Simply Wall Street is a stock analysis tool that’s earned an impressive reputation online. But does it live up to the hype? Get the scoop with our Simply Wall St review.

Simply Wall St Review: Overview

Simply Wall Street is a financial research tool that helps people discover potentially fruitful investment opportunities, particularly long-term ones.

It provides in-depth stock analysis on stocks around the world, determining which companies:

- Are in promising financial health

- Have a strong enough market cap

- And revenue growth

Thanks to their detailed fundamental analysis, you can stay up to date on 100,000+ stocks in 95 countries worldwide.

>> Already sold? Sign up now to save big. <<

What Does Simply Wall Street Do?

The service provides the information to help each user make the wisest investment decision possible.

Simply Wall St offers unique visual reports that showcase:

- The value of stocks

- Growth forecast

- Risk and rewards

- Potential insider trading

- And much more

Is Simply Wall Street Free?

There’s a free version of Simply Wall Street that you don’t need to spend a dime to use.

But the free version does not allow you to run as many reports per month.

So if you want access to more reports, you’ll need to sign up for a paid subscription.

>> Join now for instant access to great stock picks<

Who Owns Simply Wall St?

Simply Wall St is based in Sydney, Australia.

It was founded in 2014 by local entrepreneur Al Bentley, the CEO of the company.

Bentley is a self-taught investor who has vast experience dealing with stocks, learning from initially painful experiences, and relying on emotional intelligence to make key investment decisions.

Through Simply Wall St., Bentley shares his knowledge to help others build a stronger stock portfolio.

The startup has a wide consumer base, with over four million customers spanning 170 countries, with the platform covering all markets globally.

It launched its Beta to the United States, United Kingdom, and Australia in 2015, enjoyed a $600,000 seed round that same year, and subsequently garnered its first paying customers in 2016.

Simply Wall St. also raised $1.8 million from its customers in 2017 to further fund its initiative.

Simply Wall St Review: What’s Included?

Simply Wall St. has several key features that provide all the data necessary to help you make key investment decisions and buffer your own portfolio.

The features include:

- Company Reports

- Stock Screener

- Portfolios

- Stock Analysis Reports

Keep reading our Simply Wall St review for a full breakdown of each feature.

>> Sign up now to access these tools <<

Company Reports

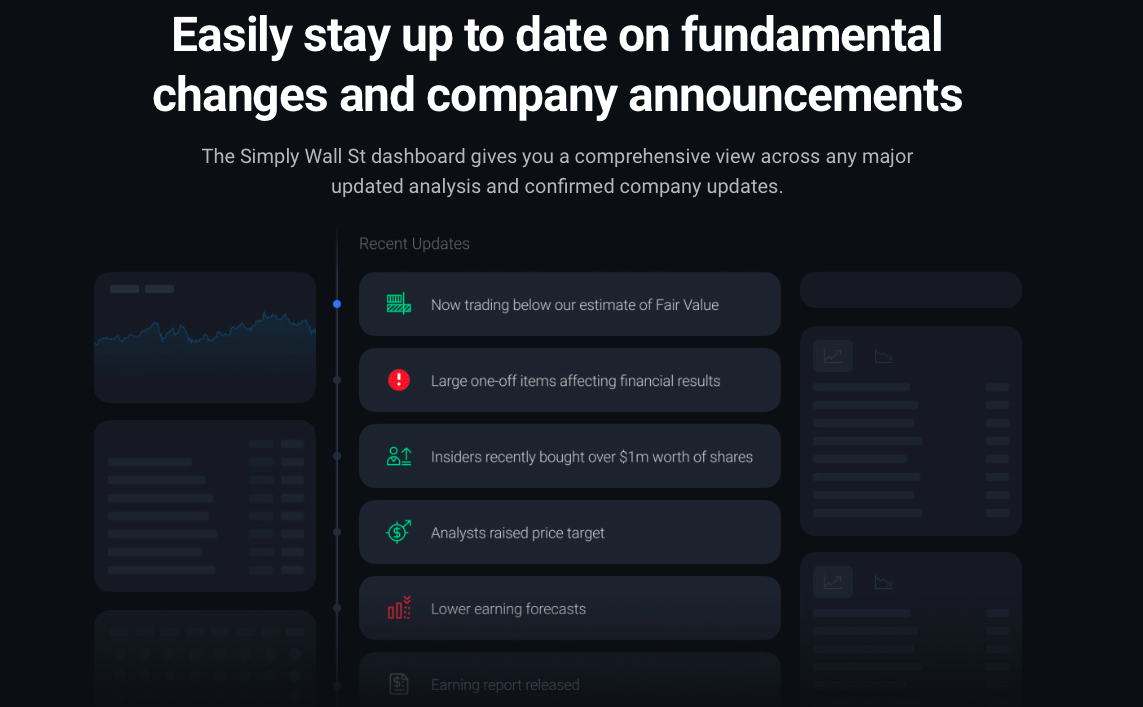

Simply Wall St provides unique, in-depth visual stock reports for the over 100,000 stocks that it covers, examining various companies, their price targets, and their potential.

The reports include a look at the risk and rewards involved with specific stocks, informing you about the potential red flags and opportunities you need to be aware of.

Key insights are extracted each day through their in-depth stock analysis, and financial data is explained to help you understand whether the stock should be invested in or not.

For example, a company’s balance sheet may be promising, and trading is going on at fair value, but the company may have negative shareholder equity and high levels of debt.

The reports also show the growth forecast for various companies, allowing you to see their predicted annual earnings and get insight based on consensus professional analysis.

The reports also provide insights on:

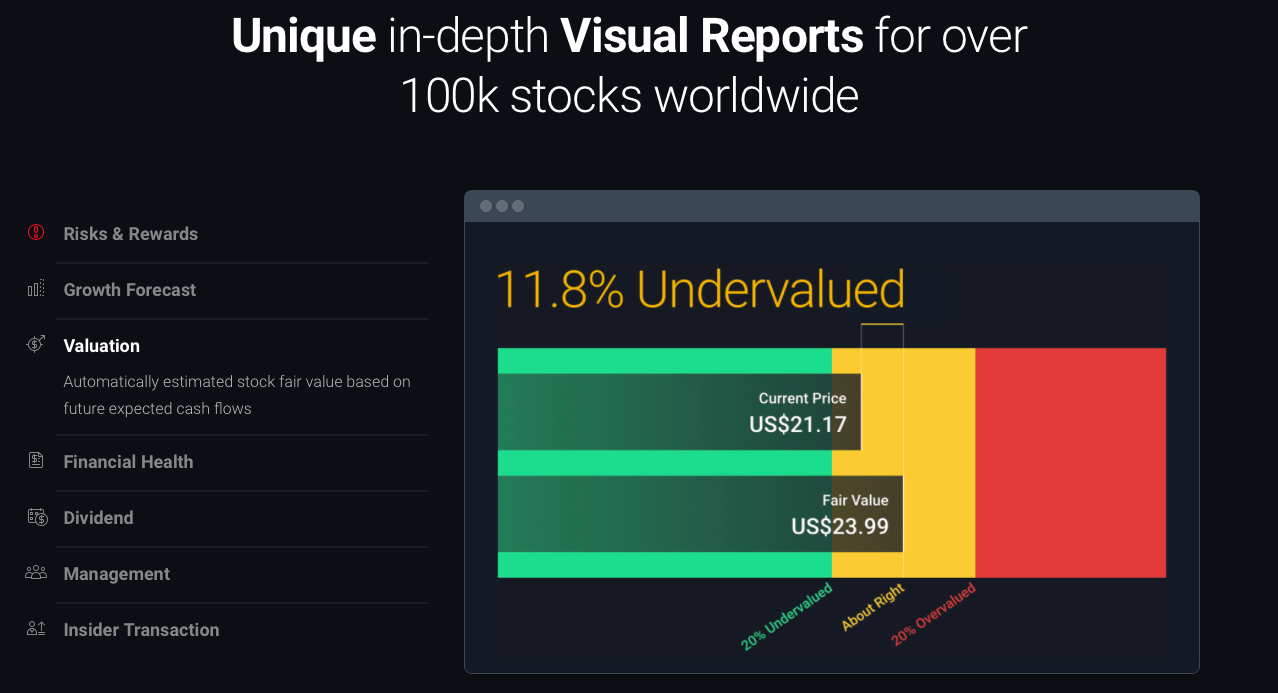

Valuations

You will also find companies and their valuations, including their current price and fair value.

Simply Wall St’s analysis will help you to understand if the stock’s values are undervalued, overvalued, or about right, based on future expected cash flows.

Financial Health Analysis

Simply Wall St also offers detailed financial health analysis, allowing you to best understand a company’s balance sheet.

The financial health analysis covers everything from assets to liabilities, showing you whether a company has enough assets to cover its liabilities, both in the short and long term.

Furthermore, it covers debt, the current cash runway, and equity.

>> Get the full analysis when you join now <<

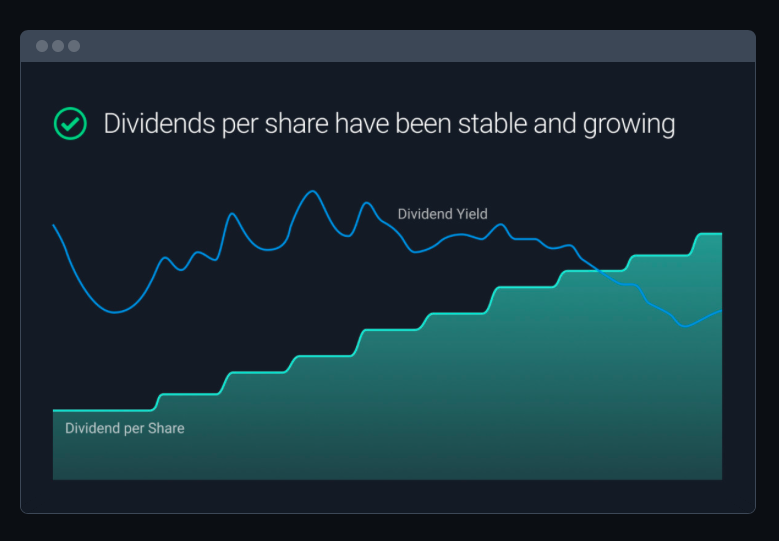

Dividend Payers

The company reports also examine dividend payers.

You can understand the dividends per share based on historical, current, and projected payments made by shareholders, then compare these payments to the industry and market standards.

>> Get the scoop on dividends here <<

Management

Simply Wall St’s also delves deeply into the company’s investment profile and the management share purchases made.

You can assess whether the right leadership structure is in place for the company in question, thanks to the management and board profiles, plus a detailed analysis of leadership capabilities and their management tenure

Insiders

Finally, you get a behind-the-scenes look at which insiders have purchased shares.

Find out which people or institutions have been consistently backing companies, listing the share price, the insiders who bought the shares, and the sell/buy rate.

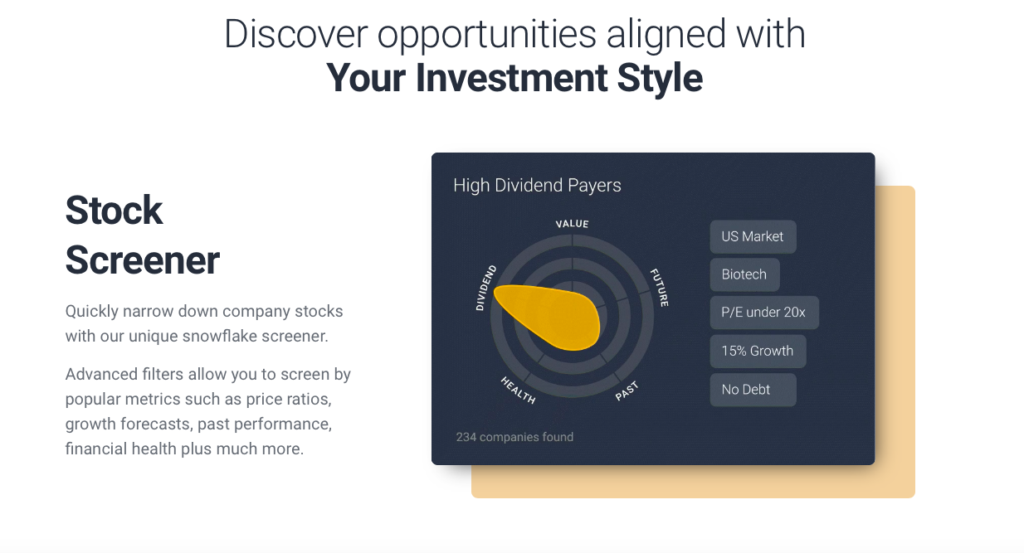

Stock Screener

Another key feature offered by Simply Wall St is its stock screener.

The screener helps discover promising investment opportunities that align with their respective investment styles.

The unique snowflake screener helps you to narrow down various company stocks.

You can determine the past performance of stocks, see if they have high dividend payers, understand their value, and earmark their growth potential.

With advanced filters, the stock screens let you screen popular metrics like:

- Price ratios

- Past performance

- Growth forecasts

- Financial health

>> Get instant access when you sign up now <<

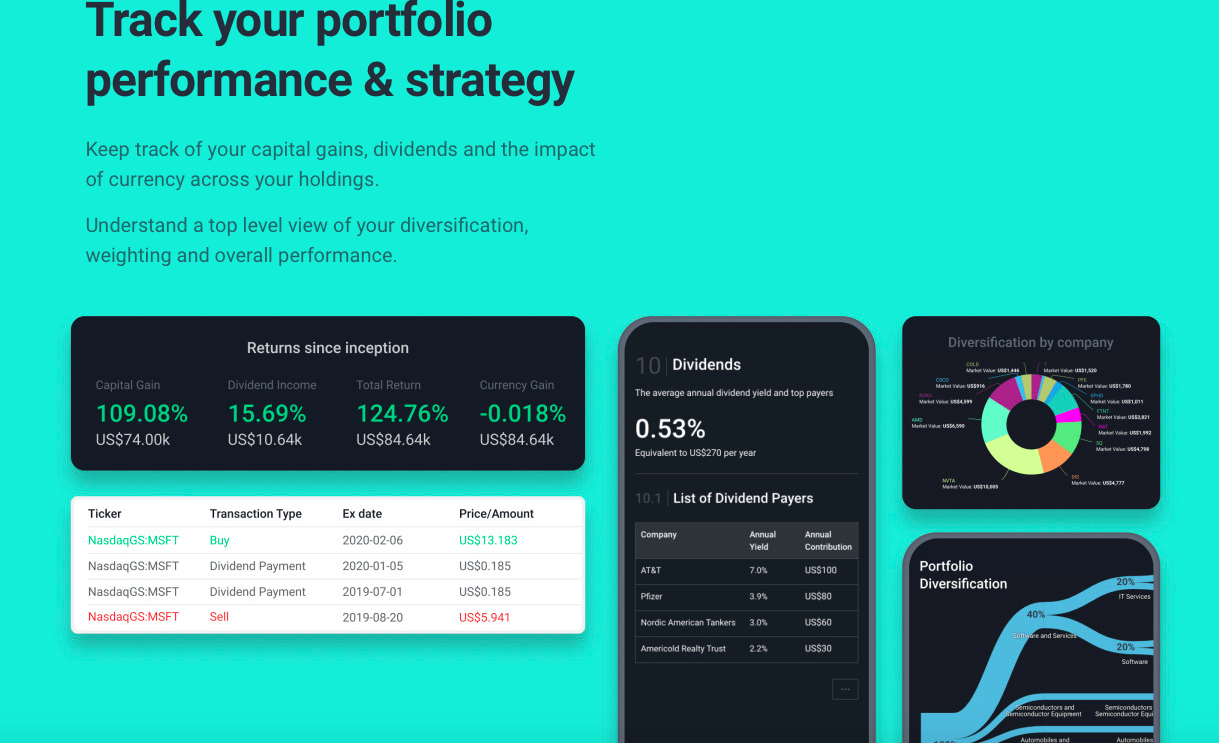

Portfolios

You can create your own portfolio on Simply Wall St.

To do so, you can go to the My Portfolios tab on the Simply Wall St website, create your name, and then select the base currency for your portfolio.

The selected base currency will be your conversion basis once you enter multicurrency transactions.

From there, you can select one of three types of portfolios: Watchlist, Current Holdings, and Portfolios With Transactions.

The latter of the three lets you calculate your portfolio returns, including all dividends and splits.

Each of the portfolio types has a data input that must be included.

The watchlist includes ticker symbols.

Current Holdings include ticker symbols and the number of shares you have.

And, Portfolios With Transactions include ticker symbols, share numbers, transaction dates, transaction types, and prices.

For the data input, you can upload a CSV file, copy and paste it from an Excel spreadsheet or input your data manually.

After filling out the required information and matching columns, you can click on the Create button and save all of your data.

Additionally, you can see sample portfolios of individual investors and companies to get a better idea of portfolio stocks, diversification, return on investment, and portfolio volatility.

Stock Analysis Reports

The stock analysis reports from Simply Wall St include an executive summary, plus stock share prices and news pertaining to featured stocks.

With each stock research report, you can also view other dividend payers for the stocks and get financial health analysis for the stocks and future growth potential.

The valuation aspect of the stock analysis reports uses a discounted cash flow calculation to calculate the fair value of different stocks.

The calculation is done every six hours on the stock market.

>> Get the latest stock picks when you join now <<

Is Simply Wall St Legit?

Simply Wall St is a reliable service that provides a wealth of financial data and expert analysis of the marketplace.

The educational platform does detailed due diligence before providing any stock report, analyzing the critical information necessary to evaluate the validity of companies and their stocks.

Once Simply Wall St garners the fundamental data and analytics, it presents the information in graphs to help you understand stocks better and get their valuations.

Indicators of Quality Investments According to Simply Wall St

Simply Wall St uses four main indicators to analyze and identify the investments it provides to members. Let’s unpack each one now.

Foundation and Financials

The crew at Simply Wall St places utmost importance on investing in companies with a strong foundation. This means a solid executive suite alongside healthy finances.

These two components, in tandem, help businesses overcome obstacles such as economic downturns and operational challenges. A positive outlook here paints a huge picture for the longevity and success of the organization as a whole.

It’s common for Simply Wall St to investigate cash flow, debt levels, and profitability among other metrics.

Growth Prospects

Few investors are going to pursue a company without growth prospects, and that’s no exception here. By looking into its plan for reaching new heights, the Simply Wall St team can assess which businesses are actually on the right path.

In most cases, Simply Wall St looks at a company’s past performance as well. While not a firm indicator of future growth, the writing’s on the wall.

The platform taps into a number of analytics for pulling out these factors. Innovative approaches, sales, and expanding market share all play a part.

Value Over Price

Price is by nature speculative, but a company’s value is a little more concrete. In Simply Wall St’s eyes, a quality investment’s value will always stand higher than the price it currently represents.

By honing in on value, the platform is able to look beyond market noise to see what really makes a company tick. That valuation often provides other vital metrics along with its trajectory.

Dividend Income

By evaluating a company’s dividends, the Simply Wall St team can make sound judgments about the underlying stock.

They look beyond current payouts, scanning for a history of dividend growth and consistency. Organizations with a spotty past are suspect.

Plus, steady returns add an incentive to the investment as an additional source of income.

How to Sign Up For Simply Wall St?

You’ll need to follow these three easy steps when you’re ready to start up a Simply Wall St account.

Step 1: Click the Link in This Review

The quickest way to join Simply Wall St is to navigate to their website using the link you’ll find in this review. This ensures you get to the right platform without having to fight with a search engine. Best of all, you’re supporting the Stock Dork at no additional cost to you!

Step 2: Follow the “Create a Free Account” Link

Once on Simply Wall St’s website, click the bright blue “Create a Free Account” button at the top right of the page. This will kick off your registration, where you’ll need to provide your first name, email address, and password.

It’s free to join, and you don’t even need to input credit card details for a free membership.

Step 3: Decide Which Plan Serves You Best

After you’ve spent a little time on the website, navigate over to the pricing plans to see which one fits the requirements you need. Feel free to stay with the Free plan or choose a paid option that allows more reports, portfolios, and watch lists.

If you opt for a paid membership, you will need to input your credit card information to proceed.

All the New Updates

-

User Base Growth

-

Changed from 4 million to 7 million+ active investors worldwide.

-

-

Coverage Adjustment

-

Now covers approximately 72 000 listed companies rather than “100 000+.”

-

-

New Features

-

Community Narratives & Market Insights: User-generated write-ups and weekly curated briefs under the “Investing Ideas” tab.

-

Dividend Tracker Dashboard: Dedicated interface for tracking historical and projected dividend income, with benchmarks against peers.

-

Transaction-Based Portfolios (launched Feb 28, 2025): Automatically factors in buys, sells, dividends, and splits to deliver a true performance return.

-

-

ETF & Sector Tools

-

Introduced 15 thematic ETFs (e.g., Clean Energy, Digital Infrastructure, Emerging Markets Tech).

-

-

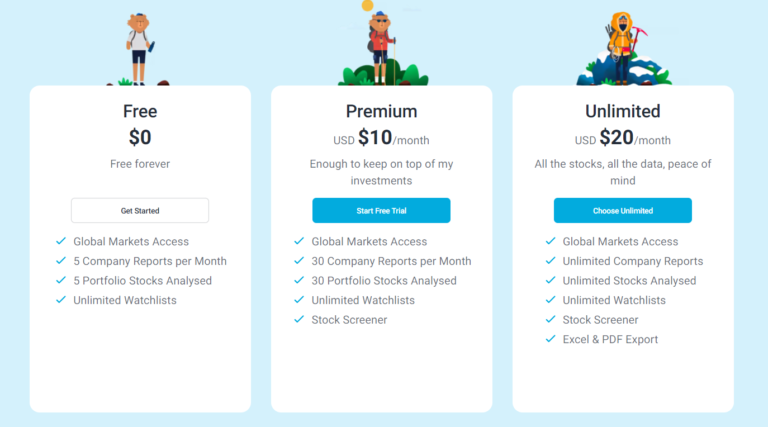

Pricing & Plans

-

Tier names and annual billing remain the same—Free ($0), Premium ($10 /mo billed yearly), Unlimited ($20 /mo billed yearly)—with identical report limits and watchlist allowances.

-

Simply Wall St Review: Pros and Cons

During our Simply Wall St review, we found a lot of positives to using this service, but there are some downsides as well.

Let’s take a look at the pros and cons.

Pros

- Comprehensive stock analysis

- Powerful stock screener

- Rock-solid reputation

- Great for visual learners

- Affordably priced

Cons

- Free version could offer a bit more

- Could be easier to edit your own data

>> Join now to start enjoying these benefits <<

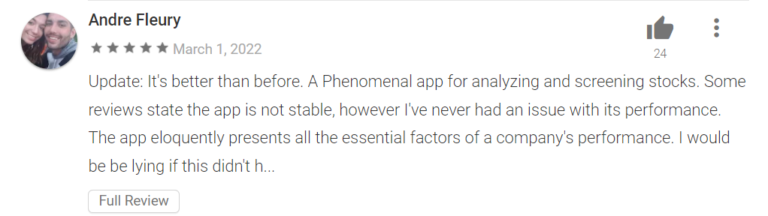

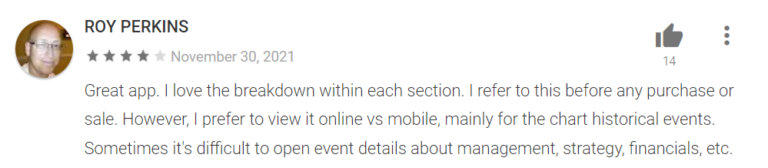

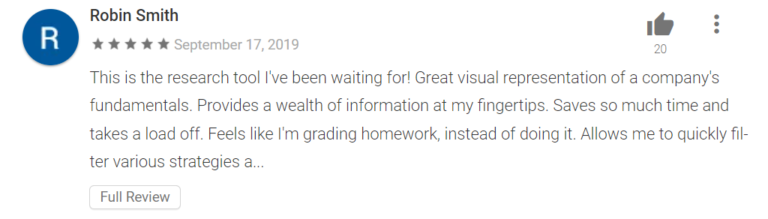

Simply Wall Street Reviews

Its detailed information, along with its illustrations, has earned Simply Wall St a strong reputation with its consumer base a graphical format that people can easily understand.

These reviews on Trustpilot give you a quick snapshot of why Simply Wall St has increasingly gained plaudits from customers and mainstream media.

Simply Wall St Review: Pricing

Simply Wall St has three types of plans, all of which could fit into most budgets.

There is a free plan and paid plans, like the premium plan and unlimited plan included with the stock education service. We analyzed all of them in our Simply Wall St review.

Free Plan

The free plan is the most basic plan offered and is infinitely free.

With the plan, you get access to analysis on global markets and unlimited watchlists.

Five portfolio stocks are analyzed for your benefit, and you get just as many company reports each month.

With the free and paid plans, you can start an account on Simply Wall St using your Google email.

Premium ($10/month)

Simply Wall St’s premium plan is a monthly $10 plan that similarly affords you global market access and unlimited watchlists while also giving you access to its stock screener.

You get six times the company reports and portfolio stocks analyzed, with 30 each.

You can take a free trial with the premium plan to test out the waters.

Unlimited ($20/month)

The unlimited plan from Simply Wall St is their most expensive subscription, as you pay $20 monthly to access everything their service offers.

In addition to the global market access and watchlist that are standard when using Simply Wall St, you get an unlimited number of company reports and stock analysis.

You can also use the stock screener and get different types of exporting methods, whether for Excel spreadsheets or PDFs.

Simply Wall St Discount

As mentioned above, Simply Wall St allows you to capitalize on a free trial with its premium plan.

The trial lasts for 30 days and affords you access to the full service.

You can only get one free trial within a 12-month period, with the approval of trials at the sole discretion of Simply Wall St.

At the conclusion of the trial period, your account automatically defaults to the free plan, and you will have to pay for one of the paid plans to access the full features again.

>> Claim your FREE trial HERE!<<

Simply Wall St Cancellation Policy

Simply Wall Street users can cancel their accounts at any time.

However, the service does not offer full refunds should you decide to discontinue your account.

According to their terms and conditions, you can get a partial refund.

But, whether you’re eligible for the partial refund is at the sole discretion of the company.

Simply Wall St offers a 14-day money-back guarantee for every new subscriber from the sign-up date.

If you ask for a refund after the 14-day period, the service will assess whether your case for a refund is valid.

A credit card is required to use the service.

Simply Wall St does not store credit card details on its servers and uses a third-party payment service called Stripe to handle payments.

Simply Wall St Review: Is It Right for Me?

Simply Wall Street is a good service for you whether you’re simply trying to understand how the stock market works or are a dedicated investor trying to optimize your stock portfolio.

With the relevant results, the stock-based data visualization service sets you up for future short-term or long-term success.

If you’re new to the financial markets, Simply Wall St offers a straightforward platform to help you understand the basics of stock analysis.

The service provides in-depth reports and a variety of financial ratios to help you make sense of a company’s financial health.

For those who focus on long-term growth, the platform shines in its ability to provide comprehensive fundamental analysis. You can sift through detailed company reports to identify stocks with promising future growth.

Are you looking to refine your existing portfolio?

The platform offers tools that evaluate your current investments and highlight areas that could benefit from adjustments. This helps you manage risks and optimize your asset allocation.

On a budget?

There’s a free plan available. This allows you to test the platform’s features without any financial commitment. You can then decide if a paid subscription fits your needs.

The free plan is especially useful for those who are cautious about spending but still want to explore the world of stock analysis.

It gives you a taste of the platform’s capabilities, helping you make an educated decision about upgrading.

Whether you’re a beginner or a seasoned user, Simply Wall Street offers tools and insights that cater to a variety of needs, without breaking the bank.

Simply Wall St Review: Platform Differentiators

Based on a thorough review of Simply Wall Street, the platform really stands out when it comes to visual data representation. Think of it as a visual translator that turns complex financial jargon into easy-to-understand visuals.

In addition, the Discover tool and stock screener stand out and serve as your personal research assistants. They sift through companies based on criteria like growth rates or debt levels, directing you toward options that align with your goals.

This user-friendly design cuts through the clutter, offering you insights that are both actionable and easy to understand. You don’t need a finance degree; the platform does the heavy lifting for you.

The focus here is on clarity and ease of use. The platform takes the guesswork out of financial research, making your decision-making process less stressful and more efficient.

Simply Wall St Review: Is It Worth It?

In summary of our Simply Wall St review, we conclude this service is worth your time and money if you want to effortlessly compile valuable data about stocks.

This is a great tool for almost anyone, but it would likely draw massive appeal from visual learners.

You can add stocks in a few minutes and access institutional-quality data to help you make an educated investment decision in the stock market.

You also get access to valuation, past earnings, financial health analysis, watchlist, and graphs, like the snowflake graph, to show you all of the intricacies that determine the validity of a stock and the company that holds shares.

With a wide range of options, plans, and analysis tools, Simply Wall St is a great resource to help you strengthen your portfolio in unprecedented ways.

You should definitely keep this on your radar if you’re looking for an affordable, accessible platform for analyzing complex market data.

>> That’s it for our Simply Wall St Review. Click here to join now! <<

Tags:

Tags: