Alexander Green claims the next great tech breakout is just around the corner, thanks to the rise of a new “Magnificent Seven”. Are his predictions on point?

In this detailed The Oxford Communique review, I track down the answer.

What Is The Oxford Communiqué?

The Oxford Communiqué is a financial newsletter led by renowned investment strategist Alexander Green.

It provides in-depth market analysis, monthly stock recommendations, and expert insights, focusing on high-growth sectors like AI.

Subscribers gain access to exclusive model portfolios and a wealth of resources designed to help them maximize their investment returns.

Backed by The Oxford Club and featuring contributions from prominent investment strategists, The Oxford Communiqué offers innovative strategies to savvy investors.

Oxford Communique Investment Philosophy

Unlike most other services, The Oxford Communiqué takes a multi-faceted investment philosophy to its subscriber base.

This means you’re not shoehorned into a particular style or niche of stocks that often ebb and flow as market parameters change.

Instead, the platform showcases five different model portfolios you can dance between as needed to maximize your chances at big gains.

Each takes more of a long-term approach, but the path to get to returns varies significantly. You’ll find traditional conservative recommendations stemming from a diverse pool of assets alongside very speculative stocks hoping to rise 1,000% or more.

Having that extra bit of freedom offers some reprieve from having to own multiple services that can erode your funds over time.

Plus, you’re hearing these picks from the same team that will offer a better chance at helping you balance everything out.

>> Join now for expert market analysis and stock picks <<

Who Is Alexander Green?

Alexander Green is the Chief Investment Strategist of The Oxford Club and a renowned financial author.

With a background managing assets at one of America’s largest firms, Green oversaw $2.8 trillion.

This experience has established him as a trusted voice in the investment community.

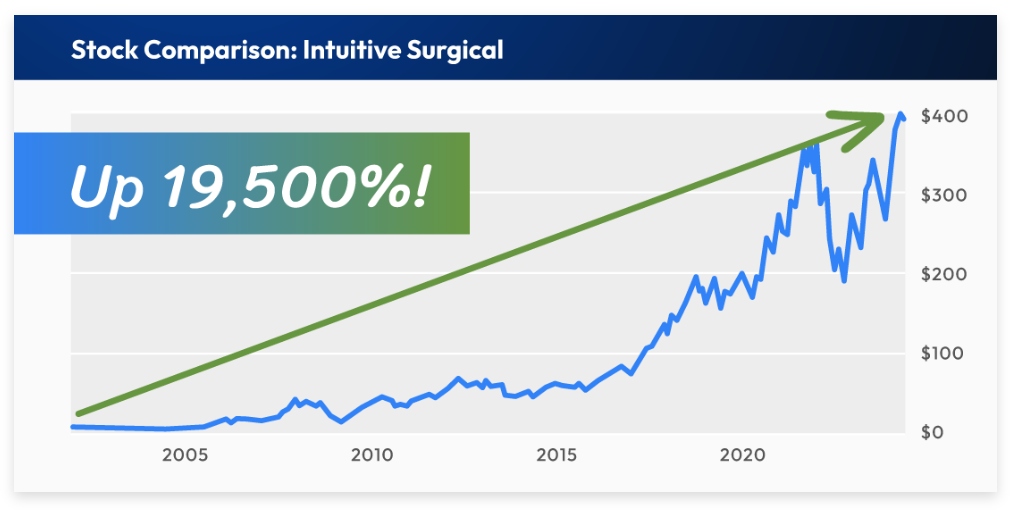

His notable achievements include early investments in some of the top-performing stocks of the past three decades, such as Apple, Amazon, Netflix, Nvidia, Intuitive Surgical, and Tesla.

Green has a knack for identifying game-changing innovations and acting swiftly.

This has earned his readers substantial returns and solidified his reputation as a credible and insightful investment strategist.

Is Alexander Green Legit?

Alexander Green’s bold claims are backed by an impressive track record of identifying top-performing stocks early.

He called four of the six best-performing stocks of the past 20 years.

Green’s ability to recognize innovations as they hit the market and act quickly has led to significant gains.

For example, his early investment in Apple in 1996 turned a few thousand dollars into nearly $600,000 per $1,000 invested.

His foresight with Nvidia, Amazon, and Netflix similarly yielded substantial returns, averaging over 10,000% ROI.

>> Get Alex Green’s latest research insights <<

What Is The Oxford Club?

The Oxford Club is a private, international network of trustworthy and knowledgeable investors and entrepreneurs.

With over two decades of success through all market conditions, the Club has a proven investment philosophy.

Serving more than 159,000 members in over 130 countries, The Oxford Club is a credible and reliable source for growing and protecting wealth.

Its experienced editors and innovative strategies ensure members receive top-tier financial guidance.

Is The Oxford Club a Scam?

The Oxford Club is undoubtedly not a scam. With over 30 years of history, it’s one of the longest-running financial publishers in the country – if not the world.

Today, it boasts nearly 160,000 members in over 130 countries across the globe. You don’t get to those numbers unless you’ve got something engaging to show for your efforts.

Customers tend to agree with the assessment. The Oxford Club carries a 4.09 rating out of 5 stars on the Better Business Bureau site, although it’s not accredited.

It has a similar score on popular review site Trustpilot.

As with any service, you need to approach investing with a level head and clear strategy. Past successes are not indicative of future results, and there’s no guarantee of returns or a certain payout.

Alex Green’s ‘The Next Magnificent Seven’ Presentation

In his latest presentation, Green compares the current AI boom to past technological revolutions, such as the rise of the Internet and smartphones, highlighting AI’s transformative potential.

He reveals how a modest $7,000 investment in seven AI super stocks could make you a millionaire in under six years.

Green identifies leading companies in this revolution to help investors benefit from AI’s rapid growth in the tech, healthcare, and manufacturing sectors.

>> Access the “Next Magnificent Seven” report now! <<

The Five Golden Metrics

Alexander Green uses “The Five Golden Metrics” to identify promising stocks, focusing on companies that:

- Lead in cutting-edge technology.

- Sell breakthrough products.

- Have strong patent protection.

- Exhibit massive sales growth.

- Possess the potential for numerous blockbuster launches.

This innovative system combines technological leadership and market potential with robust intellectual property protection and growth metrics.

By applying these criteria, Green ensures that the stocks he recommends are well-positioned to harness the transformative power of AI.

The industry is projected to reach hundreds of millions of customers and generate significant growth opportunities.

This methodical approach helps investors target companies likely to dominate the markets in the coming years.

>> Save 60% when you join now! <<

Alexander Green’s Top AI Stock Picks

Green’s top AI stock picks offer investors huge potential gains.

The first pick is an AI CPU developer whose technology powers devices from Nvidia, Google, and Samsung.

The second company is reinventing the internet with AI. It operates over 300 data centers worldwide, outpacing Amazon and Google.

Then, he includes an AI-designed drug developer that quickly identifies potential disease treatments. Trading under $10 now, this stock has immense growth potential.

The fourth is a biotech firm using AI to cure diseases at the cellular level. Its sales soared from $298 million in 2020 to $618 million last year.

Next is an AI robotics company whose robots streamline operations for retail giants like Walmart, Target, and Albertsons.

Green also recommends a cybersecurity firm that uses AI to combat cybercriminals. Serving top clients like American Express and NASA, its subscription revenue surged 68% last year.

The last company has already won a Nobel Prize and is expected to revolutionize medicine.

Brad Reingesen, Executive Director at Cal’s Innovative Genomics Institute, describes it as “unmatched and unparalleled” in science.

You can access these stock picks instantly if you sign up under the latest deal.

>> Get Alexander Green’s top AI stock picks now! <<

The Oxford Communiqué Review: What’s Included?

Here’s what you get if you join under the “Next Magnificent Seven” deal.

One-Year Subscription to The Oxford Communiqué

When you get the “Next Magnificent Seven” deal, you’ll also get a subscription to The Oxford Communiqué.

That’s a full year of insightful market analysis and monthly stock recommendations directly from Green.

You’ll receive a detailed monthly newsletter highlighting exceptional stocks developing cutting-edge technologies and companies experiencing massive sales growth.

As a subscriber, you also gain premium access to all their model portfolios. These portfolios are tailored to maximize your investment returns, providing diverse and strategic opportunities.

The value doesn’t stop there. Normally priced at $249, you can join today for just $99—less than a year of most streaming services.

All this is backed by a 365-day NO-RISK Money-Back Guarantee, ensuring your investment is protected.

>> Unlock a year of The Oxford Communiqué now! <<

Access to Several Model Portfolios

When you join The Oxford Communiqué, you gain premium access to all of Green’s model portfolios.

This includes the Oxford Trading Portfolio, Gone Fishin’ Portfolio, All-Star Portfolio, Ten Baggers of Tomorrow Portfolio, and the Fortress Portfolio.

Each model portfolio offers unique investment strategies tailored to maximize your returns.

Alerts and Updates

You’ll be informed about everything happening in the markets through monthly issues and weekly updates.

You’ll also receive premium access to a members-only website, offering daily updates on all positions, new issues, and special updates.

It all starts with “The Next Magnificent Seven” stocks, the most exciting picks in the market right now, detailed in Green’s brand-new report.

>> Get premium access to exclusive stock picks and insights <<

The Oxford Club Room Access

You’ll also gain premium access to The Oxford Clubroom. Here, you can participate in live Q&A sessions, receive monthly stock recommendations, and interact with top market experts.

This exclusive resource offers direct insights and personalized advice to help you maximize your investment potential and stay ahead in the market.

Wealth-Building E-Letters

As a subscriber, you get free access to wealth-building e-letters: “Liberty Through Wealth” and “Wealthy Retirement.”

These e-letters provide expert insights, actionable strategies, and timely advice to help you grow and protect your wealth.

Subscribers can stay informed on the latest market trends and investment opportunities, enhancing their financial knowledge and decision-making.

Pillar One Advisors

Also, you’ll gain access to Altimetry’s Pillar One Advisors as part of The Oxford Club’s special bonus. This includes experts in collectibles, real estate, tax law, insurance, and more.

This access provides users personalized advice and insights from top industry professionals, enhancing their investment strategies and financial planning.

>> Get all these features and more when you subscribe now <<

The ‘Next Magnificent Seven’ AI Bonus Reports

These additional bonuses are also included with your subscription if you join under the “Magnificent Seven” deal.

The NEXT Magnificent Seven: How These Seven AI Stocks Could Make You a Millionaire

The report reveals seven AI stocks with huge growth potential and offers a guide to profiting from the AI revolution.

It highlights each company’s technology, partnerships, and sales growth.

The report suggests these stocks could bring massive gains, similar to past successes like Apple and Nvidia.

While noting investment risks, it emphasizes the big winners who can transform portfolios and help readers become part of the growing number of new millionaires.

The #1 AI Hypergrowth Stock: Your Second Shot at Apple, Amazon, or Netflix

The report focuses on a top AI company with big short-term growth potential. This company helps other businesses use AI to improve their operations.

Sales jumped from $607 million in 2021 to $1.3 billion in 2024. The report explains the company’s activities, why its technology is important, its patents, and its future growth potential.

It also includes easy steps on how to buy the stock. The goal is to help readers profit from the AI boom and potentially become millionaires.

>> Get these exclusive AI stock reports when you join NOW!

How to Build a Million-Dollar Portfolio From Scratch

You also get an easy-to-follow guide for anyone looking to build wealth through investing. It shares simple strategies that famous investors like Warren Buffett and John Templeton used.

The report shows how to pick high-quality companies and turn a small investment into a million dollars.

The author, with nearly 40 years of experience, offers personal tips and proven methods to help you succeed.

Whether you’re new to investing or want to grow your wealth, this report gives you the tools to reach your financial goals.

The Oxford Club’s 365-Day Guarantee

The Oxford Club offers a generous 365-day money-back guarantee, giving you a full year to evaluate The Oxford Communiqué.

You can benefit from “The Next Magnificent Seven” and all other recommendations without risk.

If you’re unsatisfied, simply call or email for a prompt refund of your membership fee.

This guarantee puts all the risk on the Oxford Club, ensuring you have nothing to lose by trying their service.

>> Join risk-free under the 365-day money-back guarantee <<

The Oxford Communique Performance Track Record

The Oxford Communiqué continues to cement itself as one of the top tech services on the planet.

Members were among the first to hear about the impending dot-com collapse in early 2000, an entire month before the sector crumbled.

It also shared warnings about 2008’s housing crisis and the dangers of many speculative industries, such as meme stocks and pot stocks, that ultimately went nowhere.

There have been no shortage of positive calls, either. The Communiqué’s team told people to get back into the markets in 2009 and 2021 after prior collapses.

Gains from some of its top picks are staggering. Folks getting in on Intuitive Surgical in 2004 had the chance to enjoy 19,500% gains over the last 20 years.

Other blockbuster opportunities include Tesla, Marvell Technology, Celgene, and a whole slew more.

Pros and Cons

Here are the pros and cons of this service.

Pros:

- Led by industry expert, Alexander Green

- Proven track record with top-performing stocks

- Deep market insights and analysis

- Access to exclusive model portfolios

- Generous 365-day money-back guarantee

- Special reports on high-potential AI stocks

Cons:

- Long-term commitment needed

- Limited to recommendations, no personalized planning

>> Get started now at 60% off! <<

FAQs

How many members does the Oxford Club have?

The Oxford Club currently has close to 160,000 members in 130 countries.

This number has grown considerably since the publisher first launched over 30 years ago, despite being somewhat selective in its recruitment approach.

Time will tell how the organization fares in the future, but three experts, a top-notch team, and numerous newsletters and trading services speak to its longevity.

How often is the Oxford Communique released?

New issues of The Oxford Communiqué hit inboxes every single month, with Green’s top investment ideas and market insights.

You’ll get at least one new pick per issue that you can invest in if you so choose. Worst case, you’re only four short weeks away from the next release.

As market happenings take place more than once per month, users can expect weekly updates and alerts when breakout stocks appear.

Can beginner investors benefit from the Oxford Communique?

Yes, there’s plenty for a beginner to bite into within the pages of The Oxford Communiqué.

The platform lays out its recommendations in very clear verbiage, allowing folks of any level to invest with confidence.

Green often lays bare his current market sentiment, allowing you inside the head of an expert with decades of experience.

Having these insights at your fingertips is a sure-fire way to increase your knowledge about investing even if you’re still on the ground floor.

>> Avail your special 60% limited-time discount. Join NOW! <<

The Oxford Communiqué Success Stories

The Oxford Club has many success stories that highlight its credibility.

Look at David Mason:

Pat Douglas had a similar experience:

Small investors like Liam Rogers achieved impressive results as well:

These impressive stories demonstrate the potential for substantial returns with The Oxford Communiqué.

>> Join now to be a part of these success stories <<

Is The Oxford Communiqué Right for Me?

The Oxford Communiqué is perfect for those eager to expand their knowledge of growth investing and high-growth sectors like AI.

Whether you’re starting out or already have experience, this service provides in-depth analysis, expert stock picks, and valuable market insights.

With its wealth of resources, including model portfolios and regular updates, The Oxford Communiqué can help you make informed decisions.

This guidance can potentially lead to significant financial growth.

How Much Does The Oxford Communiqué ‘Next Magnificent Seven’ Cost?

The Oxford Communiqué “Next Magnificent Seven” deal offers a special 60% discount. Instead of the regular $249 price, you pay just $99.

This incredible offer costs less than $9 per month. Plus, it comes with a 365-day money-back guarantee, giving you a full year to evaluate the service risk-free.

This deal provides exceptional value for the comprehensive resources and expert insights included.

Is The Oxford Communiqué Worth It?

Considering the impressive benefits I spelled out in this Oxford Communiqué review, it’s a valuable resource for anyone looking to invest.

With Alexander Green’s track record of identifying top-performing stocks, subscribers can achieve substantial returns.

His strategic insights into high-growth sectors like AI further enhance the potential for significant gains.

The subscription offers many resources, including exclusive model portfolios, premium access to the Oxford Clubroom, and insightful bonus reports.

At the current discounted price of $99, down from $249, it’s an excellent opportunity to leverage Green’s expertise with minimal risk, thanks to the 365-day money-back guarantee.

If you’re serious about maximizing your investment potential and staying ahead in the rapidly evolving market, The Oxford Communiqué is a deal you shouldn’t miss.

Don’t miss out—subscribe today and start your journey towards financial success!

Tags:

Tags: