Marc Lichtenfeld has a breakthrough new strategy with the potential to generate steady income from oil and gas plays. In my Oxford Income Letter review, I’ll take a close look at his latest presentation and tell you if his oil and gas income play is worth your time.

What Is Oxford Income Letter?

Oxford Income Letter is an investment newsletter that pays particular attention to income-producing opportunities.

It’s published by the widely popular research company The Oxford Club.

Marc Lichtenfeld launched the newsletter over nine years ago. So the service has hung around for much longer than many of its contemporaries.

Some features of the Oxford Income Letter include stock picks, bonus reports, regular alerts, and model portfolios.

There are plenty of standout perks with the service, but the two biggest draws are its distinct focus on dividend payers and multiple model portfolios.

Many similar services only offer one trading portfolio. But this newsletter caters to four different investment philosophies.

>> Sign up HERE for 80% off <<

What’s the Investing Style of The Oxford Income Letter?

As one of the top services from the Oxford Club, the Oxford Income Letter strives to lay the groundwork for your golden years through smart investments.

It uses a unique 10-11-12 system developed by Lichtenfeld himself that’s designed to build income over time.

The goal is to generate 11% yields in 10 years or 12% average annual returns in 10 years with dividends reinvested, lending way to money you can count on in any type of market.

Imagine the peace of entering retirement with a steady stream of income at your disposal should the Oxford Income Letter play out as advertised.

Who is Marc Lichtenfeld?

Marc Lichtenfeld is a great analyst with a keen eye for dividend stocks. He’s the chief income strategist for The Oxford Club.

He kicked off his career in finance at Carlin Equities. Later, he worked at Avalon Research Group as a senior analyst.

Marc eventually moved to the research space to share the same tips he learned with folks on Main Street.

Many know him for his proprietary 10-11-12 system, the same strategy used to scout out investment ideas for Oxford Letter.

While he might be best known for sharing his insights at Oxford Club, he also has made appearances on CNBC, Fox Business, and Yahoo Finance.

Next, my Marc Lichtenfeld review continues with a closer look at some of the guru’s accolades.

Is Marc Lichtenfeld Legit?

Marc Lichtenfeld is legit and has an extensive career in the stock market research space.

The Oxford Club’s Chief Income Strategist is a seasoned analyst, making appearances on Fox Business, CNBC, and Bloomberg Radio.

His writings have also made it into Yahoo Finance, The Wall Street Journal, Investor’s Business Daily, Marketwatch, and Forbes.

Both of Marc’s books displayed above were bestsellers on Amazon and won Book of the Year awards.

If that wasn’t enough, his daily column Wealthy Retirement has over 200,000 readers.

>> Access Marc Lichtenfeld’s stock picks today <<

Marc Lichtenfeld’s #1 Oil and Gas Income Play for 2025

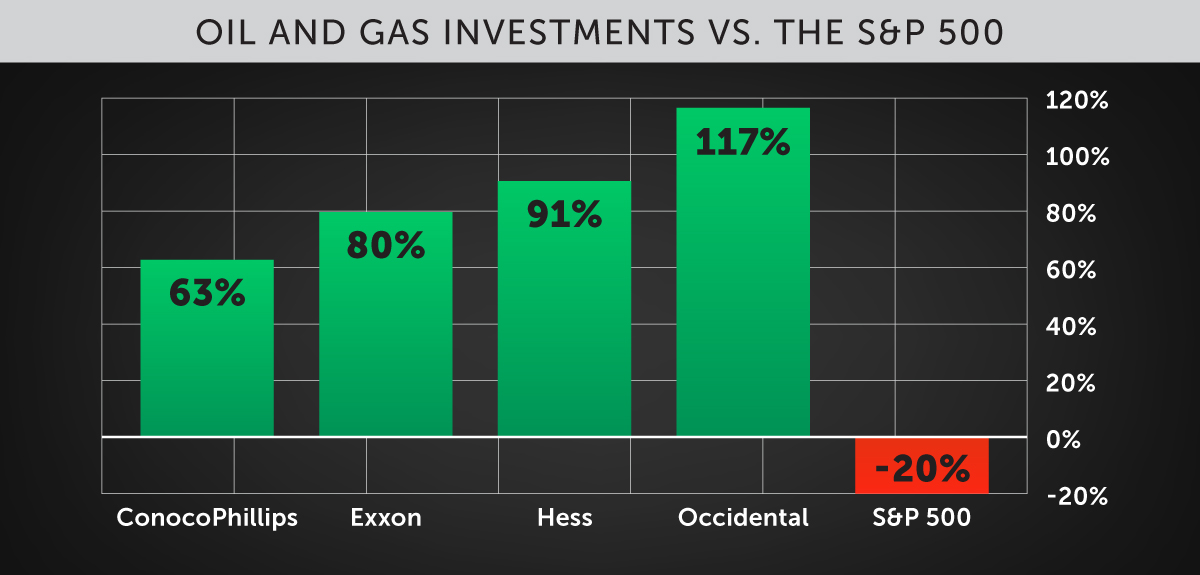

Marc is no stranger to finding sources of income. He says the next big break is coming in the form of an energy bull market.

Most of the world will casually let this opportunity slip by, but Lichtenfeld warns otherwise. There’s a lot of money to be made here, and getting your hands on it is surprisingly easy with the right stocks.

Once you get your foot in the door, this kind of investment keeps paying for itself over time. What exactly has Marc Lichtenfeld detected about the future of energy?

Marc’s The Bull Case for Energy Stocks

Both the United States and China are gobbling up all the oil they can. China’s waking up from a long COVID-related slumber and is ready to get back to work.

Already the world’s largest oil importer, China expects to increase past numbers by upwards of 20%. We could be seeing record levels of barrels flying off shelves in the coming weeks.

The United States also has a massive thirst for oil right now. We’ve eaten up most of our current reserve, and the current administration is looking outside our borders for additional supply.

The kicker is that global supply is on the decline. Lower production will likely lead to even higher prices.

This could have negative ramifications for our economy. However, Marc Lichtenfeld believes we’re looking at an incredible investment opportunity. He even thinks this oil bull market will stick around for at least six years.

Collecting Monthly Income with Oil and Gas Royalties

An upcoming oil and gas bull market may bring about some winners in the stock markets. Lichtenfeld feels you’d be missing out by going this route.

Marc’s found what he feels is a far superior AND safer way to earn some dough from the approaching boom. Even last year, this hidden gem returned 149% when everything else was down.

Anyone can use this investment, and there’s no accreditation or special account needed to get involved. You don’t even need much money – getting in can cost as little as $25.

The ultimate oil and gas income opportunity comes in the form of royalties. Through this method, you get all the perks of owning an oil or gas field without the headaches of hiring workers, buying machinery, and the like.

You pay once upfront to get your piece of the pie and then sit back and let the streams of income flow. Sure, it’s not a completely safe bet. That said, you don’t have to take on all the risks these big oil companies do.

As Marc indicates, one such royalty stream blew Exxon-Mobil away over the same time interval. Even better, you can get a royalty check from your stocks every single month.

Mark’s Top Oil and Gas Stock

Marc’s golden boy stock is one of these royalty streams from the most productive oil reserve on the planet.

Unlike other basins that are much further along in their lifespans, the Permian basin is just kicking production into high gear. It’s already outproducing all the other major basins in the US combined.

Only 37% of its wells are tapped, and over 20% of the world’s rigs are at work within its borders. That’s more than entire countries like Saudi Arabia.

This royalty stream doesn’t deal with tons of capital, heavy machinery, or any sort of storage. It’s simply a way to collect a passive income on the oil and gas being pulled out of the basin.

There’s no debt, over $11 million in cash, and it regularly pays 95% of its income back to shareholders. Revenue growth is up 717%, and the company earned $42 million in 2022.

Buying in will only set you back $25, so long as you know the name of the stock. To do that, you’ll need to get your hands on this portfolio package.

Oxford Income Letter Review: What’s Included With The Deal?

The latest Oxford Income Letter deal is packed to the brim with standout features. Drawing from our experience, we’ve broken each down for you below in our Oxford Income Letter review.

Oxford Income Letter Newsletter

A new issue of Oxford Income Letter drops once a month and offers members a brand-new investment idea.

It can be either a stock or bond, with a bigger emphasis on stocks.

Members can follow along with analysis and supporting research for the monthly portfolio pick.

Marc and the team’s analysis is thorough, but they do a great job making their trading insights easy to grasp.

Also, while many of the recommendations lean on the long term, there are some short to mid-term plays.

Lichtenfeld also offers recommendations to his readers on whether to keep the stock in a taxable or retirement account, taking into account its predicted growth and the anticipated duration of the position.

This guidance is key in enhancing the potential returns of the investment, given the distinct tax implications. It highlights Lichtenfeld’s all-encompassing approach to investment strategy.

Model Portfolios

The model portfolios track the team’s open positions.

Depending on the traits of the trade, it will fall into one of these four trading categories:

- The Compound Income Portfolio

- The Instant Income Portfolio

- The High Yield Portfolio

- Fixed Income Portfolio

I’m going to give the Oxford Income Letter service major credit here.

Most alternatives only offer one model portfolio, but Income Letter members get access to four.

You also get access to several “buy now” stocks as soon as you join.

These immediate recommendations provide an opportunity for quick action in the stock market. These services ensure members are always at the forefront of potential investment opportunities.

Weekly Portfolio Updates

Each week, the team sends out an update on changes to the portfolios and information on the markets in general.

They carefully explain why the market behaves a certain way and whether it’s time to buy or sell your stocks

You’ll always be in the loop thanks to the regular updates. Any time something big is brewing, you’ll be the first to know.

Many services offer portfolio updates, but Oxford’s updates seem to be of higher quality, with more insightful research and analysis.

The Oxford Income Letter updates not only provide a snapshot of the current market conditions but also offer a forward-looking perspective, helping you anticipate potential shifts in the market.

This proactive approach can be instrumental in helping you adjust your investment strategies in a timely manner.

Oxford Income Blasts

The stock market moves quickly, and sometimes a monthly newsletter or weekly update isn’t fast enough to receive information.

To compensate, Oxford Club sends out income blasts with urgent trading information that members should act upon immediately.

You’ll never miss a beat in the market thanks to Oxford Income Blasts. This market daily newsletter is an excellent companion piece to the monthly investment portfolio write-ups.

The blend of daily and monthly communications provides a balanced perspective. This keeps you educated about the markets without overwhelming you with information.

Access To Pillar One Advisers

Your membership also gives access to what Marc calls his Pillar One Advisors. These investors experts have knowledge of specific areas of the market and finances you get to take advantage of.

If you have an interest in collectibles or real estate, chances are you can find someone who can help you understand the niche better.

Help can also come in the form of insurance or tax law so you don’t waste or misappropriate funds.

The Pillar One Advisors serve as a valuable resource, providing expert advice tailored to your specific interests and needs.

Their expertise can help you avoid common pitfalls and capitalize on opportunities, ensuring your financial decisions are both informed and strategic.

The #1 Oil and Gas Royalty for 2025

This featured report contains the low-down on Marc’s favorite royalty play. It taps into the potential of the most productive oil basin in the United States.

Inside these pages, you’ll learn the name of this opportunity and the step-by-step process to start making some income. All you need is a regular brokerage account to start collecting those portfolio checks.

According to Marc, royalty streams can far outperform oil and gas stocks. Here you can profit from the sector’s growth while enjoying a passive cash flow.

The World’s Leading Oil and Gas Partnership

The World’s Leading Oil and Gas Partnership offers a rare opportunity that could be just as profitable as royalties. However, you’re not investing in regular stock.

Instead, you have the chance to become a partner in a pipeline company with over 50,000 miles of track. The big names in oil and natural gas already use these lines to transport their goods.

As their products pass through these pipelines, they pay a toll that the company and its partners reap the profits from. Right now, the dividend for partnering with this logistics company sits at 7.45%.

What’s more, that dividend has gone up every year since 1998. It currently costs less than $30 per share to get involved.

The Ultimate Gold Royalty Stream: Earn Huge Income From the New Gold Bull Market

Banks are quietly collecting all the gold they can. The same event in 1967 led to the biggest gold bull market in history. It looks like history is about to repeat itself.

Marc has found a way to capitalize on the coming boom, and it’s again through royalty streams. He believes royalties have the potential to grow five times more than picking up gold alone.

His secret method did just that between 2005 and 2010, and he sees the same gains on the horizon. This report reveals Marc’s answer for profiting from gold and collecting income as well from your portfolio.

>> Get instant access to these reports when you join now! <<

Free Hard Copy of Marc’s Best-Selling Book: Get Rich with Dividends

To deck out his service, Marc’s including a free hard copy of his bestselling book, Get Rich with Dividends.

This book showcases years of research on companies known to consistently grow dividends. Marc indicates which trends to look for in a good dividend stock and red flags to run from.

In Marc’s case, the results are steady double-digit returns, and oftentimes his favorite way to multiply money quickly.

To date, the book has sold more than 110,000 copies and has been translated into languages like Polish, Japanese, and Thai.

Dividend Riches: Marc’s Income Investing Video Series

Dividend Riches is a six-part video series revealing strategies that members could use for the opportunity to bring in more future income.

With each video, you have the flexibility to watch and rewatch as you see fit to get the most out of each one.

Segments focus on dividend stocks and the power of these passive income streams.

>> Sharpen your skills with Marc’s video training series <<

Money-Back Guarantee for a 12 Months

When you sign up for the Oxford Income Letter, you’re privy to a 12-month 100% money-back guarantee. You can check out the newsletter, publications, and bonus materials for an entire year.

If you’re unhappy for any reason during that time, give Marc’s team a ring and they’ll issue you a prompt 100% refund of your purchase. You’ll even get to keep all the materials you’ve received so far as a gift for trying the services out.

>> Sign up under Marc’s guarantee <<

Pros and Cons

The Oxford Income Letter has a lot going for it, but it isn’t perfect. Here in our Oxford Income Letter review, you can take a look at all the pros and cons before making a decision.

Pros

- Contains a mix of stock picks and high-yield dividend stocks

- Four unique portfolios with low-risk income potential

- Weekly updates and income blasts

- Includes three bonus reports on promising opportunities

- Free hardcover copy of Get Rich with Dividends

- Get Mark’s #1 oil and gas income stock when you join

- Six educational videos on dividend stocks

- Access to Pillar One Adviors

- Impressive 365-day money-back guarantee

Cons

- No community forum

- 80% discount only applies to first year of service

FAQs

Check out answers to some of the top questions regarding the Oxford Income Letter.

Can International Investors Try the Oxford Income Letter?

Yes, international investors can subscribe to and access the Oxford Income Letter and the Oxford Club’s other services.

The publisher makes all its content available worldwide without the need to jump through extra hurdles along the way.

That said, most of the platform’s recommendations come from U.S. markets. Users from other countries should keep in mind currency fluctuations and local regulations when making any sort of investment.

Do They Update the Model Portfolios of the Oxford Income Letter?

The team behind the Oxford Income Letter updates model portfolios on a regular basis to ensure you’re looking at the most accurate numbers possible.

New recommendations are added to the list as they’re shared from the monthly newsletter, allowing you to follow along with any gains it makes in real-time.

Alerts and updates affecting a stock’s standing outside the latest newsletter issue also make their way into the model portfolio in case you miss a crucial notification.

How Do I Cancel My Oxford Club Membership?

Should you decide one of the Oxford Club’s services isn’t for you, contact the member services team between 8 am and 8 pm Eastern time to cancel your subscription.

Since every service is different, you’ll want to read the fine print on the order confirmation email to see if you’re entitled to any sort of refund or credit.

The team typically processes refunds within 14 days of your termination date.

Oxford Income Letter Reviews By Real Members

Marc Lichtenfeld shared these member testimonials as part of his recent presentation for his #1 oil and gas income stock.

These members had great experiences with the Oxford Income Letter. Keep in mind, these reviews came directly from the service, so take them with a grain of salt.

Marc Lichtenfeld’s Oxford Income Letter has also earned a 4.6/5 rating on Stock Gumshoe. This is out of nearly 3,900 reviews.

Both the high rating and sheer number of reviews are impressive accomplishments for the newsletter.

This comes from a third-party site so I can’t verify the reviews, but it’s a good with that so many give the platform high marks.

These reviews serve to give an idea of what kind of results others have experienced with this service. All in all, it seems like this research service is the real deal.

>> Sign up now and join these satisfied members <<

Is This Service Right for Me?

Based on our Oxford Income Letter review, it is best suited for folks in the market for dividend-paying stocks with a long-term outlook.

Marc looks to find quality investments that could steadily appreciate over time — all while providing the potential to produce regular income.

His sustainable dividend yields strategy could also be a solid fit for someone nearing or in retirement.

Bond recommendations are on the table, as well, so anyone looking for a little more variety is accounted for.

That said, the core focus is stocks.

Lastly, the service offers a great blend of insights and opportunities to communicate with its lead. This could be very helpful for fresh faces on the stock market looking to build a dividend portfolio.

How Much Does The Oxford Income Letter Cost?

An annual subscription to Oxford Income Letter usually costs $249.

But members can sign up under the latest deal for just $99 for the entire year.

This shakes out to an 60% discount—not too shabby.

For a little more than 8 bucks per month, members receive a monthly trade idea, four model portfolios, and access to all the bonuses I covered.

Basically, the newsletter provides a premium experience at a fraction of the cost. And better yet, its refund period covers you for a whole year in case you don’t think you’re getting your money’s worth.

Is Oxford Income Letter Worth It?

Oxford Income Letter is an excellent newsletter with a great price. Considering you’re getting more than $450 worth of bonus materials, in addition to the frequent updates and monthly newsletter—all for $99—it’s a solid value.

Better yet, Marc’s #1 Oil and Gas Royalty bundle includes loads of research and a impressive 60% discount, so you can save $150 on a one-year subscription and get tons of additional bonuses with this limited-time deal.

The bundle provides everything you need to develop a effectively utilize Marc’s oil and gas income strategy at a steep discount, and it includes treasure trove of bonus reports.

Last but not least, your subscription is covered with an airtight satisfaction guarantee for a full year.

After a thorough Oxford Income Letter review, I’m impressed with what I saw. If you’re interested in learning more about income investing, I recommend you check it out.

Tags:

Tags: