The latest presentation from Altimetry, Joel Litman, and Rob Spivey is building up tremendous buzz online. Does it really live up to the hype, though? Read my Hidden Alpha review to find out.

What is Hidden Alpha?

Hidden Alpha is a monthly newsletter and investment research service from Joel Litman and published by Altimetry.

Joel has extensive experience as a forensic accountant, and he uses his skills to identify overlooked opportunities and market trends that could be on the path to breakout growth.

The service aims to pinpoint high-potential large-cap stocks currently flying under the mainstream market’s radar and bring them to its readers.

Members receive access to a wide spread of features and benefits, including regular research updates and stock recommendations.

>> Sign up NOW and SAVE 84% <<

What Is Alpha?

Alpha is a term that describes the margin of difference between an investment’s performance and that of the overall market.

This metric basically quantifies how much a particular investment is outperforming the market as a whole. Typically, achieving alpha returns is the primary objective when investing.

Hidden Alpha gets its name from Joel and Rob’s ability to spot alpha opportunities that the market is overlooking using sophisticated forensic accounting analysis.

Who Is Joel Litman?

Joel Litman is a talented analyst and chief investment strategist for Hidden Alpha.

Many know him for his extensive expertise in forensic accounting. This has earned him widespread respect on and off The Street.

In addition to his work with Hidden Alpha, Joel serves as the President and CEO of Valens Research. And he also sits on the board of directors at COL Financial Group, an Asian brokerage firm.

Additionally, Joel’s a certified public accountant (CPA) with an impressive set of career and academic credentials.

He earned a BS in Accounting from DePaul University and an MBA from Northwestern’s Kellogg Graduate School of Management.

Not only that, but he’s even guest lectured at Harvard Business School!

Joel’s also a member of the Association of Certified Fraud Examiners, a professional trade group focusing on forensic accounting.

Over the course of his career, he had stints at Credit Suisse, Diamond Tech Partners, Deloitte, American Express, and other prestigious institutions.

>> Get Joel’s current investment recommendations now! <<

Is Joel Litman Legit?

Joel Litman is as legit as they come.

His professional credentials are remarkable, and many prominent outlets have solicited him for his forensic accounting expertise.

Barron’s has quoted his work in the past, and he’s made appearances on CNBC. He was even interviewed by Forbes.

He also works as a Professor at Hult International Business School, which was named a top-ranked international MBA program by Financial Times and The Economist.

Few research services can claim to have such a prominent expert on their roster.

In short, Joel’s a respected voice on Wall Street with the experience, expertise, and skill you want to see in an analyst.

Who Is Rob Spivey?

Rob Spivey enters the picture as Alimetry’s Director of Research. His background as a chartered financial analyst really shines through here.

During his career, Spivey has held prominent positions at The Abernathy Group, Legacy Capital Management, and Credit Suisse.

The small financial “think tank” he founded has since grown to have offices all over the world.

His knowledge of how market trends unfold allows him to leverage both the buy-side and sell-side of finance to bring himself and his audience gains.

You may have seen Rob on CNBC, and he’s also been quoted in publications such as Forbes, US News & World Report, Barron’s, Bloomberg, and more.

An avid podcaster, Spivey has also presented his wisdom at higher learning institutions around the country.

What Is Altimetry?

Altimetry is a leading research publisher and the company behind Hidden Alpha.

It also offers several additional services, including Microcap Confidential, High Alpha, The Altimeter, and more.

Altimetry puts sophisticated, professional-grade research into the hands of everyday folks. And the firm’s expertise gives members valuable market insight.

Its research team specializes in financial analysis and accounting, which helps them identify hidden gems on the stock market.

Altimetry’s approach offers an additional lens to distinguish genuine opportunity from market hype.

Numbers don’t lie, and the firm’s accounting-based approach has produced opportunities for enormous gains.

Now that you know the main beats, let’s take a look at Hidden Alpha‘s latest presentation.

>> Join now for 84% off TODAY <<

Rob Spivey’s Presentation: Elon’s First 100 Days

Love him to hate him, Elon Musk has already made some indelible changes in the world.

He’s helped lead the electric vehicle movement, sent NASA astronauts safely back into space, and provided internet for millions of Ukrainians after the war started.

Honestly, that’s just scratching the surface.

Now, the billionaire has shimmied himself into a power position in the U.S. government even though he’s not even eligible for the presidency.

Rob Spivey believes Musk is about to unleash another disruption during the first part of Trump’s administration that could make his other initiatives look small.

The resulting chain reaction has the potential to create up to $200 trillion and make tons of people rich in the process.

Just what is he up to?

The “New Manhattan Project”

According to Spivey, Musk’s next venture affects the very heart of our government.

Also called the DOGE (Department of Government Efficiency) initiative, President Trump has described it as a “New Manhattan Project”.

It’s designed to change how the government works, from the tip-top all the way to the dregs.

This would be a massive downsizing unlike anything we’ve ever seen before, effectively “draining the swamp” and so much more.

The result would be upwards of a 75% reduction in the number of federal agencies currently operating, saving some $2 trillion in the process.

Such a monumental move follows the same “algorithm” Musk uses on all his businesses, and it’s clear that each of them runs surprisingly well.

He first questions every requirement before deleting any unnecessary part or process and optimizing what’s left.

The final, and arguably most important step, is filling the gaps with automation.

What is Musk’s New Normal?

Elon’s big vision is to bring artificial intelligence into every corner of our government agencies, having computers do the work faster and more efficiently than ever before.

Imagine a world where driver’s license requests, filling out forms, and snails-pace processes actually happen in a timely manner.

I’ll admit the thought of AI creeping into important areas is scary, but I have no issue with them doing away with the slog that is the DMV.

Plus, it’s not like AI is untested. Doctors, lawyers, and accountants (just to name a few) are already partnering with software to achieve outcomes more quickly than ever before.

The need for innovative technology to aid government departments could bring about hundreds of opportunities for AI companies to swoop in and deliver game-changing products.

Contracts are already going out in droves, and Spivey’s sure many more are on the way.

Of course, when new innovation comes into the picture, it opens the door for some fantastic profit opportunities for you and me.

How to Make Money in the ‘U.S. of AI’

Musk’s DOGE has been given a very tight timeline to make sweeping government changes, and there’s little doubt that AI will be central to the process.

I’ve never seen Elon rest on his laurels, so there’s a good chance he’ll move even faster than most people think.

The changes he makes will undoubtedly impact everyone in this country, so it’s important to be prepared.

To that end, I have no issue making some nice wealth in the process by grabbing shares of these AI companies before they grow.

Luckily, Rob Spivey has been watching this play out since the beginning, and he’s identified the ventures he feels will skyrocket the most.

You’ll get immediate access to each of these picks just by signing up for his new Hidden Alpha deal.

Join me as I unpack everything that comes with a membership.

Hidden Alpha Review: What Comes With the Service?

A subscription to Hidden Alpha is packed to the brim with excellent features.

Follow along for a look at each one.

One Full Year of Hidden Alpha

Hidden Alpha‘s heartbeat is the monthly newsletter led by Joel Litman and Rob Spivey.

Each month members receive a new issue along with one stock recommendation, market commentary, and much more.

The recommendations mostly focus on mid to large-cap stocks whose “ profits and earnings are hidden from Wall Street and the mainstream media.”

Joel and Rob enlist a small army to pore over documents, and then they filter findings through The Altimeter to find potential discrepancies between companies’ reported earnings and reality.

It’s a unique system that could appeal to folks searching for a unique angle of market analysis.

Special Updates

Along with the monthly newsletter, members also receive special updates that keep them in the loop about market-moving events that could affect the model portfolio’s open positions.

This also includes sell alerts that let members know when the team believes it’s time to lock in gains or exit a position to protect capital.

These updates are sent via email, so it’s surprisingly simple to stay on top of the latest happenings.

It also lets you go about your day knowing that the team has a watchful eye on the stock market.

Hidden Alpha Model Portfolio

You can find Joel and Rob’s active recommendations in the model portfolio, and you get ongoing access as part of your member benefits.

The model portfolio includes detailed information on each recommended holding, including the company’s name, ticker symbol, current recommendation, price action, and more.

You can quickly check in on the status of every stock pick with nothing more than a quick glance at this intuitive resource.

As an added benefit, the model portfolio includes each stock with an active recommendation, so you can even tap into stocks that were featured before you joined.

Access to Hidden Alpha’s Complete Archive

Hidden Alpha includes three bonus reports you’ll instantly receive upon becoming a member.

I’ll cover these in detail shortly, but Joel and Rob also commit to sending any new reports they pen in the coming year as well.

There’s no telling how many there will be or what information they’ll bring, but that still really sweetens this deal.

You also have access to dozens of past reports covering relevant topics that may leading you to more winning opportunities.

Some of the insights go beyond recommendations, covering topics like timing your investments for maximum gains and other evergreen reads.

>> Access all these features and bonuses now at 84% off! <<

Joel’s Warnings and Predictions

For an entire year, Joel shares his latest predictions and warnings about potential stock market shakeups.

He has earned a reputation for his uncanny foresight into potential market-moving events.

Some of his previous predictions include:

- Warned of the 2008 crash

- Called the bottom of the 2020 crash

- Recommended a series of stocks after the 2020 crash that provided the opportunity for triple-digit gains

With a track record like this, Joel’s latest warnings are definitely worth a close watch.

One FREE Year of The TimeTable Investor

Rob’s throwing in another monthly resource to help Hidden Alpha members stay in the know between issues of the newsletter.

This resource offers his monthly outlook on the market that’s broken down into three factors:

- Credit

- Earnings

- Valuation

It also shares strategies about asset allocation in cash and bonds, as well as additional insights.

The TimeTable Investor typically costs $199 per year, but new Hidden Alpha members can access its insights for an entire year at no extra cost.

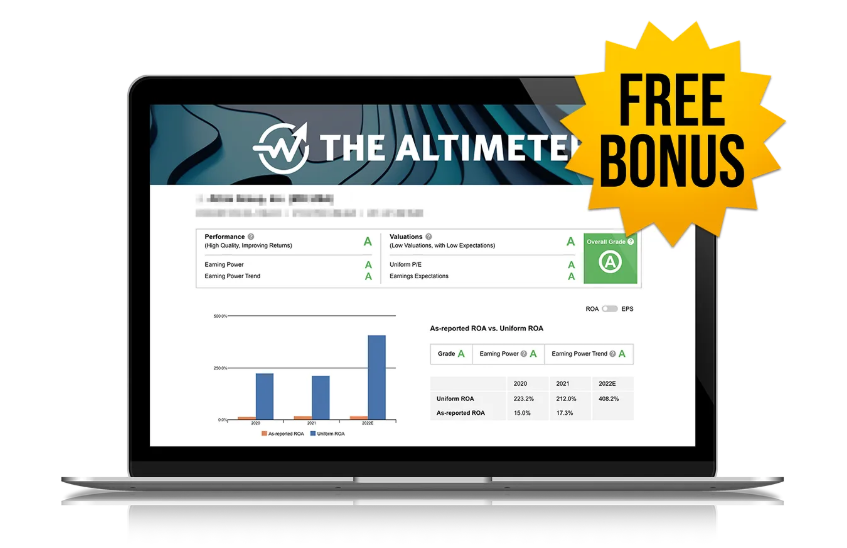

The Altimeter System

For an entire year, members have elite access to the same system that the Hidden Alpha team uses to vet their stock picks.

The Altimeter System covers 500 different stocks.

Simply type in one of the tickers supported, and it provides an estimate of a stock’s potential to surprise the market with earnings.

There’s no such thing as a stock market crystal ball. But this tool could help pinpoint opportunities worth a close look.

Altimetry Daily Authority

Included in this Hidden Alpha bundle is the Alimetry Daily Authority; a daily newsletter that hits your inbox before markets open during the week.

It’s an easily digestible snapshot of recent events, insights from our gurus, and predictions of what’s going to roll out in the coming day.

I can give it a quick read before heading off to work so I can plan accordingly, without taking really any time out of my daily routine.

Who knows, even a stock pick or two may poke out of the pages that you can invest in if you so choose.

It certainly beats scouring the headlines every morning for some news I can work with to expand my portfolio.

>> Access Joel’s latest reports and more HERE <<

Hidden Alpha New Member Bonuses

The latest deal comes with much more than access to the monthly newsletter.

Read on for a look at each feature.

Get Rich in the U.S. of A.I. (8 Companies To Buy Right Away)

This special report captures all the companies Spivey predicts will rise the most as the American government embraces AI.

He includes stocks he believes could surpass even giants like Nvidia and SuperMicro Computer this year.

You’ve got eight to choose from, and Spivey shares each name, ticker symbol, and a detailed report of why each one made the list.

In addition, he shares information on Musk’s secret project, Colossus, and how it fits perfectly into a government makeover.

I’d recommend reading this report before you do anything else, as many of these recommendations are very time-sensitive.

It’s an easy read with plenty of actionable items for anyone to take advantage of.

The #1 A.I. Stock of 2025

Joel and Rob sat down to discuss what the biggest AI stock of the government would be and unanimously came up with an answer.

Its founder was a top player at Amazon Web Services before moving on to other things, and Musk already uses it for some of Tesla’s AI needs.

The gurus ran out of room listing all its potential uses in the government sector meaning it could easily 4x your investment in record time.

After reading the report, Joel and Rob make flawless points that have me really excited about this opportunity.

As with the other stocks set to win big, you won’t want to sleep on this one for long.

> Join now to dump these “Time Bombs” before it’s TOO LATE <<

The Artificial Intelligence Ecosystem

This rare special treat is a collection of the research reports Rob and Joel put together for their institutional clients, many of whom are big names in finance.

It fits perfectly with this bundle, as many of the topics cover how the world’s top money managers are looking at AI.

Most folks would have to pay a lot of money for this type of content, making it a powerful addition to an already solid service.

There are plenty of tips and insights you can glean from a read-through that you can put directly into practice with your own investments, too.

1 Year of Access to the Altimeter Database

The Altimeter is Joel and Rob’s secret weapon, comprising a database of any stock on the S&P 500.

You’re free to type in any ticker you desire and immediately see its grade so you can decide if you’re looking at a good buy or not.

Both Joel and Rob frequently use it to vet their picks, showing just how viable it is for honing in on good investments.

I’ve seen systems like this go for thousands a month, so it’s just one more perk crammed into an already feature-rich platform.

Plus, you get unlimited access for an entire year.

30-Day 100% Satisfaction Guarantee

Under the new deal, members have 30 days to give Hidden Alpha a shot.

If you feel the service is not a good fit, simply request your money back for the full price of the subscription.

Similar services in this newsletter’s price range also offer 30-day refunds. So I usually wouldn’t give extra brownie points for following the norm.

That said, I do appreciate that Hidden Alpha offers unrestricted access to the Altimeter System during the satisfaction guarantee period.

It’s a unique tool for vetting stocks that tacks on a lot of value to the overall package.

> Sign up for latest Hidden Alpha Research under Joel’s guarantee <<

Pros and Cons

Hidden Alpha is a solid service with a lot going for it. But there are a few rough edges to keep in mind.

Pros

- One year of hidden Alpha newsletter

- Model portfolio and frequent updates

- Alimetry Daily Authority

- Full archive of content

- 3 bonus reports

- Free access to the Altimeter Database

- Insights and recommendations from two gurus

- 84% discount on the first year

- 30-day money-back guarantee

Cons

- No community forums

- Discount only applies to the first year

Is Hidden Alpha Right for Me?

Hidden Alpha could be well-suited for a wide range of folks in search of top-tier analysis and insights.

It digs into both mid to large-cap stock recommendations. So the research covers a good blend of companies that could have lower volatility and others that might have more room to grow.

While Joel and Rob do not typically focus on smaller cap companies, his latest research bundle does offer special reports about microcaps. So that camp is accounted for to some degree.

The newsletter also comes with one year of access to the team’s prized Altimetry System. This powerful tool could help members spot their own opportunities outside of the team’s picks.

However, monthly picks are not a good fit for day trading.

Most newsletters of its ilk are not particularly suited for this type of trading, so I wouldn’t count it as a point against Hidden Alpha.

How Much Does Hidden Alpha Cost?

Hidden Alpha normally costs $499 for a one-year subscription. But the team is currently sweetening the deal with a 84% discount.

This means you can sign up for the introductory rate of just $79 for the first year.

Better yet, it includes everything mentioned in this review.

There is one caveat, however. This is an introductory rate, meaning that the subscription costs $199 upon renewal.

It would be ideal for the discount to carry over. Still, I appreciate how much is included under the latest package.

Many services I’ve seen offer less for more.

Is Hidden Alpha Worth It?

Hidden Alpha is a great newsletter that’s worth the sticker price.

The latest deal might just be the team’s most impressive one yet.

It’s packed to the brim with standout features, including monthly stock picks, updates and alerts, as well as exclusive bonus reports.

Plus, it’s all covered by the team’s money-back guarantee and comes with a 84% discount on the first year.

Top it all off with one-year access to the Altimeter Database, and this is a serious deal.

All in all, there’s a lot to like with the latest deal. And I recommend checking out Hidden Alpha if you’re interested in quality research backed by forensic analysis.

Tags:

Tags: