Louis Navellier and Dr. David Eifrig’s (AKA Doc) “The Great Unraveling” presentation is turning heads in investing circles, and I want to see if it lives up to the hype. Follow along for a look at their new presentation as well as Stansberry Investment Advisory.

What Is “The Great Unraveling”?

David Eifrig and Louis Navellier’s “The Great Unraveling” is an economic event that the team believes could unravel the economy.

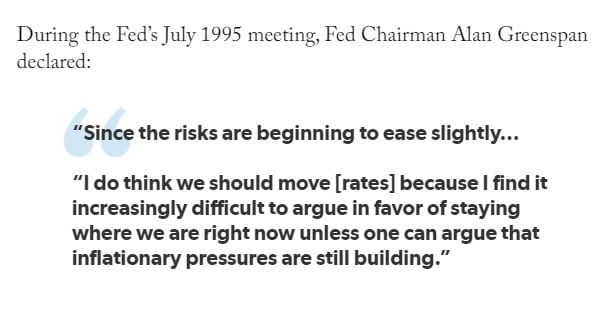

While they have their fair share of criticisms for the current administration for the state of the market, they lay most of the blame on the Federal Reserve during the mid-90s.

During the presentation, David and Louis wind back the clock and look at a “series of reckless policy decisions” the Fed made during the Clinton administration:

“And, as we’ve been hinting at, it all has to do with the Fed!

In the mid-1990s, the Fed made a major shift in the way it operates.

And it’s this shift in policy that’s behind the massive wealth gap we see today.”

— “The Great Unraveling” Presentation

The duo says that the shift 30 years in the making could spell even more trouble for the markets in the near future.

In response, Stansberry Investment Advisory has developed a blueprint to navigate the possible fallout that might have been set in motion decades ago.

I’ll dig into the presentation and latest research package, so stay tuned.

>>Get the team’s LATEST research on “The Great Unraveling” <<

Winding Back the Clock

As mentioned, David and Louis believe the Fed laid out a string of dominoes that could point to disaster in the current day.

So where do they think the Fed went wrong?

Low interest rates and “massive amounts of money printing.”

This all started back around 1994 to 1995, according to the team.

Jobs were growing and unemployment was shrinking. But despite a thriving economy and booming job market, the Fed insisted on cutting rates.

Typically, rates are cut when an economic cycle weakens as a means to reduce financing costs and encourage borrowing.

In the example mentioned above, the economy didn’t need a jolt.

David says further interest rate decreases began affecting trading patterns and the market as a whole. Folks began moving away from safer investments — like bonds and other fixed-income securities — to pursue higher gains.

“In other words, if you’re used to making 10% yields on bonds – considered “safe” investments, because they’re backed by hundreds of pages of legal documents – and then suddenly your yield gets cut in half… you have to find those returns on your money elsewhere.

So, you start to look at slightly riskier investments, which could give you a higher return.”

— Dr. David Eifrig

He also points out that, around this time, the internet was taking off.

During this period, internet-based stocks heated up and positioned people to see some surprising quick gains.

This speculative investing strategy dominated much of the markets. And eventually, internet companies were experiencing absurd profits from initial public offers (IPOs).

In January 1999, first-day gains for new companies going public were in the ballpark of 271%.

Many of them didn’t even produce revenue.

While it might not have been obvious to folks at the time, in hindsight, this was unsustainable.

The dot-com bubble eventually popped. And this led to a seismic slide in the markets.

While the market eventually bounced back, the team says the root cause has continued to build up more bubbles, including the real estate and “Everything Bubble.”

Could Inflation Unravel the Economy?

Pound for pound, the value of the US dollar is steadily sinking as inflation continues to impact the economy.

The writing has been on the wall for years, but the team says that the pandemic was the tipping point:

“But the Fed made things EVEN WORSE during the Covid crisis.

Because would you believe… that 80% of all the dollars that exist today… 80 PERCENT! – were created out of thin air since Covid first became a household term in 2020?”

With inflation running rampant and the economy waning, Louis and David warn that all the Fed’s usual tricks, printing, stimulus, and interest rate cuts might be off the table.

Louis goes as far as saying that the Fed might be trapped with no way out but to continue to raise interest rates.

And they say that the potential consequences could be severe.

>> Join Stansberry’s Investment Advisory TODAY <<

The Potential Blowback of an Unraveling Economy

At this point in the presentation, David and Louis explore some of the societal shifts that could ensue during “The Great Unraveling.”

Their first concern is the impact of ratcheting up interest rates further on businesses.

They say that higher interest rates could put a wide swath of companies out of business, which might result in a quick climb in unemployment.

And a sharp decline in employment might have catastrophic effects on people’s lives, according to the team:

“Millions could default on their mortgages. Cars could be repossessed in even greater numbers. And so much more.

The U.S. would also be stuck… and have to decide whether to drastically cut spending on things like Social Security and Medicare – or default on its debt.”

Louis and David cap off this thought with a warning that these events could culminate into intense social and political chaos.

It’s clear that they don’t have high hopes for the economy, which is why they’ve teamed up with Stansberry’s Investment Advisory to build a blueprint for navigating the markets in times of crisis.

And the whole package is available under the latest deal.

>> Get the team’s LATEST research on “The Great Unraveling” <<

What Comes with Stansberry’s Investment Advisory?

The team has put together an extensive collection of resources.

Let’s kick things off with a look at the newsletter.

12 Months of the Stansberry’s Investment Advisory Newsletter

This monthly newsletter offers members a direct line to the team’s latest market research and analysis.

Alan Gula is the service’s lead analyst, and Andrew McGuirk is the contributing analyst.

Each issue is delivered on the first Friday of every month and offers one recommendation.

The recommendations currently fall on the more conservative end of the safety spectrum.

On occasion, the newsletter could also recommend short positions. However, this is not the team’s core focus.

Additionally, the newsletter provides access to Stansberry Investment Advisory’s model portfolio. It has the potential to hold around 20 to 30 recommendations at a time. Though, this number could vary.

>> Access these features and more for 75% OFF <<

New Member Bonuses

Under the latest deal, new members can access a wide range of bonus perks.

Read on for an overview of every feature.

A membership also includes Louis Navellier’s Growth Investor newsletter for an entire year.

Each issue provides its own set of recommendations and market analysis. This means Stansberry’s Investment Advisory members are getting two premium research services for the price of one.

Louis and the Growth Investor team target high-growth and dividend stock opportunities.

So it offers a good blend of analysis that could appeal to a wider audience.

The Great Unraveling Playbook

The Great Unraveling Playbook offers members a step-by-step plan for staying on top during times of crisis.

And this report details everything members need to know about “The Great Unraveling.” Some topics touched on include how David and Louis believe it could unfold, and steps that have the potential to protect and grow wealth.

Here are a few of the main beats:

- How “The Great Unraveling” could spur a new political party

- Opportunities to preserve cash “while others are decimated by the dollar’s fall”

- Strategies to potentially multiply the value of retirement savings

These are just some of the tips and tricks you can pick up by reading this bonus report.

There are plenty more.

The Great Unraveling Perfect Portfolio

During their research, the Stansberry’s Investment Advisory team discovered a portfolio that has the potential to outperform the S&P 500 and a traditional 60/40 portfolio.

In fact, they say that it has performed around five times better than the S&P in the long term.

The report gives members a rundown on what types of assets to hold. It also offers a step-by-step guide on where to find them.

The 100% Stock Secret

This resource teaches members proven strategies that could help maximize gains.

Because David anticipates that “The Great Unraveling” has the potential to slow down the stock market, he recommends folks check it out before making their next investment.

The reports are all solid and can be read in any order. That said, if you’re looking to follow the team’s strategy to the letter, you might want to move this one up your list.

The Two Most Valuable Assets to Own in a Time of Crisis

David Eifrig discovered two assets that he believes could grow in value even in the face of “The Great Unraveling.”

The identities of these two assets are only available to members.

But in the presentation, David also provides some insights into why he holds both in such high regard.

According to him, the first asset “is up over 2,010% over the long term since 1992, without a single down year.”

And the second offers “a powerful way to profit during a currency crisis – yet it has absolutely nothing to do with gold or even cryptos.”

99 Stocks Every American Should Sell Right Now

Navigating the stock market is about more than simply picking out stocks with potential. Learning the tell-tale signs that a company might take a dive is equally important.

That’s why the team has put together this comprehensive report.

It reveals 99 securities that they believe might not make it out of “The Great Unraveling” unscathed.

Given the sheer volume of stocks on the list, it’s possible that many folks own at least one or two of the stocks listed.

30-Day Money-Back Guarantee

Under the latest deal, a membership to Stansberry’s Investment Advisory comes with a solid 30-day money-back guarantee.

From my experience, this matches up with many alternatives. So it’s nice to see the newsletter is holding the line on this front.

The typical holding period is 1 year or longer, so this window might not provide enough time to see a position to its conclusion.

Still, it does provide a fair amount of time to check in on the quality of analysis and the extra special reports — not to mention the Growth Investor newsletter.

>> Join under the team’s guarantee <<

Pros and Cons

Stansberry’s Investment Advisory has plenty of pros, but there are a few cons to consider.

Pros

- 75% discount on the first year

- 30-day money-back guarantee

- Conservative safety rating

- Bonus subscription to Growth Investor

Cons

- No community forums or social component

- Discount applies to the first year only

How Much Does It Cost?

Stansberry’s Investment Advisory usually costs $199 for an annual subscription.

But right now, new members have access to an introductory deal that knocks the price tag down to a much more affordable $49.

This adds up to a 75% discount on the sticker price.

And there’s no trade-off for opting for the discount. Members receive the full “The Great Unraveling” package.

Given everything on offer, the team has put together a great bundle.

It’s important to note, however, that this is an introductory deal. When the newsletter renews, the next subscription costs $199.

While it would be ideal to have the pricing carry over, I do appreciate that the introductory deal has one set cost. Many other services I’ve seen have separate tiers that require purchasing an upgrade to get this much upfront value.

Final Verdict

Louis and David Eifrig’s “The Great Unraveling” presentation lays out a compelling case for exercising caution in today’s market.

We’ll have to wait and see if events unfold as they anticipate they could. That said, I think they make some solid points.

I also appreciate that they dig into three decades of historical analysis instead of playing politics with the last two admins.

Regarding the research, Stansberry’s Investment Advisory’s latest deal has plenty of high notes.

It includes a 75% discount on the first year, a 30-day money-back guarantee, as well as one-year access to Louis Navellier’s Growth Investor.

I’ve checked out quite a few of these research packages in the past. And in my experience, it’s a rare sight to see two premium newsletters packed into one.

Plus, the deal also comes with five bonus reports that include additional recommendations and warnings.

All in all, it’s an impressive package with a lot to offer.

I recommend checking out Stansberry’s Investment Advisory if you’re looking for a quality research service with a conservative safety rating.

>> Claim your 75% DISCOUNT to Stansberry’s Investment Advisory <<

Tags:

Tags: