Read our 5%ers review to find out everything you need to know about this top prop trading firm.

The5ers is one of the biggest prop firms in the industry and offers programs that cater to a variety of trading styles, including more aggressive strategies.

Its instant funding programs are a game changer for anyone looking to dive right into trading forex, and the firm also offers an account-level system that allows you to progressively build up capital.

But is The5ers legit, and can this firm help you make money?

Read our the5ers review to find out!

What Is The5ers?

The5%ers was founded in 2016 by Gil Ben-Hur and Snir Achiel.

Ben-Hur and Achiel are day traders from Isreal who created the platform to help skilled traders increase their profitability without risking their own money.

The prop firm funds forex traders up to a million dollars in capital through its Growth Trading Plan.

5%ers Evaluation Process

The5ers lets users prove their trading skills through an evaluation program dubbed Level 1.

During the program, traders must reach set profit targets to gain access to a fully funded account.

Once traders have proven their risk management capabilities, they can proceed to Level 2, where they can earn more capital and boost their earning potential on the platform.

For the Level 1 account, users must:

- Attain the set profit target

- Stay below the maximum leverage limit

- Have a reasonable stop loss for all trades

After successfully reaching Level 1 target goals, you officially become a Funded Trading Partner and receive a fully funded account.

Is The5ers Legit?

The 5%ers is a legitimate prop trading firm that caters to serious forex traders who want the opportunity to make money with fewer trading restrictions.

Founded in 2016, the platform strives to create an atmosphere for everyday folks to earn money in challenging commodities markets. It features an impressive boot camp program traders have to walk through in order to qualify for an account.

Once inside, the 5%ers has a fund all capital comes from.

In all, the prop trading company has cultivated a growing user base since its inception, and this shows no sign of slowing down anytime soon.

Is The5ers Regulated?

Because the 5ers is not a broker, it is not regulated.

This is par for the course for prop trading firms.

What Broker Does The5ers Use?

The5ers does not trade with retail brokers; instead, it trades directly through commercial liquidity providers.

The firm states that it values confidentiality, which is why it has not publicly disclosed its supplier’s identity.

>> Already sold on The 5%ers? Click here to sign up today! <<

Who is Gill Ben Hur?

Gill Ben Hur is the founder of the 5%ers and one of the chief architects behind its continued operation.

His background is in teaching the art of trading to the larger community through various means, a clear nod to the 5ers robust educational platform. Ben Hur even spent time as a co-owner of an educational trading community before bringing his talents here.

It’s these years in the trenches that allowed Gill to build out the 5ers form that we know today.

Is Gill Ben Hur Legit?

Ben Hur is indeed a legit trader and owner of the 5ers service.

The guru started his day-trading journey all the way back in 2007 when he started out as an independent trader. He’s since honed the skills needed to run a successful prop trading firm.

His experiences have allowed Ben Hur to connect with high ranking forex traders over the years, whose insights have added to the efficacy of the site.

If one prop firm wasn’t enough, Gill is a serial entrepreneur with a handful of other businesses under his belt. These include a fintech company and yet another prop firm focusing on stocks.

How Does The5ers Work?

The 5ers seeks out new and experienced traders and helps them sharpen their skills while they earn money by trading.

The firm’s instant access accounts allow forex traders to earn profits, even during the evaluation process.

The accounts that The5ers offers vary depending on risk level, as well as the capital level.

Each account caters to traders with different investing styles, which include aggressive traders who live to take chances or beginner traders trying to gain some much-needed experience.

After deciding the risk and capital level you’re comfortable with, all you need to do is log in, pay the participation fee, then begin trading.

The forex trading program is hosted on MetaTrader 5 (MT5), a highly advanced platform for forex traders and brokers.

Users can access the platform on their desktop or mobile device.

>> Ready to get started with The 5%ers? Click here to sign up today! <<

Who Can Get a Fully Funded Account?

Traders who can complete The 5ers’ evaluation programs gain access to a fully funded account.

These three programs include:

- Low-Risk Evaluation Program

- High-Risk Program

- $100K Bootcamp (New)

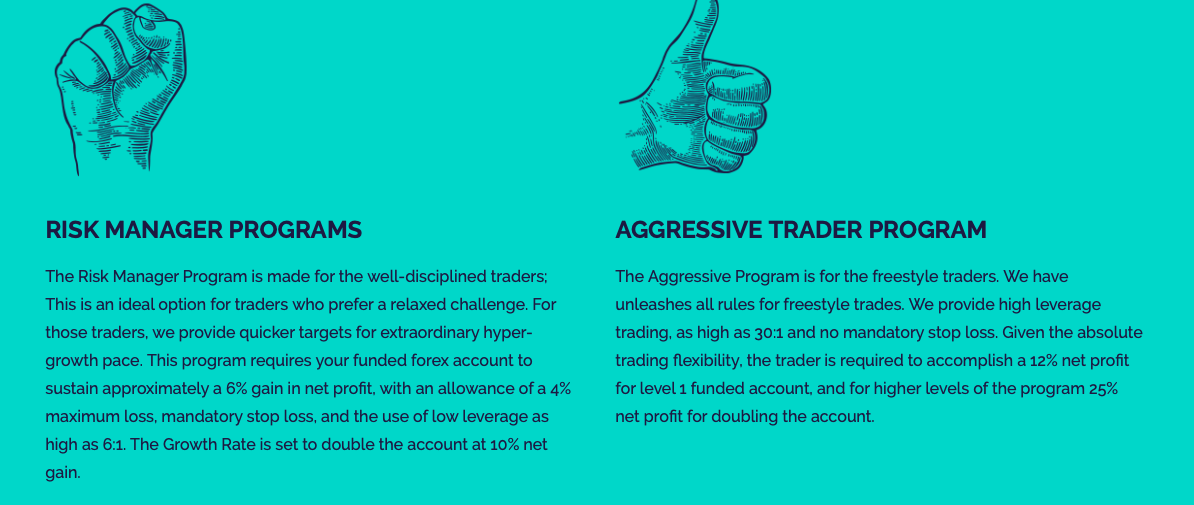

Low-Risk Evaluation Program

The Risk Manager program requires each forex trader to sustain a net profit gain of 6–7%, with an allowance of 4% maximum loss.

Its goal is to maintain profitability while minimizing risk, so it’s tailor-made for more disciplined traders.

The leverage for the low-risk evaluation program is relatively low at 6:1, and there is a mandatory stop loss.

The growth rate, meanwhile, can double your trading balance for every 10% of profits you earn.

You get an extended window to pass the low-risk challenge, 180 days, to be exact.

So if you’re new to trading with a prop firm, you might want to try out one of these low-risk accounts first.

High-Risk Program

Also called the Aggressive Trader program, the high-risk program is for freestyle forex traders who prefer high leverage trading.

The program offers higher account leverage of 30:1, with no mandatory stop loss.

The aggressive risk option gives traders the potential to make higher profits.

You’re required to reach a net profit rate of 12% for the Level 1 funding account, and your trading balance can be doubled for every 25% of profit earned.

You are given a 60-day window to complete the high-risk challenge.

$100K Bootcamp (New)

The $100k Bootcamp is a newer offering by the 5ers that provides a lower price point to enter.

The fees for this program are broken into two parts: 50€ to enter and €250 once you pass.

Unlike the other challenge accounts, this one is broken up into 3 steps and completion will provide you with 10:1 leverage.

This program can take up to 12 months to complete, so you might want to consider the other two if you want to trade with a fully funded account sooner.

Is Hedging Allowed with The5ers?

The 5ers site expressly forbids using separate accounts to hedge a position.

However, it does not state whether you can hold an opposite position within one account to offset potential losses.

Many prop trading firms do allow traders to hedge positions, but you usually need to coordinate with the firm, so it’s possible that this is The 5ers’ stance.

Can I Trade the News with The5ers?

Yes, news trading is allowed with the 5ers.

This is a point in the firm’s favor, as not every prop firm lets funded traders trade the news.

Can You Trade Gold with The5ers?

Yes, you can trade Gold (XAUUSD), as well as Silver (XAGUSD), with a funded account.

>> Start trading with a funded account today! Sign up NOW! <<

The5ers Review: What Do You Get?

There are some great features included when you sign up for the5ers membership.

Continue reading our The5ers review and find out what the service includes.

- Growth Trading Program

- Access to Weekend Holdings

- Trading Resources

- Profit Splits, Payments, and Withdrawals

Growth Trading Program

The growth program allows you to double your trading balance with every milestone you reach.

You receive a growth program schedule that tracks:

- The initial balance

- Milestone target

- Maximum Loss

- Leverage

- Maximum stop loss

Access to Weekend Holdings

One of the biggest advantages the 5ers has over other prop firms is that it allows traders to hold positions over the weekend.

This is especially attractive for long-term traders working with weekly and monthly charts.

Other prop firms don’t allow traders to hold positions over weekends or have very strict guidelines.

But with the 5ers, trades can be held overnight, on the weekends, and after the market closes.

Trading Resources

The5ers includes a forex blog with articles, interviews, and trading psychology tips.

The firm also offers a forex trading room, equipped with weekly and monthly charts, to guide traders, monitor dollar index behavior, and trade with other traders in real-time.

Additionally, there are trading courses, which are particularly useful for a beginner looking to become a more advanced trader.

The 5ers also provides a look at forex pivot points, an economic forex calendar, and various webinars and live events to educate users on the financial markets.

Also included among its comprehensive learning tools are countless videos, tips on how to reach profit targets, and workshops covering topics such as forex scalping and supply/demand.

The firm’s resources are ideal for professional forex traders and upstarts looking to become full-time traders.

Profit Split, Payment, and Withdrawals

Traders gain access to a 50% profit split after completing the first stage of the program, risk-free, with the split added to their account.

At Level 2 and beyond, traders can withdraw their percentage of the profits at any time by using the platform’s dashboard.

You can withdraw $1,000 through PayPal, but any withdrawals exceeding the $1,000 mark will be paid through a bank transfer via TransferWise.

Each month, traders receive a fee-free payout, with further withdrawals incurring a minimum charge of $15 or a handling fee worth 3%.

>> Like what The 5%ers has to offer? Sign up today! <<

Pros and Cons

We found a lot of pros in our the5ers review; however, some areas can be improved on.

Read our pros and cons list to find out more.

Pros

- Instant funded accounts

- Can hold positions over the weekend

- Excellent education materials

- Fairly priced entry fees

- Simple scaling plan

Cons

- 50/50 profit split is average

- Only for forex trading

Platform Differentiators

The5ers really stands out against other big names in prop firms thanks to the three different funding programs we covered earlier in our The5ers review. You can start wherever you feel comfortable and adjust your level as you see fit.

With instant funding, you’re clear to trade without a minimum daily requirement. If you or the markets are having a bad day, you can sit it out with no repercussions. Other programs aren’t quite so flexible but still allow up to 14 days between trades.

The same holds true for maximums. You’re free to trade to your heart’s content each day without having to deal with some generic ceiling.

If that wasn’t enough, The5ers has no issue with holding trades overnight or over the weekend. Many prop firms make you close out your trades by the end of the day whether you’re leaving money on the table or not.

I’ll admit that other funding trading companies are factoring in more ways to trade, but The5ers already works with five different asset classes including crypto. It’s much more open to folks wanting to invoke newer strategies or who prefer trading in multiple markets at the same time.

The 5%ers Customer Support

There are actually a myriad of connection points you can use to seek out information or troubleshoot within the 5%ers’ larger umbrella.

Phone support is available during normal business hours for the Middle East, but those times may not line up well with your schedule. Hopefully the company can add some additional blocks for North America, but they at least provide a domestic number.

It’s also possible to interact with the 5ers team members through email or chat. Someone monitors the chat function at all hours of the day, even if you have to deal with a bot to begin your conversation. Email serves the same role, but you obviously won’t get as fast of a response.

The site offers a rather comprehensive FAQ that users can turn to for immediate answers to some of the most common questions. If you can’t find your answer here, you’ll have to resort to the methods above.

Finally, The5ers has profiles on all major social media platforms, including Facebook, X, YouTube, and even Instagram.

The5ers Security and User Experience

The5ers is not a forex broker, so you don’t have to worry about your money getting mixed up in a cyberattack. Instead, the firm uses its own funds any time a new user comes into the fold.

It does employ top of the line encryption for the personal information you provide when making your account so that data doesn’t fall into the wrong hands.

Users love what The5ers brings to the table, as witnessed by the 4.9 out of 5 stars it holds on TrustPilot with several thousand reviews.

The abundant training materials and boot camp course are a major factor in the score, giving folks the confidence and skills they need to effectively tackle forex trading.

Along those same lines, it’s possible to access The5ers from just about anywhere on the globe. It actually encourages the various languages and mindsets from individuals 18 years old or older.

Also, each of the funding programs features very clear guideless for both success and failure. As you sign up, you’ll know precisely what your profit targets and requirements are.

>> Join risk-free under 14-day moneyback guarantee <<

FAQs

What are HUB credits?

The5ers uses hub credits at every level to reward performance. These are bonus dollars that you can use on the website to lower the cost of future programs that you plan to sign up for.

Traders usually receive these any time they pass into a new level. The amount you earn from one place to the next can vary, so keep that in mind.

When you’re ready, redeem these at the checkout screen when purchasing your next challenge.

How many The5ers accounts can you have?

At the time of writing, you’re allowed to have multiple accounts with each of the funding programs the platform currently has available. Keep in mind you’re only able to use one email address for all your active accounts.

It’s possible to have up to three High Stakes accounts, and four Hyper Growth accounts all trading at the same time from your registration. You can also have up to three Boot Camp accounts up and running at any given time.

Who Can Trade With The 5%ers.com?

There are few restrictions on who can trade with The5ers.com. Users simply need to be 18 or older and not be from one of the 30 or so countries not on their approved list.

If you fit the bill, you still have to pass the entire Boot Camp process before The5ers will consider you for a program with actual stakes.

There are several commodities, cryptocurrencies, and forex up for grabs once you’ve started a program. The site does not support stock trading at this time.

The5ers Trader Reviews by Members

The 5ers has built a name for itself as a reputable prop trading firm and has the reviews to prove it.

Check out what others have to say about the service.

The5ers Trustpilot Reviews

The 5ers has locked in an impressive score of 4.7 out of 5 on Trustpilot, with 430 reviews.

For a third-party site with critical reviewers, these ratings say a lot.

The5ers Forex Peace Army Reviews

Unfortunately, there are no reviews or ratings of The 5ers on Forex Peace Army.

We’ll update this when the site reviews this prop trading firm, but for now, the Trustpilot reviews offer glowing recommendations of the service.

How Much Does The5ers Cost?

The 5ers’ fees depend on the account size and the starter capital that goes with the account.

Four funded capital account sizes are available on the Risk Manager Program or Aggressive Trader Program, featuring varying participation fees.

5%ers Fees

$24,000 – The profit target for this one is $375 (6%) for the Risk Manager or $750 (12%) for the Aggressive Trader, with $6,000 of instant funding provided. The participation fee for this level is $275.

$40,000 – Here, the profit target is set at $600 (6%) and $1,200 (12%), with $10,000 of instant funding. The participation fee for this level is $450.

$52,000 – The profit target is $910 (7%) for the Risk Manager and $1,560 (12%) for the Aggressive Trader. The instant funding provided is $13,000, while the participation fee is $565.

$80,000 – Users get $20,000 of instant funding, with the participation fee set at $875. Here, the profit targets are $1,400 (7%) and $2,400 (12%) for the Risk Manager and Aggressive Trader programs, respectively.

5%ers Cancellation Policy

The 5ers offers a 14-day money-back, risk-free guarantee.

If you’re unsatisfied with the service the prop firm provides, you will get a full refund within 14 days of making a purchase.

However, the signup fee for the service is non-refundable if:

- You have started trading

- You violate the firm’s terms and conditions

Any Level 1 accounts that have reached or exceeded the maximum stop-out rate will be closed.

If there are remaining profits in the account, the trader will receive the remaining balance at the next payout cycle.

Is The5ers Worth It?

Based on our the5ers review, it is a rock-solid prop firm for forex trading and offers a fair pricing model compared to its competitors.

While the 50/50 split may turn some away, this firm offers a lot of trading flexibility that goes above and beyond industry standards.

The 5ers instant funding accounts are perfect for traders that don’t want to wait for months to start earning profits.

So if you’re a forex trading looking for a firm with a stellar reputation and the tools to help you develop as a trader, you should definitely take a close look at the 5ers.

>> That’s it for our 5%ers review! Click here and JOIN TODAY! <<

Tags:

Tags: