What makes Commodity Supercycles appealing is how The No. 1 Gold Stock fits into the bigger picture. It isn’t a one-off idea.

It’s presented as part of a broader commodity roadmap, which is exactly why people interested in gold, energy, and long-cycle opportunities may find this service worth joining.

>> Join Commodity Supercycles With Whitney Tilson and Matt Weinschenk <<

What Is Inside The No. 1 Gold Stock Presentation?

Gold has a long history of rewarding patience, but it also has a habit of frustrating those of us who think we’re playing it the right way.

Just like any other investment, there’s a right and a wrong time to get involved.

Let’s face it; when we hear about moves on mainstream news, it’s usually way too late to get in.

On the flip side, I know several people who only get into gold when fear sets in. That’s a play on emotion, not numbers.

What does they know that we don’t?

The Golden Renaissance

Matt claims we’re walking into the next big gold bull market, which is great news for all of us.

Those numbers are astronomical and definitely something worth taking advantage of if it pans out.

Many investing greats seem to agree, as they’re scooping up gold and gold stocks faster than ever.

Even the biggest central banks are collecting shares of gold to save away for a rainy day, which should only drive up the cost of gold more.

Of course, we won’t hear about any of this in the news until after the fact, which makes it all the more impactful that Matt’s talking about it now.

>> See the Commodity Supercycles Gold Pick Now <<

Following the Money Behind the Gold Boom

I wouldn’t chase just any AI stock, and I certainly wouldn’t do the same for gold, either.

Mining companies often mean well but can fall short when it comes to delivery. Even owning bullion comes with its share of headaches.

Commodity Supercycles secret strategy dodges all the potential pitfalls these avenues bring by focusing on royalties instead.

You may have never heard of Franco-Nevada, but they coined this concept of paying some money upfront to collect a percentage of all the gold the mine unearths over the years.

Needless to say, that initial investment has paid itself back many times over.

A Smarter Way to Think About Gold Exposure

While Franco-Nevada set the stage for generating royalties from mines, they’re not the only ones to participate.

Other companies are trying on those same shoes, and some are positioned better than the royalty giant to generate revenue in this season.

We just have to know where to look.

You can learn more about how this opportunity works through the special report The No. 1 Gold Stock and exploring the full research behind it.

He’s including it with a subscription to Commodity Supercycles right now, so let’s check out the service next.

>> Start Commodity Supercycles For Just $79 <<

The No. 1 Gold Stock Review: What Comes With Commodity Supercycles?

Joining Commodity Supercycles gives you more than access to a single gold idea.

It’s designed as a full research ecosystem that helps you understand where commodities are headed and how to stay positioned as those cycles unfold.

Here’s what’s included and how each part fits together.

One Year of Commodity Supercycles

One Year of Commodity Supercycles

At the core of the offer is a full year of Commodity Supercycles, Stansberry Research’s flagship commodities research service focused on long-duration trends in resources like gold, energy, and industrial materials.

The service is built around the idea that commodities shift in uncharacteristic ways, but it is possible to discern patterns if you know how to look.

On the inside, you’re treated to ongoing research that explains why commodity themes are gaining interest and the ways you can act on them.

Whitney Tilson and his team gather information from across numerous sources, adding to the intrigue for me.

Nothing here is over-the-top, either, allowing you to read through and take immediate action.

Access to the Commodity Supercycles Model Portfolio

You’ll also get access to the Commodity Supercycles model portfolio, which shows how they apply their research in practice.

The last time I checked, there were more than 40 commodity-related recommendations here. The team tracks each one with clear labels so you know exactly what you’re looking at.

It’s your literal roadmap that shows how exposure is spread across different resources, stages of the cycle, and risk profiles.

Reviewing the portfolio helps you understand position sizing, diversification, and how ideas like The No. 1 Gold Stock fit into a broader strategy.

It’s especially useful if you want guidance without having to decide everything from scratch.

>> Discover Commodity Supercycles’’s Gold Strategy <<

Updates and Research Alerts

Markets don’t stand still, and neither does the research.

With Commodity Supercycles, you receive ongoing updates and alerts that explain when something materially changes.

These messages typically focus on shifts in commodity prices, company-specific developments, or broader macro events that affect the original thesis.

It’s the best way I’ve seen to stay informed without being in the news all the time, searching for news that might affect your portfolio.

Alerts also remove a lot of the emotional side of trading that I’ve come to hate. There’s often urgency here, but clear reasoning helps you to act with a level head.

The Stansberry Digest

The Stansberry Digest

Your subscription also includes The Stansberry Digest, a daily publication that offers a broader view of markets, economics, and major trends.

While it isn’t limited to commodities, it provides helpful context for understanding how gold and resource markets fit into the bigger picture.

The Digest often covers policy decisions, global events, and market sentiment in plain language, which complements Matt’s more focused commodity research.

Reading it regularly helps you stay aware of the forces influencing inflation, currencies, and investor behavior, all of which play a role in how commodity cycles develop over time.

>> Claim Access To Commodity Supercycles <<

Whitney Tilson’s Daily

Whitney Tilson’s Daily

Another included feature is Whitney Tilson’s Daily, which delivers short, frequent insights from one of Stansberry’s most well-known editors that I’ve really come to appreciate.

His commentary focuses on stocks, market movements, and major economic developments, often highlighting what Wall Street is missing or mispricing.

Tilson may or may not hit on commodities, but you’re getting a bigger picture here that can help with diversity and exposure.

It’s a quick read, but over time it builds a habit of thinking critically about markets instead of reacting emotionally.

Access to Back Issues and Special Reports

Sometimes older news is good news, so Tilson and his team keep an archive of Commodity Supercycles content at your disposal.

I dig around here frequently to read through past research and uncover cyclical trends that I hope to take advantage of the next time they appear.

You can move through it at your own pace, which is another huge perk.

Having this archive is useful if you want to understand the full reasoning behind current recommendations or study previous cycles for comparison.

Whether you want to skim recent insights or spend time studying longer-term themes, the back catalog makes the service feel like a reference tool rather than a one-time read.

>> Don’t Miss Commodity Supercycles’ Gold Pick <<

Commodity Supercycles Bonus Reports

Along with the core research, Commodity Supercycles includes several bonus reports designed to deepen your understanding of precious metals and related opportunities:

Special Report No. 1: The No. 1 Gold Stock to Buy in 2026

Special Report No. 1: The No. 1 Gold Stock to Buy in 2026

This is the centerpiece bonus I’d highly recommend starting your Commodity Supercycles journey with.

In it, Tilson and his team zeroes in on a single gold-focused royalty company he believes is uniquely positioned for the years ahead.

You’ll get to read about how the company generates exposure to gold without many of the operational risks that hurt producers, and why its structure allows it to benefit as gold prices and production rise.

Best of all, you can get in for around $50 bucks right now.

Special Report No. 2: The Silver Trade

Special Report No. 2: The Silver Trade

The Silver Trade takes a complementary angle to gold by focusing on how silver often behaves differently during precious metals cycles.

The research team explains why silver has a history of lagging early in gold bull markets, only to accelerate later once momentum builds.

Silver serves as both precious metal and industrial marvel, and this report beautifully showcases how supply changes can amplify silver’s moves.

When you finish reading, you’ll know precisely how to take advantage of this unique niche so you could earn from silver as it follows gold up the ladder.

Special Report No. 3: The Secret Currency: How to Make 500% From the U.S. Government’s Second, Secret Currency

Special Report No. 3: The Secret Currency: How to Make 500% From the U.S. Government’s Second, Secret Currency

This report shifts away from metals and looks at a lesser-known corner of the financial system tied to government-backed mechanisms.

The research team lays out how this so-called “second currency” operates behind the scenes and why it exists alongside the dollar.

He explains the conditions that could bring renewed attention to it and how past examples created significant gains for those positioned early.

While more speculative than the gold and silver research, the report is meant to broaden your perspective on how government policy, currency structures, and hidden incentives can create unexpected opportunities.

It’s included as a way to diversify your thinking and explore an angle I’d never think to consider.

>> Get Started With Commodity Supercycles <<

Refund Policy

That means you have complete access to all the content I covered above, but you can change your mind in that first month and get your membership fee back if the service doesn’t resonate with you.

It’s a fairly basic guarantee, but it’s still enough time to review an issue of the newsletter, read the bonus reports, and even make an investment if you so choose.

>> Unlock Matt Weinschenk’s Gold Thesis <<

Pros and Cons

Every service has strengths and limitations. Here’s how this one stacks up.

Pros

- Includes one year of Commodity Supercycles

- Focuses on a lower-risk commodities

- Stacked model portfolio

- Reasonable entry price for long-term research

- 30-day money-back guarantee

- Many special bonus reports

Cons

- Best suited for patient, long-term positioning

- No community interaction point

- Lacks some diversity

Track Record and Past Performance

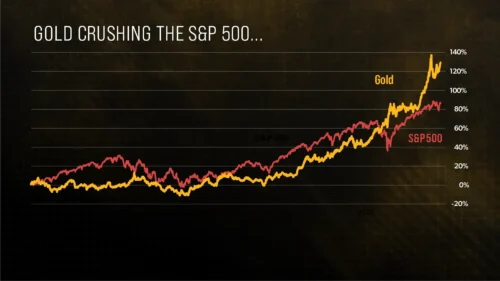

In The No. 1 Gold Stock, Matt highlights that over the last five years alone, gold has outperformed major benchmarks like the S&P 500, the Dow, and the Nasdaq, even during periods when stocks were surging.

Gold continues to be a strong investment medium, but the service holds up well even on a global scale.

Over the past five years, Commodity Supercycles brought in an average return of 30%, following a win rate of 65%.

Not every investment is a winner, and I appreciate Matt pointing that out. Still, these numbers far surpass benchmark indexes, and that’s something I can get excited about.

>> See Why Commodity Supercycles’ Likes This Gold Stock <<

How Much Does Commodity Supercycles Cost?

Under normal circumstances, a full year of Commodity Supercycles is priced at $499.

As part of this special bundle, you can get all the same content for just $79, which is an impressive 84% off the cover price.

At that price, you’re not only getting the core Commodity Supercycles service, but also access to the model portfolio and the additional bonus reports included with the offer.

The service renews at $199 after the first year, but I think you’ll find plenty of value here even at that price point.

>> Secure The No. 1 Gold Stock Today <<

Is The No. 1 Gold Stock Worth It?

Is The No. 1 Gold Stock Worth It?

All signs point to a huge gold ramp-up in 2026, and The No. 1 Gold Stock captures one of the best ways to pursue it.

Commodity Supercycles’ approach of utilizing gold royalty companies instead of dealing with miners or physical assets feels genius and is a way that can keep paying out for the long haul.

I love that the content you receive focuses on that point but goes much deeper, offering alternate investment methods while also sharing ideas from the greater commodity landscape through Commodity Supercycles.

Having a year of service is a huge plus and makes this feel like a gift that keeps on giving. Plus, you start out with some 40 recommendations already posted in the model portfolio that are ripe for the picking.

Even better, this new bundle introduces an incredibly low price point, and the 30-day money-back guarantee is still there if you’re at all apprehensive.

If you’re hoping to strike gold this year, I’d jump in on The No. 1 Gold Stock bundle before there’s nothing left to claim.

Tags:

Tags: