As the cryptocurrency market continues to expand at a breakneck pace, the allure of altcoins has captivated the interest of traders and investors alike. These alternative cryptocurrencies, which go beyond the well-known Bitcoin, present a plethora of opportunities for significant returns. However, the volatility and sheer number of options can make the task of picking the right altcoin akin to finding a needle in a haystack.

In this dynamic environment, thorough research and astute analysis are paramount. Digging up promising altcoins requires a blend of market savvy, technical knowledge, and strategic thinking. This guide will equip you with advanced techniques to research the altcoin market, ensuring that your investment choices are backed by solid research and fundamental analysis.

Decoding Altcoin Potential: Market Research Techniques

Finding promising altcoins requires a meticulous approach grounded in market research and analysis. Investors must research a sea of information to pinpoint which altcoins hold genuine potential. Here are some advanced techniques to help you decode the potential of altcoins.

Trends and sentiment

Successful altcoin investments begin with a keen understanding of market trends and sentiment. This involves monitoring social media platforms, forums, and news outlets to gauge public opinion and the general mood surrounding specific altcoins. Tools like sentiment analysis algorithms can provide valuable insights by scanning large volumes of data to identify prevailing attitudes towards different cryptocurrencies.

Researching the project’s mission and looking at the team

A critical factor in assessing an altcoin’s potential is understanding the project’s mission and the team behind it. Scrutinize the project’s whitepaper to grasp its goals, technological innovations, and unique value propositions. A solid, visionary mission can often indicate a project’s long-term viability. Equally important is the team driving the project. Look for a team with a proven track record, relevant expertise, and a transparent approach. The credibility and competence of the developers and advisors can significantly influence the project’s success and, consequently, the altcoin’s value.

Analyzing the altcoin’s market cap, volume, and liquidity

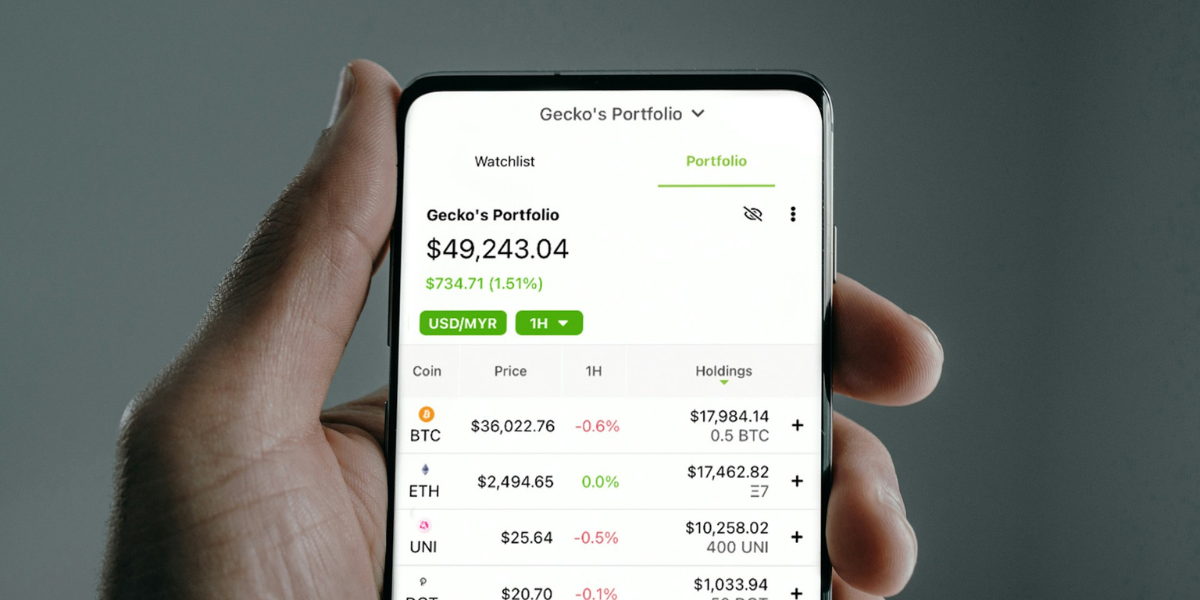

Numbers tell a compelling story in the world of finance, and cryptocurrencies are no exception. Evaluating an altcoin’s market cap, trading volume, and liquidity provides a quantitative measure of its market standing and potential growth. A high market cap often signifies a well-established altcoin with considerable market confidence. However, it’s essential to consider this in conjunction with trading volume and liquidity. High trading volumes indicate robust investor interest and easier trade execution, while liquidity reflects the ability to buy or sell the altcoin without causing significant price fluctuations. Together, these metrics offer a comprehensive picture of an altcoin’s health and potential for appreciation.

Boost Your Portfolio: Maximizing Profits with Sign-Up Bonuses

Leveraging sign-up bonuses and promotions offered by exchanges can be a game-changer for new investors. These incentives reduce initial financial risks and provide an opportunity to explore and invest in promising altcoins without significant upfront costs.

- Free Capital: Sign-up bonuses come in various forms, such as free tokens, cashback on trades, or deposit matches. For new investors, these bonuses offer a unique chance to diversify and experiment with different altcoins.

- Risk Mitigation: For example, a $50 sign-up bonus can be used to invest in various altcoins, allowing you to test the waters without risking your own funds. Over time, gains from these initial investments can significantly boost your portfolio.

- Volatility Cushion: These bonuses also offer a cushion against market volatility. By using bonus funds, you can afford to take calculated risks on lesser-known altcoins that have potential for high returns. This strategy improves your market knowledge and improves your chances of finding a hidden gem.

To get started and make the most of these opportunities, check out the best crypto sign-up bonuses and promotions on this page where they’ve reviewed platform rewards for both US traders and global investors. These offers can provide the initial boost needed to get started with a smaller account size.

Advanced Fundamental Analysis: Digging Deeper into Altcoin Metrics

When it comes to picking a winner, having a surface-level understanding is not enough. Finding promising altcoins requires advanced fundamental analysis, focusing on technology, partnerships, and thorough document reviews.

Looking at the technology and innovation

- Blockchain Protocol: Examine the scalability, security, and sustainability.

- Unique Features: Look for innovations like smart contracts, interoperability, and better privacy.

- Consensus Mechanism: Consider the type of system used, such as proof-of-stake or proof-of-work.

Partnerships and community support

- Strategic Alliances: Check for partnerships with established companies and influential figures.

- Community Engagement: Evaluate the activity and sentiment on platforms like Reddit and Twitter.

- Real-World Applications: Identify practical uses in DeFi, supply chain management, and digital identity verification.

Reviewing the whitepaper and development roadmap

- Whitepaper Details: Look for clear explanations of the problem, solution, and technical implementation.

- Economic Model: Understand token distribution, incentives, and inflation/deflation mechanisms.

- Development Roadmap: Check for a realistic timeline and past performance in meeting milestones.

By getting into these aspects, investors can uncover altcoins with true potential that will make it past the 5th page on Coinmarketcap. Remember, the next big crypto success story might be just a deep dive away.

Protecting your investments in altcoins

Here are key tactics to mitigate risks and safeguard your investments.

Strategies for reducing risks

Thorough research is essential. Understand the fundamentals of each altcoin, including its technology and development team. Use stop-loss orders to automatically sell assets at a predetermined price, preventing further losses. Hedge your portfolio by allocating a portion to more stable assets.

Diversify if you can

Diversification is crucial. Spread your investments across various altcoins to reduce the impact of any single asset’s poor performance. This not only mitigates risk but also increases the potential for growth. Balance your crypto investments with traditional assets to further stabilize your portfolio, as traditional markets often exhibit different risk dynamics.

Advanced techniques

- Staking and Yield Farming: Participate in staking or yield farming to earn rewards and interest on your altcoins, providing a passive income stream that can offset potential losses.

- Utilize Stablecoins: Keep a portion of your portfolio in stablecoins to act as a buffer against volatility. Stablecoins can provide liquidity and stability in uncertain markets.

- Cold Storage: Use cold storage solutions for long-term holdings to protect against hacking and cyber threats, ensuring the safety of your assets.

By implementing these risk management strategies, you can protect your altcoin investments and stay calm while the other sh*t coins go bust.

Final Words

It’s true that the stories of 10x, 20x, and even 50x altcoin winners make anyone want to become an altcoin pro, but finding the winners amongst all the different cryptocurrencies requires a strategic approach. By combining thorough market research, advanced fundamental analysis, and robust risk management techniques, you can improve your chances of picking altcoins with genuine potential.

Ready to uncover the next big altcoin before everyone else? Head over to Coinmarketcap and explore the newest projects that are making waves. Dive into the data, analyze their potential, and leverage sign-up bonuses to kickstart your investment journey. The next crypto success story could be just a click away, waiting for investors like you to discover it. Happy trading!

Tags:

Tags: