Capital market instruments are securities that exist to help a company or government entity raise money for long-term goals.

The capital market deals with long-term securities, whereas the money market deals with short-term investments.

Investments within money markets pertain to a timeframe of a year or less.

Some of the long-term instruments consist of bonds, debentures, and long-term loans provided by financial institutions.

So what are capital market instruments exactly?

The term “capital market instruments” refers to the physical securities that you trade, such as stocks and bonds.

The capital market is vital to economic growth for three key reasons.

It enables the transfer of funds from entities with a surplus to those in need of capital, promotes investments and savings, and facilitates overall balanced economic growth.

Primary And Secondary Capital Markets

There are two types of capital markets. They are primary and secondary markets.

The primary market (also known as new issues market) is where new money is set in motion, typically through an initial public offering (IPO).

By using this market, the capital is raised by governments and businesses through two main financial instruments: equities (stocks) and debts (bonds).

Bonds are also known as debt instruments.

The money is kept on hold in the company until it expires, it sells on the secondary market, or the company issues a buyback on its stocks.

Secondary Market

The secondary market is where old debt/stocks are traded between investors; the debt essentially acts as real money.

Investors buy from the secondary market to gain assets for a passive income.

Existing securities are also traded on this market, which is different from the primary market based on new money/new securities.

They may also sell to get liquid cash.

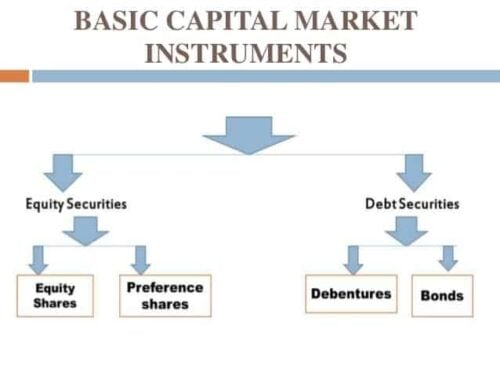

Capital Market Instruments Include:

There are two types of capital market instruments: bonds and stocks.

Bonds and the Bond Market

Debt securities, also known as bonds, are securities the government, another municipality, or a corporation issues.

Most bond trades take place “over-the-counter” because of how diverse bonds are in offerings, meaning that the trades are not happening on formal exchanges.

There are several different types of bonds that an investor may choose from:

Corporate Bonds – Investment-Grade

Businesses that need investments use corporate bonds; in return, investors receive a “bond” at a fixed rate of interest.

There are three levels of maturity for corporate bonds:

- Short-term lasting five years or less

- Intermediate lasting 5 to 12 years

- Long-term lasting 12+ years

Investment-grade bonds are typically for businesses that are unlikely to default, such as larger corporations.

They are riskier than government bonds but not as risky as junk bonds, making them a good option for investors looking for moderate-risk investments.

Corporate Bonds – Junk bonds

Junk bonds come with a high risk, but also offer higher yields, as companies that put out these bonds tend to be small or unreliable.

This makes it unlikely that investors will get their initial investment back.

However, because junk bonds provide smaller businesses with credit they may not have access to, they are still a viable investment choice if the business can turn a profit.

Foreign Bonds

Foreign bonds allow a foreign entity to raise capital in the currency of another company.

This provides an investor a unique way to diversify their portfolio and offers some protection from economic fluctuations within their country.

Though, it can be risky for the company itself due to currency fluctuations.

Nevertheless, it does provide a foreign business with another avenue to obtain capital.

Treasury Bonds

Treasury bonds, also known as government bonds, are from the federal government for a set period of time, normally 10+ years.

These bonds are low risk, meaning the interest they earn is below the market average.

While these are close to risk-free, it depends on the country you are receiving the bond from.

Municipal Bonds

Municipal bonds often are not treasury bonds and while they are similar, they are not the same.

These bonds aren’t issued by the federal government.

They are issued by the state or local governments or one of the federal agencies.

These bonds are generally “safe” but do present a greater risk than treasury bonds.

What makes municipal bonds popular is that they come in a tax-exempt version for certain infrastructure projects such as building roads or bridges.

Zero-coupon Bonds

Zero-coupon bonds come at a heavy discount because there is no interest until the bond expires.

Essentially, its value gains over time.

This may concern investors; however, these bonds are indexed to account for inflation which ensures the owner maintains their purchasing power.

Stocks

Stocks are equity instruments that are widely traded by expert and first-time investors.

Stocks are also one of the easiest investment strategies to grasp, as they mainly revolve around trading shares of a company on stock exchanges.

However, while these types of market plays can be easy to understand, there are a lot of nuances to learn, and some forms of stock trading are admittedly complex.

Common Stock

Common Stock refers to a corporation selling a percentage of their company in return for capital.

This normally takes place in a local stock market such as the New York Stock Exchange.

Common stocks are the default when discussing investments.

The shareowners not only have a stake in the company they invest in, but they get dividend payments where applicable; dividends are usually paid out each quarter.

While trading stocks offer a higher yield, they also come with a higher risk than bonds.

If a company goes bankrupt, the likelihood of an investor getting their money back is slim since they come after creditors, bondholders, and preferred stock holders.

Preferred stocks, just like common stocks, can be bought through a broker on the stock market, but they have different benefits.

Both stockholders represent part of the company, but preferred shareholders have a fixed dividend rate which is due each year.

While a business does not have to pay in the event of financial hardship, the dividend can be back-dated, meaning it may be paid when the business recovers.

Examples of Capital Market Instruments

Capital market instruments are not just securities such as stocks and bonds.

They can also include derivative options such as loans, treasury bills, debentures, etc.

Stocks and bonds may have higher yields for the investor, but they come with more risk.

Derivatives

Derivatives come in the form of options and futures contracts, both of which are a type of instrument in the capital market.

Options

Options provide investors the opportunity to sell a financial security at a later date.

The price that the security will be sold at is determined beforehand.

Futures Contracts

A futures contract is similar to options, as it’s based on an action that will take place at a later date.

The traders must follow through with a promised item or service, otherwise, they may settle a contract in exchange for cash.

Debentures

Debentures are fixed-interest securities that a company uses to borrow money from investors.

The principal amount is set to be paid at a future date.

If a company is liquidated before paying the investor based on their rate and maturity of the debenture, these shareholders will be the first to be paid off.

Which of the following is/are capital market instruments?

- 10-year corporate bonds

- 30-year mortgages

- 20-year Treasury bonds

- 15-year U.S. govt agency bonds

- All of the above

The answer is E: All of the above.

Bonds are classified by their fixed maturity lasting longer than one year.

While a mortgage is not a type of bond, it does represent a capital market instrument because it’s an equity with a fixed interest rate and maturity.

What Are Capital Market Instruments: Final Thoughts

Capital market instruments are key components of the stock market.

Without them, economic growth would be diminished.

As an investor, you must understand the function of each instrument, and which ones will help you reach your personal goals.

Without a basic grasp of how these instruments function, you may be making riskier investments you would not otherwise make.

Tags:

Tags: