You may have heard of a bond or even own one. Especially if you own one, you may wonder, “what happens when a bond becomes due?”

When a bond becomes due, it is time for the issuers to pay back the money the holders invested, plus interest.

Typically, an investor buys a bond from an issuer, who is either a corporation or a government.

You pay a fixed price, then wait to regain your initial price of purchase, plus interest.

The amount investors receive when the bond becomes due depends on the types of bonds they hold and the maturity terms.

Read on to learn more about what happens when a bond becomes due so you can make the most of your bond investments.

What Happens When a Bond Becomes Due?

A bond becomes due on its maturity date. Upon maturity, the bondholder receives the principal and the interest accrued.

The face value is the principal amount paid to an issuer as an investment.

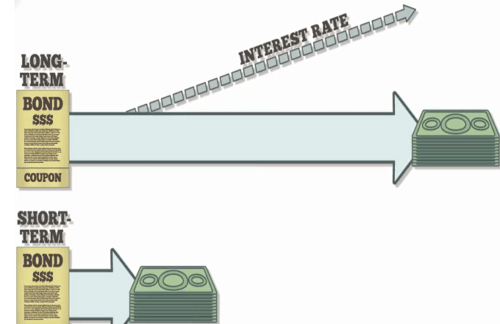

There are three categories that a bond can fall into are long-, medium- and short-term.

The terms of their maturity vary depending on the type of bond.

Short-term bonds take 1–3 years. Middle-term bonds take 10 years, while long-term bonds mature in up to 30 years.

The more time it takes for a bond to mature, the higher the interests. For example, you stand to make more money investing in bonds that mature in 30 years.

But, waiting too long increases the risk of loss. The longer the issuer holds the money, the more likely they are to default the loan payment.

What Happens When a Bond Becomes Due: You Must Wait for the Bond’s Maturity Date

The period of time waiting before receiving the investment yield is known as the maturation period.

At the end of the specified timeframe, you receive your fixed income principal amount, plus interest.

Bonds attract investors because the holder knows what to expect when they mature.

Since the interest is a fixed figure, it is easy to calculate your return when the bond becomes due.

The issuer pays the interest as cash deposits to a bank account or coupon installments.

Just like the interest rate, the coupon rate is set as a percentage of the principal amount.

What Happens When a Bond Becomes Due: How Do Interest Rates Affect the Value of the Bond?

An investor or bondholder could opt to sell the bond before the maturity date.

And when this happens, the amount received will depend on the prevailing economic times.

For example, if the interest rate is higher than it was during the issuing, the holder sells the bond at a loss, below par value; if the rate is lower than it was at the time of issue, the bondholder sells the bond at a premium, known as above par.

Selling before your bond becomes due also attracts a broker’s commission.

The commission fee is called a markdown and is a percentage of the sale cost. The higher the markdown, the thinner your profit margin becomes.

So, before you decide to sell your bond, ask the broker what the markdown rate is.

Compare the markdowns of different brokerage firms before settling for one. Typically, the price of the bond and the markdown rate vary from one firm to the next.

What Happens When a Bond Becomes Due: Can I Lose Money With Bonds?

Bonds have a reputation of being less risky than stocks and other types of securities, which can be good in the long term.

While it is true to say that they are generally safer, this does not mean that you cannot lose money holding bonds.

Yes, a bond can lose money. They are only safer because their value does not rise and fall as frequently as stocks do.

But, like other financial investments, they carry risks. And you could lose the funds you invested.

What Happens When a Bond Becomes Due: The Ways You Could Lose Money While Holding Bonds

Here are some of the reasons that could cause you to make a loss when you invest in a bond:

- By incurring trading losses

If you keep trading bonds, you risk incurring losses due to the rise and fall of interest rates and bond prices.

So without proper timing, you could sell your bond for less than what you paid for it.

- Effects of inflation

If the inflation rate is higher than the bond interest rate, you lose on your investments.

You will still receive the face value, but it will not be worth much, going by the present value of the currency.

- Market risk

There is always a chance that the entire bond market could decline.

If it happens, the value of every bond falls despite the type or quality you hold.

- Credit risk

If you hold a bond from an entity that is not financially stable this poses a credit risk, and you may lose some money.

The issuer may fail to give any interest payments or may fail to pay you back the face value when the bond becomes due.

Avoid losing your investment or interest payments by conducting thorough market research.

Also, ensure that the company you give your money to is financially stable before you buy bonds.

A Government bond, known as a treasury bill, may be a safer option.

You are less likely to make losses because governments have more resources than corporates.

But even then, make a careful consideration of all possible risks before investing.

What Happens When a Bond Becomes Due: Final Thoughts

So, what happens when a bond becomes due? Well as we explained, the bond must be paid once it reaches maturity.

When that time comes, the investors must receive their principal back, plus interest.

The issuer pays the interest funds as cash deposits paid to a bank account or as coupons.

The amount the issuer of the bond will pay back on the day of maturity depends on the bond chosen for investment.

There are three types of bonds: short-term, medium-term, and long-term bonds.

Each type of bond has a varying interest rate and a different yield at the date it matures.

Generally, bonds are a safe investment, but investors could still make losses.

You could lose money when selling your bond for less than what you paid. Your investment’s value could also go down if the entire bond market goes down.

An inflation rate higher than the bond’s interest rate could lower the value of the money received from your investment.

Also, if the issuer is having financial challenges and cannot pay its debt, you could lose your entire investment.

So, while it is good to invest in bonds, be careful when you buy them.

You can read more about different types of bonds and other capital market instruments here.

Conduct thorough market research and avoid pulling out before the bond becomes due.

This way, you will have a positive yield when the bond becomes due.

Tags:

Tags: