Gold has always been a place people turn to when they want stability, and Garrett Goggin believes the biggest openings today are coming from early-stage gold companies that Wall Street keeps overlooking.

His take in “Wall Street’s AI Algorithms” points to a setup that could benefit anyone paying attention to where this trend is heading.

In this Wall Street’s AI Algorithms review, I break down what stood out to me and how his #1 gold pick fits into the opportunity he’s watching.

>> Join Garrett Goggin’s Golden Portfolio IV Today <<

What Is Golden Portfolio IV?

What Is Golden Portfolio IV?

Golden Portfolio IV (GPIV) is Garrett Goggin’s research service built for people who want clearer direction in the gold space without having to track every development themselves.

It’s more of an entry-level plan and strategy in my opinion, centering around miners, developers, and royalty companies that typically do well through thick and thin.

I’ve seen Goggin mix in other metals too, so don’t think you’ll be limited to just the yellow stuff here.

The crux of the package is a quarterly newsletter that takes a no-nonsense approach to sharing these insights, along with ongoing insight as these stories move from early-stage progress toward meaningful production milestones.

I’m drawn in by the fact that GPIV pursues undervalued companies that Wall Street tends to overlook, since there’s usually more room for gains there.

If you want guidance from someone who has spent decades studying this sector and understands where value often appears first, Golden Portfolio IV offers a straightforward way to follow along.

>> Secure Your Spot In Golden Portfolio IV <<

What Is Inside Garrett Goggin’s “Wall Street’s AI Algorithms” Presentation?

Garrett Goggin believes a quiet shift is unfolding in the gold market, and most people haven’t recognized it yet.

Even as gold pushes toward record levels, he says many of the strongest early-stage gold companies remain overlooked.

With most trades driven by automated systems, early-stage miners rarely show up where institutional eyes are looking.

That’s a blind spot that I’m excited to look more into.

How Automation Changed the Way Opportunities Appear

Goggin explains that today’s market behaves very differently from the one many people grew up with.

Algorithms scan filings for revenue, cash flow, and other data points they can quantify quickly.

If a company hasn’t reached production yet, even if it’s sitting on a world-class resource, these systems essentially treat it as invisible. Numbers rarely lie, but they don’t tell the whole story.

It feels like Wall Street is taking its automated approach for granted, not even sending in analysts to pore over results to locate companies that should be on the grid.

Because of that, strong early-stage miners often remain quiet until one pivotal milestone appears: revenue.

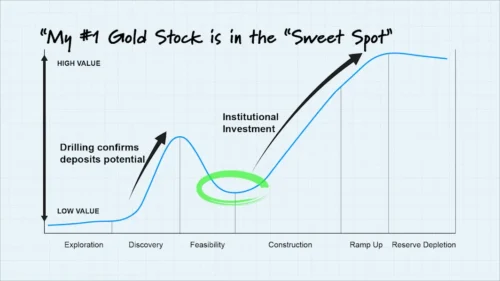

Goggin walked through example after example showing how a stock can trade sideways for years before production begins, and then suddenly attract major attention the moment the financials reflect real output.

It’s a pattern I’ve seen myself, and hearing it laid out this clearly made the underlying logic hard to dismiss.

The Data That Really Matters

I can’t blame Wall Street for not investigating every company out there, but the shift to automation leaves incredible opportunities for us on the table in the mining world.

Not every venture is worth its weight in gold though, so Goggin steps in with strict criteria he uses to locate his top picks.

Next, Garrett makes sure these miners have proven themselves and are close to institutional involvement – but not quite there yet.

Finally, he checks the stock’s value. The more undervalued, the better.

Each of these metrics makes perfect sense, and I’m even more convinced by the strategy because it comes straight from someone who’s been in the mining world for a number of years.

My only remaining question is: Are there any stocks that meet Goggin’s criteria right now?

The Company He Believes Is Poised for a Major Repricing

As it turns out, Garrett’s been tracking a company that he says holds nearly five million ounces of gold that ticks all these boxes.

He’s followed its progress for almost two years, digging through its studies, meeting leadership, and visiting its site.

Despite the strength of its resource, he believes the market values it as though none of it exists.

In his analysis, the company’s true worth is several times higher, and the only missing ingredient is the moment it starts producing revenue.

If you want to tap in before this major shift occurs, you can get the complete details through his Golden Portfolio IV service.

The next section breaks down what comes with a membership and how it helps you follow the opportunities Goggin is tracking.

>> Start Following Garrett Goggin’s Gold Picks Now <<

What Comes With the Golden Portfolio IV Offer?

Once you join Golden Portfolio IV, you get ongoing guidance that helps you follow the opportunities he believes Wall Street keeps missing. Here are the features that stood out to me the most:

One Year of Subscription to Golden Portfolio IV

One Year of Subscription to Golden Portfolio IV

A full year inside Golden Portfolio IV gives you access to Goggin’s quarterly research, where he lays out the gold trends he’s watching and the companies he believes are positioned to benefit from them.

Each issue highlights what’s changing in the precious metals space, where institutional money is likely to flow next, and how the companies in his coverage are progressing toward major milestones.

He keeps the language grounded, focusing on catalysts that matter, resource updates, production timelines, and market conditions that often precede stronger moves in the sector.

I wish these came a bit more frequently, but so far there’s been enough information in each one to keep me engaged until the next issue comes.

Access to the GPIV Live Model Portfolio and Live Fundamentals

Access to the GPIV Live Model Portfolio and Live Fundamentals

Members also get access to a live model portfolio that shows every active recommendation in one place.

I appreciate how Goggin keeps it updated so you can see how each company is performing, what its most recent fundamentals look like, and where he believes value still remains. The portfolio tracks position status, buy considerations, and the thesis behind each pick, giving you a clear sense of how all the pieces fit together.

I spend a lot of time here, gauging which opportunities appear the best to invest in right now. Since Garrett is so specific and data-focused, the info here is very easy to process.

Access to the GPIV News and Analysis

Access to the GPIV News and Analysis

The news and analysis updates serve as your real-time window into Goggin’s thinking.

Whenever something meaningful happens, whether it’s a shift in gold prices, a permitting update, or new data from one of the companies he follows—he explains what it means in plain language.

These are not rapid-fire alerts meant to pressure you into trading; they are steady check-ins that help you stay informed without constantly refreshing market screens.

Goggin’s strength is narrowing the noise and pointing you to developments that historically precede institutional interest, especially for early-stage miners preparing to move into production.

This is the most valuable part of the service for me and makes the gap between newsletters way more tolerable.

Free Starter Guide: “Why Golden Portfolio IV is Your Ultimate Gold Investment”

Free Starter Guide: “Why Golden Portfolio IV is Your Ultimate Gold Investment”

The moment you join, you’ll receive a starter guide that helps you understand Goggin’s approach and why he believes this moment in the gold market deserves attention.

It’s in many ways a look inside Garrett’s noggin, revealing the insights he’s gleaned over the years about how analysts value early-stage miners, why algorithms overlook them, and when that magic shift to profitability starts to occur.

The guide sets the foundation for following the model portfolio and prepares you to read Goggin’s quarterly issues with more clarity.

This is the very first place I’d start your journey with Golden Portfolio IV, as it sets the tone for understanding everything else in this bundle.

>> Unlock Goggin’s Golden Portfolio IV Research <<

Golden Portfolio IV Bonuses

Garrett hands out the following bonus materials at no extra charge to new members:

Bonus: Exclusive One-on-One Interview With the Chairman of the #1 Gold Stock

One of the most valuable pieces included with Golden Portfolio IV is the private interview Garrett Goggin conducted with the Executive Chairman of his #1 gold pick.

This conversation adds clarity that you simply can’t get from public filings alone.

Hearing a company leader talk through the project’s progress, upcoming milestones, and long-term vision helps you understand why Goggin views this opportunity as unusually compelling.

The Chairman discusses the scale of the resource, the steps toward production, and the potential impact once revenue begins appearing in official filings, information that matters when Wall Street often reacts late.

I feel like a fly on the wall of a board meeting when I read it, and it helps immensely in understanding Goggin’s outlook.

>> Get Access To Golden Portfolio IV Now <<

Refund Policy

Refund Policy

Golden Portfolio IV comes with a standard 30-day guarantee, which is fair but nothing to write home about.

You’ll get to try the service for that first month and, if you’re not happy with what you see, you can reach out for a refund.

The company does charge a 25% “test drive” fee if you choose to cancel, so it’s not quite as risk-free as many of the other platforms I’ve reviewed.

Still, any kind of refund policy is a blessing, since you’re getting access to insights and material that you can carry with you for the rest of your investing days.

>> Move Early With Garrett Goggin’s Insights <<

Pros and Cons

Here are my top pros and cons based on my full review.

Pros

- Strong track record in gold markets

- Boots-on-the-ground analysis AI cannot replicate

- Clear explanation of why gold miners are mispriced

- High-upside flagship recommendation

- Quarterly deep-dive research + ongoing alerts

- Transparent model portfolio

Cons

- Focuses heavily on gold, which may not fit every reader’s diversification needs

- Only quarterly issues (though alerts supplement this)

Golden Portfolio IV Reviews by Members

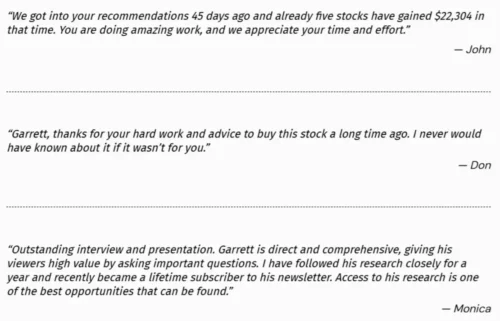

The feedback from current Golden Portfolio IV members paints a clear picture of how Goggin’s research lands in the real world.

Several people mention how quickly his ideas have made a difference for them.

This mix of practical gains and trust in his process suggests people find real value in the service’s research and support.

Not everyone will have these same results, of course, but it still paints a healthy picture of what this service can do.

>> Claim Your Golden Portfolio IV Membership <<

Golden Portfolio IV Track Record / Past Performance

Goggin’s track record centers on finding gold companies long before Wall Street pays attention, and his past results show why he puts so much weight on early-stage opportunities.

He points to several triple-digit wins over the years, 215%, 257%, 336%, 419%, 638%, 800%, 806%, 824%, and even a 2,038% gain following NewMarket Gold.

There’s also the small matter of entering SilverCrest Mines at twelve cents before it ultimately climbed 8,358%.

More recently, he says one of his live portfolios holds five open positions averaging 469% gains, including three above 800%, with the smallest gain at 11% tied to the company he’s spotlighting now.

>> Access Garrett Goggin’s Gold Strategy Now <<

How Much Does Golden Portfolio IV Cost?

A full year of Golden Portfolio IV is currently available for $189, a discounted rate from the $500 he usually charges.

That gives you immediate access to Goggin’s research, his #1 gold pick, the quarterly issues, the live model portfolio, ongoing news updates, and the exclusive Chairman interview.

It’s a very fair price for the material, and the value comes from getting all of Goggin’s ongoing analysis for an entire year.

Plus, you’ll get the same $189 rate when you go to re-up at the end of your subscription.

Is Golden Portfolio IV Worth It?

Is Golden Portfolio IV Worth It?

After working through Goggin’s research, the strongest takeaway is how clearly he explains the disconnect between early-stage gold companies and the way Wall Street reacts to them.

If the ideas in this Wall Street’s AI Algorithms review resonate with you, then Golden Portfolio IV offers a structured way to follow the opportunity with ongoing support rather than trying to piece everything together on your own.

I’m really pleased with the amount of content you receive here, despite having an initial aversion to a quarterly newsletter. Updates come regularly to fill in the gaps, and I’ve never felt like Garrett abandoned me to my own devices.

The sleek price point right now is another great draw, even if it won’t be around for long. I’m bummed about the “test drive” fee, but I am glad there’s a chance to get most of your money back if you decide to go another direction.

In all, Golden Portfolio IV is definitely worth the cost of entry. Act now though to capitalize on the latest gold mining opportunity before Wall Street susses it out for themselves.

Tags:

Tags: