City Traders Imperium is widely regarded as one of the top prop firms for trader education. But does the service live up to its reputation? Tune into our City Traders Imperium review to find out.

City Traders Imperium Review: Overview

City Traders Imperium (CTI) is a forex prop firm with a unique emphasis on supporting trader development.

Based in London, the firm was co-founded in 2018 by former professional head traders Daniel Martin and Martin Najat.

Its co-founders established CTI after expressing frustration about how other UK prop firms conducted business. In their words, they did not want to sell a “pipe dream” to traders.

Unlike other proprietary trading firms where you’re left alone to pass or fail, CTI has extensive educational resources and mentorship to prepare you for success in the financial markets.

So folks of different skill levels can become funded traders, improve trading psychology, access managed trading accounts, and earn a high-profit split.

This proprietary trading firm lets you trade:

- Forex

- Commodities

- Indices

While you can trade gold on every account, indices are not available for a select few.

You can pick up indices as commodities across all funding plans and accounts.

City Traders Imperium also offers scaling plans with up to 1:33 leverage through its challenge model. There are other funded account providers that offer higher leverage, but CTI’s aggressive scaling plans more than make up for this.

What Broker Does CTI Use?

City Traders Imperium does not publicly disclose its broker.

This is a fairly common practice in the industry.

How Do You Become a Funded Trader With CTI?

Getting funded with City Traders Imperium is a reasonably straightforward process, and it’s a lot more flexible than its competition. Many prop firms have a two-step process, but CTI lets you prove yourself without time limits.

Another plus is that this proprietary trading firm offers up to a 100% profit split as you work your way through various phases.

There are quite a few accounts to choose from, and they are broken down into a few categories.

You’ll have to decide between a 2-step challenge model, 1-step instant funding, or a direct funding program.

Who Can Get a CTI Funded Account?

Traders who prove their capabilities to make profitable trades and successfully pass the CTI Challenge can access a fully funded account on the prop trading platform.

If you’re a professional, retail, day, or swing trader, you can trade on City Traders Imperium.

Challenge vs Instant vs Direct Funding Program

Each of the options for starting your trading journey are a little different. Let’s take a brief look at them now.

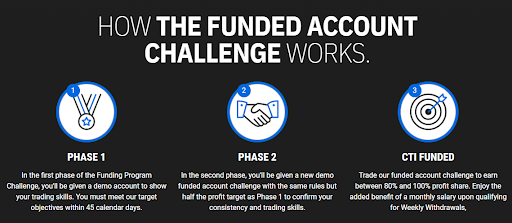

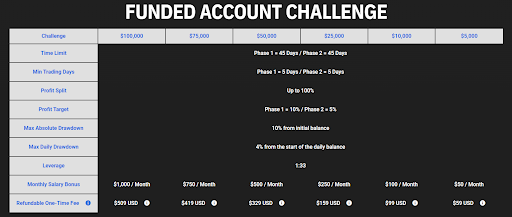

2-Step Challenge Funding Account

The 2-step Challenge funding account is exactly as the name implies. It’s a low-cost test to see if you have what it takes out on the open markets. You’re given a demo account to trade with, and CTI gives you quite a bit of flexibility.

There are two phases to pass before receiving an actual funded account with real money. Phase 1 requires a 10% profit target, and phase 2 requires an additional 5% from your initial amount. You have 45 days per phase to meet those goals.

Time is not your only enemy. You also fail if your max daily drawdown is 4% from the start of the day. Similarly, your max absolute drawdown can’t exceed 10% of your initial balance.

Should you pass the test, you get a funded account that earns somewhere between 80% and 100% profit share.

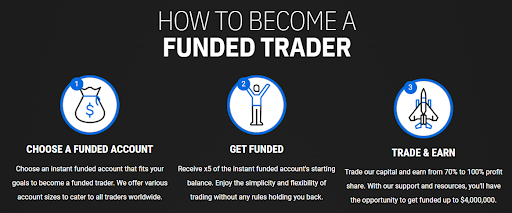

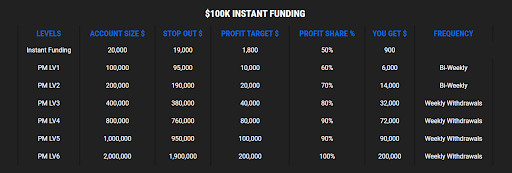

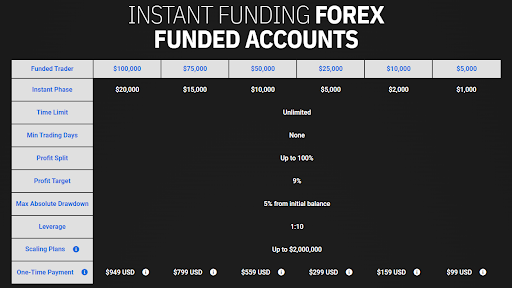

1-Step Instant Funding Account

The 1-Step Instant Funding Account does away with a lot of the headaches of trading. All you have to do is pick an instant funded account and you’re off to the races. Accounts span a wide range of initial payments should you want to invest a lot or a little.

Once you’re in, CTI hands you at least five times the instant funded account’s starting balance. From there, you get to kick back and trade at your leisure.

That’s right – there are no time limits or minimum trading days to contend with. In fact, there are basically no rules you need to follow at all.

The only thing to watch out for is the max absolute drawdown. Your losses can never exceed 5% of your initial account balance.

Every time you hit a 9% profit target, you move up to the next rank. Higher ranks afford you better profit splits all the way to 100%.

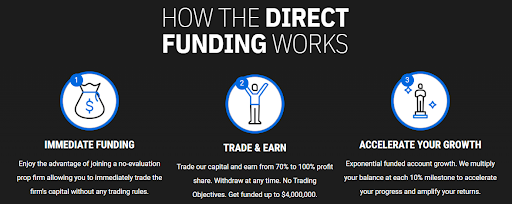

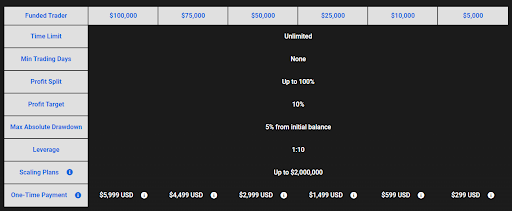

Direct Funding Account

A Direct Funding Account has a lot of similarities to the 1-Step Instant Funding Account. It has a 5% max absolute drawdown and no time limits or minimum trading days. You can still earn up to 100% profit share.

The differences lie with profits and losses. For direct funded accounts, there’s a higher buy-in, but you also have more money to work with right out of the gate.

There’s a bit more risk since you’d have to pay for any drawdown. Starting with extra funds does increase your chances of significant gains if you play your cards right.

An additional upside is that you can withdraw your portion of the profit at any time from a direct funded account. None of the other account options give such leeway.

What if I Fail to Trade within CTI’s Rules?

If you fail to trade within the rules, you will lose your account. You’re welcome to try your hand at the program again, and CTI will even throw a discount your way.

Folks disqualified from any funding program get a 10% discount on their next Challenge and Instant purchases. The discount shows up as a coupon code in your termination email.

Additionally, you’ll get a 5% discount on your next Direct Funding purchase in the form of cashback shortly after signing up.

Some competitors’ forex-funded trader programs do offer a free retry (if you meet specific criteria), but their evaluation processes are typically much more difficult to pass.

>> Already sold on City Traders Imperium? Click here to sign up TODAY! <<

City Traders Imperium Review: Features

This service has so much to offer and that’s why we prepared an overview of all the features in our City Traders Imperium review.

- Multiple Trading Styles Allowed

- Scaling Plans

- Profit Share Split

- Free Course

- Trader Support

- Mentoring

- Withdrawal

>> Ready to get started with City Traders Imperium? Sign up NOW! <<

Multiple Trading Styles Allowed

Regardless of whether you’re a skillful trader with an aggressive mindset, have strong risk management skills, or you’re relatively new to trading, you can make the most of a CTI-funded trading account.

You can trade hedge positions, use your own E.A.s, and leave trades anytime, including overnight or on the weekend.

The firm is well suited for:

- Swing trading

- News trading

- EA trading

- Day trading

- And more

Retail traders looking for more support will find a surprising amount of flexibility. You can’t trade crypto, however, which might turn some traders away. But anyone looking to trade forex, gold, or indices should feel right at home.

Scaling Plans

City Traders Imperium offers scaling plans that increase the amount of capital that you’re entrusted to trade with. Scaling also provides you with higher profit splits.

The amount of capital accessible depends on the funded account you select. But the profit spread increases follow the same trends.

The highest possible capital that you can scale up to is $2,000,000 per account, with a maximum of $4,000,000 in overall trading capital. This is an impressive number that is much higher than many of its competitors.

Profit Split (Spreads)

City Traders Imperium has one of the best profit splits we’ve ever seen from a prop firm. Depending on your success as a prop trader, it’s possible to earn up to 100% of the profits you generate.

Up until this, the highest we’ve seen is 90%, which was already impressive.

The spread will depend on how high your account has scaled.

Here are the spreads you could have access to:

- 50%

- 70%

- 80%

- 100%

Anything above 70% is already high compared to industry standards, and 100% is almost unheard of.

Trading Courses

As mentioned earlier, a free course accompanies the Funder Trader program on City Traders Imperium. The course is designed to help traders improve their chances of success and transition to portfolio managers who trade capital regularly.

It provides trading education, gives you a better sense of financial ideas, and shows you how to improve your risk management.

If you need even more insights, there’s a more comprehensive set of courses provided by CTI. But they do have a small upfront fee.

Trader Support

Trader support is available, with customer service provided through live chat, social media, and email. However, customer support is not available 24/7, as its hours are 10 am to 7 pm on weekdays.

CTI reviews speak highly of the team’s customer service.

The only drawback is that the customer service does not include phone support. While a phone number would be nice, the team is very responsive through social media and email.

Mentoring and Coaching

CTI has a mentoring program leagues beyond what other prop trading firms offer.

You can sign up on the CTI website to be coached by Daniel Martin, the co-founder of City Traders Imperium. He’s a prop trading pro, and you could learn some solid trading strategies from his mentorship.

Great Psychological training is also available, which is a great addition to the firm’s already impressive educational lineup. Anyone looking to make intelligent, dispassionate trades, will certainly want to give this resource a closer look.

City Traders Imperium Withdrawal

Withdrawal methods depend on which stage of the funding process you’re in and which program you enlist in.

Instant Funding Withdrawals

For Instant Funding withdrawals, CTI will issue a 50% profit share once your profit exceeds 9% of your initial account size. You also get the bump up to level one.

At level one, you can request your first withdrawal after ten active trading days. From there, you can ask for profits during the last five days of the calendar month.

Climbing to level two gives you a bit more freedom. You can withdraw funds on the 10th and 25th of each calendar month.

For level three and beyond, you can pull out money every week on Friday. Doing a withdrawal doesn’t affect your account growth and you don’t have to compensate for any money you take out.

Challenge Withdrawals

Challenge mode works a bit differently. You need to pass phases 1 and 2 before even thinking about earning some cash. Once you reach phase 3, CTI will send you a full refund of your sign-up fee and your account will go live.

To qualify for withdrawals, you’ll need to complete ten active training days or achieve at least 10% in profit. You can ask for your first withdrawal after those ten active trading days.

After that, you can request a withdrawal during the last five days of the calendar month.

You can get bumped up to bi-weekly withdrawals the moment you achieve 10% profit on your live account.

There’s even a way to qualify for weekly payments. In a nutshell, this happens when you receive a minimum of four withdrawals, maintain a consistent trading style, and don’t have any account violations.

With your Challenge account, even you’re eligible for a monthly salary as long as you meet two criteria:

- Meet all the requirements for weekly withdrawal.

- Bring in an average of 3% net profit per month.

Direct Funding Withdrawals

One of the biggest benefits of a direct funding account is that you can pull out profits whenever you want. Payments can be issued in the form of:

- PayPal

- Transferwise

- Revolut

- Crypto

>> Click here to sign up for a funded trading account TODAY! <<

Is City Traders Imperium Legit?

City Traders is a legit prop firm that has a reputation for producing successful traders, and it’s a registered UK business.

The prop firm has a solid online reputation with customers, and its customer support team is typically reachable through live chat, email, and social media channels.

It should also be noted that CTI isn’t regulated or authorized by the Financial Conduct Authority (FCA) because it does not undertake any regulated activities.

The company is fully legitimate and is a solid trading partner for anyone willing to trade consistently.

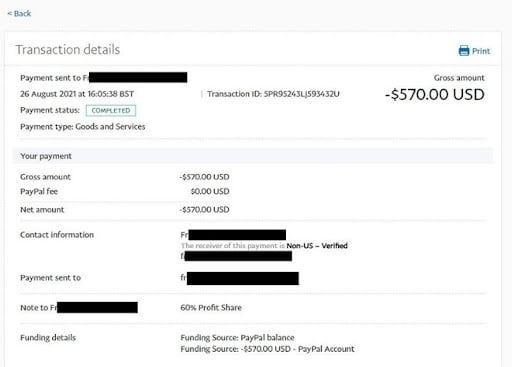

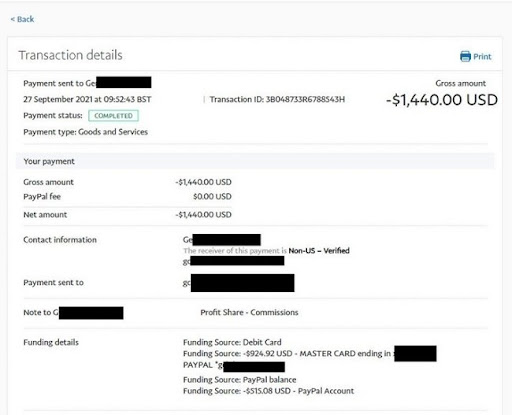

Payment Proof

If you’re wondering if there is payment proof online for City Traders Imperium, you’ll be happy to know that the firm has a page dedicated to showing prop trader payments.

The snapshot below is just one of many screen grabs the firm has provided.

City Traders Imperium Review: Pros and Cons

City Traders Imperium is a stellar prop firm, but there are a few places where it could improve.

Check out our list for the pros and cons of this prop trading firm we found during City Traders Imperium review.

Pros

- Competitive profit split up to 100%

- Excellent mentorship programs and growing forex traders

- Supports a range of trading styles (news, swing, EA, etc.)

- Unique focus on psychological training

- Fair challenge program with no rules or time limits

- Great for novice and experienced

Cons

- Some programs don’t allow all trading styles

- Forex only — no crypto

Difficulties Traders Came Across Who Participated in The Brokers Challenge

The brokers challenge ended up not being sunshine and rainbows for some traders. Here are a few of the difficulties they faced:

Dealing With the 5% Relative Drawdown Rule

Traders were required to not let accounts drop by more than 5% of its peak value. Those going in with riskier strategies could have lost that chunk and then some in a single bad trade. Volatile markets while undergoing the challenge can further exacerbate the issue.

Lower Than Expected Leverage

Leverage allows traders to control large amounts of capital by putting down a much smaller amount. When traders have less leverage to deal with than they’re used to, they may not be able to generate the types of gains they normally do. In some situations, it’s even more challenging to keep up.

Maintaining a Minimum 30 Days of Active Trading

Not all traders take to the screens every day to move stocks around. This platform requires a solid 30 days of trading at a minimum, which is potentially off-putting to those not used to it. Life, mental strain, or lack of opportunities can also play a detrimental role.

Limited Asset Choices

City Traders Imperium has fewer asset choices than some of its competitors, somewhat limiting the field of play. Traders who have skill with a certain class may find themselves at a disadvantage they couldn’t come back from.

Trading Strategy Restrictions

Similarly, the platform places restrictions on specific trading strategies like copy trading, high-frequency, and Martingale. Anyone who typically enters the fray with one of these at their disposal could run into issues when having to pivot.

No Demo Accounts

There’s no way to prepare for the brokers challenge through any kind of demo account on the website. You’re required to pay upfront and may feel overwhelmed being thrown right into the mix with little time to prepare.

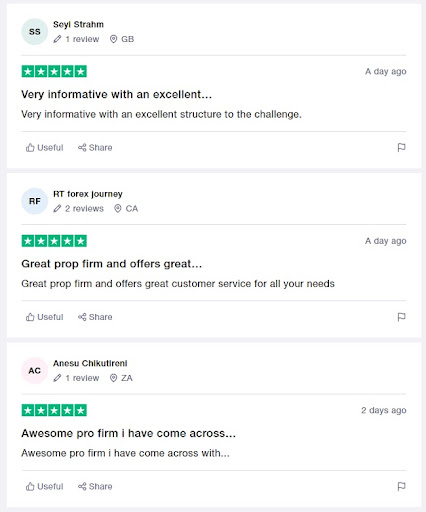

City Traders Imperium Trader Reviews

There are plenty of positive reviews online for City Traders Imperium.

We’ve collected testimonials from a few rating sites to give you a balanced look at what reported members think about CTI.

Trustpilot Reviews

City Traders Imperium boasts an impressive 4.8 rating on the third-party review site Trustpilot.

Let’s see what folks have to say about this prop firm.

This is quite the achievement, as members tend to let you know (in great detail) if they don’t like a service.

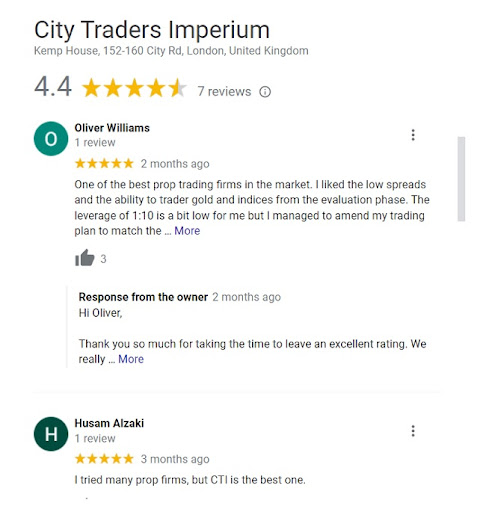

Google Reviews

City Traders Imperium has locked in a rock-solid 4.9 on Google reviews.

City Traders Imperium Myfxbook Review

Unfortunately, we couldn’t find any reviews for City Traders Imperium on Myfxbook. We’ll keep an eye on any reviews in the future, but for now, Trustpilot is the best source of third-party reviews that we’ve found.

We also checked Forex Peace Army, and the site does not have reviews for this service either.

> Like all that City Traders Imperium has to offer? Sign up TODAY! <<

City Traders Imperium Review: Funded Accounts Pricing

There are six pricing options for each of the Challenge, Instant Funding, and Direct Funding programs. The amount you pay varies depending on the program you choose and how much funds you want.

Keep reading our City Traders Imperium review to learn more about pricing options.

Challenge Accounts Pricing

$5,000 Challenge Account – One-time fee of $59.

$10,000 Challenge – One-time fee of $99.

$25,000 Challenge – One-time fee of $159.

$50,000 Challenge – One-time fee of $329.

$75,000 Challenge – One-time fee of $419.

$100,000 Challenge – One-time fee of $509.

Instant Funding Forex Accounts Pricing

$5,000 Forex Funded Account – One-time fee of $99.

$10,000 Forex Funded Account – One-time fee of $159.

$25,000 Forex Funded Account – One-time fee of $299.

$50,000 Forex Funded Account – One-time fee of $599.

$75,000 Forex Funded Account – One-time fee of $799.

$100,000 Forex Funded Account – One-time fee of $949.

Direct Funding Accounts Pricing

$5,000 Direct Funding – One-time fee of $299.

$10,000 Direct Funding – One-time fee of $599.

$25,000 Direct Funding – One-time fee of $1,499.

$50,000 Direct Funding – One-time fee of $2,999.

$75,000 Direct Funding – One-time fee of $4,499.

$100,000 Direct Funding – One-time fee of $5,999.

>> Ready to become a funded trader? Sign up for CTI now! <<

City Traders Imperium Review: Cancellation Policy

In the case that a funded account has not been traded, CTI will refund the signup fee up to 7 days after the registration date. The caveat is that refunds cannot be issued on an account that has been traded.

It makes sense, as someone could easily take a loss on their account and then ask for a refund, which circumvents the whole Evaluation process.

This is why you want to make sure your trading strategies are tip-top if you’re going to try to land a larger funded account.

Platform Differentiators

After playing around with City Traders Imperium for a bit, it clearly stands out in a few key ways.

Perhaps the most obvious is the platform’s dedication to helping traders grow their skills. There are an abundance of tools and features to learn from at every turn.

With the potential to walk away with up to a 100% profit split, the money-making model here is really well done. City Traders Imperium puts a lot of faith in its traders that you don’t often see elsewhere.

There are several funding programs to choose from here, creating space for many different types of traders. Each of these tiers comes with its own pros and cons, but there’s likely something for everyone to sink their teeth into.

Is City Traders Imperium Review Worth It?

Our City Traders Imperium review showcased why this service could be one of the best prop firms available, given its flexible rules, instant funding, scaling programs, and a sizable profit share.

It has a mentorship program unlike any other that we’ve seen, providing one-on-one coaching from a founding member.

This proprietary trading firm is an industry leader that offers an exceptional blend of accessibility, support, and spreads. Many competitors score high marks in one of these areas, but CTI nails all three.

All in all, CTI could be a fantastic fit if you’re a day, EA, news, or swing trader. There’s definitely enough to like here to give this firm a fair consideration.

>> That’s all for our City Traders Imperium review! Sign up TODAY! <<

Tags:

Tags: