Motley Fool just made a serious upgrade to its popular research package, prompting me to take another look. Is it worth adding to your arsenal of investment tools? Read my Motley Fool Epic Bundle review for all the details.

What Is Motley Fool Epic Bundle?

Motley Fool Epic Bundle is an investment research suite that packages four of the company’s top services.

These services are Motley Fool’s Stock Advisor, Rule Breakers, Everlasting Stocks, and Millionacres: Real Estate Winners.

Millionacres is a rather recent addition to the lineup, as the bundle initially only included the former three.

This collection represents some of Motley Fool’s best research.

Previously, Fool fans had to pay full price to subscribe to these services separately, but now you can bundle all four into one convenient discounted subscription package.

>> Sound like a good fit? Sign up HERE <<

What Is Motley Fool?

Motley Fool is a leading retail research firm and the publisher behind Epic Bundle’s services.

It’s a respected company known for its commitment to delivering consistent value for members.

Founded in the mid-90s by brothers Tom and David Gardner, The Fool has earned a stellar reputation for its insightful research, transparent marketing, and objective stance on the market.

Founders Tom and David Gardner set out to provide quality market analysis that could appeal to folks of all investing backgrounds.

And over the years, the firm has developed a deep catalog of offerings tailored to specific market niches.

Rule Breakers and Stock Advisor were some of The Fool’s first newsletters, and they helped make the company a household name with several years of market-beating performance.

What Makes the Motley Fool Epic Bundle Stand Out? (Membership Benefits)

Check out some of the top features that differentiate this bundle from others like it:

Thorough Investment Research

Instead of simple stock recommendation lists, the Epic Bundle goes far deeper. Users get to access the research behind top stock picks and detailed insights on why it’s worth checking out. This way, you can go in with confidence when making your trades.

Community Access & Feedback

Most services lack the community Motley Fool has built for itself over the years. People come to be a part of a powerful system and stick around for the long run. In addition to the Fool’s editors, you’ve got multitudes of peers to bounce your ideas off of. At the same time, you’ll pick up on tips and strategies unknown to you that you may never have heard any other way.

Special Reports and Live Webinars

The Motley Fool Epic Bundle has no shortage of special reports any time a major breakthrough or market shift takes place. Its team wants to make sure you’re always aware of the latest happenings even when you can’t keep an eye on the news. They also employ frequent webinars to teach investment tactics, show live trading, and reveal sentiments that you can observe from anywhere.

What’s Included In The Motley Fool Epic Bundle?

As mentioned, this package includes an annual subscription to Stock Advisor, Rule Breakers, Everlasting Stocks, and Millionacres Real Estate Winners.

Keep reading our Motley Fool Epic Bundle Review for a breakdown of each service.

Stock Advisor

Motley Fool Stock Advisor is the company’s flagship research service.

Launched in 2002, it remains one of the firm’s most popular subscriptions to this day.

Stock Advisor’s investment philosophy favors longer holding periods in a select group of high-quality stocks.

Typically, the service aims to have about 25 positions in its model portfolio at a time, with expected holding periods of no less than five years.

This investment strategy tends to overlook short-term volatility in favor of consistent growth over time.

So if you’re interested in buy-and-hold plays, Stock Advisor’s monthly picks could be a great fit.

The service provides a model portfolio containing all of its active recommendations and regular newsletters that keep members updated on the team’s latest research.

You’ll receive unrestricted access to the Stock Advisor model portfolio as soon as you join, plus two new picks every month.

It also comes with a wide array of additional research materials, educational resources, expert analysis of emerging stock market trends, and more.

Currently, the newsletter has more than 1 million members, making it one of Motley Fool’s most influential research publications.

This is arguably the star of the Epic Bundle.

We also have a dedicated Stock Advisor review that you can check out for more info.

>> Access The Fool’s flagship service HERE <<

Rule Breakers

Motley Fool Rule Breakers was launched shortly after Stock Advisor made its rise to notoriety.

And it quickly followed its predecessor’s act with a similarly strong performance.

The research focuses on industry disruptors and high-octane growth plays. This newsletter has produced many of The Fool’s biggest winners over the years.

However, it maintains many of the same investment principles as its sister service.

For example, the team also believes a portfolio of 25 stocks with projected holding periods of at least five years gives the best chance at long-term success.

Despite the similarities, this newsletter has a separate research team for Rule Breakers’ stock picks.

The service includes a model portfolio, research reports, and two new recommendations every month.

Members also get access to other Motley Fool resources like exclusive analysis reports, trading education, community forums, and more.

Currently, Rule Breakers has about 100,000 members, so it’s quite a ways behind Stock Advisor in terms of circulation. Still, it’s widely regarded as one of Motley Fool’s most notable offerings.

Check out our Motley Fool Rule Breakers review for a closer look.

>> Dig into Rule Breakers and more today <<

Everlasting Stocks

The Everlasting Stocks service is an investment newsletter with an eye on the long, long term.

It includes the top-rated stocks favored by none other than Fool co-founder and CEO Tom Gardner and his team of experts.

The service is backed by the same team of analysts that beat the S&P 500 by a 3-to-1 margin over the past 19 years.

Tom Gardner believes members can buy any of these Everlasting Stocks and expect to hold them forever. These buy-and-hold-forever recommendations are the service’s backbone and main draw.

The service offers instant access to 15 recommendations on sign-up.

Plus, you’ll receive any future picks from the team as long as you’re a member.

Currently, Everlasting Stocks has about 700,000 members.

To learn more, check out our in-depth Everlasting Stocks review.

>> Find out the team’s latest recommendations <<

Real Estate Winners

Real Estate Winners is one of the Millionacres’ services focused on real estate investment.

As an entry-level offering, it delivers real estate-related stock ideas, expert research, thorough analysis, and plenty more.

A Millionacres subscription is ideal for those wanting to dip their toes into real estate investing.

Some perks include:

- New stock recommendations each month

- Regular updates on recommended stocks following earnings and other events

- Top 10 Investment Alerts delivered each quarter

- Tons of great educational content and resources to make you a smarter real estate investor.

It is also easy to track your investments, as you will receive updates for each pick in the portfolio.

Some of the benefits of Real Estate Winners are:

- A way to hold investments in a taxable brokerage account or an individual retirement account (IRA).

- REITs liquidity

- Cash flows from rental properties

- High-yielding dividends that are legally required

One major advantage of this offer is getting started on real estate investing without having to purchase a physical property.

Although owning physical property comes with plenty of benefits, such as providing passive income, it still is a more active form of investing. And logistics can have an effect on profitability.

>> Tap into this team of real estate experts <<

Bonus Reports & Stock Picks

Motley Fool Epic Bundle members also get an exclusive set of 10 bonus research reports when they sign up.

You won’t have access to any of these reports if you join the service individually, but members get them as an added “thank you.”

Given Fool’s reputation for quality research and transparency, the reports can offer some valuable insights.

Is Motley Fool Epic Bundle Legit?

The Epic Bundle is a legit service packed with comprehensive market analysis.

The deal includes some of the most acclaimed stock research newsletters offered by Motley Fool’s analysts.

Each service provides its own unique investment angle. This makes it a great tool for building a diversified portfolio.

Even better, you get four services for less than the price of two. It’s possibly the best value that the company has to offer.

Buying the bundle also sets you up with a large assortment of Motley Fool stock picks, as well as opportunities in real estate.

Investing Style

The Motley Fool Epic Bundle provides a comprehensive collection of resources focusing on dynamic growth stocks.

Motley Fool’s analysts have a keen eye for spotting stocks with explosive growth potential, and they often identify them well before the broader market notices the opportunity.

Some of their greatest hits include early endorsements of market disruptors like Amazon, Netflix, and Tesla, which have exploded in value since the Fool recommended them to readers.

Stock Advisor, Rule Breakers, and Everlasting Stocks each have their own unique attributes, but they share a common focus on promising growth opportunities and trailblazing companies.

Since 2022, many of the Fool’s stock recommendations have gone on to become consistent performers, but the next generation of picks could be even bigger.

Another key aspect of the Fool’s favored strategy is diversification. The company typically recommends readers hold a minimum of 25 stocks to properly hedge their risks.

If you’re more interested in real estate markets, the Real Estate Winners newsletter focuses on real estate investment trusts, or REITs, and other real estate-adjacent opportunities.

REITs and real estate stocks have the potential to offer various benefits, such as high-yielding dividends, lower volatility, and diversification from traditional equities.

Even if you’re primarily interested in stocks, you could benefit from adding some real estate to the mix, so the Real Estate Winners newsletter adds yet another wrinkle of value to the bundle.

Ultimately, the Epic bundle has something for everyone, and it could help you expand your horizons by putting new investment opportunities on your radar.

Track Record

Diving into the world of investment can be daunting, but understanding the track record of service can provide clarity. Our Motley Fool Epic Bundle review showcases its prowess in identifying stocks with significant growth potential.

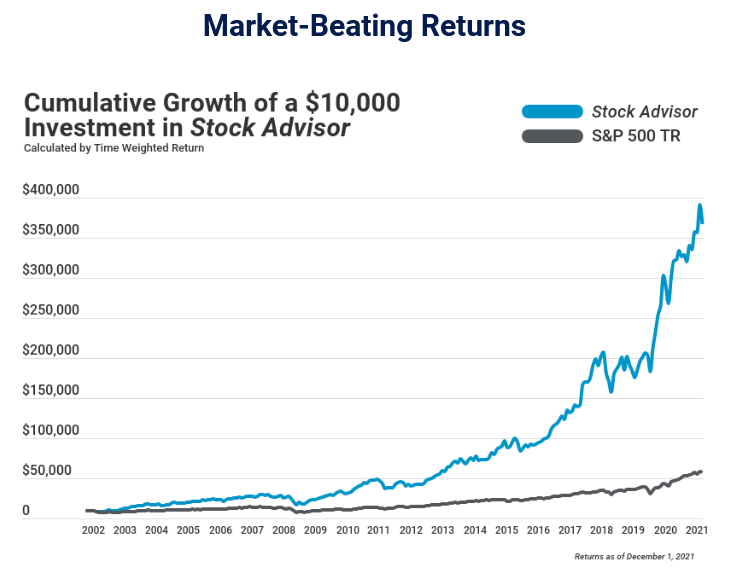

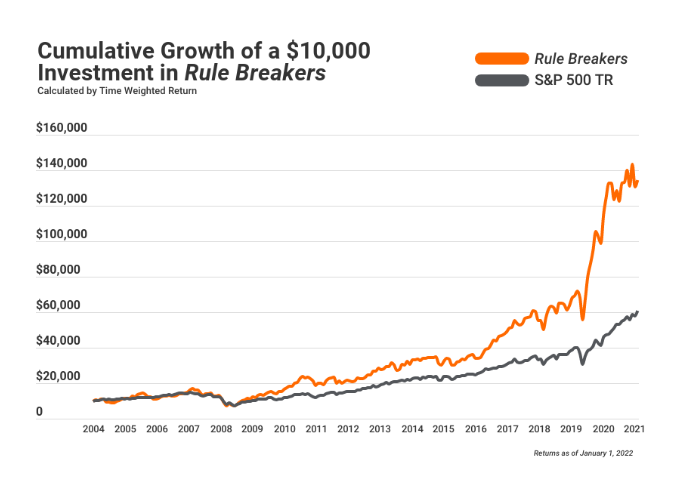

Overall, each individual service stands quite strong. Stock Advisor is one of the best out there, averaging 776% returns since its inception in 2002. While targeting a different subset, Rule breakers still managed 282% overall gains. The Everlasting Stocks portfolio is currently up over 230% since its debut.

Below are just a few of the biggest winners these services have identified over the years:

- The Trade Desk (2017-2021): A top-rated stock by Motley Fool, its value has seen a significant rise from around $8 to a peak of $100. Despite recent market fluctuations affecting its performance, the team remains optimistic about its future trajectory.

- American Tower: As the world’s largest REIT, it has consistently paid dividends. Since its latest pitch in 2019, the stock has thrived in downturns, with dividends growing from $1 to $1.40.

- Twilio (July 2019): Once dubbed the “hidden 5G superstar”, its stock recommendation started at $150 and soared past $400.

- Arista Networks (2017-2021): Another double-down recommendation, its performance has been positive over the years, with the potential to be a future hall of fame pick.

- Markel: Known for its triple recommendation in 2021, it’s been likened to a “mini-Berkshire”. Despite its high stock price, when compared to giants like Berkshire Hathaway, it seems relatively affordable.

- Guardant Health (March 2019): Pitched as a company with a “$147 billion opportunity” due to its lung cancer diagnostic tests, early 2021 investors had a chance to double their investment. However, its current value is down by nearly 50%.

- Shopify (Since 2016): Recognized as one of the best stocks ever recommended by Motley Fool.

- MercadoLibre, a Latin American e-commerce titan, has seen an impressive 8,500% growth since its recommendation.

- Tesla has provided returns of nearly 11,600% since its 2011 recommendation.

- Netflix, another stellar pick, has surged by more than 22,700% since its endorsement.

In essence, the Motley Fool Epic Bundle offers a diversified portfolio of expertly selected stocks, showcasing its commitment to long-term growth and value for its subscribers.

Pros and Cons

Motley Fool’s Epic Bundle is a great service, but it has a few downsides. We prepared a list of the pros and cons in our Motley Fool Epic Bundle review.

Pros

- Excellent price

- Motley Fool is legit

- Bonus trade ideas

- Highly vetted monthly stock picks

Cons

- Moderately high cost

- Doesn’t include options

FAQ

Here are answers to some of the biggest questions surrounding this service:

How Do I Cancel My Subscription?

Once you’re on the other side of your trial membership, there’s no way to obtain a refund for your bundle.

If you’re looking to cancel a future renewal, visit the “My Account” section of your dashboard and choose to “Disable Auto-Renewal”. Otherwise, you can call the customer support team during normal business hours to terminate your next subscription over the phone.

Does It Have a Return Policy?

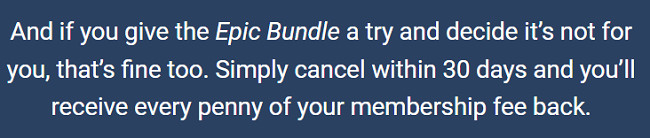

As mentioned earlier, there is a 30-day money-back guarantee for the Motley Fool Epic Bundle. Once you move outside that window, you can no longer request a refund for the service. In most cases, these refunds are only available to new members and will not apply when you renew your package the following year.

What Is the Success Rate of the Motley Fool Epic Bundle?

The Epic Bundle combines the power of the Motley Fool’s top platforms into one streamlined package. To date, it has recommended 334 stocks with at least 100% returns. More than 50 of those have led to quadruple-digit gains. Along that same line, its returns have far surpassed those of the S&P and will very likely continue to do so.

How Much Does It Cost?

The Motley Fool Epic Bundle costs just $499 and includes one-year subscriptions to all four publications mentioned in this review.

At that rate, the cost averages out to about $42 per month.

In exchange, you get unlimited access to some of Fool’s best offerings.

This rate isn’t just an introductory offer. What you pay for the first year is what you’ll pay for the second year.

Of course, future price increases are always possible. However, you won’t have to worry about the deal expiring when your first year is over.

30-Day Membership-Fee-Back Guarantee

Epic Bundle’s refund policy lets you test drive the package for a full thirty days.

If you decide this service isn’t right for you, then you get every penny of your purchase back.

It’s all outlined here by Motley Fool:

So you get full access to the Motley Fool subscriptions mentioned above, including the 10 bonus reports.

And it’s all backed by a 30-day membership-fee-back guarantee.

Should You Subscribe to Everything in The Bundle?

Each of the four services found within the Epic Bundle capture a unique niche of the market. There’s little to no overlap, so signing up for the entire package nets you a slew of recommendations to choose from.

If you’re planning to go all in with the Fool’s picks, it makes perfect sense to sign up here and get them for one low price. You’ll have a lot to pick from that you can weed through, although sometimes you’ll get a repeat performer that you might already own.

That said, folks only looking to invest in one or two of the areas these services target may be better off purchasing them individually. You’ll want to weigh the costs of going it alone knowing that there’s a lot of value packed in here.

Is Motley Fool Epic Bundle Worth It?

Motley Fool Epic Bundle is an excellent deal for anyone looking to get their hands on Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners at a hefty discount.

You’ll also get access to 10 exclusive research reports when you sign up with the service.

These added bonuses are not available with individual memberships.

The package has everything you need to make a serious run at the stock market in one convenient subscription.

And you’ll enjoy it all at a substantially discounted rate.

What’s not to like?

The Fool’s Epic Bundle seems like a great option for anyone who’s serious about advancing their investing skills. I highly recommend you give it a close look.

Tags:

Tags: