Louis Navellier’s newsletter has made a name for itself in uncovering tremendous breakout stocks. He turns his attention next to opportunities presented by the new Trump administration, but is the guru barking up the right tree? Check out this Growth Investor review to find out.

Growth Investor is an investment newsletter led by Louis Navellier and published by InvestorPlace Media. Members gain elite access to trade ideas, bonus reports, and more.

This stock-picking service has two model portfolios: High Growth Investments and Elite Dividend Payers.

Trade ideas mostly follow a conservative approach, with mid-to large-cap recommendations. However, picks can also fall in the moderately aggressive and aggressive range.

The Growth Investor team analyzes several industries, including oil and gas, tech, agriculture, etc., so there could be quite a bit of diversity in the picks.

There’s a lot more to the service that I’ll explore in my review, so stick around. But before we dig in, let’s switch gears and take a look at the service’s lead.

>> Save 60% when you join now! <<

Louis Navellier is a great investment analyst, and I’m impressed with the quality of his stock market research.

Pinpointing breakthrough stocks is tricky business, so it could be a boon to have someone with his experience in your corner.

He’s a Wall Street veteran who calls himself a “1 percenter”. He once had the honor of meeting former President Ronald Reagan.

If his name sounds familiar, you might know him from his pricier newsletter, Platinum Growth Club. Some other popular services he leads are Breakthrough Stocks and Accelerated Profits.

He is also the founder and chief investment officer of Navellier & Associates Inc. The firm manages nearly $1 billion in mutual funds and institutional accounts.

Louis’ track record is more established than most gurus, and he has decades of experience as a money manager. The New York Times even once called him “an icon among growth stock investors.”

>> Get Louis’ latest recommendations now! <<

What Is InvestorPlace Media?

InvestorPlace Media is a great publisher that backs a wide range of investment newsletters. It was founded more than 40 years ago, so it’s been in the business longer than many competitors.

It’s one of America’s largest and most respected independent financial research publishers, and several of its analysts have been featured in prominent publications like The Wall Street Journal, Bloomberg, and many more.

Whether you love him or hate him, we now have Donald Trump back in the Oval Office.

His outspoken demeanor alone can cause the stock market to move, and right now is no exception.

Several stocks jumped on his reelection news, but Louis Navellier believes that’s only the beginning.

Many of Trump’s executive actions have the potential to pave the way for more growth both right out of the gate and a bit further down the road.

Knowing which stocks to target could lead to massive returns if you play your cards right.

Just what has Navellier so excited?

Donald Trump 2.0: History Repeats

Back when Donald Trump assumed the Presidency in 2016, several major media outlets assumed the worst.

We heard talk of gloom and doom, culminating in what they thought could be the worst economy in decades.

In actuality, several stocks exploded higher than anyone predicted. Those doubting missed out on some big profits.

That four-year stretch wasn’t just some fluke. We witnessed the same type of growth when Ronald Reagan enacted his pro-business policies some 40 years earlier.

What I find most interesting is that this 2024 boom could be much larger, given the deck is finally stacked in Trump’s favor.

Republicans control the House and Senate for the next two years, giving the President leverage to implement all his policies before the political climate shifts.

That news alone is enough to get me really excited about what’s to come.

A Return to Innovative Technology

Navellier’s not saying we were in an innovative dead zone for the past four years, but Biden’s administration certainly didn’t make it easy.

Excessive regulations costing upwards of $1.8 trillion figuratively attached a heavy stone to economic movements.

I’m guessing we’ve all seen first-hand what that much red tape can do to folks trying to enact change.

Trump, along with the help of some of the brightest business minds of our era, are working to eliminate all that fog as soon as possible.

After all, he established an American AI initiative back in 2016 to keep us on the cutting edge of technology, a place he wants to return to as soon as possible.

Louis predicts this is all a glow-up to artificial general intelligence, a new form of AI that can think and react for itself.

How to Capitalize on the Trump Melt-Up

I always get excited about the rise of new technologies, as these spaces are the breeding grounds for new millionaires.

This next generation of artificial intelligence could pave the way to wealth unlike anything we’ve ever seen before.

I admit, the tricky part is knowing how to play the space for your shot at profits. For every company that succeeds, many more will fall by the wayside.

That’s where Louis Navellier comes in. He’s already done the research for us to uncover stocks with the most growth potential.

You can have instant access to all those picks by signing up for his latest bundle under this new deal.

Join me as I unpack everything you get for becoming a member.

>> Get all the details on the “QaaS” bundle here <<

Growth Investor Review: What Comes With the Service?

This service offers a suite of exceptional stock market research analysis guides and tools.

Keep reading for a full explanation of everything that’s included with this deal.

Annual Growth Investor Newsletter Subscription

Louis Navellier delivers stock picks to subscribers on the last Friday of every month. There’s no set number of recommendations, but there are usually around two in every report.

I’m a big fan of this structure. I’d rather get a list of well-researched opportunities than haphazardly picked stocks trying to reach an arbitrary quota.

Plus, the team sometimes provides more than two a month, which is a nice surprise.

The Growth Investor newsletter is easy to read, and it’s well organized.

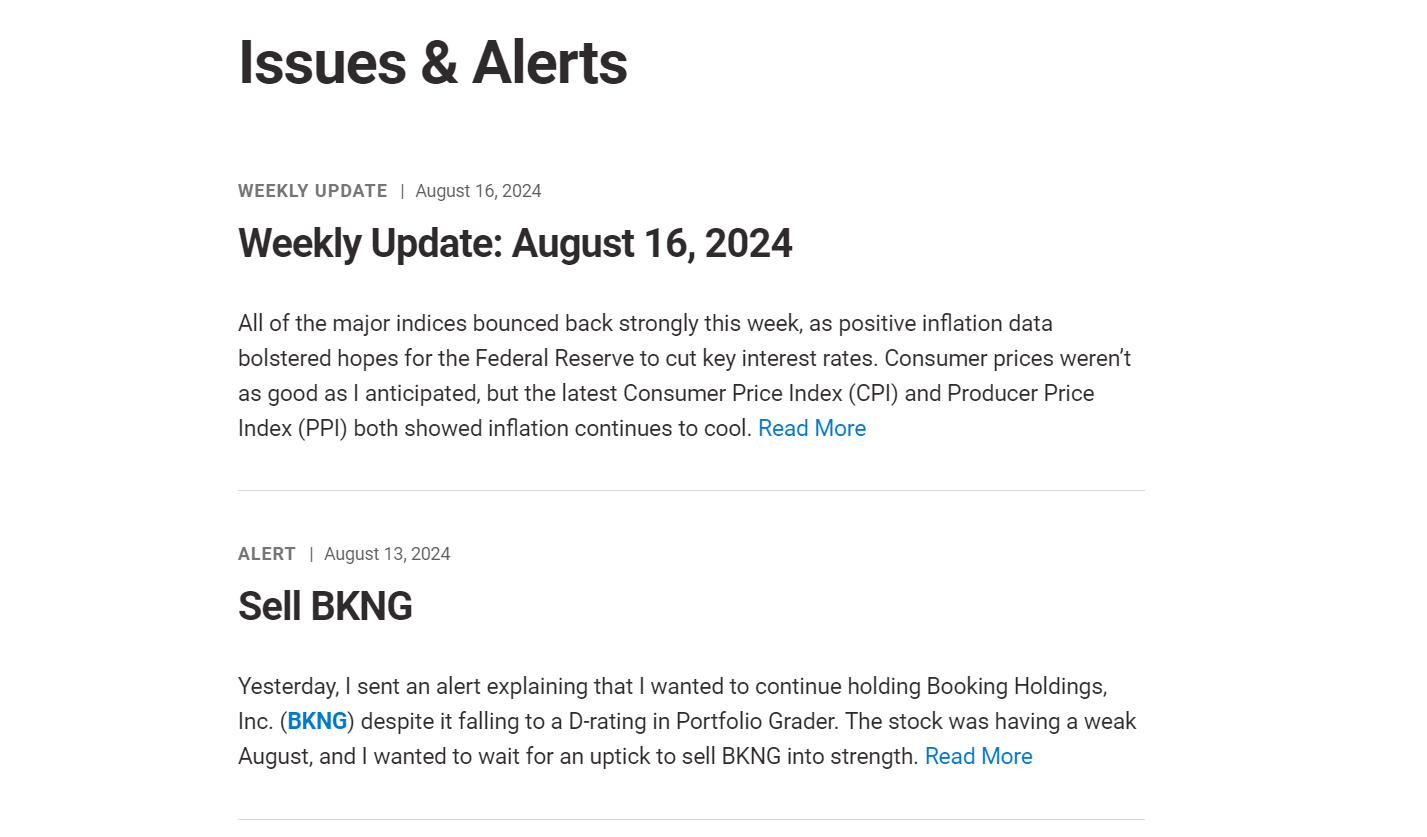

New issues can be found on the Issues & Alerts tab. Here’s what the newsletter looks like:

Right out of the gate, something I really like is that the Growth Investor team includes a table of contents that clearly marks buy and sell alerts. This makes skimming the recs a breeze, and it’s a big time saver.

Each issue contains stock picks, market commentary, sell alerts, and more. The sell alerts are not a monthly occurrence.

The newsletter will also keep members up to date with any rating changes.

>> Access all Growth Investor recommendations NOW <<

Model Portfolios

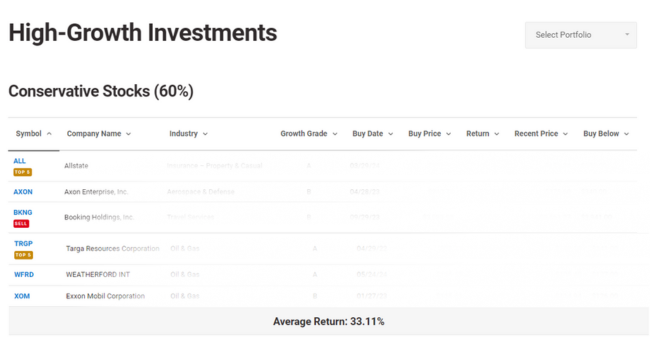

As mentioned, Growth Investor provides two model portfolios: High Growth Investments and Elite Dividend Payers.

Every trade idea is entered into one of these portfolios, along with the following details: ticker symbol, company name, performance, and more.

This is a snapshot of the High Growth Investment Portfolio:

Each model portfolio is also broken into three categories: conservative, moderately aggressive, and aggressive.

You can click on the ticker for more info and see the initial alert and buy rec.

The team keeps you updated on all the model portfolio moves with special briefs.

Additionally, you’ll receive alerts with the latest stock market news.

The alerts also notify you when you should buy or sell out of a recommendation.

These updates can be fairly frequent, which is a nice change of pace in the research space. I appreciate how much time the team takes to keep members in the loop.

This is a handy feature that lets you go about your day without missing a beat in the market.

When you sign up for Growth Investor, you also get access to a research archive containing all the service’s previous special reports and research resources.

The archive contains the team’s in-depth research on a wide variety of tech trends, including 5G, cybersecurity, and much more.

Even the older reports in the archives still contain valuable insights that can help you make better sense of the market. They also have the potential to lead you to promising trade ideas to boot.

A subscription includes unrestricted access to the archives as a membership perk, so the research can be explored at your leisure.

In terms of the sheer volume of research, the archives could be the most valuable part of this deal, giving you a ton of bang for your buck.

Weekly Updates

In addition to receiving a monthly newsletter, Navellier sends out weekly updates on Fridays with all his thoughts and insights on what happened during the week.

After you’re up to speed, he offers his take on the market and stock news just down the road so you’re prepped and ready.

You likely won’t find any new recommendations here, but Louis will let you know if an event affects one of his current positions and how to react accordingly so you’re not thrown for a loop.

I’ve found these bite-sized reports just as informative as the main newsletter, and it’s rare to find a service going the extra mile like this one does.

>> Access these features and more for 60% OFF! <<

Trump’s 100-Day Melt-Up Special Reports

The latest Growth Investor package provides additional trade ideas and market research.

Here are all the extra reports and features you get:

Trump’s 2nd AI Wave: How to Profit From the Next Generation of AI

Reaching the goal of implementing artificial general intelligence requires massive amounts of computational power.

Data centers are popping up all over the country to keep up with demand, and Navellier has located one company he predicts stands to gain the most.

It’s out there building data centers as we speak as the tech giants pour hundreds of billions into the sector. You do the math.

In this special report, Louis shares the name and ticker symbol of this firm already making a name for itself.

He covers the company’s background and the reasons he’s so bullish about it in a concise and easy-to-read format so you can get involved before it’s too late.

The Company Powering Trump’s AI Revolution

Artificial intelligence similarly requires tons of energy to discover answers to our most pressing questions.

A ChatGPT inquiry consumes ten times the power of a normal Google search, and AGI will demand that much more.

We could see data centers rival the amount of energy every home in the country uses in less than a decade.

Donald Trump’s drilling initiative could carve out a new natural gas infrastructure to keep data centers up and running.

Navellier’s pick for this energy push is none other than a natural gas stock that operates in a key part of Texas’ Permian Basin.

He shares all the details inside.

The Bitcoin President: The #1 Stock for the Coming Crypto Melt-Up

Trump has been no less vocal about his love for cryptocurrency and desire to make America the “first crypto nation”.

He’s planning to set aside a stockpile of Bitcoin as a reserve currency and adjust regulations to make coins more accessible than ever.

We’ve already seen how his election sent Bitcoin above $100,000 for the first time.

That shockwave could be just the beginning of a crypto melt-up on the horizon.

Louis Navellier’s on top of these movements yet again, discovering a little-known crypto stock set to take advantage of the situation.

The guru lays bare his findings in this report, explaining his pick in a way that even someone new to digital currencies can put to use.

Made in America: How to Profit From Trump’s Manufacturing Boom

Another of Trump’s big initiatives is to return manufacturing to U.S. soil.

The tariffs are all over the news and seem to create avenues for competitive facilities within our borders.

It’s possible that artificial intelligence and robotics could further push manufacturing costs down.

We saw snippets of an American manufacturing boom in 2016, but Navellier predicts even more growth this time around.

He’s identified one company with the chops to benefit most, and he provides all its details in this short bonus report.

You’ll also learn more about why our country is ripe for a manufacturing resurgence and how this one stock’s unique offerings speak to the need.

The Trump Losers: Three Stocks to Avoid Like the Plague

As much as I hate to see it, not every company is going to benefit from the Trump administration.

Certain sectors, like oil and clean energy, could actually see significant losses if the President is able to make oil as cheap as he plans.

Other areas are on the chopping block too, and you don’t want these ventures pulling your earnings down.

In Three Stocks to Avoid Like the Plague, Navellier highlights three stocks likely to crash or even go bankrupt.

Not only will you find their names and ticker symbols inside, but also detailed explanations of why each one made the list.

>> Get all the bonus reports now! <<

90-Day Money-Back Guarantee

A Growth Investor membership has its perks, and Navellier is so sure that his strategies will work that he backs up the program with an unbeatable 90-day money-back guarantee for your subscription.

This robust guarantee offers you a full 90 days to “test drive” the service. If you don’t like it for any reason, you can qualify for a full refund.

The best part is, you get to keep every report, financial strategy, and stock recommendation from the time that you were a member.

With a guarantee like this, it’s easy to see that Navellier stands by his product.

>> Get started now to take advantage of Louis’ guarantee <<

Is the Service Right for Me?

Growth Investor is best suited for people looking for research on growth investments and dividend payers.

The team has a broad focus, so they often find promising stocks from all corners of the market.

As such, the service could be a good fit for someone searching for a wide variety of recommendations.

For example, some newsletters heavily lean into energy, tech, mining, etc. However, Louis and the Growth Investor team don’t limit their recommendations to any particular sector or category.

Pros and Cons

I found plenty to like during my review of Growth Investor, but it could improve in some areas.

Pros

- Monthly newsletter with multiple growth stock picks

- 5 bonus reports on how to make the most of the coming Trump Melt-Up

- Weekly market updates

- Full model portfolio featuring current recommendations

- Access to the complete research archives

- 90-day money-back guarantee

Cons

- No community forums or chats

- Doesn’t cover options, futures, or shorts

How Much Does Growth Investor Cost?

Growth Investor typically costs $499 for a yearly subscription. Right now, the team is sweetening the deal by offering an introductory rate of $99.

This stacks up to an 80% discount. You’re paying less than $2 per week for multiple chances at game-changing gains.

Even better, there’s no trade-off to opting for the discount. The package includes everything mentioned in this review.

When it comes time to renew your Growth Investor subscription, Navellier and crew will honor your discounted rate yet again.

Unless this changes down the line, you can continue to enjoy this feature-packed service for the same low price.

>> Join now to claim 80% discount! <<

Is Growth Investor Worth It?

A thorough review of Growth Investor showed us why this service is an excellent investment newsletter packed with insightful analysis.

For just $99, you can access an impressive collection of research and regular stock ideas for a full 12 months.

Something I also appreciate about this service is that it has existed for nearly two decades. I’ve seen many research newsletters pop up overnight and then disappear without a trace.

It’s nice to know that the service has managed to maintain its momentum—even through financial crashes.

I’m also extremely impressed with Growth Investor’s comprehensive 90-day money-back guarantee. It’s a strong signal that Navellier stands by his work and his members.

If you’re in the market for a balanced approach to growth investing, I recommend giving Growth Investor a try.

Tags:

Tags: