Trademetria’s trade journaling software is designed to help boost your future performance by helping you identify errors and successes in your past trades. Read our Trademetria review to discover what this service offers and whether it has the tools to take your trading to the next level.

It is challenging to study trade patterns to see what’s working and what’s not, and we don’t always have the time to hunt for details.

That’s why trade journals, like Trademetria, are crucial trading companions that can improve trading strategies while reducing the time it takes to catalog endless bits of trade information.

Can Trademetria’s trade journal increase your trading performance?

Take a look at our Trademetria review and find out!

Trademetria Review: Overview

Trademetria started with the goal of helping novice traders boost trading performance through trade analyzer software.

The platform was developed after the 2008 financial crisis that troubled many people financially.

Since then, Trademetria has grown into a powerful tool with stellar customer service and a tech support team that investors can use for goal tracking and trade analysis.

What Is Trademetria?

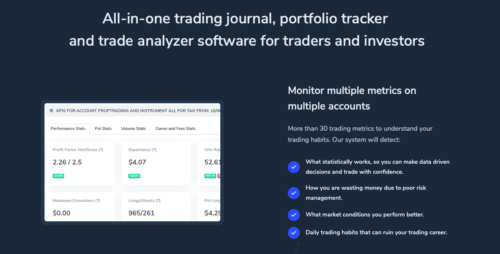

While not a stock trading company, Trademetria includes a trading journal, trade analyzer software, and a portfolio tracker.

The platform lets users track every cent that they invest in the market, whether they are a stock, options, forex, or futures trader.

With a powerful trading journal tool, investors can carefully analyze trades to further develop their trading style and tweak their trade strategy.

As Thiago Ghilardi puts it, understanding and learning from your trades is the way to succeed in day trading.

These features are fleshed out through three different tiers of service, each catering to a different level of trader.

>> Already sold on Trademetria? Click here to sign up for an account TODAY! <<

Who Founded Trademetria?

Thiago Ghilardi is a computer science major and professional trader who went on to found Trademetria after learning the ins and outs of the stock market.

Ghilardi started trading during his college days back in 2001 and quit his job after graduating to pursue trading full time.

He even moved to New York in 2006 as a prop trader to get closer to the action.

Ghilardi Started a Successful Trading Company Before Trademetria

In 2008, Ghilardi started his trading firm and rode out the stock market recession.

After discovering the key to his success was analyzing trades and past performance to improve future results, Ghilardi founded Trademetria.

Since then, his goal has been to help traders and investors improve trading results by teaching them what they are doing right and wrong through trade tracking and analysis tools.

Trademetria Review: What’s Included?

Trademetria offers some cool features to help traders avoid pitfalls, correct poor risk management, and boost trading performance.

Take a closer look at them in our Trademetria review.

- Trade tracker

- Reporting

- Trading journal

- Entry and exit trading points

- Risk management metrics

- Trade simulations

- Fundamental research

Trade Tracker

The bread and butter of Trademetria, the trade tracker is the place for traders to view all their online trading in one convenient location.

The best part is that importing trades is exceptionally easy.

To import trades, investors can simply use the import option to bring over trade data from their preferred trading platform.

Fortunately, Trademetria is compatible with over 140 of the top trading platforms and firms.

With trading data imported, traders and investors can review trading history and fill gaps in their portfolios.

Discover Patterns with Trade Analyzer Software to Boost Your Trading Performance

The trade tracker is the ideal place to discover patterns that reduce performance.

The detailed analysis makes it clear whether a trader is letting profits run, holding on to losing stocks, or if stops are too tight.

The software also helps reveal the best trading strategies and which symbols are the biggest winners and which are constant losers.

Traders can also look at their trading month at a glance to see if they are meeting goals or overtrading on a specific day of the week.

Reporting

Within the reports tab, Trademetria has several day trading tools that can be used to better understand how stocks are performing.

Key Metrics

Reports feature analysis tools in over 30 key metrics to analyze stocks such as win rate, maximum drawdown, gross P&L, net P&L, trade duration, and expected return.

Daily Trading Report

Within the daily trading report, investors can look back and see how trades have fared for a single trading day.

A trader can view details such as total trades, win rate, average net per trade, market condition, and profit factor.

This tool helps day traders view trading performance, analyze trading habits, and plan a strategy.

Trade Calendar

The trading calendar allows an investor to see their trades through various charts and graphs.

These charts show trading performance over a specific time interval so you can analyze several key metrics.

Trading Journal

What’s a trade tracking platform without a space to record some notes?

Trademetria features a trading journal where traders and investors can pen ideas about any single trade or the overall market day.

This feature is also an area to record behaviors, ideas, thoughts, and emotions that may have played into a day’s trades.

It’s a breeze to use keywords to search through past notes and pull up pertinent information quickly.

Entries are auto-filled with vital trade information to save time and effort.

Trademetria intentionally keeps its trading journal simple, featuring an HTML editor and some customization options.

Day traders can stay organized by formatting text and embedding screenshots to any entry, making them easy to locate for future analysis.

Trade journal entries are suitable for stocks, options strategies, futures, forex, and even other markets.

Back Office Management

Trademetria has a back-office reporting feature that allows firms to improve their administrative efficiency.

Brokers and firm managers can use fully customizable tools to analyze reports, study trades, and sift through analytics on organizations they represent.

Entry and Exit Trading Points

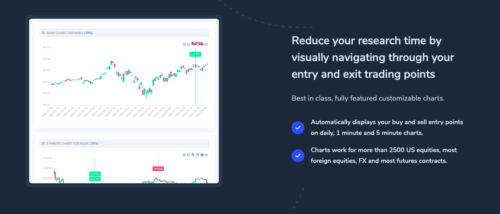

Trademetria also helps traders save time by automatically displaying entry and exit points on one-minute, five-minute, and daily charts.

These charts track trade entries and exit points for most futures, forex, and over 2,500 U.S. equities.

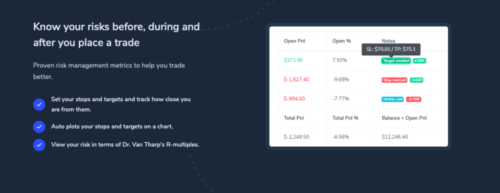

Risk Management Metrics

Risk management is an essential feature for anyone looking to protect their money from the markets’ potential pitfalls.

Traders can set stops and targets for trades, and also track proximity to those markers.

The platform provides an estimation of expected risk before, during, and after an investor has placed a trade.

This helps traders avoid trading blind.

Trademetria also lets users view their risk in terms of Dr. Van Tharp’s R-multiples.

If a visual format is more appealing, traders can also post this data to charts and view risk analysis from there.

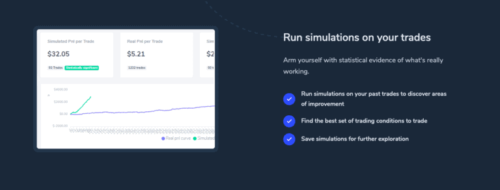

Trade Simulations

Another of Trademetria’s helpful features is the trade simulator.

This is where a trader can go back in time and run simulations on past trades through the platform’s charting software.

By studying past trading habits, users can discover ways to improve future trades.

Tools such as the P&L simulator can help swing traders locate the best conditions for trades.

It’s also possible to save simulations for further exploration at another time.

Fundamental Research

A trader can do some basic research on financial data within one of 20+ world exchanges within the platform.

Clicking on a stock will provide traders with the company profile, the earning dates, and the ability to track trade data through charts.

The fundamental research section functions much like screening software, serving to highlight stock opportunities that might be ripe for investment.

Customer Support

Trademetria has a team ready during trading hours to help users through any issue they may encounter.

The company also has a YouTube channel with several videos containing information on how to get the most out of the website.

>> Like all that Trademetria has to offer? Click here to sign up now! <<

Importing Trades into Trademetria

Trademetria works with more than 150 platforms and brokers from all corners of the world to import trades. It also offers several different methods to do so.

First, you’ll need to navigate to your dashboard within the app. After clicking the “Import Trades” button, you’ll see all the available options for your account. Let’s take a quick look at them now.

Manual

Although not advisable for large quantities of trade, Trademetria does have a manual import option. You’ll need to type out all the info for your trade into the appropriate boxes. Required entries include ticker symbol, quantity, date, and price. Several other fields can help you distinguish similar purchases or sales.

Broker CSV

As I mentioned, Trademetria has support for a large number of brokers. Once you select yours from the list, import instructions pop up to guide you through the rest of the process.

No matter which brokerage you currently deal with, they’ll need to provide a CSV file of your trade history. Keep in mind that formats and rules may be different from one brokerage to the next.

Template CSV

If your brokerage didn’t make the list, you’re not out of luck. Trademetria has a template you can download and adjust with the information you collect from your brokerage on your past trades. You will need to modify Trademetria’s document precisely as explained for everything to work.

Adjustments

It’s possible to import adjustments as well. If you withdraw funds or make a similar small change, this tab lets to capture it within Trademetria’s system. This way, you can document every cent flowing into or out of your account; you’ll want to list notes for each adjustment for future reference.

Auto Sync Via API

Saving the best for last, Trademetria allows automatic synchronization with several brokers via API. This means all your brokerage data flows to Trademedia without you having to lift a finger once you’ve set it up.

The exact process depends on the broker, but it typically requires grabbing an API key and loading it into Trademetria. Once set up, the two systems communicate seamlessly.

Is Trademetria Safe?

Trademetria is a legit company that is no stranger to the financial space.

Founder Thiago Ghilardi has been trading for over 20 years.

Trademetria gets high marks from its members, which may speak to the quality of the service.

Although trade history is imported from brokerages and firms, not a cent of your invested money ever passes through Trademetria’s site.

You can use Trademetria without having to worry about your money flowing through an additional source.

If something goes awry with your account, the company is known for having an excellent customer service team to get users back on track as quickly as possible.

Trademetria Cancellation Policy

Trademetria makes it easy to sign up, and you don’t need to use a credit card for their Free Tier service.

Once you decide to dive into one of the subscription plans, all plans must be paid for in advance.

Trademetria states it’s easy to cancel at any time.

However, the platform also spells out very clearly that they offer no refunds on any of their services.

Trademetria Review: Pricing

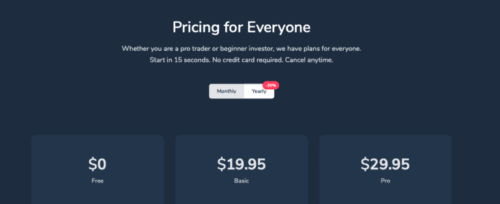

Trademetria has three pricing options for traders to consider: Free, Basic, and Pro.

Free

The Free Tier service offers a lot to traders, even though it costs zero dollars per month.

The majority of the platform’s features are available for free, including the trade journal, key metrics, the day trade report, trade calendar, analytics, trade history section, and the ability to track deposits and withdrawals.

At this tier, the platform only allows a trader to import 30 orders a month.

Anything from equities to options to futures and forex can all be brought in.

Free users are also limited to 3 real-time quotes per month and can only track one account.

Basic

The Basic Tier is a clear step up from the Free Tier.

It offers more reports and a P&L simulator to analyze trading performance more thoroughly.

This tier also introduces fundamental research, strategy rankings, and the ability to export trade data to another source.

As with the Free Tier, a day trader can still only track one account but can now obtain unlimited real-time quotes and import up to 100 trades per month.

Pricing details vary depending on the length of the subscription.

The monthly rate is $19.95, but members can save 30% by purchasing the annual plan for $169 per year.

Pro

While the Pro Tier doesn’t add any new features, it gives you unlimited trade imports.

In addition, the Pro Tier allows users to track multiple accounts, up to 50 in total.

This plan costs $29.95 per month.

As with the Basic Tier, there’s a 30% discount for signing up for a year at a time.

This lowers the annual price to $249.

>> Ready to sign up for Trademetria? Don’t wait, just click HERE to get started! <<

Trademetria Review: Pros and Cons

It’s hard to find much fault with a journaling site that gives away many of its top tools and features for free.

But during our Trademetria review, we spotted areas where the service can improve.

Take a look at the pros and cons of this service.

Trademetria Pros

- Broker import feature for over 140 brokerages

- Easy-to-use analyzer software for traders of any experience level and type, including swing traders, options traders, and more

- Several tools to track and filter trades, including fully featured customizable charts

- Effortlessly import and export trade data to track trade history

- Trade journaling as well as an individual trade journal to track select trade data with custom strategy tags

- Track every detail of your trading business

- Key metrics trade tracking to track a particular trade or multiple trades

- Reporting features with several key metrics

- Three tiers of service, including a free account

- Competitive platform pricing options

- Pro users can track multiple accounts

- Excellent customer support team

- P&L simulator for swing traders and active traders

Trademetria Cons

- No mobile app

- Not a trading platform or trading firm, unlike some all-in-one services, though Trademetria trade journal’s quality far exceeds those that you would find on all-in-one solutions

- Lack of trading community

Trademetria Review: Is Trademetria Right for Me?

Almost any trader can benefit from what Trademetria has to offer.

Its trade journal alone is one of many key features that should be in any trader’s repertoire.

If you’re a novice or part-time trader, you can get plugged into Trademetria’s free tier at no cost and start journaling your trades easily.

Additional features such as reporting and trade tracking to analyze your trades only serve to sweeten the pot.

If you’re an investor with a little more experience, you’ll find the advanced features of the Basic Plan right up your alley.

The P&L simulator and ability to research trades may have you rolling in dividends.

Upping the import limit to 100 trades also opens up many more possibilities.

Full-time investors with more than 100 trades per month who want to track several accounts can benefit from the Pro Tier.

By going Pro, you’re only limited by the amount of time you have in front of the computer.

Trademetria Reviews by Members

Investors who have subscribed to Trademetria have a lot of good things to say about the platform.

The service has a 4.7 out of a 5 rating on Capterra, with many positive reviews.

Here are just a few of the recent reviews from the site:

Very good. Grateful for the free trial option… Everything is very intuitive, no entry barrier really. This is the only app that felt less painful than a handmade excel sheet. Most amateur users prefer excel not because its flexibility but because it starts very simple and you can make it more complicated on the go, this makes us feel safe and not too silly. Trading platforms tend to show charting and data as a sort of pseudo-science the more complicated it looks the better. – Carlos, on Capterra

Another Trademetria review reads:

Excellent customer service, I switched from another logging software because I trade in Europe and my trading software uses a comma for decimals instead of a period. In my old logging software I had to switch comma for a period for every trade and then import – after contacting customer support they were not able to do anything. With trademetria I contacted customer support and explained the situation, the issue was fixed in 5 minutes so my import is flawless and takes seconds. – Tim, on Capterra

Here’s one more Trademetria review:

I get a very clear breakdown of my trades and support is available for any help I need. They even worked with a fellow trader from Australia to make sure date formats were usable for his country. This was very nice to hear, because it means they are motivated to make changes to their software as needed to accommodate everyone and all needs. – Dana, on Capterra

Trademetria Review: Is It Worth It?

Trademetria was designed with an active trader in mind and features several tools you can use no matter what price point you’re starting at.

Depending on your needs, you can choose between free, basic, and pro memberships — each of which appeals to a different type of trader.

The trade journal and reports make it easy to analyze stock trades.

The data will help you see what you’re doing well and where your trades might need a little work.

With an impressive free entry-level tier, there seems to be no reason not to try the service.

Once you outgrow the Free Tier, it’s easy to upgrade to the next level and capitalize on the other plans’ extra features.

Tags:

Tags: