For decades, Defense contracts and energy grants have quietly steered where money flows, often long before the public catches on.

Luke Lango believes that influence is becoming more direct, and The President’s Market could prove pivotal if his read on Washington’s buying is right.

In this The President’s Market review, I take a closer look at whether the idea stands on its own merit or if the strategy falls short of delivering.

>> Get Luke Lango’s President’s Market Access <<

What Is The President’s Market?

The President’s Market is a focused research initiative built around one idea: when the U.S. government becomes an active buyer, certain stocks can move fast.

Through direct purchases, long-term contracts, and funding programs tied to national priorities, the government is now influencing markets in a much more visible way.

The research zeroes in on companies positioned to benefit from this shift, especially those connected to national security, supply chains, and strategic infrastructure.

A big part of the analysis looks at federal purchasing behavior and other procurement arms that quietly direct billions into the private sector.

Subscribers receive a curated set of research that highlights specific companies, explains the logic behind each idea, and provides ongoing guidance as conditions evolve.

With the amount of money the government flings around, I can see the potential here, especially if there’s a way to get in before moves become headlines.

What’s happening right now though that makes this so pertinent?

>> Join The President’s Market Today <<

What Is The President’s Market Presentation About?

Despite debt and economic concerns, the government always seems to have money to spare.

Its purchases don’t always make sense to me, but right or wrong, there’s a lot of money moving around.

Much of that’s been in on the down low, quietly influencing markets from the background. Luke believes that’s about to change.

Today, it’s stepping forward as an active buyer, directing capital toward companies it views as essential to national priorities.

When the market finally catches on, prices tend to move fast, and that can be good news for us.

Why This Isn’t Business as Usual

We live in one of the most politically tense eras of modern history.

Wars are being waged all around us, and I’m not just talking about the most obvious ones.

Countries compete for dominance on the global stage through technological prowess, and much of that battle revolves around controlling rare minerals.

While “rare”, these elements are the lifeblood of objects we use every single day, like laptops and smartphones.

Without them, our ability to function, as sad as that sounds, comes to a screeching halt.

To Luke’s point, it feels like the United States is sorely lacking in this department. We depend far too much on foreign powers to supply these minerals, leaving us crippled if the political tide changes.

It’s even scarier when powers like China have unfiltered access to these resources, leaving much of the world at their mercy.

It’s Time to Fight Back

It’s Time to Fight Back

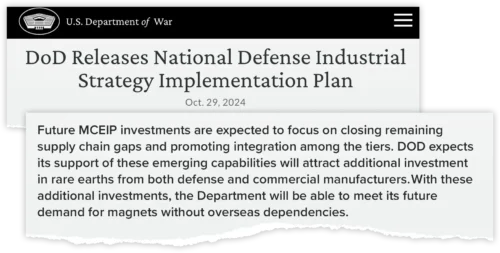

We can’t get left wondering if and when China will supply these resources to us. Miracle or otherwise, the government realizes it’s time to take action.

Lango’s saying this is more than finding some rare earths of our own to use. America needs to break China’s control of the sector and wrestle back supply chains.

It’s hard to be the world’s superpower, after all, if we’re wondering where our metals are coming from.

The shift takes us underground, allowing us to gather up our own supply of crucial resources, but the fun doesn’t stop there.

Many of the extra steps needed to go from raw material to final product could be making their way back to the United States as well.

Keeping everything in-house assures there’s never a kink in the process that will slow us down, or a sanction that blocks a crucial process for microchips or another need.

How to Tap Into Some Potential Gains

Luke’s presentation reveals a shift of colossal proportions, and something of this caliber moves a lot of money around.

The government could soon be handing companies a lot of cash (if it hasn’t already) to break ground, build facilities, and manage processes, and I want a piece of that action.

Lango’s been close to this story for some time, and I believe he has the market knowledge to help us do just that.

You can get all his research by signing up for his newsletter through this President’s Market bundle, along with the names of all the stocks he anticipates will see massive growth as we regain rare earth dominance.

Next, I want to share with you all the content included inside so you can see how everything comes together.

>> Unlock Luke Lango’s Market Strategy <<

The President’s Market Review: What Comes With Innovation Investor?

Here’s everything you get for joining The President’s Market:

A Full Year of Innovation Investor

A Full Year of Innovation Investor

First and foremost, a subscription gives you a full year of Luke Lango’s flagship research letter, Innovation Investor, delivered on a regular schedule.

Each issue focuses on a small number of high-conviction ideas tied to long-term innovation trends.

Luke explains why a company matters, what catalyst he’s watching, and how it fits into the broader market environment.

The writing stays clear and grounded, making it easier to follow along without needing a finance background.

As you collect suitable stock picks over time, the service builds a cohesive strategy rather than a scattered list of stock ideas.

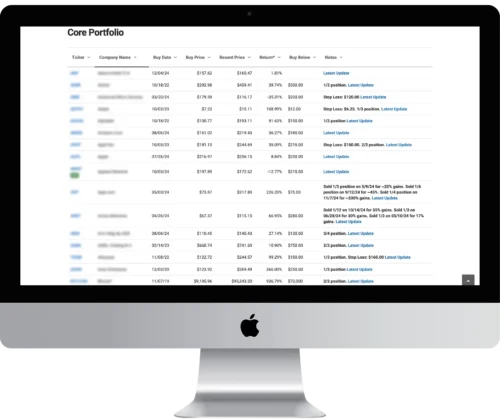

24/7 Access to Luke’s Model Portfolio

24/7 Access to Luke’s Model Portfolio

The model portfolio acts as the central reference point for everything Luke recommends and is where I spend a good chunk of my time between newsletters.

You can log in at any time to see which positions are active, which ones are being monitored, and where changes have been made.

Each holding includes context around entry levels, position size, and current outlook. This structure helps remove guesswork, especially during volatile periods.

Instead of wondering whether an idea is still valid, you can quickly see how Luke himself is treating it within the portfolio.

Daily “Portfolio Notes”

Daily “Portfolio Notes”

Portfolio Notes are short, frequent updates that explain what’s happening beneath the surface any day the market is open.

It’s really nice not having to wait an entire month for new content. Luke uses these notes to comment on earnings, price moves, or macro developments that affect existing positions.

They’re especially useful during fast-moving markets, as they provide clarity on whether a move is meaningful or just noise.

These are concise while still covering both macro and micro trends that you can capitalize on.

Instant Access to the Best Ideas Vault

Instant Access to the Best Ideas Vault

New members get immediate access to a library of Luke’s past research, often referred to as the Best Ideas Vault.

This archive includes previous recommendations, thematic essays, and detailed breakdowns that still inform current thinking.

There’s a lot of valuable content here, even if some of it came out a while back. I use the material to learn about patterns and how past moves could affect future performance.

It’s valuable for anyone who wants context on how today’s ideas connect to earlier trends.

>> Discover Luke Lango’s President’s Market <<

Weekly Updates & Urgent Alerts

Weekly Updates & Urgent Alerts

In addition to scheduled issues, Innovation Investor provides weekly updates and time-sensitive alerts when conditions change quickly.

These alerts are used sparingly and typically tied to meaningful developments, such as a major policy shift, contract news, or a decisive market move.

The goal isn’t to keep you glued to a screen, but to make sure you’re informed when action may be needed.

You’re not hit over the head with these, so you’ll want to pause and read any time one comes through.

Daily Insights from Luke’s Hypergrowth Investing

Daily Insights from Luke’s Hypergrowth Investing

Beyond specific stock calls, Luke regularly shares broader insights tied to the biggest shifts in technology and the broader economic landscape.

These daily commentaries focus on themes like artificial intelligence, energy transition, and government-driven innovation.

They help frame why certain sectors are gaining attention and how capital is likely to flow next.

Each send separates actual worthwhile material from noise so I’m not wasting time sifting through news on my own.

You can often see recommendations you can take action on right away too, adding to the depth this service brings.

Professional U.S.-Based Customer Support

Professional U.S.-Based Customer Support

Finally, subscribers have access to professional, U.S.-based customer support.

This team handles account questions, access issues, and general service concerns promptly and clearly.

While it’s not part of the investment research itself, reliable support matters when you’re managing subscriptions and accessing time-sensitive material.

Knowing there’s a responsive team behind the service makes the overall experience smoother and more dependable.

>> Get Innovation Investor With Bonuses <<

The President’s Market Bonuses

Beyond the core Innovation Investor access, The President’s Market also includes several research bonuses designed to deepen your understanding of how government spending, national priorities, and early-stage positioning can translate into real opportunities.

The President’s Market: How To Make 500%–1,000% Gains From Washington’s NEXT Buying Spree

The President’s Market: How To Make 500%–1,000% Gains From Washington’s NEXT Buying Spree

This featured report lays the foundation for emerging rare earths campaign. Luke Lango walks through how and why the federal government’s buying behavior can trigger outsized stock moves, sometimes in a matter of days.

The focus stays on identifying companies that sit directly in the path of future government demand, rather than reacting after purchases become public knowledge.

The report explains what signals matter, why timing is critical, and how these situations differ from traditional growth stories driven by earnings or hype.

Bonus Report #1: How To Make 1,000% On Washington’s Favorite Stock

Bonus Report #1: How To Make 1,000% On Washington’s Favorite Stock

This bonus narrows the lens to a single company that Luke believes stands out due to its deep and ongoing relationship with the U.S. government.

Lango provides his full research on the stock, its ticker symbol, and why he feels it’s such a winner in today’s climate.

He even examines why repeated federal contracts and insider familiarity can create a powerful tailwind over time.

You won’t find a short-term moneymaker here, but as we’ve all seen in the past, government reliance can steadily reshape a company’s growth profile long-term.

Bonus Report #2: 300–500% Upside Thanks to the “America First” Cyber Fortress

Bonus Report #2: 300–500% Upside Thanks to the “America First” Cyber Fortress

Cybersecurity takes center stage in this report, reflecting the government’s growing urgency around digital defense.

Luke explains how national security priorities have shifted toward protecting data, infrastructure, and AI systems, and why certain companies are positioned to benefit disproportionately.

The report connects policy language to real-world spending patterns, showing how defense-driven demand can spill into the private sector.

It makes sense, considering how important defense is right now. Protection from outside threats comes at all levels, and taking advantage of budding cyber safeguards sounds like a huge win.

Bonus Report #3: VC Insider’s Millionaire Playbook

Bonus Report #3: VC Insider’s Millionaire Playbook

In the VC Insider’s Millionaire Playbook, the focus toward how venture capital insiders think about early-stage growth.

The report breaks down how institutional players evaluate emerging technologies long before they hit mainstream awareness.

Luke uses this framework to help readers spot similar characteristics in public companies that are still flying under the radar.

The value here isn’t about copying venture capital deals, but about understanding the mindset and filters professionals use when chasing asymmetric upside.

Complimentary One-Year Membership to TradeStops Basic

Complimentary One-Year Membership to TradeStops Basic

The final bonus adds a practical risk-management layer through a one-year membership to TradeStops Basic.

This tool is designed to help you manage position sizing, volatility, and exit points using data-driven signals.

Rather than replacing research, it complements it by helping you decide how much risk to take on each idea.

It helps take some of the guesswork out of investing, allowing you to enter positions with the right mindset and minimal amounts of emotion.

>> Start Luke Lango’s President’s Market <<

Refund Policy

Refund Policy

The President’s Market comes with a 90-day money-back guarantee, which gives you a full three months to evaluate the research without feeling rushed.

During this period, you can review the analysis, follow Luke Lango’s thinking, and decide whether the approach fits your expectations.

If at any point within those 90 days you feel the service isn’t right for you, a full refund is available by contacting customer support.

There are no hoops to jump through or complicated requirements, making it easy to assess the value before committing long term.

>> Access The President’s Market Now <<

Pros and Cons

Every service has trade-offs, and The President’s Market is no exception.

Pros

- One full year of Innovation Investor

- Clear macro-driven thesis tied to real government actions

- Strong educational framing for understanding policy-driven moves

- Model portfolio and applicable alerts

- Bonus subscription to TradeStops Basic

- Multiple Bonus reports

- 90 Day Refund Policy

- Excellent Customer Support

Cons

- Focused heavily on volatility-driven gains

- Not built for rapid or short-term gains

Track Record and Past Performance

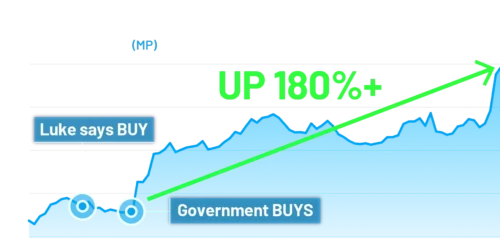

Luke Lango leans heavily on real, recent examples to support the core argument behind The President’s Market.

In the presentation, he points to multiple cases where government involvement directly preceded sharp stock moves. MP Materials jumped roughly 50% in a single day after Pentagon involvement became public.

Lithium Americas surged about 100% following Department of Energy backing, while Trilogy Metals reportedly tripled overnight after federal participation was disclosed.

Beyond these government-linked examples, Luke also references earlier calls from his career, including Nvidia, Tesla, AMD, Shopify, Palantir, and even Bitcoin, many of which went on to deliver multi-hundred or four-digit percentage gains over time.

He’s careful to frame these as illustrations of pattern recognition rather than promises. After all, no one can guarantee future outcomes.

The broader takeaway is consistency in spotting inflection points early, especially when powerful institutions step in and change the demand equation.

>> Claim Innovation Investor Risk-Free <<

How Much Does Innovation Investor Cost?

Access to The President’s Market is bundled with a discounted subscription to Innovation Investor, which is Luke Lango’s flagship research service.

At the time of this offer, new members can start with a heavily reduced introductory price of $49, down from the standard annual rate of $199.

This entry plan provides a full year of access to the newsletter, the model portfolio, ongoing updates, and all the bonus research tied to The President’s Market.

The value here isn’t just the lower price, but the scope of what’s included during the trial window.

You’re able to review Luke’s current ideas, track how he manages positions, and explore the supporting research without committing to the full regular rate upfront.

Expect to pay full price once you go to renew, but I feel there’s plenty of value to justify that price point too.

>> Invest With Luke Lango Today <<

Is The President’s Market Worth It?

Is The President’s Market Worth It?

After going through the research, The President’s Market checks a lot of boxes for me.

It’s a path to investing ahead of breakthrough themes that need to take place in order for America to flourish, leaving me little doubt that there’s a big opportunity here.

You just have to be willing to focus on large, government-driven forces and staying patient as they play out.

What strengthens the case is how seamlessly this idea carries into Innovation Investor, where Luke continues to track these themes and refine his thinking over time.

There’s a lot of content packed into this bundle outside of the rare earths play that will keep you busy for the year, and at just $49, a single good pick could earn that entry fee back and then some.

If you prefer a structured, long-term approach backed by real-world spending trends, the service feels well thought out.

I’d recommend getting started right away though, since the government’s pursuit of rare earths won’t slow down.

Tags:

Tags: