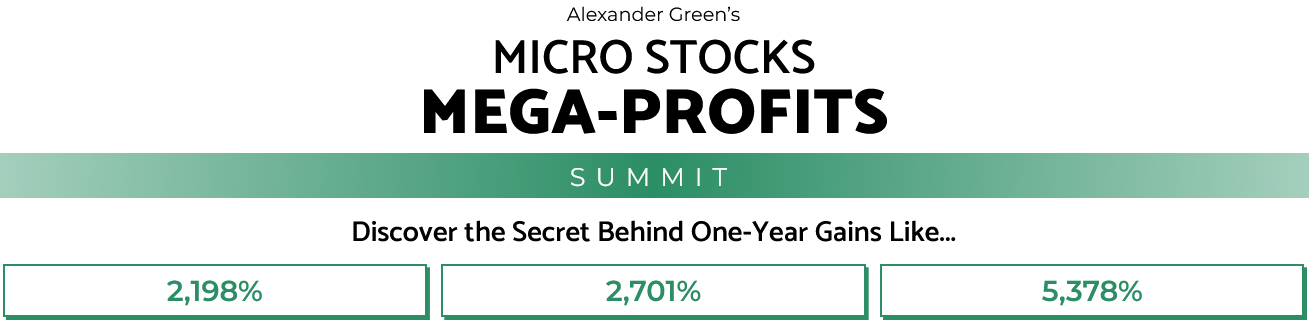

Alex Green’s Micro Stocks Mega-Profits presentation outlines some very promising opportunities in up-and-coming microcap stocks.

Does the service really have the chops to navigate this minefield of stocks?

My Oxford Microcap Trader review puts Green’s service to the test to find out the truth.

What Is Oxford Microcap Trader?

Oxford Microcap Trader is a specialized research service focusing on tiny, under-the-radar stocks that could see massive growth.

As you may have guessed from the name, Oxford Club publishes the service, and Alexander Green serves as its chief investment strategist.

The Oxford Microcap Trader service provides a wide spread of benefits for its members, including stock picks, expert guidance, special research reports, and more.

Alex Green’s Micro Stock Mega-Profits bundle also includes bonuses like exclusive in-depth research reports and more. Better yet, our readers can get a substantial discount.

In this Oxford Microcap Trader review, we’ll break down the Micro Stock Mega-Profits bundle in detail, so keep reading to get the full story on this trending deal.

By the time we’re done, you’ll have all the information you need to decide whether the Oxford Microcap Trader service is a good fit for your needs.

We’ll also analyze this service’s past performance, reviews by members, and much more, so you’ll have a complete picture from all angles.

Is Oxford Microcap Trader Legit?

The Oxford Microcap Trader is indeed a legitimate service that takes a rather unique approach to investing.

It hinges on the same principles of the Oxford Club itself, a publisher with nearly 200,000 subscribers and more than 30 years of history.

Everything within is backed by a carefully selected team of experts whose sole goal is to locate the top stock opportunities valued between $50 million and $300 million.

Some of the biggest winners since the platform went live easily eclipsed quadruple-digit gains, a trend that continues whether the overall market is up or down.

Green himself brings a lot of credibility into the mix with his skills and experience. Let’s take a closer look at his accomplishments and what qualifies him to lead this service.

>> Ready to get started? Sign up here and save 80% <<

Who Is Alexander Green of Oxford Club?

Alexander Green leads the Oxford Microcap Trader service and several other investment newsletters under the Oxford Club banner, including The Oxford Communique and The Insider Alert.

Alexander Green is a respected research analyst and a Wall Street veteran with a passion for helping everyday folks get more out of the market.

Prior to joining up with Oxford Press, Green worked as an investment advisor, research analyst, and Wall Street portfolio manager.

Green also penned four New York Times bestselling books, including:

- The Gone Fishin’ Portfolio: Get Wise, Get Wealthy and Get On With Your Life

- The Secret of Shelter Island: Money and What Matters

- Beyond Wealth: The Road Map to a Rich Life

- An Embarrassment of Riches: Tapping Into the World’s Greatest Legacy of Wealth.

Alexander Green is a respected research analyst and a Wall Street veteran with a passion for helping everyday folks get more out of the market.

Prior to joining up with Oxford Press, Green worked as an investment advisor, research analyst, and Wall Street portfolio manager.

Green also penned four New York Times bestselling books, including:

- The Gone Fishin’ Portfolio: Get Wise, Get Wealthy and Get On With Your Life

- The Secret of Shelter Island: Money and What Matters

- Beyond Wealth: The Road Map to a Rich Life

- An Embarrassment of Riches: Tapping Into the World’s Greatest Legacy of Wealth.

As you can see from my Alexander Green review, the guru has a long and fruitful investing career. He was able to retire at the age of 43 and signed on with Oxford Press to serve as the chief investment strategist for several services.

He’s been the mind behind some of Oxford Club’s most popular presentations, such as The Tiny $4 Tech Stock with Technology That Will Replace Smartphones.

Each of Alexander Green’s services have different focuses, but today we’ll be focusing on his work with Oxford Microcap Trader.

Alexander Green Track Record

Alexander Green has made countless winning calls during his time at Oxford Club, but his picks are mostly reserved for paying subscribers.

However, we found an example that will provide some background on Green’s stock-picking prowess.

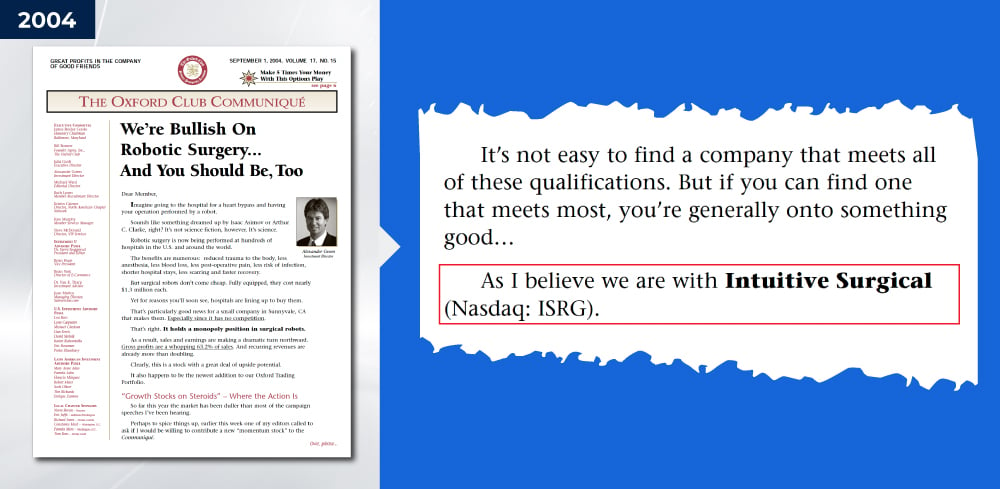

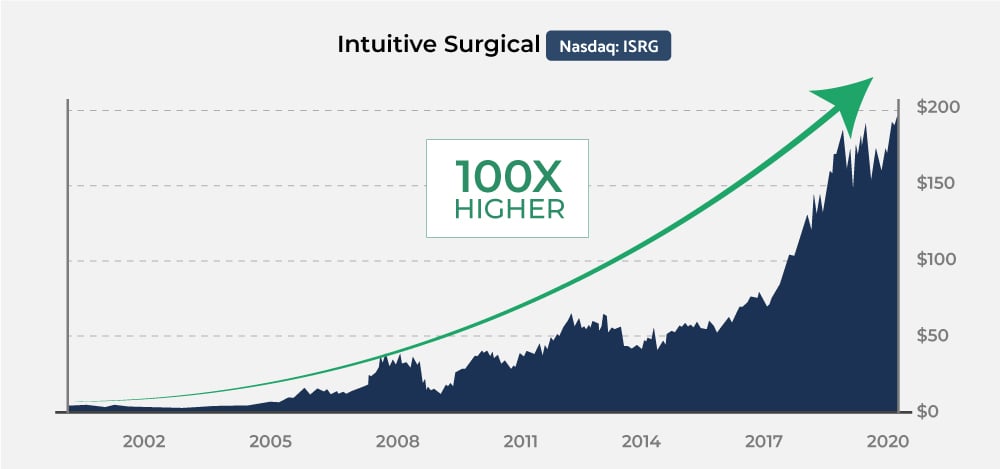

Green recommended Intuitive Surgical in 2004, long before the company was a well-known name on Wall Street.

Shortly after Green recommended the stock to his readers, Intuitive Surgical’s share price exploded after it launched the world’s first robotic surgical system with its Da Vinci product.

Shortly after its launch, the system saw a huge influx of demand, and you can currently find it in countries all over the world. As a result, early shareholders saw massive 100x returns on their investment.

Green’s Intuitive Surgical play is just one example of his many winning picks. Green also bought Apple at less than $1, Netflix at $2, and Amazon around $35 when adjusted for stock splits.

That’s an impressive collection of winners. As you can see, Alexander Green’s track record serves as an incontestable testament to his investing foresight and analytical skill.

What is Alexander Green Net Worth?

Our guru shies away from sharing any information about his net worth, leaving us at best guessing how much he has stored away.

He’s not afraid to admit he’s stumbled a few times while on his investment journey, but this doesn’t take away from his accomplishments or expertise.

The fact that Green was able to retire safely at just 43 speaks volumes to his skillet, which leads me to believe he’s sitting on multiple millions that he can now use as he sees fit.

I’m not put off by the fact that he went back to work for Oxford Club, as many experts in the field feel compelled to share their experiences and insights with those of us that continue to struggle under pressing economic conditions.

Is Alexander Green Legit?

Alexander Green is a respected guru and a Wall Street veteran. He even pens a free e-letter that helps readers achieve financial independence.

Green’s resume and track record are testaments to his expertise, experience, and skill. He’s a talented guru, and his stock market insights can be incredibly valuable.

What is The Oxford Club?

Oxford Club is the company behind Oxford Microcap Trader and a leading investment research publisher.

On its website, Oxford states that it has one simple mission: help members grow and protect their wealth.

The Oxford Club has a vast international network of highly skilled investors and entrepreneurs, and the organization has seen tremendous success since launching more than two decades ago.

Currently, Oxford Club has more than 157,000 members worldwide, spread across 130 different countries.

Oxford Club operates several research services and investment newsletters under its banner, including:

- Oxford Communique

- Lightning Trend Trader

- Oxford Income Letter

- Oxford Club Insider Alert

- Oxford Swing Trader

- Momentum Alerts

Few firms can boast the same quality catalog of research services.

Is Oxford Club Legit?

You don’t have to worry about shady business practices with Oxford Club. This company has been doing clean, above-board business since its original founding in 1991.

The company’s roster includes numerous rock star gurus that have given their readers chances at enormous gains over the years.

With a reader base of more than 150,000; Oxford Club is clearly doing something right. You have nothing to worry about when dealing with this respected US-based business.

>> Get started with Oxford Microcap Trader now <<

Micro Stocks Mega-Profits Review

In his latest presentation for Microcap Trader, Alexander Green highlights several promising opportunities in up-and-coming stocks with under-the-radar businesses.

You’ll have to sign up to get these stocks’ tickers. However, they seem promising based on the details Green shares in his presentation.

But, before we jump into Green’s top-rated microcap stocks, we want to give you some background on why this segment of the market holds so much promise.

The Case for Microcap Stocks

If you watch financial news, you know all about the top US large-caps and blue-chip stocks. These companies are household names, and common holdings in many portfolios.

However, you probably won’t hear about the most promising up-and-coming stocks on the market, microcap stocks.

These tiny, low-profile stocks may not have the name recognition of America’s Big Tech behemoths, but they have the potential to offer investors superior returns in comparison to their larger-cap counterparts.

>> Sign up now for instant access to top-rated microcap stocks <<

What Is a Microcap Stock?

According to Green’s definition, microcap stocks include any company with valuations ranging from $50 million to $300 million.

These smaller companies tend to be in the earlier phases of their growth curve. As a result, they often present investors with significantly greater upside than more established companies.

It makes sense when you think about it. If a company grows its valuation from $5 million to $5 billion, it grows at an enormous multiple of 1,000x. It’d be a remarkable achievement for the company, but it’s certainly not impossible.

On the other hand, achieving the same growth rate at a $100 billion company is virtually impossible. The company would have to grow to $100 trillion to match that pace, which is $15 trillion more than the combined value of the entire global economy.

As you can see, the upside for microcap investors can be enormous, but this category isn’t without its risk.

There are no guarantees in the stock market, and smaller, less established stocks are more likely to fail. Fortunately, having an expert to guide your way can potentially mitigate the risks.

When it comes to small-cap stocks, it’s all about buying the right ones, and Alex Green’s Microcap Trader could be exactly what you need to find the diamonds hidden in the rough.

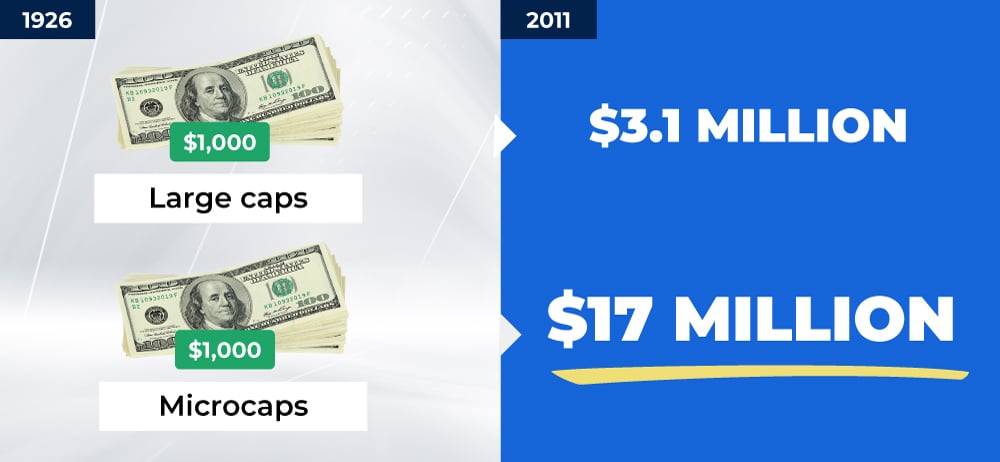

Growth Potential

Green says microcaps have outperformed large-caps nearly ever single year. In 2020, the S&P 500 – America’s benchmark for large-cap stocks – only had six stocks gain more than 100%.

Conversely, smaller-cap micro-stocks produced dozens of triple and even quadruple-digit gainers. Bit Digital saw gains up 5,378%, and Blink Charging rallied 1,350%.

2020 wasn’t an anomaly, either. Microcap stocks have outperformed large-caps year after year, and Alex Green has more than 85 years of data supporting the claim.

According to a study from Ariel Research, $1,000 invested in microcaps in 1926 would be worth $17.1 million today. However, you’d only have one-fifth of that total if you bought large caps.

The very same study also showed that microcap stocks outperformed large caps nearly 98% of the time. With numbers like that, it’s no wonder Green is so bullish on microcaps.

But, what is Alexander Green’s investment strategy, and how does he pinpoint winners in this highly unpredictable corner of the market?

>> Get the best microcap stocks for 2022 when you join here <<

Should we invest in micro cap stocks in 2025?

Micro cap stocks can elicit fear in the hearts of many investors due to their often volatile nature and unpredictability.

If handled correctly, however, these small companies can yield amazing gains even if they move the needle slightly thanks to their low valuations.

They can also help round out a portfolio consisting of areas like bonds, buy-and-hold, or other offerings set to rise slowly over time.

Because there are so many micro caps to choose from, it’s helpful to have a guru like Green to work alongside you. He’s proven very successful at cutting through the rubble to find those money-making gems.

The market as a whole has done really well through 2024 to date, making right now a potentially great time to get involved in micro cap stocks if you haven’t already.

As always, never invest more than you can afford to lose.

Green’s “Non-Negotiables” for Microcap Investing

Green has three dealbreakers when it comes to choosing the best microcaps for his Oxford Microcap Trader subscribers.

First, the company must have explosive revenue growth. Strong revenue growth is a good indication of a company’s long-term chances at success. As the old business adage goes, “if it’s not growing, it’s dying.”

Next, Green targets companies that are leading an emerging industry or disrupting an existing one. Companies in these situations tend to have the best opportunities for sustained growth and value.

Finally, Green looks for companies with relatively low share prices. Generally, he targets stocks with share prices under $10 to make his picks more accessible.

However, those three simple rules aren’t the end of Green’s strategy. He also uses sophisticated growth and value indicators to perfectly time every trade.

Furthermore, Green is also an avid follower of insider trading. He constantly scans the market to identify the type of insider activity that can signal a major rally could be in the cards.

This brief overview is a gross oversimplification of Green’s investment strategy, but it should give you some idea of how Green makes his stock picks.

Green’s Top-Rated Microcap Stocks for 2025

Alexander Green recently identified a handful of promising microcap stocks that could see enormous gains this year.

He wrote several in-depth research reports explaining his findings, and you get them free when you sign up for Oxford Microcap Trader.

We’ll review these special reports and all of Oxford Microcap Trader’s features next.

>> Sign up for Oxford Microcap Trader to get the details on these stocks <<

Oxford Microcap Trader Review: What Comes With Micro Stocks Mega-Profits?

- One-year subscription to Oxford Microcap Trader

- Buy and sell alerts

- Weekly email updates and alerts

- Unlimited access to Oxford Microcap Trader model portfolio

- VIP Member services team

- Options the Easy Way: Turbocharge Your Profits with 1 Click bonus three-part video series

- FEATURING Green’s 1,000% Profits with This Sub-$10 Microcap special report

- BONUS 5 Tiny Stocks That Will Supercharge Your Wealth

- Alex Green’s Performance Guarantee

Oxford Microcap Trader

The Micro Stocks Mega-Profits bundle starts with a one-year subscription to Green’s microcap stock service, Oxford Microcap Trader, and it’s your main source for the latest research and stock recommendations from Alexander Green.

Green will notify you whenever he discovers a new microcap opportunity with a short-and-sweet with detailed information about the stock and Green’s recommended trading strategy.

As a Microcap Trader member, you can expect to receive one to two new microcap stock picks every month for as long as you’re a member.

Each report includes all the information you need to make an informed decision on each stock. Green does the research and heavy lifting, and all you have to do is wait for the alerts to hit your inbox.

>> Get up to two new microcaps every month with Oxford Microcap Trader <<

Buy and Sell Alerts

You’ll receive a buy notification whenever green sees a new opportunity on the horizon, so you can take action and get into position at the best price possible.

Of course, Green will also let you know when it’s time to exit a position, so you won’t get caught flat-footed if circumstances take an unexpected turn.

You’ll receive Green’s alerts via email, so they’re easily accessible on the go. That way, you can react quickly when it’s time to take action.

Oxford Microcap Trader Model Portfolio

Once Green recommends a stock, it goes on record in the Oxford Microcap Trader model portfolio, and you can access this resource as part of your subscription.

The model portfolio is available on the Microcap Trader members-only website, and it includes detailed information on all of Green’s stock picks.

A quick glance at the model portfolio can tell you a lot about each stock’s progress. It includes details such as the company’s name, ticker symbol, price action, and much more.

The model portfolio is an excellent feature that gives you a bird’s-eye view of every microcap stock recommended by Green. Checking it regularly will help you stay on top of each stock’s progress and more.

>> Get started now to access the Microcap Trader model portfolio <<

Weekly Updates

Green tracks the model portfolio closely and provides weekly updates on its progress. His weekly briefs bring you up to speed on all the latest news surrounding each company.

You don’t have to meticulously follow each stock pick because, once again, Green does the hardwood for you. If something noteworthy happens, you’ll be among the first to know about it.

Weekly updates keep you engaged with the latest market-moving news, so you’ll be aware of all the factors at play for each company.

VIP Member Services Team

If you ever have an issue with your Oxford Microcap Trader service, you can contact the VIP member services team to help you work through your issue.

The team is staffed by qualified customer service professionals who are passionate about solving problems and helping members with their issues.

Microcap Trader’s member services team is available via email or phone, so you can get in touch with them through your preferred means of communication.

It’s always nice to know that someone is there to lend a hand in case you run into an unexpected issue, and you’re sure to have an excellent experience whenever you reach out.

>> Get the service & support you deserve with Microcap Trader <<

Micro Stocks Mega Profits Bonus Resources

The current microcap trader bundle also includes valuable bonus resources and microcap stock picks. Here’s what you get:

Options the Easy Way: Video Series

The Micro Stocks Mega-Profits bundle also includes a three-part video course that gives viewers an in-depth introduction to options trading.

In the videos, Alexander Green explains the ins and outs of options trading and shows you how you can use options to enhance your trading strategies.

Options can be extremely effective tools for more advanced traders, but the learning curb can be steep.

Green’s video series helps novice traders learn the ropes so they can put these game-changing financial instruments to work for them.

1,000% Profits Featured Report

This featured report includes details on a promising microcap stock that could see enormous gains in the not-so-distant future.

It includes detailed information on Green’s number one microcap stock pick for the year ahead, including trading instructions and much more.

This stock costs less than $10, and Green believes an investment in this company could produce 10X gains for its shareholders.

You’ll find everything you need to jump on board this promising trade in this featured report. It’s one of the most valuable resources in this entire Oxford Microcap Trader.

>> Sign up now to get Green’s No.1 microcap stock <<

5 Tiny Stocks Bonus Report

The second special report features five more promising microcap stocks that Green has identified in recent weeks.

These companies each pass Green’s selection criteria, and they have favorable growth and value indicators. They have strong revenue growth, and recent insider activity has been bullish.

Each of these under-the-radar businesses could see enormous success this year, and you will get all five stock picks in this report from Alexander Green.

In total, these bonus resources include six additional Alexander Green stock picks, and you get instant access to them as soon as you sign up.

You could see enormous returns if even one of these tiny stocks hits it big. The potential upside in each of these companies could be enormous.

>> Get the tickers for Green’s Top-5 “tiny stocks” when you join now <<

Performance Guarantee

Alexander Green stands by his work, and he wants members to know he’ll deliver on his promises. So, he covers each new Oxford Microcap Trader submission with a performance guarantee.

Green guarantees you will have the opportunity to collect at least nine instances of triple-digit gains over the next year based on his recommendations.

If he fails to deliver, you’ll get another year of Oxford Microcap Trader absolutely free of charge.

The guarantee is very appealing. Having the chance to jump on nine 100%-plus winners over the course of a year could be a game changer for your portfolio.

Is Oxford Microcap Trader Legit?

Oxford Microcap Trader is a legit newsletter service that provides a wealth of insights into the world of microcap trading. Microcap and penny stocks are difficult to navigate, so it’s a relief to have someone knowledgeable like Andrew Green leading the service.

This newsletter is backed by an impressive guarantee that few services in the industry can match. Nine opportunities to earn triple-digit gains is a lofty goal for most, but if anyone could deliver these results, it’s Green.

Micro Stocks Mega-Profits Pros and Cons

Oxford Microcap Trader looks like a great service, but no one’s perfect. Here are the pros and cons:

Pros

- Chief investment strategist Alexander Green has experience as a research analyst, investment advisor, and a Wall Street portfolio manager

- Discover promising investment opportunities in under-the-radar businesses

- Micro Stocks Mega-Profits bonus reports include six additional stock picks

- Featured report includes details on a potential 10X gainer

- Up to two new microcap stock picks every month

- Green’s strategy monitors insider activity, growth and value indicators, and more to identify trade candidates

- VIP member services team available by phone or email

- Studies show microcap stocks tend to have more upside than large caps.

- Extremely generous performance guarantee

- Weekly trade updates with buy and sell alerts to keep you on track

- Three-part options training video series included free

- Oxford Club is a respected publisher

Cons

- May be cost prohibitive for some

- No community chat or forums

>> Start enjoying these perks when you join Microcap Trader now <<

Oxford Microcap Trader Performance/Track Record

In the years Oxford Microcap Trader has been in existence, it’s turned in some particularly amazing opportunities for profit.

Take Blink Charging (Nasdaq: BLNK), for instance. The platform identified it in early 2020, and folks following the recommendation could have been treated to 2,198% gains by the same time the following year.

The service did even better with Celsuis Holdings (Nasdaq: CELH). Shares jumped over 3,300% from the time the team recommended adding it to a portfolio.

Oxford Microcap Trader saw many other picks surpass the four-digit returns mark. Its highest return to date is 5,378% and counting.

Sure, not all recommendations reach this level of success, and that’s completely within the realm of reason for a research service like this one. Still, the immense gain potential backed by Green’s expertise is a force to be reckoned with.

Oxford Microcap Trader Reviews by Members

Unfortunately, we were not able to verify any Oxford Microcap Trader reviews by members when we searched online.

However, we saw some online chatter about this service, and it seemed mostly positive.

Alexander Green is a respected guru, and his track record as a Wall Street portfolio manager, investment advisor, and research analyst speaks for itself.

Although we don’t have any verified reviews by members, Green’s performance guarantee tells you this service is legit.

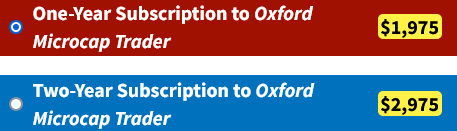

How Much Does Micro Stocks Mega-Profits Cost?

Oxford Microcap Trader memberships typically retail for a whopping $10,000.

However, Green is offering a tremendous deal to promote his Micro Stocks Mega-Profits bundle.

For a limited time, you can save more than 80% on the full sticker price and subscribe for just $1,975.

At that rate, your subscription cost averages out to just under $165 per month. In exchange, you get all the features and bonuses detailed in this review, including Green’s performance guarantee.

>> Click here to claim your 80%+ discount before it’s gone for good! <<

Is Oxford Microcap Trader Worth It?

The substantial discount makes Alexander Green’s Micro Stocks Mega-Profits deal extremely enticing. Factor in the extremely generous performance guarantee, and you’ve got a tremendous bargain on your hands.

You’ll receive new microcap stock picks from Green for as long as you’re a member of the service, plus a steady stream of updates and alerts that ensure you’ll never miss a beat.

The regular updates make it easy to follow the progress of these under-the-radar businesses, so you can forget about the market and go about your day stress-free.

Better yet, the current deal also includes six bonus stock picks, and you get all of them, including Green’s featured 10X stock under $10, as soon as you join.

As an added bonus, you also get access to an in-depth video series on options trading that can help you get even more out of the service.

As a former Wall Street portfolio manager and investment advisor, Alexander Green’s experience is also a valuable asset for his readers, and he’s proven time and time again that he has what it takes to pick winning microcap stocks.

Although this service costs substantially more than an entry-level investment newsletter, it provides a much higher level of service and support than you’d receive with those services. It

You’ll also get more frequent and higher-quality stock picks than you will with most bargain-basement competitors. When it comes to research, you get what you pay for.

The 80%+ discount makes this Oxford Microcap Trader bundle an absolute steal. It’s a small price to pay to have first-hand access to microcap stocks with enormous upside. There’s no doubt that Oxford Microcap Trader is worth the upfront investment.

>> Get started now and save 80%+ on Oxford Microcap Trader <<

Tags:

Tags: