Understanding the ins and outs of invoice financing can be a game-changer for businesses looking to maintain a healthy cash flow.

With the rapid pace of today’s economy, the ability to quickly turn invoices into cash is invaluable.

What Is Invoice Financing?

Invoice financing is a financial tool that allows businesses to borrow money against amounts due from customers.

This tool helps businesses improve their cash flow, pay employees and suppliers, and reinvest in operations and growth earlier than they could if they had to wait until their customers paid their invoices.

Unlike invoice factoring, invoice financing allows businesses to maintain control over their invoices and customer relationships.

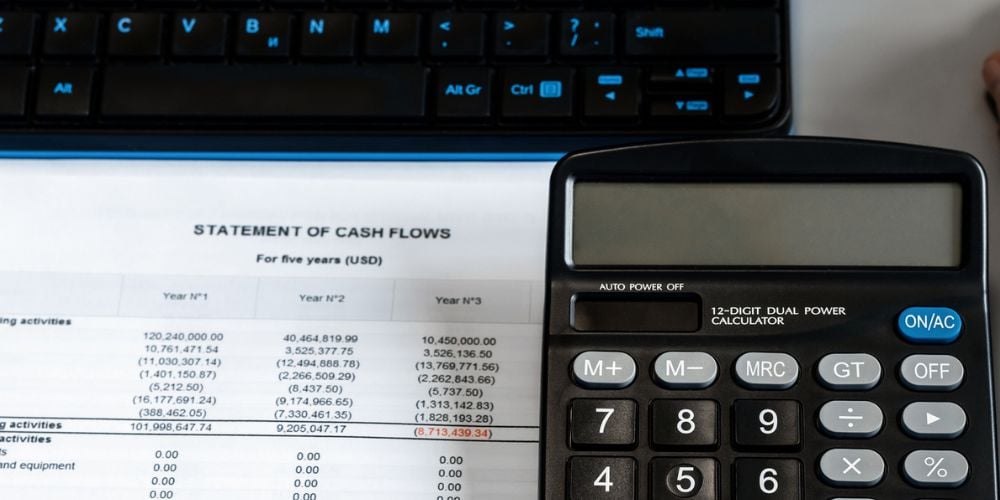

How Invoice Financing Works?

When a business needs immediate cash, it can sell its outstanding invoices to a lender. The lender then advances a percentage of the invoice amount, often up to 85%, to the business.

The customers pay their invoice amounts to the lender according to their terms.

After receiving payment, the lender remits the remaining balance to the business, minus fees and interest. Businesses, lenders, and customers are the main parties in invoice financing.

The business seeking finance sells its invoices to the lender—typically a financial institution or an online funding company. The customers pay their invoices directly to the lender.

The Types of Invoice Financing

Recourse financing is one type of invoice financing where the business retains the credit risk. This means if the customer doesn’t pay the invoice, the business must buy back the unpaid invoice from the lender.

Non-recourse financing transfers the credit risk from the business to the lender.

If the customer defaults, the lender takes the loss. This arrangement usually comes with higher fees due to the increased risk to the lender.

Benefits of Invoice Financing

One of the greatest benefits of invoice financing is improved cash flow. By converting sales on credit terms into immediate cash, businesses can manage their payables more effectively.

It often allows quicker access to capital than a traditional loan because there is less underwriting and the collateral is the invoice itself.

Additionally, because invoice financing is based on the creditworthiness of the customers, businesses without strong credit can still obtain funding.

Potential Drawbacks

The costs associated with invoice financing can be a drawback. Fees and interest rates can add up, turning invoice financing into an expensive option in the long run.

It may also lead some businesses to rely too heavily on financing to sustain operations rather than improving their cash flow management.

Customer relationships may suffer when a third party is collecting the invoices, as customers may feel they are being treated differently than when dealing directly with the vendor.

Who Can Benefit from Invoice Financing?

Many industries commonly use invoice financing, from manufacturing and wholesale to service providers and startups.

Typically, small to medium-sized enterprises (SMEs) that have a lot of their money tied up in unpaid invoices can benefit the most.

This type of financing can be a lifeline for businesses that need working capital to continue operations.

How to Choose an Invoice Financing Provider?

Selecting an invoice financing provider requires careful consideration. The provider’s reputation can be a clear indicator of their reliability and the quality of service they offer.

Entrepreneurs should consider fees, the provider’s flexibility with terms, and their customer service quality.

It’s advantageous to receive estimates from various lenders to find the best possible terms.

Pro Tips for Successful Invoice Financing

Entering an invoice financing agreement armed with knowledge is vital. Ensuring that invoices are detailed and precise can prevent disputes and delays in funding.

Good relationships with customers facilitate collections, leading to more predictable financing outcomes.

It’s also necessary to fully understand the terms in any financing agreement to avoid surprises.

Frequently Asked Questions

How does invoice financing differ from a business loan?

Invoice financing provides immediate funds based on your invoices’ value, whereas a business loan gives a lump sum based on your creditworthiness.

Does invoice financing impact my business credit rating?

Typically, it does not affect your business credit score as it’s not a loan.

Can new businesses access invoice financing without an established credit history?

Yes, because financing is based on the creditworthiness of your customers, not your business’s credit history.

Are there industries that typically cannot use invoice financing?

Most service-based industries can use it, but it’s less common for retail businesses which typically don’t issue invoices.

What is the repayment period for an invoice financing agreement?

The repayment period typically aligns with the invoice due dates, usually 30-90 days after the advance.

Conclusion

Invoice financing offers a way for businesses to harness the financial power of their outstanding invoices. It’s a form of funding that offers flexibility, especially for businesses that need to improve their cash flow quickly.

Like any financial decision, it’s crucial to weigh the pros and cons carefully, preferably with the advice of a financial expert.

In the world of business, moving money efficiently can mean the difference between growth and stagnation.

With invoice financing, companies have the chance to turn their future earnings into current cash, offering a way forward in today’s dynamic economic landscape.

Tags:

Tags: