You can use CoinStats’ free crypto profit calculator to calculate your crypto trades’ profit or losses, hypothetical crypto trade results over possible future price changes, and back test various crypto strategies, trading theses, and investment ideas.

In a quick read, this crypto profit calculator tutorial tells you how to calculate crypto trading profit and loss of real and hypothetical crypto trades for whatever purpose you need:

- Appraising and evaluating the prospects of an entry, exit, or crypto trade today or soon based on possible future crypto price movements.

- Developing active crypto portfolio management strategies by backtesting them against previous historical crypto prices.

- Informing a budgeting decision to dollar cost average crypto investments at regular intervals by backtesting your crypto investment budgeting plan.

- See how much you would have earned or lost in hypothetical, historical backtesting scenarios of cryptocurrency investments and trades.

Backtest Crypto Trading Theses and Strategies

One simple way to start off using a crypto profit calculator is you may want to see how much you would have earned or lost by today on an investment of a certain amount in a certain cryptocurrency at a certain date in the past based on the historical market prices of that crypto.

A frequent disclaimer of investing and financial services communications is that past performance is not an indicator of future performance. The world is always changing.

That is true. But here are some considerations for investors that prove the opposite can be true as well. Past performance can be an indicator of future performance because of:

- Accumulating experience, network connections, and capital investment

- Compounding returns on improvements at economies of scale

- Accumulating debt, wasted opportunities, and capital divestment

- Compounding losses on inefficiencies at economies of scale

So back testing crypto investment ideas over historical prices using a crypto profit calculator is one way to look for historical patterns that align with trades.

For example, you may be curious to see if different investing strategies and operations like diversifying, active management, or dollar cost averaging to save some money in crypto really cancels out short-term price volatility or even wide swings in long-term crypto price cyclicality.

Here are three quick how-to guides for using different online cryptocurrency resources together with the CoinStats crypto profit calculator to backtest and forecast crypto trading profit and loss possibilities.

Dollar Cost Averaging With the Help of a Crypto Profit Calculator

Dollar Cost Averaging is a method of investing in a cryptocurrency or basket of cryptos at a steady pace with a certain fixed amount to purchase at regular intervals.

Writing about this gradual entry strategy that averages out some of the volatility of stock prices, an author at The Motley Fool, recently stated:

“When you dollar-cost average, you break your investment into pieces and put a portion of your money into the stock market at equal time intervals instead of putting all of it into the market at once.”

The reasons a crypto trader might dollar cost average into a position are:

“Buying stocks can be stressful. Buy too soon and you risk regret if the price drops. But if you wait and the price goes up, you feel like you missed out on a deal. Dollar-cost averaging is a strategy that tries to minimize those risks by building your position over time. When you dollar-cost average, you invest equal dollar amounts in a security at regular intervals. Rather than attempting to time the market, you buy in at a range of different prices.”

Here’s one way to backtest a dollar cost averaging plan using the crypto profit calculator.

Say you wanted to see how using dollar cost averaging would have averaged out the volatility of Ether’s price (ETH) over the past bear market and preceding bull run.

You might start by deciding on saving away $25/month that you wouldn’t miss either way by buying ETH and holding it in your crypto wallet through any movement of the market.

You may read about the market and see what’s happening, but you don’t have to sweat it, you’re not changing anything about your plan based on anything you read.

So you use a crypto profit calculator and some historical Ether prices just to see what this entry strategy would have done with your money through some recent crypto price volatility and cyclicality.

Backtest ETH Entry Strategy Using Crypto Profit Calculator

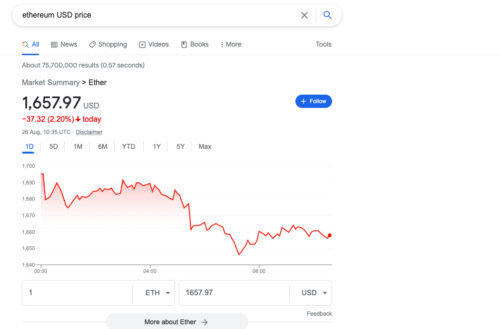

You start by visiting Google Finance and searching for ETH and looking at the historical price chart. What if I had accumulated $25 worth of Ether (ETH) on the first of each month since June 25, 2021 you ask yourself. That looks from the chart like the lowest price it’s been since summer 2021 Ether ATH prices, or just recently.

So you go to Google and type in “Ethereum USD price history and historical data yahoo finance” and click “I’m feeling lucky.” You set the time period on the ETH price history table from June 25, 2021 to the present date and click apply.

Then you go and get the price of ETH on the first day of July 2021 and find it was (I’m just going to use the leftmost column) $2274 USD. You type $2274 into the crypto profit calculator’s “Buy Price” field. You type $25 into the investment field. You type today’s ETH price in sell price.

You do this for the first of each month and make a list in a doc or spreadsheet of the gain or loss for each purchase of ETH if you were to sell it at the prevailing market price today.

Then you sum up the gains and losses to see how you did overall. Average them if you’re looking at percentages gain and loss.

In this case you could then compare against how you would have done if you had for example purchased $250 worth of ETH on a certain date, or if you had purchased a different cryptocurrency that way or with dollar cost averaging.

Final Words: How to Calculate Crypto Trading Profit and Loss

The CoinStats profit calculator has a myriad of applications, especially if you use it in combination with other tools. Go ahead and follow the above-mentioned techniques to backtest crypto testing strategies, dollar cost averaging, and backtesting ETH entry strategy.

You’ll find out that insights gained via the crypto profit can be immensely helpful to your crypto decision-making process!

Tags:

Tags: