Follow along while we pit Stock Advisor vs Rule Breakers to see which stock-picking service deserves your hard-earned cash.

Investing in the stock market can be frustrating for even the most experienced traders.

Fortunately, Motley Fool has some great research tools available in the form of Stock Advisor and Rule Breakers.

While they both report consistent average returns and focus on long-term investments, they’re guided by completely different strategies.

So which service caters to your investing style?

Read our Stock Advisor vs Rule Breakers review to find out.

Stock Advisor vs Rule Breakers

Stock Advisor and Rule Breakers are services created by David and Tom Gardner.

The brothers co-founded Motley Fool back in 1993 and have grown it to be one of the most sought-after reservoirs for financial and investment insight.

While they do offer stock picks, the Fool’s focus is helping newbies and pros navigate all things stock market, which is why they place extra emphasis on investment education.

Two standout services they offer are Stock Advisor and Rule Breakers.

These are the top-touted services created by Tom and David Gardner.

They both focus on long-term investments but have distinct trading philosophies guiding their picks.

Stock Advisor takes a more conservative approach to investing, while Rule Breakers leans more into high-growth opportunities.

Rather these are stock picks that are backed by intense investment research.

Who Is Better, Tom or David Gardner?

David Gardner’s picks outperform his brother Tom as of 2021.

That being said, both brothers outperform the S&P 500 by quite a lot.

What Is Stock Advisor?

The Stock Advisor team scrubs the market for stocks with excellent growth potential that should stay in your investment portfolio for at least five years.

Stock Advisor targets stable companies with good fundamentals that will help them stand the test of time.

Each month, you get two stock picks that you can add to your portfolio.

Sounds good, right?

Well, it doesn’t stop there.

Stock Advisor also features a continuously updating starter stock list that the team feels every subscriber should have in their stock portfolio.

There’s also a bunch of fantastic educational material as well as a community feature that connects you with other like-minded Motley Fool subscribers.

The key takeaway with this service is that Stock Advisor has a stellar track record of providing solid stock picks over its nearly 20 years of existence.

You can read our full Stock Advisor review here.

What Is Rule Breakers?

Like Stock Advisor, the Rule Breakers service provides stock picks for long-term plays, but there’s a twist.

This service looks for stocks that are primed for significant growth opportunities.

Rule Breakers offers two new stock picks each month but also keeps a best-buy list.

The analyst team scours the market for companies that are disruptors in their industry and poised to explode.

One notable pick was Tesla in 2020.

The service has been around since 2004 and has had great success so far.

Similar to the Stock Advisor service, you also get access to a ton of additional features, including educational resources, a model portfolio, and much more.

You can read our complete Rule Breakers review for more info.

Stock Picks: Motley Fool Stock Advisor vs Rule Breakers

Both Stock Advisor and Rule Breakers have a proven team of analysts with years of experience picking great stocks.

The main difference between these stock-picking services is in their approach to selecting their favorites from the market.

Stock Advisor Investment Strategy and Stock Picks

Motley Fool Stock Advisor is about making stock picks that the team feels will have a solid long-term performance.

We’re not talking stocks that burn out quickly — these picks are designed to be held for at least five years.

Though, each stock pick has the potential for high growth.

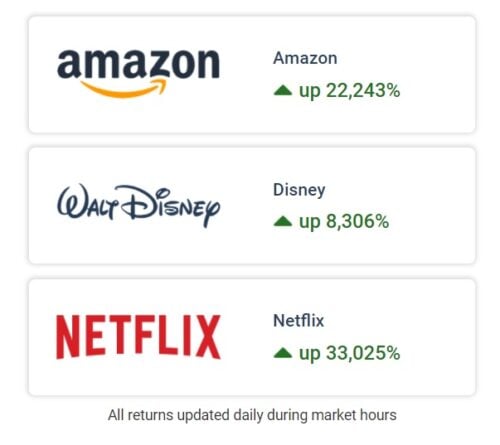

For example, years ago, they identified companies like Netflix and Amazon that have seen an insane return and are now in the S&P 500.

Both Tom and David Gardner have a team that uses their unique methods to find these long-term stars.

Tom and his team hunt for stocks in industries that have lost popularity in recent years.

They may have slower growth in the short term, but each pick tends to do exceedingly well in the long term.

Not every stock is a winner — though, many are.

Rule Breakers Investment Strategy and Stock Picks

Motley Fool’s Rule Breakers is all about helping you pick high-growth stocks to invest in that look to have large returns in the short term.

However, these are still intended to be held in the long term.

They also keep a “Best Buys Now” list of five stocks, updated monthly, that often see great success on the market.

Rule Breakers has had an excellent track record and is still performing incredibly well today.

Several Rule Breakers stocks picked last year have already provided the opportunity for a solid return. Tesla and Shopify are some notable picks.

As an added bonus, you can use the search query to look through the exhaustive list of all the stocks in the Rule Breaker database.

One drawback to consider is that these Rule Breaker stocks tend to lean into the tech sector quite a bit.

This makes sense, as some of the biggest gainers are in tech, but it can require a little more risk tolerance.

Performance: Stock Advisor vs Rule Breakers

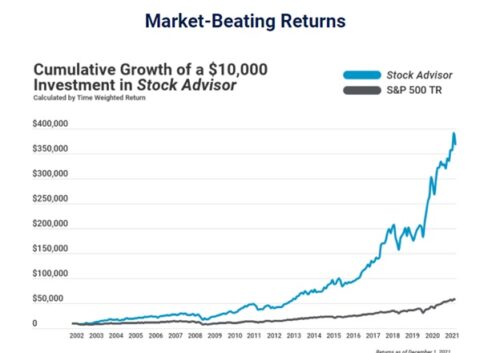

In terms of Motley Fool Rule Breakers vs Stock Advisor performance, there are quite a few familiar trends.

Both stock-picking services have outstanding track records when it comes to picking stocks with high yields.

They also focus on long-term investments — though, Rule Breakers targets riskier plays with high-growth stocks.

Let’s take a look at just how much Rule Breakers and Stock Advisor picks have outperformed the market.

Can’t Decide? Get Stock Advisor, Rule Breakers, and Everlasting Stocks in the Epic Bundle For $499.

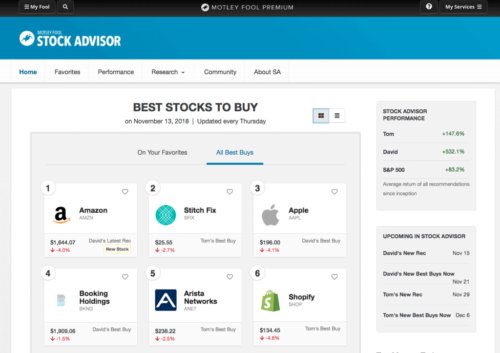

Stock Advisor Performance

Stock Advisor has identified some hidden gems by looking at companies with strong consumer appeal.

The stock newsletter has seen its picks return over 500% as of the end of 2020.

By comparison, the S&P 500 has only seen a 100% increase.

>> Does Stock Advisor sound like it’s for you? If so, click here to become a member now! <<

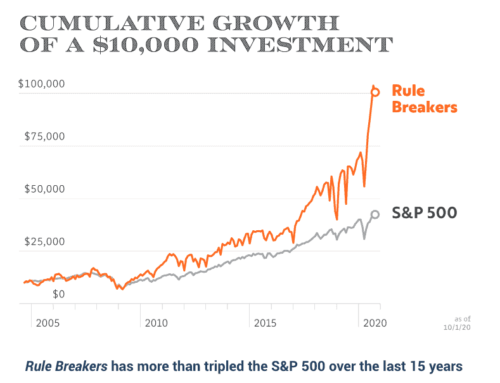

Rule Breakers Performance

David Gardner and his team at Rule Breakers are experts at picking stocks that are poised for high growth.

And this is reflected in the performance of Rule Breakers stock picks.

The average stock sees a 277% return, and the platform has outperformed the S&P 500 by more than 300%.

>> Already sold on Rule Breakers? Click here to sign up today! <<

Starter Stocks: Motley Fool Stock Advisor vs Rule Breakers

Motley Fool Stock Advisor and Rule Breakers have a strong list of starter stocks to build a rock-solid investment strategy and strengthen any portfolio.

The difference between the two lies in what they offer beyond that.

Let’s take a look at their starter stocks.

Stock Advisor Starter Stocks

The Motley Fool Stock Advisor updates its list of starter stocks once every year.

Since starting a portfolio can be an overwhelming process for a newcomer, Fool suggests using this list as a launching pad to grab some good market picks.

Each stock pick serves as a robust foundation to build a portfolio around.

In addition to other Stock Advisor services, this is a great way to learn how to build your portfolio from the ground up.

The list is not just for novices, though.

Even experienced traders can use these value stocks to strengthen their portfolios.

>> Sold on Stock Advisor? Click here to sign up today! <<

Rule Breakers Starter Stocks

Motley Fool Rule Breakers focuses on providing stock picks that have enormous growth potential, and you can see this in its Starter Stocks.

If you prefer a more aggressive investing style or are just starting and want a strong investment core, a Rule Breakers subscription comes with a list of starter stocks to help you catch up with the market.

Motley Fool suggests picking at least three of these high-growth stocks to build a portfolio around.

Experienced folks looking for substantial gains can also take advantage of these picks to strengthen their portfolio and investment strategy.

There’s also a Rule Breakers portfolio that you can use to model your own portfolio around.

Community: Stock Advisor vs Rule Breakers

Having a great community at your back is a huge blessing in the investment market.

The Motley Fool understands this and gives you access to the best of the best, so you can find stocks that match your investment strategy.

Stock Advisor Community

The Motley Fool has one of the strongest investment communities on the internet.

Stock Advisor has a large number of supporters to bounce ideas off of, pick up stock tips, and more.

Stock Advisor also offers community events to encourage engagement among fans.

All you have to do to gain access is to become a subscriber.

Rule Breakers Community

Rule Breakers’ investing community is a great place to increase your stock knowledge by sharing thoughts with other members on the site.

You can also search through the forum for trading ideas and use this space to check your hunches against what others think.

The community is an often overlooked feature that can take your skills and portfolio to the next level.

If you decide to subscribe to Rule Breakers, do not miss out on this tool.

You might even find some high-growth companies worth investing in.

Pricing: Stock Advisor vs Rule Breakers

Motley Fool’s Stock Advisor and Rule Breakers have similar pricing models and some awesome discounts.

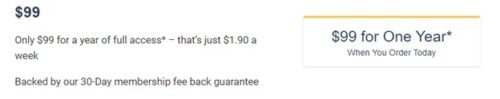

Stock Advisor Pricing

Stock Advisor costs $199 to join for the year — without the discount.

Stock Advisor Discount

You can currently pick up everything the Motley Fool Stock Advisor has to offer for just $99 for an entire year, which boils down to only $1.90 per week.

This is advertised as being 50% off the regular price, so it could potentially double when your discount expires.

30-day money-back guarantee

No matter the price, there’s a 30-day no-risk guarantee.

If you’re not completely satisfied with the service for any reason within those first 30 days, just cancel to get every penny of your membership fee back.

Is Stock Advisor Worth the Money?

Yes, we believe the Stock Advisor program is worth the money.

It has proven itself time and time again to be a reliable research tool for stock investing.

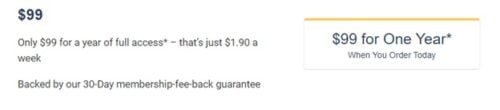

Rule Breakers Pricing

Rule Breakers is priced at $299 per year, but there’s currently a discount available.

Rule Breakers Discount

Rule Breakers is also available for just $99 a year

No one knows when the price will go back up, though, so you might want to take advantage of the offer while it’s still available.

30-day Money-Back Guarantee

Rule Breakers also comes with a 30-day money-back guarantee.

As long as you can make up your mind about the service within those first 30 days, there’s no reason not to give it and its selection of stocks a try.

Is Rule Breakers Worth It?

If you have the risk tolerance, Rule Breakers could be the best option.

Because these are high growth opportunities, they could provide excellent upside.

Main Differences Between Stock Advisor and Rule Breakers

While the foundation between these two services is unsurprisingly alike, the differences between Rule Breakers and Stock Advisor come down to your mindset.

Are you looking for long-term stability or high growth?

Stock Advisor is a bit like the calm, cool, and collected sibling, and decisions are a bit more rational and certainly less volatile.

Stock picks are more mainstream, but on average still see significant returns.

Rule Breakers, on the other hand, is the more impulsive sibling.

They see some massive wins by focusing on companies with a lot of growth potential.

That being said, there is always the risk of a loss with these stocks as well.

The volatility and discipline that follow this option don’t sit well with everyone.

Which Is Better Stock Advisor or Rule Breakers?

If you’re the type of person to ride the market for the foreseeable future, step into the Stock Advisor camp.

If you’re a bit more of a risk-taker and are big into buying low and watching for stocks to skyrocket, go with Rule Breakers.

In either case, you’re in good hands with Motley Fool Stock Advisor or Rule Breakers.

The firm’s teams are open, honest, and transparent in their dealings.

They have a passion for succeeding, and they genuinely want to pass that success along to you.

Conclusion: Motley Fool Stock Advisor vs Rule Breakers

Both Stock Advisor and Rule Breakers have a strong core in The Motley Fool and are solid pillars in the stock market community.

Each service frequently makes solid picks for stocks and sees returns that far surpass even the S&P 500.

When it comes to choosing one or the other for a source of investments, the answer is simple — choose both!

While the foundation is the same for each service, the advice each one provides is in a league of its own.

>> Still Can’t Decide? Get The Epic Bundle Here! <<

Tags:

Tags: