Looking to invest in thorium stocks? As the world moves toward cleaner and more sustainable energy solutions, thorium is gaining attention as a potential game-changer in the nuclear energy space.

Safer and more abundant than uranium, thorium could reshape the future of power generation.

For investors, this presents a unique opportunity to get in early on companies exploring or developing thorium-based technologies.

In this guide, we’ll explore some of the best thorium stocks to watch, what makes thorium a promising energy source, and how you can position your portfolio for long-term growth in this emerging sector.

TL;DR: Best Thorium Stocks To Look Out Now

- Lightbridge Corporation (LTBR): Advanced nuclear fuel tech developer.

- NuScale Power Corp (SMR): Small modular reactor (SMR) specialist.

- Centrus Energy Corporation (LEU): U.S. nuclear-fuel supplier for advanced reactors.

- Cameco Corporation (CCJ): One of the world’s largest uranium producers

- NexGen Energy Ltd. (NXE): High-grade uranium developer in Canada.

- Denison Mines Corporation (DNN): Uranium exploration & development in Canada.

- Ur-Energy Inc (URG): Uranium producer using in-situ recovery in the U.S.

- Vistra Corp (VST): U.S. power producer with nuclear generation exposure.

- American Rare Earths Ltd (ARRNF): Rare-earth and thorium-bearing deposit explorer.

- Mitsubishi Corporation (MSBHF): Global industrial conglomerate with nuclear-fuel and thorium R&D ties.

- BWX Technologies (BWXT): Manufacturer of nuclear reactors and components for fuel/SMRs.

What Is Thorium and Thorium Stocks and Why do they Matter | Thorium Stocks

The Basics of Thorium

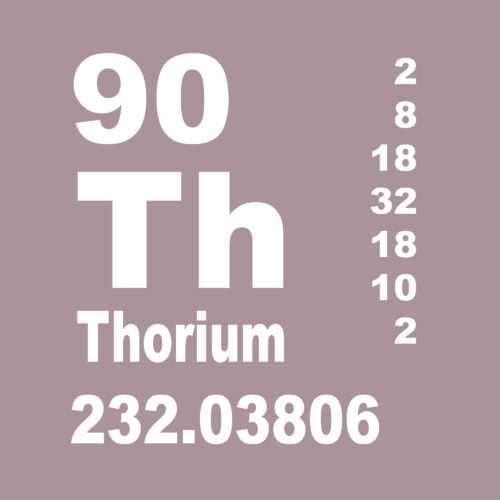

Thorium is a naturally occurring, slightly radioactive metal (element 90) found in small amounts in many rocks and soils.

Unlike uranium-235 (which is naturally fissile), thorium-232 is not fissile by itself but is “fertile”, meaning that when it absorbs a neutron, it can convert into uranium-233, a fissile material.

Because of that chain, some advanced reactor designs propose using thorium as part of their fuel cycle.

According to the World Nuclear Association, thorium is about three times more abundant in Earth’s crust than uranium.

That abundance and the fuel-cycle potential are key reasons why thorium receives investor curiosity.

Advantages Over Uranium

In theory, thorium-based fuel cycles offer several potential advantages. They may produce less long-lived radioactive waste, and the waste may be less prone to proliferation risks.

Some reactor designs believe they can design safer systems around thorium because the chain reaction might be more self-limiting.

For example, companies like Lightbridge Corporation (formerly “Thorium Power”) have publicly pointed to these advantages.

The Commercialization Challenge

It is important to be realistic; there are no widely deployed commercial reactors today running on pure thorium fuel. Most current reactors use uranium or plutonium.

The thorium-fuel path remains experimental, with significant technical, regulatory, and economic hurdles. In other words, investing in this theme requires patience and a long-term horizon.

11 Best Thorium Stocks To Add (Updated)

Without further ado, here are the top thorium stocks to check out right now:

Lightbridge Corporation (NASDAQ: LTBR)

Overview

Lightbridge is one of the few names working squarely on next-generation nuclear fuel rather than building reactors or mining uranium.

The company’s Lightbridge Fuel is a metallic fuel concept designed for today’s light-water reactors and for emerging small modular reactors.

The pitch is simple to grasp, even if you are new to the space: better heat transfer, the potential to run cooler, and a path to more electricity from the same hardware.

This unique design traces back to the firm’s origins in thorium fuel research, even as the provider pursues metallic uranium-zirconium and other options at the same time.

Growth Catalysts

The near-term story sits in the lab, not in a factory, and that is exactly what you want to see at this stage.

In 2025, the team completed a key manufacturing milestone by co-extruding demonstration fuel material and then fabricating enriched uranium-zirconium “coupon” samples representative of what it plans to deploy.

Alongside that work, the company expanded a collaboration with Oklo to evaluate co-located fuel-fabrication and recycling facilities.

If that effort progresses, it could shorten the road from lab-scale to commercial-scale manufacturing and anchor Lightbridge inside a broader advanced-reactor supply chain.

The combination of real irradiation testing, iterative manufacturing progress, and a practical plan for future fabrication is what makes this name more than a concept.

Conclusion

If you want targeted exposure to advanced nuclear fuel, this is a credible way to play it.

The company is working through the right sequence: prove the material, gather data in a test reactor, then line up a practical path to fabricate at scale.

It is not the lowest-risk pick in the group, but if the testing track record stays clean and the fabrication plan keeps moving, the payoff could be meaningful over a long investing horizon.

NuScale Power Corp (NYSE: SMR)

Overview

NuScale Power represents one of the most significant innovations in modern nuclear energy. Its small modular reactors, or SMRs, are designed to produce scalable, carbon-free electricity while reducing the size, cost, and complexity of traditional nuclear plants.

Each NuScale Power Module™ generates about 77 megawatts of electricity, and up to a dozen can be combined to create a full-scale plant.

The company’s design is the first and only SMR to receive certification from the U.S. Nuclear Regulatory Commission, a milestone that separates it from every other advanced-reactor developer in the U.S. market.

Growth Catalysts

Momentum for SMRs continues to build as governments and private utilities search for solutions that balance clean energy with stability.

The company has expanded global partnerships, including agreements with international utilities and technology firms exploring SMR deployment for grid modernization, industrial heat, and desalination.

Its collaboration with data centers and hydrogen producers adds to the potential addressable market, as industries dependent on uninterrupted power look for dependable carbon-free energy sources.

Moreover, recent project advances, including design refinements and long-term manufacturing contracts for reactor components, demonstrate a shift from concept to commercial readiness.

Conclusion

For investors betting on the future of nuclear power, this company offers one of the clearest long-term opportunities.

Its certified design and broad partnership network put it in a leadership position, but patience will be essential as the company transitions from development to deployment.

Centrus Energy Corporation (NYSE: LEU)

Overview

Centrus Energy operates at the core of nuclear fuel supply, focusing on enriching uranium and providing fuel services to power plants.

Its roots trace back to the U.S. government’s uranium-enrichment programs, and in its current form, the firm has positioned itself to support both utility-grade fuel (low-enriched uranium) and the emerging “advanced reactor” fuel cycle.

The company brings nearly six decades of experience supplying fuel for nuclear reactors, and it now holds unique U.S. domestic enrichment technology, which has become a strategic asset in efforts to safeguard energy and national-security supply chains.

Growth Catalysts

One of the most compelling features is the company’s role in producing high-assay low-enriched uranium (HALEU), a next-generation fuel required by many of the advanced reactors under development.

This gives it a forward-looking product roadmap rather than staying entirely tied to existing reactor designs.

On the policy front, U.S. efforts to re-establish domestic uranium-enrichment capacity and reduce dependence on foreign fuel providers create a favourable backdrop.

The company also serves utilities globally via long-term contracts and is investing in manufacturing and engineering facilities to expand its enrichment and advanced-manufacturing capabilities.

Conclusion

For investors seeking exposure to nuclear-fuel supply rather than the utilities or reactor builders, Centrus offers a meaningful entry point.

It combines legacy fuel-supply business with next-generation opportunities in HALEU and advanced manufacturing, making it more than a commodity play.

That said, this is still a long-term story; the real payoff depends on fuel-cycle evolution, regulatory momentum, and the company’s ability to scale its technology effectively.

Cameco Corporation (NYSE: CCJ)

Overview

Cameco is a major player in the global nuclear-fuel ecosystem, covering mining, refining, conversion, and fuel services.

It has built its reputation on owning some of the highest-grade uranium reserves in the world, and it supplies utilities globally with the fuel needed to generate baseload nuclear power.

The company also holds interests in downstream segments, including fuel fabrication and advanced enrichment technologies, underscoring its integrated position in the fuel-cycle value chain.

Growth Catalysts

The push toward decarbonisation is reviving nuclear power’s role, which boosts demand for uranium and fuel-cycle services.

Cameco’s large, low-cost mining operations help it stand out when production constraints tighten.

Furthermore, its vertical integration from uranium mining through fuel conversion and fabrication positions it not just as a commodity miner but as a value-chain operator, which helps margins when the market shifts.

Finally, as advanced reactors and new nuclear applications gain interest, companies like this one could benefit from new demand curves beyond traditional utility reactors.

Conclusion

This is a relatively “safe” entry point into the nuclear-fuel theme compared to early-stage or speculative plays.

It has scale, integration, and access to raw materials that underpin potential upside if nuclear-energy demand grows.

At the same time, because it is tied to the commodity cycle and long-horizon infrastructure development, readers should view this as a longer-term investment rather than a quick win.

NexGen Energy Ltd. (NYSE: NXE)

Overview

NexGen Energy is a development-stage uranium company headquartered in Vancouver, focused on a singular goal: bring into production one of the world’s highest-grade uranium deposits in the Athabasca Basin of Saskatchewan, Canada.

The company controls the 100 % interest in the Rook I project, encompassing over 35,000 hectares of claims in the southwestern Athabasca Basin.

Its strategy is built around delivering long-term value rather than short-term production, emphasizing environmental responsibility and high-grade resources that could keep extraction costs low when the project enters the mine phase.

Growth Catalysts

The core driver is the Rook I project itself: when/if it reaches production, it could redefine uranium-supply economics thanks to its high grade and favorable geology.

That gives NexGen optionality: when uranium demand strengthens, the project’s advantages become more compelling.

Another catalyst is the growing recognition globally that nuclear fuel supply needs diversification and expansion to support clean-energy goals. High-grade, large-scale projects like Rook I are rare and therefore strategically valuable.

The company also emphasizes modern mining-design concepts, including advanced environmental planning and real-time reclamation, which may make permitting and stakeholder approval smoother.

Conclusion

For folks who believe in a future where nuclear power, and consequently uranium demand, rise meaningfully, this company offers a high-upside play with a premium asset.

It’s less about immediate production and more about optionality tied to the uranium-supply cycle.

That makes it a theme bet rather than a near-term dividend payer. If the project advances on schedule and uranium demand holds firm, the reward could be substantial, but patience and conviction are essential.

Denison Mines Corporation (NYSE: DNN)

Overview

Denison Mines Corporation is a Canadian company journeying toward production within the high-grade uranium-rich Athabasca Basin in northern Saskatchewan.

Its flagship asset is the Wheeler River project, in which it holds an effective 95% interest.

With decades of uranium-exploration experience and a portfolio of joint-venture interests, Denison’s strategy combines resource development with mining-legacy infrastructure and existing processing capacity.

The company also offers mine-decommissioning and post-closure services, which provide a diversified uranium-sector footprint beyond simply finding ore.

Growth Catalysts

The Wheeler River project stands as the growth engine: once permitted and built, it aims to deliver significant uranium tonnage from a prime uranium jurisdiction.

The Athabasca Basin remains one of the world’s most favorable mining environments, which gives Denison a geographic advantage.

Furthermore, global conversations on nuclear power expansion and fuel security make such near-production assets more attractive to utilities and investors.

The company’s dual focus, on developing its own mine and participating in other uranium-project ventures, adds optionality.

Conclusion

Denison Mines is a well-positioned uranium developer with a strong asset in a top jurisdiction.

For those seeking exposure to the uranium supply rebuilding narrative, it offers more upside than large majors but also more execution risk.

If the Wheeler River project moves into construction and uranium demand accelerates, Denison could be a standout; if not, it may lag more established names.

Ur-Energy Inc. (NYSE: URG)

Overview

Ur-Energy is a U.S.-based uranium producer and developer dedicated to supplying nuclear-fuel feedstock.

Its flagship Lost Creek in-situ recovery (ISR) facility in Wyoming has already produced uranium and demonstrates operational credentials.

The company also has the Shirley Basin project, fully permitted and construction-ready, also in Wyoming, offering a pathway to increased production capacity.

With a focus on domestic U.S. supply in a sector where energy security and supply-chain issues are increasingly discussed, Ur-Energy combines production and development in one theme play.

Growth Catalysts

The U.S. government’s heightened focus on domestic nuclear-fuel supply presents a favorable backdrop, and being U.S.-based gives Ur-Energy strategic positioning for contracts or policy tailwinds.

Its Lost Creek facility illustrates the ISR method—typically lower-cost and less environmentally disruptive than conventional mining—providing a competitive cost structure.

Meanwhile, Shirley Basin’s development readiness offers upside if uranium pricing and offtake agreements align.

The company also has exploration programs in the Great Divide Basin region to build longer-term resource optionality.

Conclusion

xUr-Energy offers one of the more grounded entries on our list thanks to its current production and credible growth pipeline.

It is less speculative than pure exploration firms but still carries the typical risks of commodity supply and development.

If uranium prices rise and U.S. utilities commit to domestic supply, Ur-Energy may reward those with patience.

Vistra Corp (NYSE: VST)

Overview

With more than 41,000 MW of installed generation capacity across the U.S., this company stands out by blending conventional and zero-carbon power sources under one umbrella.

A significant portion of that capacity comes from nuclear facilities. Following its acquisition of four nuclear plants, the firm now operates a nuclear fleet delivering reliable baseload power.

The combination of nuclear, natural gas, solar, and battery storage gives the company a unique footprint in the evolving energy market.

Growth Catalysts

The nuclear component of its portfolio offers more than just large-scale generation; it also positions the company to benefit from a broader power-demand shift.

As data centers, artificial-intelligence operations, and large-scale industrial users demand uninterrupted, low-carbon electricity, the firm’s nuclear assets provide an edge.

Regulators recently approved extensions on its nuclear plant licenses, signalling long-term operational stability.

Additionally, by combining nuclear with storage and renewables, the company is better prepared for a future where utilities must balance variable output with reliable baseload supply.

Conclusion

Vistra looks solid for anyone seeking exposure to an energy company with meaningful nuclear-power capability, thanks to a compelling blend of scale, diversification, and future-looking positioning.

The nuclear assets give a structural advantage as demand for clean, reliable electricity rises, but the path ahead is still dependent on major investments, favorable policy frameworks, and sustained demand growth.

American Rare Earths Limited (OTCMKTS: ARRNF)

Overview

American Rare Earths focuses on rare-earth element (REE) deposits in the United States, particularly in Wyoming and Arizona.

The company’s rare earth deposits tie perfectly into thorium and other critical minerals fueling the nuclear space.

Growth Catalysts

The U.S. is intensifying efforts to domesticize supply chains for REEs and other critical minerals, materials required for everything from renewable-energy equipment to advanced battery systems and high-tech manufacturing.

Additionally, its large identified resource base gives optionality: as demand for REEs and nuclear-fuel feedstocks grows, projects with favorable grade, location, and processing characteristics stand out.

Conclusion

For those comfortable with elevated risk and looking for upstream exposure in the rare-earth/critical-minerals niche, adjacent to nuclear-fuel themes, this company offers a speculative but potentially meaningful stake.

Its low-penalty element profile and U.S. location are strengths, but production remains a future event, making patience essential.

Mitsubishi Corporation (OTCMKTS: MSBHF)

Overview

As a major global industrial conglomerate, this company operates across diverse sectors, including energy, materials, industrial infrastructure, and advanced technology.

Though not a pure nuclear-fuel play, its involvement in advanced-reactor research and nuclear technology makes it relevant to next-generation nuclear themes.

It participates in nuclear-reactor development partnerships and holds exposure to fuel-cycle innovation through its energy and industrial businesses.

Growth Catalysts

The company is actively linked to advanced reactor initiatives, including high-temperature gas-cooled reactors and next-gen technologies in Japan.

Its broad global footprint and diversified business lines offer resilience and optionality as energy markets shift.

By combining industrial scale with nuclear innovation exposure, it may benefit if advanced fuel cycles, including thorium-hybrid reactors, gain momentum.

The conglomerate’s ability to invest across geographies and sectors allows it to capture multiple angles of the energy-transition story.

Conclusion

If you want a broadly diversified industrial exposure that includes an advanced-nuclear angle, this company might fit.

Mitsubishi blends global scale, industrial depth, and future-tech optionality. It’s less risky than a pure startup-fuel company, but also likely offers lower upside if the nuclear-fuel theme accelerates rapidly.

BWX Technologies (NYSE: BWXT)

Overview

This company specializes in nuclear engineering and manufacturing services, producing reactor components, nuclear fuels, and servicing both governmental and commercial clients.

With heritage dating back to naval-reactor work for the U.S. Navy and a track record in both fuel and components, it plays a critical role in the nuclear ecosystem.

Its capabilities now extend into advanced fuels and micro-reactors, aligning with the next phase of nuclear deployment.

Growth Catalysts

BWXT recently commissioned a new advanced-fuel production line designed to manufacture TRISO-fuel for Generation IV reactors, a sign of its move toward future reactor technologies.

Contract awards from the U.S. government and a strong backlog in reactor-component manufacturing illustrate the company’s relevance.

As nuclear utilities and reactor-builders shift toward smaller modular reactors and advanced fuel types, the company’s engineering and manufacturing footprint becomes a critical link in those supply chains.

Conclusion

For investors targeting the nuclear-fuel and reactor-supply-chain niche, this company stands out as one of the most tangible links to real-world manufacturing and deployment.

It offers a more grounded play than speculative fuel start-ups, with existing revenue streams and expanding manufacturing capability.

The reward may accrue steadily as reactor programmes expand and supply chains mature, rather than overnight.

Are Thorium Stocks a Good Investment?

Investing in thorium stocks presents a compelling opportunity due to the significant potential of thorium as a fuel for nuclear power.

Advantages of Thorium and Thorium Stocks

Thorium’s ability to achieve a controlled nuclear chain reaction and its higher energy release compared to uranium make it an attractive option for nuclear power producers.

Thorium Stocks: Higher Energy Efficiency

Thorium can produce more energy per unit of fuel than uranium.

This higher energy release means that thorium-based nuclear reactors could be more efficient, leading to potentially lower energy costs and reduced radioactive waste.

Thorium Stocks : Increased Safety

Thorium reactors are considered to have enhanced safety features compared to traditional uranium reactors.

The design of thorium-based nuclear reactors minimizes the risk of meltdown; they can safely shut down without external intervention, which is a significant safety advantage.

Thorium Stocks : Abundance and Stability

Thorium is more abundant in nature than uranium. It is estimated that there is three times more thorium in the earth’s crust compared to uranium.

This abundance makes thorium a more stable and predictable resource, reducing the risk of supply shortages.

Thorium Stocks : Political and Economic Stability

Thorium is not subject to the same geopolitical and economic volatility as uranium.

Uranium markets are often influenced by international politics and the actions of governments, which can lead to price fluctuations.

In contrast, thorium’s stability makes it a more reliable investment option.

Thorium Stocks : Long-Term Potential

As countries seek cleaner and safer energy sources, thorium-based nuclear power could become more prevalent.

It is worth noting that this shift could increase demand for thorium, driving up its value over time.

Investing in thorium stocks now could be economically viable and provide significant returns as the market for thorium expands.

Thorium Stocks : Environmental Benefits

Thorium reactors produce less long-lived radioactive waste compared to uranium reactors.

Additionally, unlike plutonium, thorium-based fuels produce significantly less long-lived radioactive waste, making them an attractive alternative for sustainable nuclear energy.

The primary byproduct, uranium-233, can be recycled, and the waste generated has a much shorter half-life, making it easier to manage.

This makes thorium a more environmentally friendly option for nuclear power.

Thorium Stocks : Innovation and Development

Continued innovation in thorium reactor technology is expected to enhance the feasibility and efficiency of thorium-based power.

Companies investing in research and development in this area are well-positioned to benefit from technological advancements.

Thorium Stocks : Global Energy Trends

The global shift towards renewable and low-carbon energy sources supports the case for thorium.

As more countries adopt policies to reduce carbon emissions, thorium could play a crucial role in the transition to cleaner energy.

Investment Considerations

Effective investing in thorium stocks involves understanding the current market dynamics and future potential of thorium.

While the long-term outlook is positive, investors should consider the following:

-

Technological Maturity – Thorium reactor technology is still in the development phase, and widespread commercial adoption may take time.

-

Regulatory Environment – The regulatory landscape for nuclear energy can impact the development and deployment of thorium reactors.

-

Market Demand – The demand for thorium will depend on the pace at which countries and companies transition to thorium-based nuclear power.

Thorium stocks do have the potential to be a strong investment due to thorium’s advantages as a nuclear fuel and the continued growth in demand for cleaner energy sources.

Risks and Challenges to Consider

Technology and Commercialization Risk

The transition from experimental fuel cycles (including thorium) to large-scale commercial deployment takes time. Reactor designs must adapt, licensing must be secured, supply chains built, and utilities must commit capital. Even if theoretical advantages are strong, real-world roll-out may lag expectations.

Policy and Regulatory Uncertainty

Nuclear-fuel cycles and reactor licensing are heavily regulated. Changes in government policy, regulatory delays or cost overruns can derail timelines. Public-safety and waste-management concerns add additional layers of risk.

Market and Commodity Volatility

Mining, fuel-fabrication and reactor-construction are all capital-intensive and subject to commodity-price swings, input-cost inflation and project delays. For companies focused on uranium (even those seeking thorium exposure), commodity cycles remain influential.

Company-Specific Execution Risk

From fuel-tech developers to miners, many companies in this theme are smaller, early-stage and dependent on funding, partnerships or government contracts. Any one setback in licensing, financing or execution can significantly affect value.

Time Horizon and Investment Allocation

Because the thorium and advanced-nuclear-fuel story is long-term, short-term investors may face volatility and risk. It is prudent to consider these stocks as thematic and allocate accordingly rather than treat them as safe core holdings.

Thorium Stocks FAQs

Who Are the Biggest Thorium Producers?

The largest producers of thorium are India, Brazil, Australia, and the United States.

These countries have significant reserves of thorium and are actively involved in its extraction and research for potential energy applications.

Who Is Building Thorium Reactors?

Thorium reactors are under development in various countries, including China, India, the United States, France, Denmark, and several others.

China is notably advancing in this field with projects like the molten-salt thorium reactor, aiming to reduce reliance on coal and mitigate pollution.

Denmark’s Copenhagen Atomics is also making strides in thorium reactor technology, targeting a fully operational reactor by 2028.

What Are the Best Nuclear Stocks to Buy?

There are many strong contenders in the nuclear industry.

Some prominent stocks include Centrus Energy Corporation and the other thorium-related stocks listed in this article.

These companies are involved in various aspects of the nuclear energy sector, from fuel production to advanced reactor technologies.

What Are the Environmental Benefits of Thorium Reactors?

Thorium reactors produce less long-lived radioactive waste compared to uranium reactors.

The primary byproduct, uranium-233, can be recycled, and the waste generated has a much shorter half-life, making it easier to manage.

This makes thorium a more environmentally friendly option for nuclear power.

Why Is Thorium Considered Safer Than Uranium?

Thorium reactors are designed with inherent safety features that reduce the risk of catastrophic failure.

For example, a molten salt reactor can shut down safely without external intervention.

Additionally, thorium itself is less radioactive than uranium, which contributes to safer handling and operation.

How Does Thorium Stocks Impact the Cost of Nuclear Energy?

Thorium-based nuclear reactors could potentially lower the cost of nuclear energy by improving fuel efficiency and reducing waste management expenses.

However, the initial costs of developing and deploying thorium reactors are high, which could impact short-term economic feasibility.

In the long term, the cost benefits of thorium could become more apparent as the technology matures and scales up.

How Do Fissile Materials Influence Thorium Stock Investments?

Fissile materials like uranium-233, which can be produced from thorium-232, are crucial for sustaining a nuclear reaction.

Companies developing thorium reactors or exploring thorium deposits are likely to see increased investor interest due to the potential for efficient and safer nuclear power production.

Investing in companies with strong positions in thorium technology or deposits can be a strategic move for long-term growth.

Final Words on Thorium Stocks

The idea of “thorium stocks” might feel exotic today, but the broader premise of next-gen nuclear fuel and reactor innovation is very real.

Whether thorium becomes widespread or remains a niche, the companies listed above provide exposure to the evolving nuclear-fuel ecosystem, from advanced fuel design to reactor deployment to resource supply.

If you believe in a nuclear renaissance driven by energy security, decarbonization, and next-gen fuel cycles, these companies merit consideration.

That said, this theme is higher risk and longer-term than many mainstream sectors, so allocate accordingly, monitor developments, and remain patient.

wTag_trans%20(1)-1.png)

Tags:

Tags: