If you’ve ever wanted to cherry-pick the very best stocks for your portfolio, then Ratings by TradeSmith could be exactly what you’re looking for. Not only will you get stock ratings from bullish to bearish with this service, but you’ll also be able to see several different indicators to help you decide which stock you want to trade.

Does this sound too good to be true? Read this Ratings by Tradesmith review to find out exactly what’s included with this trading tool.

What is Ratings by TradeSmith?

Ratings by TradeSmith is a software that claims the use of a proprietary 9-layer algorithm to spot some of the most lucrative stocks, ETFs, and mutual funds on the stock market.

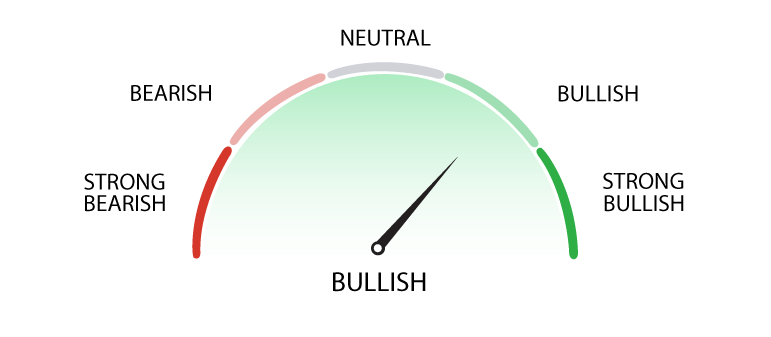

This 9-layer algorithm is meant to determine how bullish you can be on any given stock. It can range anywhere from bearish to strong bullish.

And it’s even able to spot trends most people wouldn’t even think to look for when they’re doing market researching.

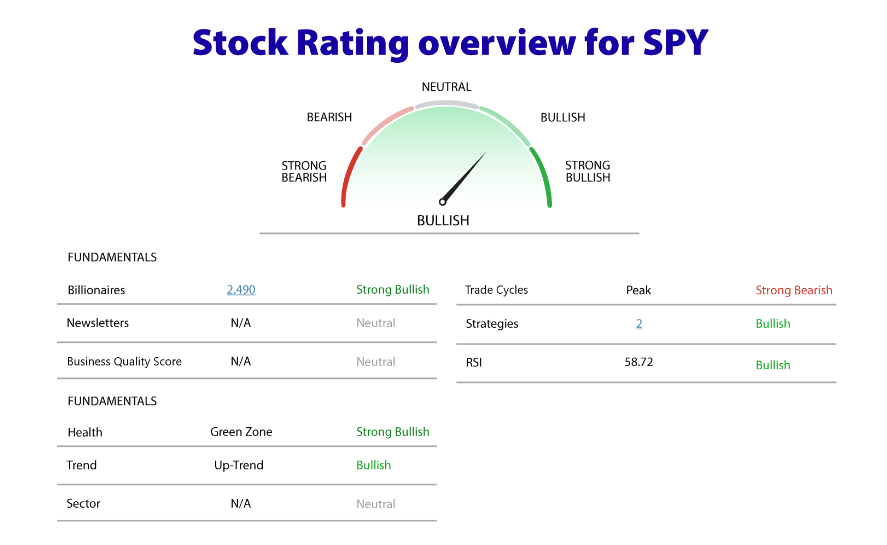

For example, there’s an indicator that tracks 27 billionaire super-investors and tells you exactly how many of them are invested in each stock you’re interested in.

After all, if a bunch of billionaires are buying into a stock, there’s probably a pretty high chance that the value of that stock is going to rise, right? It’s this kind of insight that makes Ratings such an interesting trading tool. And it’s also what makes this stock screener unique.

>> Save 65% when you JOIN NOW <<

Is Ratings By TradeSmith Legit?

Ratings By TradeSmith is a legit service and one of many in TradeSmith’s portfolio. It uses a number of fundamental and technical indicators to provide a rank from Strong Bullish to Strong Bearish on any stock its system tracks.

These tools provide an additional layer of confidence to your own research about whether you’ve located a viable opportunity for gains.

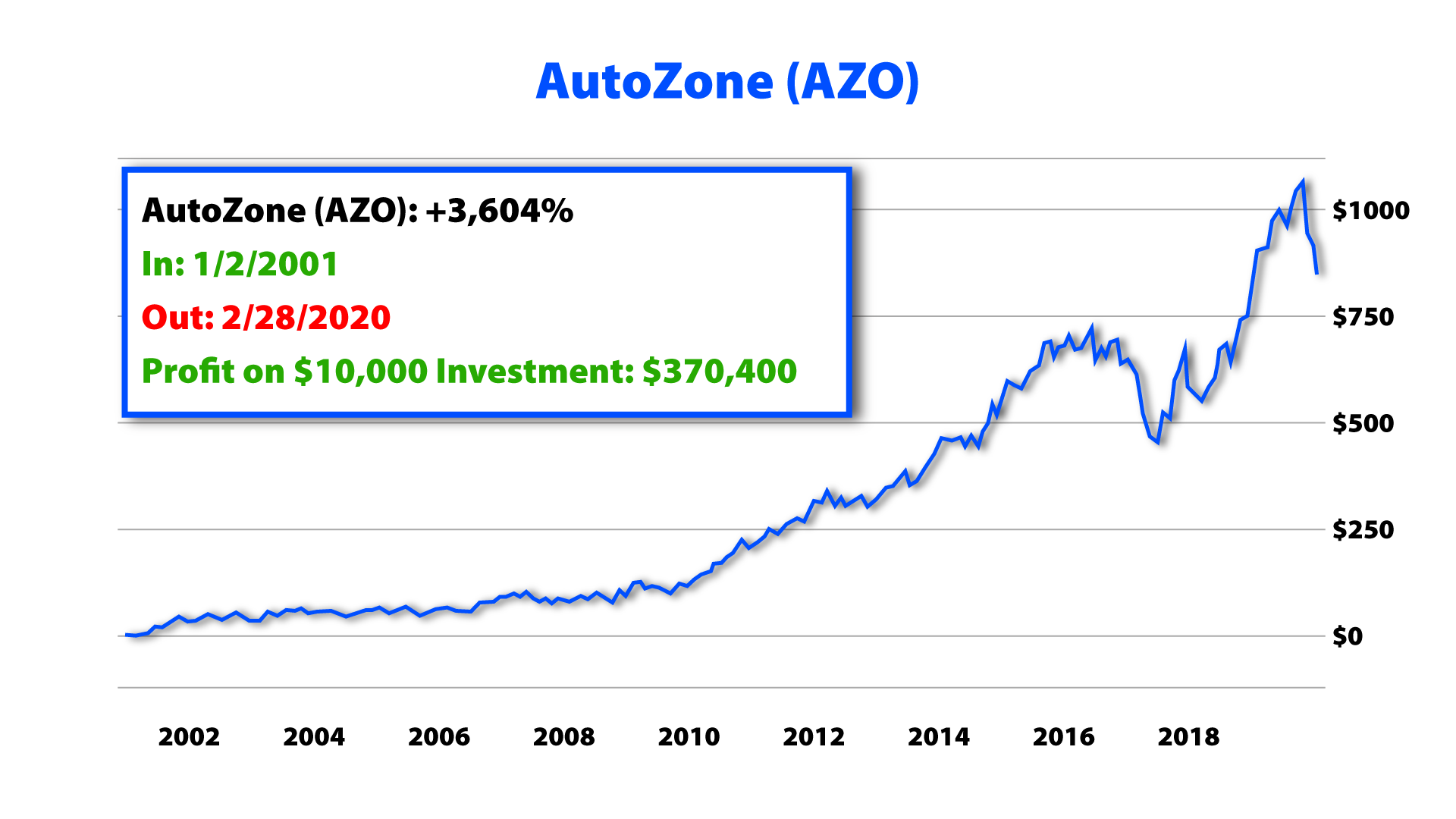

Past wins speak for themselves. Ratings By TradeSmith recommended Monster Beverage (MNST) just before a 4,627% tear and AutoZone (AZO) before it jumped 3,604% – and that’s just scraping the surface.

You won’t see these kinds of results every day, but the platform’s certainly no stranger to turning out 1,000%+ returns.

What is TradeSmith?

TradeSmith is a powerful research tool designed to help you make logical investing decisions. It utilizes the latest data-driven software to pick up on the latest trends and provide an action plan for success.

The platform showcases 15 unique products, each targeting a specific investing style. Users can tap into quant-based research, cryptocurrency tools, and systems for learning to trade like a pro, among others.

No matter which tools you opt to use, TradeSmith makes the entire investment process simple. Alerts, analyses, and detailed research are just some of the features folks use to win with the platform.

More than 60,000 investors call TradeSmith home, taking advantage of some or all of its available services. It boasts a 94% customer satisfaction rate among its customer base, with more than $30 billion invested using TradeSmith tools.

The 7-Figure Stackers VIP Pass Presentation

There’s a lot going on behind the scenes in the economy right now. Between market uncertainty and inflation, it’s hard to know which stock picks are going to give you the best results.

That’s why the folks at TradeSmith have made this “crack the code” algorithm to help you identify the best-performing stocks for your portfolio.

This algorithm is based on 9-indicators that will split your great stock ideas into two categories, bullish and strong bullish.

It’ll also give you the results of each indicator the algorithm uses, as well as basic information about the fundamentals of each stock.

You can then use all the research it gives you to move your money from good stocks into what TradeSmith likes to call “7-Figure Stackers.”

What is a “7-Figure Stacker”?

This software behind “7-Figure Stackers” is made from algorithms that will tell you exactly which stocks or market sector is most likely to bring you the biggest wins based on factors like RSI, market cycles, and trading strategies.

These algorithms take into account detailed information on a company’s overall financial health. It also has the results from several technical indicators. It will then compile and use all the data it collects to pinpoint whether a given stock is “super bullish.”

The idea is that you can use these super bullish stocks to build a solid portfolio of potential winners, called “7-Figure Stackers.” Because once you load your portfolio up with multiple super bullish stocks, the potential winnings could “stack up” over time.

>> Step up your trading game with 7-Figure Stackers <<

How Can “7-Figure Stackers” Shield You from Volatility?

There’s a three-step process you can follow if you want to shield yourself from volatility while creating a portfolio of “7-Figure Stackers”.

Start with the first step and repeat as many times as you’d like to.

Step 1: Check where any stock idea stands by typing the ticker into the search bar inside Ratings by TradeSmith.

Step 2: Create a risk-adjusted model portfolio of your super bullish stock picks.

Step 3: Exit and re-enter these positions according to the VQ trailing stop alerts and Ratings readouts.

By following these steps, you should be able to shield yourself from a lot of the volatility that the market experiences in general.

You can check each stock with your Ratings account as much as you’d like to make sure each of your stock picks are still super bullish. And if your stock is no longer super bullish, you can trade it out with a different one.

How to Find these Promising Stocks

It’s really easy to find promising stocks when you use Ratings to pull them out from the 146,206 publicly traded stocks, bonds, and ETFs on the market. This software will help you find the stocks that offer the biggest return potential, without exposing you to any unnecessary risk.

Or if you’d like, you can find trade ideas from any newsletters or email lists you’re currently reading. It doesn’t matter where you find them. Just get a list of stocks you are interested in, and see which are the best for your portfolio and goals.

Then you can make the trade you want at an optimal entry point.

The best part about this is that you won’t have to spend hours doing research to make a single trade anymore. You can look up any stocks to see which assets are the most likely to profit big.

And then use the three-step process above to trade the stocks you want.

>> Start discovering promising stocks now <<

What Comes With The Service?

When you buy Ratings by TradeSmith you’ll get instant ratings on thousands of stocks, multiple indicators, the volatility quotient of each stock, plus a 100% satisfaction VIP guarantee.

Instant Ratings on Thousands of Stocks

You’ll be able to look at a stock and instantly know if it’s bearish, bullish, or neutral. The readouts will appear for each ETF, mutual fund, or stock that you type into the ticker bar when you use your TradeSmith account.

If you want a more detailed analysis there are other indicators available to help you decide if you’d like to make a trade. I’m going to go over a few of these right now.

>> Join now for instant access to to 1,000s of stock ratings <<

TradeSmith Stock Health Indicators

When you decide to make a trade, it’s important to know if the underlying asset is healthy or not. Are they hemorrhaging money? How are their fundamentals? Is it an actual quality business you’re buying into, or is it just a scam to fleece investors?

After all, you don’t want to get stuck holding a huge chunk of a company that’s worth nothing when bad news comes along during after-hour trading.

But now there’s no need to worry. Because you can easily tell how solid each asset is by looking at the health indicators available with your TradeSmith account.

Volatility Quotients

With Ratings, you’ll also be able to know the volatility quotient of a particular stock. That way you’ll be able to tell how volatile each stock is, which might come in handy when you’re trading options or deciding whether you want to jump into a trade.

It’s also a useful tool when you’re trying to avoid too much risk in your portfolio. If a stock is too volatile, maybe you skip that one and move onto the next. No matter what you use it for, it’s always a nice tool to have in your arsenal.

>> Access TradeSmith’s legendary VQ ratings here <<

The Billionaire’s Conviction Indicator

One of my favorite indicators that comes with this package is the Billionaire’s Conviction Indicator. TradeSmith says that according to their research, if more than three billionaires own a stock, the “win rates for that stock goes up by an additional 65%”.

I’d imagine if you had several billionaires investing in a certain stock, that correlation would go way up. That’s why I think this is a really useful tool to have. After all, billionaires probably have teams of people researching their stock picks before they buy in. Why not use that to your advantage?

The RSI Indicator

Have you ever made a trade, and then almost instantly have it turn against you? If that has happened to you, then you probably bought into a stock that was oversold. And then the pullback you experienced was just gravity working its magic to bring order back into the world.

But what if there was a way to know if that stock was oversold before you make that trade? Might save you money and time in the trade, right? That’s why I love using an RSI indicator when I trade. It’ll always tell you when a stock is overbought or oversold. And that will help you to not jump into a trade at the worst time.

100% Satisfaction VIP Guarantee

Of course, you don’t need to take my word that this is a great product. You can try it out for yourself and make your own decision.

You have 90-days to decide if you love using Ratings. And if you don’t love it, you can just contact their customer service department and get a credit for the entire price you paid for it.

That’s a generous guarantee on their part. I can’t think of anywhere that will let you use their product for months before you can decide you don’t like it.

I guess that’s how confident they are in this product. They give people the chance to test it out and make sure it really works before they have to commit to it.

>> Take advantage of the 90-day moneyback guarantee <<

Pros & Cons

Pros

- Easy to use. (No time-consuming research required.)

- You can check fundamentals at a glance.

- Crazy good 100% 90-day satisfaction guarantee.

- Trade based on algorithms, not feelings or “know-how.”

- Trading software created by an actual software architect with decades of experience.

- Advanced portfolio analysis tools help you to quickly see if an asset is a buy, hold, or sell.

Cons

- Personal coaching is not included.

- There are no chart-based indicators.

>> Join now to start enjoying these perks <<

TradeSmith Ratings Performance Track Record

Ever regret not seeing that trade that made everyone rich but you? With Ratings, not seeing great trades will no longer be the reason you’re not making any money.

Here are just a few of the great trades Ratings could have pointed you towards:

AutoZone (AZO) was up +3,604% in about ten years.

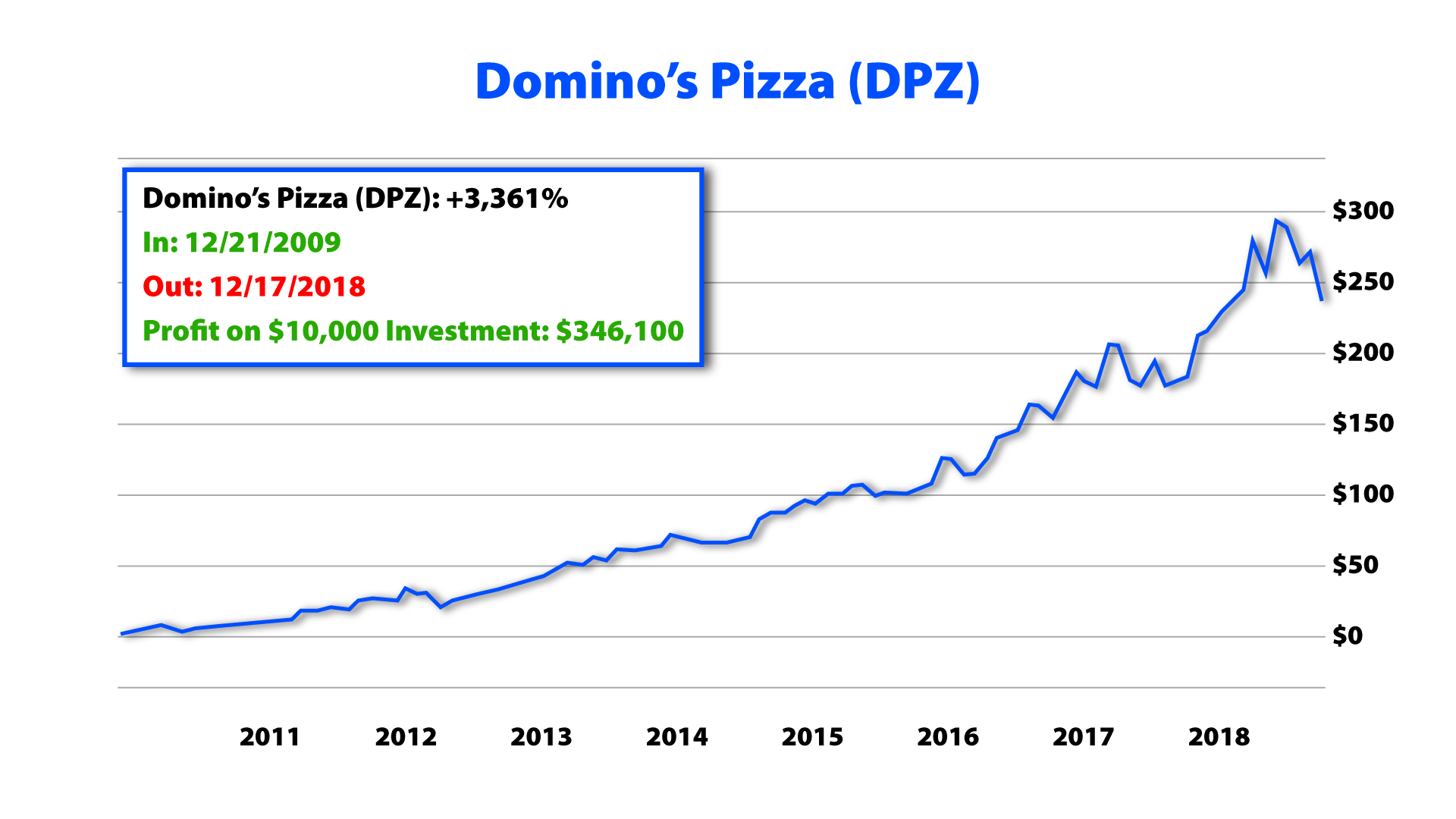

Domino’s Pizza (DPZ) was up +3,361% in this uptrend.

These are just a few of the best examples from TradeSmith’s extensive backtest. Hopefully, there will be several more like these in the future.

>> Discover more trade opportunities with Ratings by TradeSmith <<

How Much is Ratings by TradeSmith?

Right now, you can sign up for this service at a 65% discount. You can get everything I mentioned above for $348 dollars a year. Plus, if you don’t love it, you have 90 days to ask for a full credit.

Note: This offer is time sensitive though, and you might not get the discount if you wait.

Is It Worth It?

Ratings by Tradesmith provides tools and indicators that can help you navigate the market more effectively and make better sense of what’s next for your favorite stocks.

TradeSmith’s ratings condense numerous technical & fundamental factors into a simple rating of either “bullish” or “bearish”. So you don’t have to be an investing genius to use it to great effect.

Simply put, Ratings can broaden your stock market vision and help you make better trading decisions with more confidence than ever before.

The 7-Figure Stackers deal is an excellent value at $348 for a whole year. Plus, if you’re unhappy for any reason, you can call customer service within the first 90 days and get a full credit for your purchase.

Overall, the 7-Figure Stackers deal is a good opportunity to upgrade your trading arsenal. If you want to get serious about the market, Ratings by TradeSmith could put your trading game over the top.

After an in-depth Ratings by TradeSmith review, I can confidently say this trading tool could be a gamechanger for both beginner and veteran traders alike. I recommend you check it out if you’re in the market for expert stock ratings.

Tags:

Tags: