For generations, folks have searched for the Holy Grail of building lasting wealth. Some have written the concept off as fiction, but Brett Eversole believes he’s finally found it.

Through his True Wealth newsletter with Stansberry Research, he warns that a $7.4 trillion mone

.y flood could soon ignite what he calls “The Melt Up Tsunami”.

Eversole believes this surge could reshape the market and create rare opportunities for those ready to act.

In this True Wealth review, I take a closer look at his theory, his track record, and whether his Melt Up Tsunami forecast is as powerful as he claims.

What Is True Wealth?

True Wealth is Brett Eversole’s long-running investment research service published by Stansberry Research.

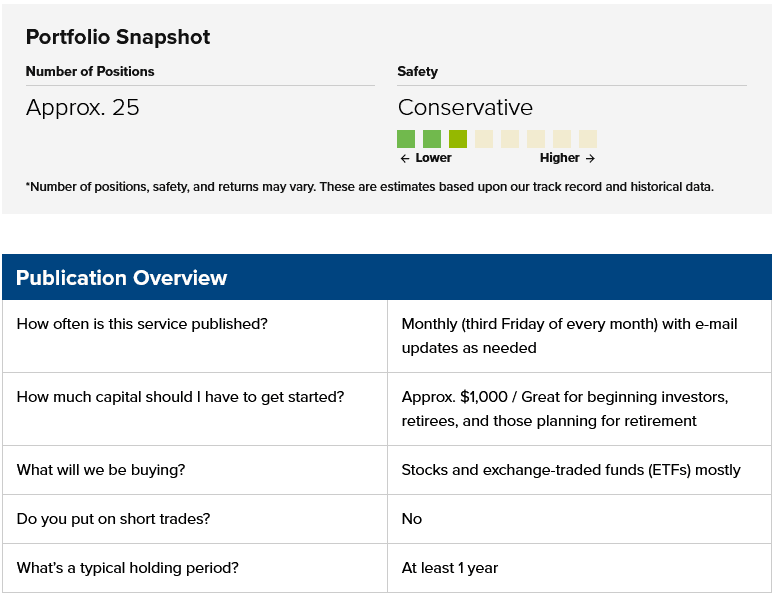

It’s built for people who want straightforward, data-driven guidance on how to safely grow their money without chasing hype or short-term trades.

Each month, members receive Eversole’s latest insights into undervalued areas of the market, stocks, funds, and assets that most investors overlook until it’s too late.

What makes it appealing to me is the blend of education and action. You’re not only getting new recommendations but also Eversole’s reasoning, research charts, and market perspective.

The service aims to help readers understand where the big opportunities are forming and how to position early.

>> Already sold? get started now! <<

Eversole’s philosophy centers on buying assets that are both cheap and hated by the market, a contrarian approach rooted in decades of behavioral finance research.

An interesting approach for sure, and I think learning a bit more about the guru will help bring it into focus.

>> Sound like a good fit? Sign up for 80% off! <<

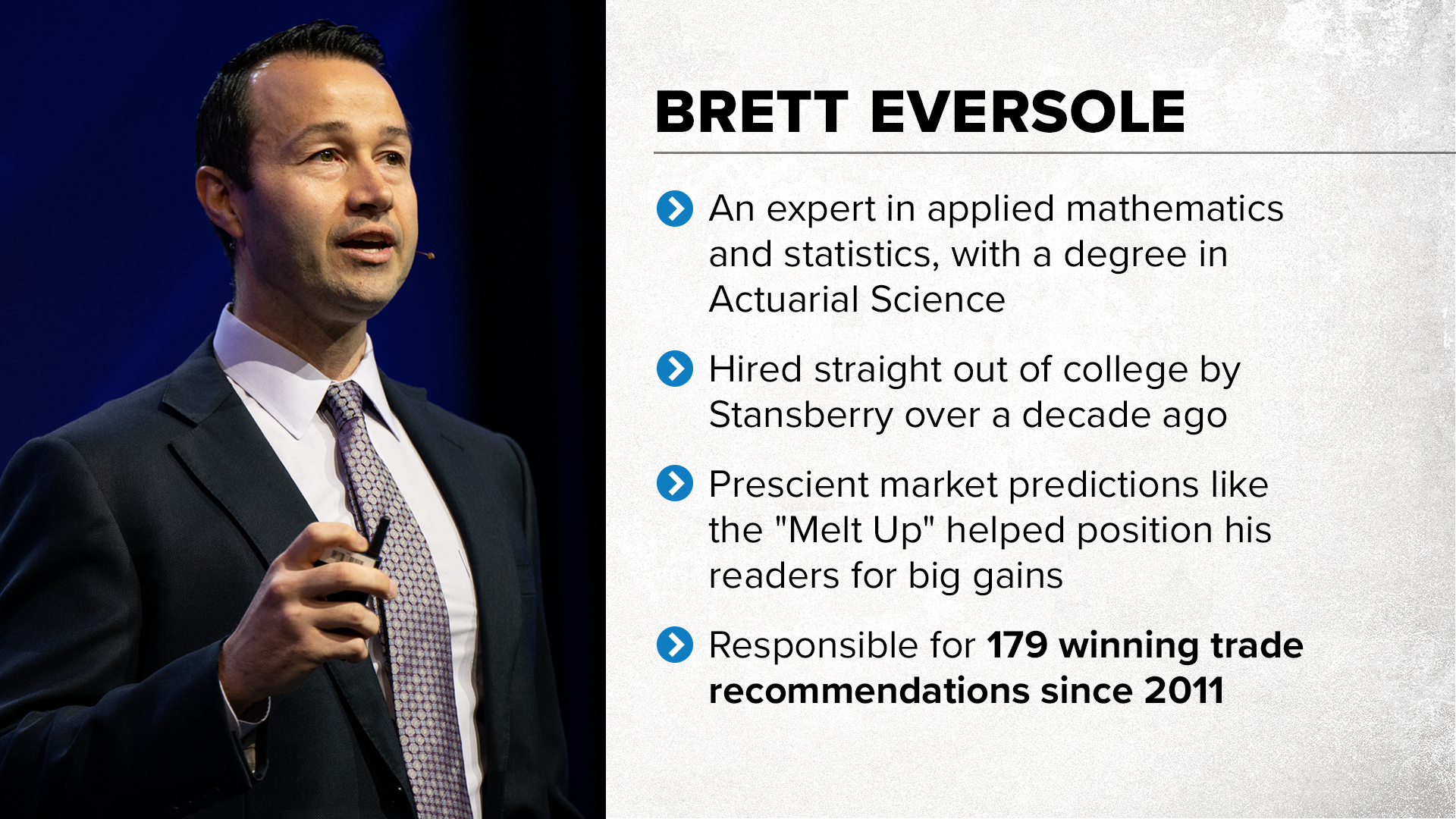

Who Is Brett Eversole?

Brett Eversole is a senior analyst and portfolio strategist at Stansberry Research with more than 15 years of experience in financial markets.

His background in applied mathematics and statistics caught Stansberry’s eye, and Brett’s been a part of the team from more or less the moment he stepped out of college.

As head of True Wealth and a number of other Stansberry services, Eversole has been key in developing the system that makes them possible.

His work focuses on identifying market trends before they become mainstream and communicating them in a way that helps everyday readers take confident action.

Eversole’s ability to translate complex ideas into clear strategies has made him one of the firm’s most trusted analysts.

Is Brett Eversole Legit?

There’s little doubt that Brett Eversole has built a strong reputation inside and outside Stansberry Research for his accuracy and discipline.

Over the past decade, his forecasts have repeatedly captured major turning points in the markets, including the 2020 rebound and the post-pandemic tech recovery.

Past subscribers have seen double- and triple-digit gains in past recommendations that followed his data-backed signals.

He’s also appeared at investor conferences and contributed to Stansberry’s top publications, sharing his insights on market psychology and valuation cycles.

With a background rooted in real financial analysis rather than speculation, Brett Eversole has earned his spot among the industry’s more respected market strategists.

>> Get the team’s latest recommendations <<

What Is Stansberry Research?

What Is Stansberry Research?

Stansberry Research is a prolific research company based in Baltimore, Maryland.

It publishes a vast collection of specialized research services and newsletters.

The firm was founded back in 1999, and its unique focus on affordable retail research quickly catapulted the company to the top of the heap.

Today, Stansberry is one of the leading voices in the investment research industry, and the Stansberry Research editorial team counts some of the most recognizable names in the business among its ranks.

What Is Inside Brett Eversole’s “Melt Up Tsunami” Presentation?

I’ve thankfully never been present when a tsunami approaches the coast, but I’ve seen videos of how powerful they can be.

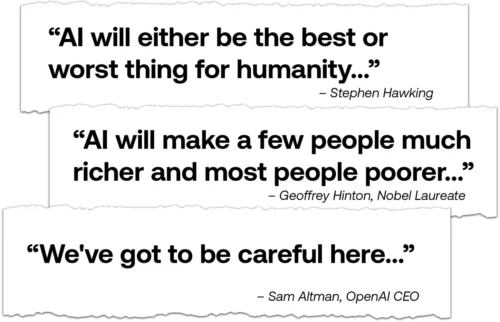

Brett Eversole attributes that same level of force behind what he calls The Melt Up Tsunami, a financial surge fueled by more than $7.4 trillion in idle cash sitting in money-market funds and savings accounts.

This, he says, is not just spare capital but the fuel for an explosive rally that could catch most of Wall Street off guard.

You Don’t Want to Miss This Wave

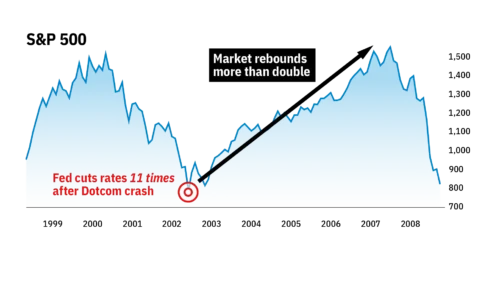

Market corrections are a part of life, but Eversole says they cause an unhealthy case of “FOGI” – fear of getting in.

I’ve seen all the scary headlines myself, and they’re anxiety-inducing, to say the least.

In the grand scheme of things, though, Brett says the wins can far outweigh those small bumps in the road.

On the contrary, bull markets often see the biggest spikes in their final phases, and that’s something you don’t want to miss out on – unless you don’t care about making money.

This is the “Melt Up”, and it’s something we’ve seen happen over and over again for at least the last 100 years.

That’s the kind of data I can get behind, and the next Melt Up may be the biggest yet.

Every major bull market ends not in panic but in euphoria, the moment when latecomers finally rush in.

He compares today’s environment to 1999 and 2017, when stock markets soared while skeptical investors waited for the “right” time to reenter.

The difference now, he explains, is the unprecedented scale of this cash pile. With inflation cooling and rates stabilizing, he believes that money will soon rotate back into equities.

Eversole’s charts show how past inflows of this kind sparked rapid market expansions, and his tone makes it clear: waiting on the sidelines might be the biggest risk of all.

There’s No Time Like the Present

The gloom and doom media presents America in a dire light, but Eversole says those claims couldn’t be further from the truth.

Our country’s economy is doing the best it has in some time, with funds flowing into AI and the S&P 500 climbing despite tariff threats and blocked trade deals.

I don’t consider myself an expert on market growth, but that sounds like a very good thing to me.

You’re right to be skeptical, but that money isn’t materializing out of nowhere.

Institutional investing is at record highs, and those money managers have been sitting on sticks for some time.

They’re able to see the writing on the wall from policy shifts early, and all that momentum has to go somewhere.

The Path Forward

The really cool thing is that Eversole’s foresight puts us in a sweet spot to move right alongside all that cash instead of being chasers.

He reveals that certain sectors, technology, metals, and select small caps, could stand to benefit most as this “money flood” moves into the market.

His message isn’t about timing the top or chasing trends but understanding how to position yourself before the surge accelerates.

For anyone watching from the sidelines, Eversole suggests this is the time to pay attention. Readers can learn how to put his Melt Up Tsunami insights into action by joining True Wealth.

The next section explains what comes with a membership and how it helps turn these insights into practical opportunities.

>> Get the team’s latest research and stock insights <<

True Wealth Review: What Comes with a Subscription?

Joining True Wealth unlocks a slew of features you can use to capture big wealth moves before they happen:

>> Join now to access all features and reports <<

1 Year of True Wealth Newsletter Subscription

Every month, members receive the newest issue of True Wealth, which features Brett Eversole’s top ideas across stocks, sectors, and alternative assets.

Issues include a detailed market outlook, charts, and valuation analysis that walk readers through why a specific opportunity stands out.

Eversole’s writing feels accessible yet informative, with clear guidance on buy-up-to prices, stop losses, and exit points.

His focus is always on assets that are safe, undervalued, and backed by long-term potential.

It’s the best medicine to cure FOGI that I’ve seen by a long shot.

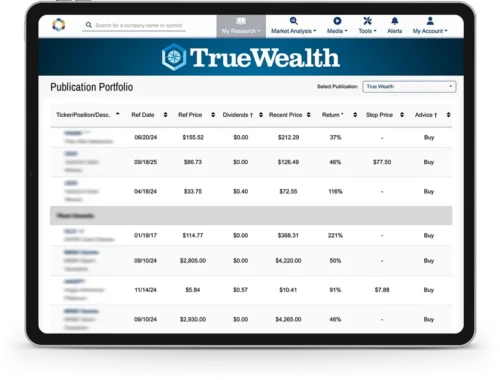

True Wealth Model Portfolio

Subscribers also gain full access to Eversole’s model portfolio, which tracks every active recommendation.

This feature gives readers a clear view of what positions are open, which have hit targets, and which are being monitored for future action.

The portfolio updates regularly, allowing you to see how individual plays perform and how Eversole adjusts to changing conditions.

It’s a hands-on learning tool that reveals how professional-level research translates into real-world results.

Not only does it offer a list of actionable plays, it’s a compass for finding gains as the next Melt Up takes center stage.

Special Updates and Alerts

Markets move fast, and True Wealth ensures subscribers stay ahead of critical shifts.

Whenever Eversole sees a new opportunity or change in outlook, he sends a special update directly to members’ inboxes.

These alerts include analysis on why a move matters, what action (if any) should be taken, and how it fits into the bigger picture.

This is your ticket to reacting intelligently to market developments instead of panic selling, and it’s given me a lot of peace even when market drops could be coming our way.

Complete Archive of True Wealth Issues and Reports

Membership also comes with access to the full digital archive of True Wealth issues and bonus reports.

This library spans years of research, offering valuable context for how past market cycles unfolded and how Eversole adapted.

It’s an incredible educational asset for anyone wanting to study the evolution of successful strategies in real time.

Each archived report provides insights into past melt-ups, commodity surges, and unique asset trends that shaped market history.

I’ve probably spent too much time here reading through content, but it’s a great educational source for information you’re not familiar with.

The Stansberry Digest (Free Daily Market Insights)

Every True Wealth membership automatically includes access to The Stansberry Digest, Stansberry Research’s flagship daily letter.

Written by top editors and analysts across the firm, it delivers commentary on market news, earnings trends, and economic data, often highlighting connections to Stansberry’s wider research network.

The Digest keeps readers informed between monthly issues, helping them develop a stronger sense of timing and strategy.

I’d recommend making it part of your daily routine over a morning coffee so you’re always up on the latest market info.

DailyWealth

In addition to the Digest, you’ll get DailyWealth, a free daily email curated by Stansberry Research.

While short and easy to read, these updates pack meaningful insights into global markets, emerging opportunities, and timeless investing lessons from industry veterans.

The tone is conversational and relatable, often focusing on the bigger mindset behind successful investing.

Together with the monthly issues and portfolio access, DailyWealth gives members a steady stream of perspective and confidence to stay focused on their goals.

>> Access these benefits and more <<

True Wealth Bonuses

Check out all the bonuses you’ll receive if you sign up right now:

Special Report #1: Never Bet Against America: Five Stocks That Could 5X During the Melt Up Tsunami

Special Report #1: Never Bet Against America: Five Stocks That Could 5X During the Melt Up Tsunami

This first report focuses on Eversole’s belief in the long-term strength of the U.S. economy and innovation.

He highlights five companies positioned to benefit most as trillions of dollars reenter the market.

These firms come from sectors like advanced technology, energy infrastructure, and financial systems that serve as the backbone of America’s growth.

Eversole explains why these businesses have strong balance sheets, recurring revenues, and scalable potential that could multiply in value as the market surges.

He uses data from earnings trends, consumer demand, and capital flow analysis to make his case.

Readers walk away understanding why “betting on America” remains one of the smartest strategies when market sentiment turns overly cautious.

Special Report #2: $8,000 Gold and Beyond: The New Era for Precious Metals

Special Report #2: $8,000 Gold and Beyond: The New Era for Precious Metals

In this report, Eversole turns his attention to one of the world’s oldest and most reliable stores of value: gold.

He argues that years of government spending, ballooning deficits, and persistent inflation could push gold to levels once thought impossible—possibly $8,000 per ounce.

The report explains how global central bank buying, currency debasement, and tightening supply all set the stage for a major bull run in precious metals.

Eversole breaks down which miners, refiners, and ETFs are best positioned for this environment, providing a data-supported outlook that separates hype from value.

I’m sure many of us dabble in gold already, but the insights here can help make the precious metal even more valuable over time.

Special Report #3: Unexpected Profits: Surprise Gains and Income From a Forgotten Market

Special Report #3: Unexpected Profits: Surprise Gains and Income From a Forgotten Market

Here, Eversole introduces readers to an overlooked corner of the market that quietly generates consistent returns without the media spotlight.

He reveals how certain income-producing assets, ignored by Wall Street analysts, are benefiting from long-term demographic and economic trends.

The report showcases examples of how this “forgotten market” can offer both growth and income stability, especially during times when mainstream stocks appear stretched.

Eversole also includes charts and historical comparisons to show how similar setups in the past delivered double-digit annual gains.

The goal here is to help you uncover reliable opportunities beyond the usual high-risk plays while maintaining steady cash flow.

Surprise Bonus Report #4: A Secret Currency That Could Pay You 500%

Surprise Bonus Report #4: A Secret Currency That Could Pay You 500%

The final bonus dives into what Eversole calls a “hidden” financial opportunity, an unconventional asset he believes could rise sharply during the Melt Up.

Here, Brett reveals an alternative currency system with tangible value tied to real-world demand.

Eversole walks through why this sector is attracting quiet institutional interest and how the same forces driving the market’s money flood could accelerate its growth.

He outlines the mechanism behind its potential 500% upside and provides readers with steps to gain exposure responsibly.

The report’s goal is to help investors understand how diversification into overlooked assets can amplify returns while managing broader market risk.

>> Grab the report to know which stocks to drop now! <<

Refund Policy

Refund Policy

One of the most reassuring aspects of True Wealth is its straightforward refund guarantee.

You can take a full 30 days to explore the service and evaluate the quality of research without any obligation.

That means unrestricted access all issues, reports, and bonuses risk-free.

If, for any reason, you decide the service isn’t right for you, simply contact Stansberry Research’s customer support team for a complete refund, no questions or hidden conditions.

This policy reflects Stansberry’s confidence in the value of Brett Eversole’s work and their commitment to maintaining trust with readers.

It gives new subscribers the confidence to try True Wealth without having to take on much risk.

>> Join under Brett and Matt’s guarantee <<

Pros and Cons

There’s a lot to like about True Wealth, but there are some areas that could be improved.

Pros

- Backed by one of the most respected research firms, Stansberry Research

- One full year of True Wealth with portfolio and alerts

- Proven analyst with a strong data-driven approach

- Excellent educational value, especially for understanding market psychology

- Low-risk entry price with a clear refund policy

- Bonuses add lots of long-term value

Cons

- No community forum or chat

- Focuses more on U.S. markets, limiting global diversification

True Wealth Track Record / Past Performance

Since its inception, True Wealth has earned a reputation for uncovering opportunities before they become mainstream.

During Steve Sjuggerud’s tenure and now under Brett Eversole’s leadership, the service has consistently pinpointed profitable long-term trends.

Eversole’s data-driven strategy identified major plays such as the post-2020 stock market recovery, early signals in the housing rebound, and strong runs in gold and commodity markets.

Brett has been ahead of big gains and losses for Silvercorp Metals and Alibaba to name a few, helping readers cash in before shares fell off.

While he never promises overnight results, Eversole’s disciplined, evidence-based approach has allowed True Wealth to maintain one of the strongest track records across Stansberry Research.

It remains a trusted resource for readers seeking consistent performance and clarity in uncertain markets.

How Much Does the Service Cost?

A full year of True Wealth normally costs $499, but new subscribers can join through Brett Eversole’s Melt Up Tsunami promotion for just $79, an 84% discount.

This offer includes 12 monthly issues, access to the complete model portfolio, all bonus reports, and a 30-day money-back guarantee.

Multi-year renewals are occasionally offered at deeper discounts, sometimes including exclusive access to additional Stansberry resources.

Compared with other premium advisories, True Wealth stands out for its value: expert market research, data-driven insights, and ongoing guidance at a fraction of typical industry pricing.

Is the Service Right for Me?

True Wealth is best suited for folks in the market for conservative, contrarian investment ideas with a long-term horizon.

McCall and Eversole play the long game. They don’t chase hype stocks, and they take a balanced risk-reward approach to the market.

Given current market conditions, their cautious approach could prove to be a wise strategy.

Is True Wealth Worth It?

Is True Wealth Worth It?

After carefully analyzing this True Wealth review, it’s clear that Brett Eversole’s service offers solid value for the cost.

The research quality, depth of analysis, and clear communication style make it stand out among mainstream financial newsletters.

What sets True Wealth apart is how it blends education with actionable insights, helping members understand not just what to buy but why certain trends matter.

Eversole’s Melt Up Tsunami thesis gives readers a data-backed perspective on where major money flows may head next and how to prepare for them.

At just $79 with a 30-day refund policy, it’s a low-risk entry point into professional-grade investment research.

For anyone seeking long-term guidance rooted in facts rather than hype, True Wealth remains a smart and accessible choice.

If you’re ready to learn how to take advantage of the next major market surge, this service offers the perfect place to start.

>> That’s it for my review. Click HERE to claim your 80% discount!<<

What Is Stansberry Research?

What Is Stansberry Research?

Special Report #1: Never Bet Against America: Five Stocks That Could 5X During the Melt Up Tsunami

Special Report #1: Never Bet Against America: Five Stocks That Could 5X During the Melt Up Tsunami Special Report #2: $8,000 Gold and Beyond: The New Era for Precious Metals

Special Report #2: $8,000 Gold and Beyond: The New Era for Precious Metals Special Report #3: Unexpected Profits: Surprise Gains and Income From a Forgotten Market

Special Report #3: Unexpected Profits: Surprise Gains and Income From a Forgotten Market Surprise Bonus Report #4: A Secret Currency That Could Pay You 500%

Surprise Bonus Report #4: A Secret Currency That Could Pay You 500% Refund Policy

Refund Policy Is True Wealth Worth It?

Is True Wealth Worth It? Tags:

Tags: