Investors often search for techniques to optimize their investments, and portfolio rebalancing is a key strategy in maintaining long-term financial health.

This guide offers a deep dive into what portfolio rebalancing involves, its significance, and how to implement it effectively.

What Is Portfolio Rebalancing?

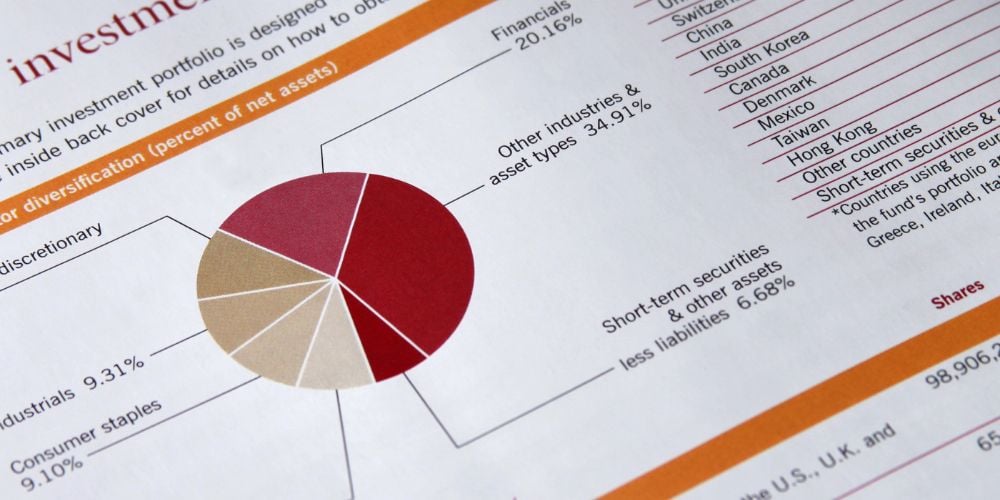

Portfolio drift occurs when the actual allocation of assets within your portfolio deviates from your initial target allocation due to differing returns across asset classes.

For example, if equities in your portfolio perform strongly while bonds lag, the percentage of equities in your portfolio will increase, altering your risk profile and potentially exposing you to greater volatility than intended.

This drift can inadvertently shift your portfolio from a balanced approach to a more aggressive or conservative stance than you had planned for, depending on market movements.

The Rebalancing Process

The process of rebalancing involves selling off investments from over-weighted asset categories and using the proceeds to buy investments in under-weighted asset categories.

This strategic adjustment ensures your portfolio remains aligned with your investment goals, risk tolerance, and financial situation.

Timing can vary by investor; some may choose to rebalance at regular intervals, such as annually or semi-annually, while others may opt to rebalance when their portfolio drift exceeds a specific threshold, such as 5% from target allocations.

Benefits of Regular Rebalancing

Regular rebalancing has several key benefits. It enforces a disciplined approach to buying low and selling high, which can lead to better long-term investment performance.

Rebalancing also ensures that your investment portfolio remains well-aligned with your risk tolerance and investment goals, helping you stay on track towards achieving your financial objectives despite market fluctuations.

This strategic process helps mitigate risk and can contribute to the overall health and performance of your investment portfolio.

The Significance of Portfolio Rebalancing

Portfolio rebalancing is crucial for several reasons. Primarily, it helps maintain an investment strategy aligned with one’s risk tolerance.

As investments grow or shrink, the portfolio might become weighted too heavily in one area, increasing risk.

By rebalancing, you sell off assets that have grown disproportionately and buy more of those that have decreased, potentially capitalizing on the ‘buy low, sell high’ principle.

Methods of Portfolio Rebalancing

There are typically two main methods for rebalancing—periodic and threshold rebalancing. Periodic rebalancing involves adjusting your portfolio at regular intervals, such as annually, regardless of market conditions.

This method is straightforward and discourages emotional decision-making based on market fluctuations. Threshold rebalancing, however, is more dynamic.

It initiates rebalancing activities once an asset class deviates from its target allocation by a predefined percentage.

This method ensures that the portfolio stays closer to the desired allocation, providing more consistent risk management.

Steps to Rebalance Your Portfolio

Rebalancing a portfolio begins with understanding your ideal asset allocation, reflecting your risk tolerance, investment goals, and time horizon.

Assess your current portfolio to pinpoint deviations from your target allocation. Next, adjust your investments by buying or selling assets to approach the desired allocation.

During this stage, consider transaction costs and potential tax implications, which could affect the net benefit of rebalancing.

Common Mistakes to Avoid in Portfolio Rebalancing

A frequent mistake in rebalancing is overdoing it—rebalancing too often or making minor tweaks that may not warrant the incurred transaction costs or taxes.

It’s also important to rebalance based on strategy rather than emotional reactions to market highs and lows, which can lead to poor investment decisions.

Tools and Resources for Rebalancing

A variety of tools are available to help with portfolio rebalancing. Many investment platforms offer built-in rebalancing features that automatically adjust your portfolio at set intervals or when allocations reach certain thresholds.

Alternatively, consulting with financial advisors can provide tailored advice and strategic insight into when and how to rebalance effectively.

Frequently Asked Questions

What is portfolio rebalancing?

Portfolio rebalancing is adjusting your investment mix to maintain desired asset allocation and risk levels, typically by buying or selling assets to match your original investment strategy.

How often should I rebalance my portfolio?

It’s commonly recommended to rebalance annually or semi-annually, or when your asset allocation deviates significantly from your target, typically by 5% or more.

What are the benefits of portfolio rebalancing?

Rebalancing helps manage risk, maintain investment diversity, and could potentially capitalize on buying low and selling high.

Can rebalancing help during market volatility?

Yes, rebalancing can help you stick to your investment strategy and avoid emotional decisions during market ups and downs.

Are there any costs to rebalance my portfolio?

Yes, transaction fees, taxes, and potential costs associated with buying and selling investments should be considered when rebalancing.

Conclusion

Portfolio rebalancing is a fundamental investing strategy geared toward maintaining an appropriate risk level while adhering to your financial goals.

By understanding the nuances of when and how to rebalance, you can better navigate the complexities of investment management and potentially improve your financial outcomes.

Tags:

Tags: