Stansberry Innovations Report is one of the leading research services from Stansberry Research. Check out my Stansberry Innovations Report review to see if it’s the real deal.

What Is Stansberry Innovations Report?

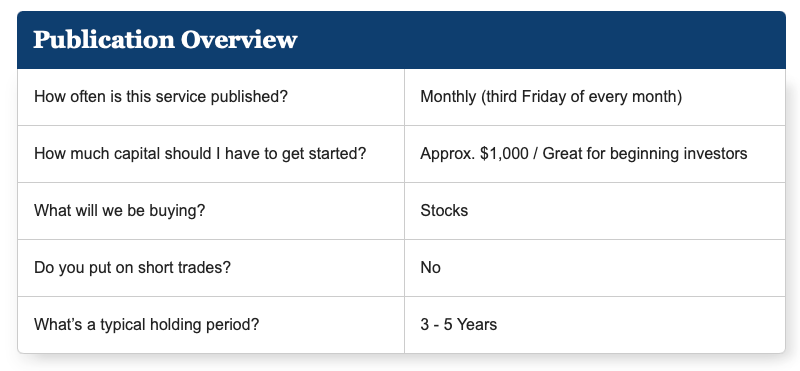

The Stansberry Innovations Report is a monthly research service from the veteran analysts at Stansberry Research.

Unlike more generalized services, the Innovations Report specifically focuses on disruptive technologies and other high-octane growth opportunities.

Led by veteran analyst Eric Wade, the service favors investment opportunities in promising sectors like biotech, crypto, aerospace, and others.

Members of the service get a new briefing every month that comes loaded with tons of research, investing insights, and more.

Each issue also includes a new featured stock recommendation from Eric Wade, along with supporting research and trade recommendations. Plus, Wade provides analysis of the latest macro conditions and keeps readers updated on his outlook for the market.

Typical holding periods for Innovations Report recommendations range from three to five years, so it’s an excellent choice for people interested in longer-term investing.

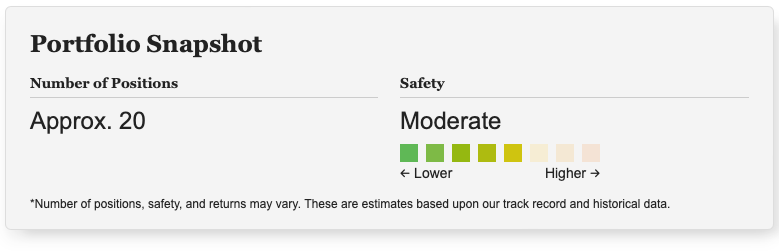

According to service’s page on Stansberry’s website, its model portfolio typically carries about 20 active positions, although the exact number varies.

It’s listed as “moderate” risk on Stansberry’s “Safety” scale, so it’s likely that Wade is looking for more established tech opportunities in an effort to manage risk.

Now that I’ve given you some background on the service, let’s took a closer look at the man behind the curtain, Eric Wade.

>> Sign up HERE for a 84% discount! <<

Who is Eric Wade?

Eric Wade grew up in a trailer in the mountains of New Mexico with nothing to his family’s name.

It didn’t take long for Wade to realize he’d need to work hard to get ahead. That led him to start a valet parking business in high school and carry that mentality forward.

Investment firm AG Edwards and Merril Lynch came calling after college. Eric put in the work to get every financial certification he could on his way up through the ranks.

Eventually, Wade began mining Bitcoin in 2013, and he never looked back. Since then, he’s become a prominent analyst for both stock and crypto opportunities.

Wade finally settled into a role at Stansberry Research with the goal of helping everyday people achieve success in the market. Now, he’s the lead editor for the Innovations Report, and he contributes to other Stansberry services.

Is Eric Wade Legit?

Eric Wade is the real deal, and his track record speaks for itself. Since signing on with Stansberry, he has made 80 recommendations that went on to produce triple-digit gains.

If that’s not impressive enough, nine of them went on to rack up gains exceeding 1,000%, providing opportunities for 10X returns.

Wade also has a reputation as a fast mover. He was mining Bitcoin before most people even knew cryptocurrency existed, and he achieved a 30X gain on Bitcoin and Ether as a result of his prudent approach.

Eric is an experienced expert who has proven himself to be both an astute investor and a skilled researcher. He’s extremely qualified to lead the Stansberry Innovations Report.

>> Get Eric’s latest stock picks and recommendations <<

What is Stansberry Research?

Stansberry Research is a U.S.-based company with a track record stretching back more than 25 years.

Today, it has more than 20 financial publications and deep stable of well-regarded analysts, including Eric Wade.

Since its launch, Stansberry has grown to become one of the leading publishers of research for the retail market.

Today, the company’s subscriber rolls include hundreds of thousands of readers spread across more than 100 countries.

When you see the Stansberry name, you can expect high-quality research and excellent customer service.

Eric Wade’s Presentation: Two Powerful Technologies Set to Collide

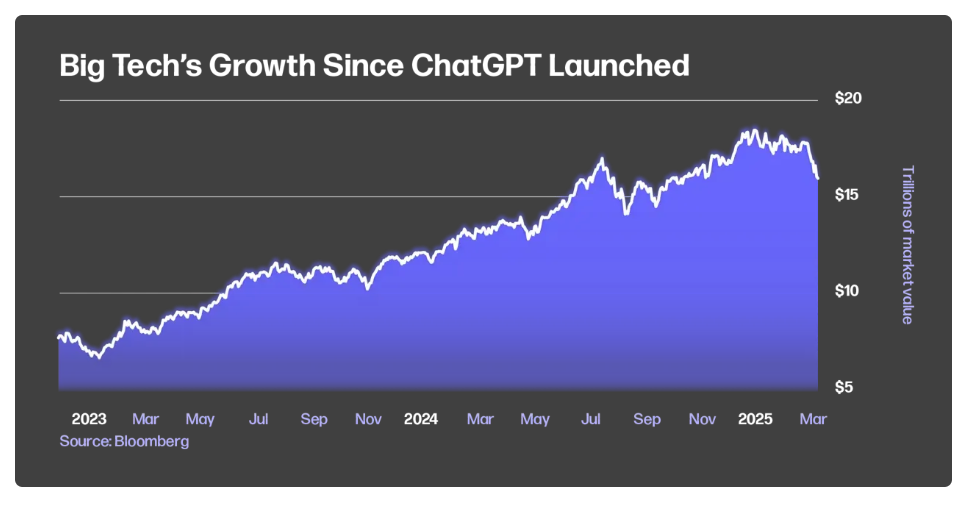

We’ve seen several emerging trends emerge from the tech world over the past few decades, and those of us who have been ahead of these trends have had a chance at monumental gains.

If you’ve been on the sidelines this entire time, don’t fret. Eric Wade believes the biggest one yet could be right at our doorstep.

The technology he’s so excited about sits at the convergence of two innovations that are each making an impact in their respective circles.

Combined, these emerging technologies stand to change the world around us in an indelible way.

I know I don’t want to look back at this moment and wish I had invested when the time was ripe, but just what is Wade talking about?

>> Get the full scoop on Eric’s Robot Takeover presentation <<

A Marriage Made in Heaven?

Eric’s first disruptive technology is humanoid robots, the formerly science-fiction machines that perform tasks and move around on two legs.

They’re obviously not new, but they seem to be improving a mile a minute when it comes to functionality.

Companies Amazon and Walmart are already employing them to take the place of human operators in assembly and storage, while McDonald’s has them running entire restaurant locations.

I even had a robot prepare and serve me a cup of coffee on a recent trip to Japan.

You can probably guess, but the other breakthrough tech Eric and his research team have tabs on is artificial intelligence.

AI is already everywhere, tucked deep into your smartphone in the form of Siri or even autocorrect.

We have a smart thermostat that uses AI to regulate temperature and save us money, and medical sciences are turning to AI for ways to combat disease.

It’s not hard to see how these two technologies can work seamlessly together to revolutionize industries, but isn’t that still a long way off?

Mainstream Happens Faster Than You Think

In my experience, people underestimate how quickly new tech becomes mainstream.

There’s no gradual transition; smartphones and the internet went from a murmur to everywhere seemingly overnight.

The problem is, we get caught waiting in the slow initial slope and miss these big opportunities before they explode.

Here’s the thing – this convergence of technologies is already here, and the largest companies are pouring money in droves.

I’m not talking chump change; think along the lines of tens of billions of dollars. If that’s not the confirmation you need to know something’s happening here, I don’t know what is.

We’re also seeing prices for these technologies dropping at an exponential rate. The cost to run some of these robots could fall to as little as 10 cents per hour – no human can compete with that.

What does all this mean for us, though?

How to Capitalize on the Robot/AI Convergence

The age of humanoid robots is here, whether we like it or not, and it’s coming for a ton of our jobs.

That concerns me to my core, but I also see tons of opportunity here for outstanding gains before the tech moves to center stage.

Wade and his crew have been hard at work uncovering the best investment strategies to grab some of that wealth, and he’s sharing that research with all his readers.

You can get access to these recommendations as well simply by signing up for Stansberry Innovations Report under this special deal.

This bundle is jam-packed with a ton of other great features as well, so walk with me as I unpack each of those now.

>> Uncover the play on AI convergence <<

Stansberry Innovations Report Review: What’s Included?

Here’s what you get when you join under this deal.

12-Month Subscription to Stansberry Innovations Report

The Innovations Report newsletter is the main entree in this offering. Each monthly issue includes loads of detailed analysis, market news, and one featured stock pick from Eric Wade.

According to the Stansberry website, the Innovation Report portfolio averages about 20 open positions, and the service’s investment strategy leans towards the conservative side.

Stansberry recommends that subscribers have a minimum of $1,000 to invest before they start trading with the Innovations Report, so it’s an excellent option for beginners and smaller-budget investors.

You’ll get a new report immediately after the market closes on the third Friday of each month, so you have all weekend to look them over before the market opens on Monday.

Model Portfolio

You also get access to a model portfolio featuring Eric Wade’s current stock picks for the Stansberry Innovations Report.

Here, you’ll typically find about 30 different stocks that are actively recommended by Wade, along with information on the companies and their performance.

According to its page on the Stansberry Research website, Eric Wade typically carries about 20 open positions at a time, and the opportunities lean slightly towards the conservative side of the spectrum.

The model portfolio contains all the pertinent info on every stock pick, including company name, ticker symbol, current recommendation, performance, and much more.

This isn’t exactly groundbreaking stuff, as most research services offer similar features. However, as usual, Stansberry’s execution outclasses the competition.

This model portfolio has a very aesthetically pleasing design and it’s extremely easy to use. Best of all, you can get yourself up to speed on all of Eric Wade’s picks with just a quick glance.

>> Get Stansberry Innovations Report and bonuses at 84% off! <<

Special Updates and Alerts

Eric and crew will fire off emails whenever something noteworthy is happening in the market. Some examples of notifications may include portfolio updates, sell alerts, and market-moving news breaks.

The updates are short and sweet, but they convey a lot of information in a very efficient manner.

When I test drove this service, I could make adjustments to my positions much more quickly as a result of Wade’s alerts.

Normally, I have to discover the news myself, locate a non-paywalled article that explains the situation, read through it, and then determine the best option before I can take any action.

Eric’s alerts cut that entire process down to just a couple of steps. He efficiently explains what’s happening and his recommendations for responding to it.

I managed to get all the information I needed in less than 30 seconds in most cases, so I give Eric high marks here. His alerts manage to informative without sacrificing brevity.

Research Report Archives

If you sign up now, you also get access to Eric Wade’s research archives, where you can access research reports and recommendations from the past.

These resources stretch back for several years, and it’s unavoidable that some of the information becomes outdate over time. However, there’s still a lot of value here.

You can discover dozens of stock picks from prior years, which gives you even more potential trade opportunities to explore.

Plus, many of Eric’s special research is educational in nature, so the library features many reports covering valuable skills and strategies that remain relevant to this day.

Here are some examples:

- The Tax-Free Way to Make 500% Gains in America Today

- The 3 Assets You (Legally) Do Not Have to Report to the Government

- The Great Disruptor: How to Make 10 Times Your Money on the Medical Breakthrough of Our Lifetime

As you can see, these reports are still worth reading, so I recommend you don’t overlook the value that the archives brings to the table.

There’s a vast reserve of valuable educational resources and stock picks worth exploring here.

>> Sign up now to access Eric Wade’s archives <<

Bonus Subscription to Stansberry Digest

Your membership also includes a bonus subscription to Stansberry Digest, a comprehensive daily market news report.

You’ll get a new issue of the daily market news report every weekday after the market closes, so you can close your trading day with a comprehensive overview of the latest major financial stories.

In an average year, you’ll benefit from the insights of more than 20 experts, each bringing their unique perspective to the financial markets.

These experts cover a broad spectrum of topics, ensuring you’re always up-to-date with the latest threats, opportunities, patterns, and trends.

The daily format of Stansberry Digest keeps you informed by providing a reliable source of information that will help you navigate the complexities of the financial world.

Bonus Reports

If you join Stansberry Innovation Report right now, you’ll also get these bonuses.

The Winners of the AI Robot Revolution

This special report contains all the info you need to play the AI robot revolution for a shot at those big returns.

Eric provides a detailed analysis of each stock recommendation he’s currently pursuing in the sector, including names and ticker symbols so you can take action right away.

He even expands upon why the sector’s so hot right now and long-term implications for growth.

I hadn’t heard of most of these stocks before reading this report, but Wade makes a very compelling case for each one.

It makes sense that these aren’t yet household names, just like Apple and Microsoft were before they took off.

My No. 1 AI Stock

Artificial intelligence is already booming with or without robots, and there are several companies vying for a top spot in the struggle to be the best.

Nvidia has been a clear winner here, but Eric looks under the hood at the ventures fueling this giant that have huge runways for growth.

One in particular makes the software the largest companies need to test and innovate their chips in hopes of staying ahead of the curve.

It already boasts some big names as customers, including Samsung, Volvo, and Sony to name a few.

You’ll get an in-depth analysis of this AI play, so you can move on it if you so choose.

>> Uncover Eric Wade’s Top AI recommendation <<

AI Stocks to Avoid

As important as it is to invest early in the biggest AI winners, it’s absolutely essential to cut dead weight loose before it pulls your portfolio down.

In AI Stocks to Avoid, Wade draws attention to four stocks you’ll want to avoid and his reasoning behind each one.

These red flags are dealing with valuation bloat, concerns over layoffs due to AI, and one that simply didn’t innovate in time.

Some of these names threw me for a loop, but I appreciate Eric taking the time to clearly explain his concern so I can make an educated decision on what to do.

>> Unlock the stocks to avoid now! <<

The Top Crypto for 2025

Eric’s keen on all the major tech trends out there, which of course includes cryptocurrency.

This could be a banner year for digital currency due to the pro-crypto shift in the White House and a number of new initiatives, but not every coin makes for a worthwhile investment.

In this guide, Wade shares the one crypto he’s most excited about in 2025 and why it could become one of the top ten coins in the world with its current trajectory.

You’ll get his full research right here alongside everything you need to take advantage even if you’ve never purchased crypto before.

>> Get access to exclusive reports and bonuses now at 84% off <<

30-Day Money-back Guarantee

Stansberry Research and Eric Wade offer a 100% money-back guarantee for 30 days on every new subscription to Stansberry Innovations Report.

If you’re unsatisfied for any reason, simply contact Stansberry’s US-based customer support team and request your refund.

You’ll get your money back with no questions asked.

The 30 day term gives you enough time to receive at least one issue of the newsletter, allowing you to see Eric’s latest stock pick.

If you decide to request a refund, they’ll even let you keep the bonus reports as a “thank you” for giving them a shot.

A 30-day guarantee is pretty standard in the research newsletter industry, so Stansberry doesn’t really get extra points here.

However, its 100% cash refund policy is an improvement over competitors that only back up their guarantee with a credit.

Overall, the guarantee provides a safety net if you’re uncertain about the service, and 30 days is plenty of time to decide if it’s a good fit for you.

>> Sign up under Eric’s money-back guarantee <<

Pros and Cons

After completing my thorough review of this Stansberry Innovations Report bundle’s features, these are my top pros and cons:

Pros

- Focuses on high-growth investment opportunities

- Led by respected and experienced guru Eric Wade

- Covered with an airtight 30-day guarantee

- Affordably priced

- Features five bonus research reports, including Eric’s #1 crypto pick

- Access to model portfolio and research archive

- Backed by a reputable U.S.-based company

Cons

- Smaller stocks could be volatile

- No chat room or message board

>> Join with 84% off today! <<

Stansberry Innovations Report Reviews by Members

I came across some impressive testimonials for Eric Wade and his service. First, Michael from Michigan shared the following:

Another subscriber, Joel, also had some high praise for Wade’s research:

I pulled these testimonials from one of Eric Wade’s presentations, so there’s a possibility they were cherry picked for their positivity.

Take them with a grain of salt but don’t dismiss them outright because they’re authentic and they provide valuable insights into what’s possible with the service.

Additionally, Stansberry Research included this disclaimer alongside these testimonials, so I figured I’d share it here as well.

“The investment results described in these testimonials aren’t typical, investing in securities carries a high degree of risk, you may lose some or all of your investment.”

– Stansberry Innovations Report Testimonials Disclaimer

Remember, no matter how much experience you have, equity markets are inherently uncertain. Always conduct proper due diligence and consult with a certified financial planner before making investment decisions.

However, Eric’s research can greatly expand your stock market knowledge, and help you discover more promising trade opportunities in much less time.

How Much Does Stansberry Innovations Report Cost?

A one-year subscription to Eric Wade’s service typically costs $499, but you can access a limited-time discount using any of the links on this page.

If you take advantage of the sale price, you’ll save roughly 84% on your subscription and pay just $79 for the first year.

The best thing about this deal is that there are no trade-offs. You still get all the bonus reports and member perks described in my Stansberry Innovations Report review.

Best of all, it’s all covered under the Stansberry Research 30-day money-back guarantee.

Just so you’re aware, this introductory offer is only valid for the first year. When your renewal date comes around, Stansberry Research will send you a bill for $199.

Is Stansberry Innovations Report Worth It?

After completing my extensive Stansberry Innovations Report review, I am giving it an ‘A’ grade. It has everything I like to see in a research advisory, and it’s a great value for the price.

Plus, it’s backed by an extremely competent guru in Eric Wade, and it’s published by one of the most respected names in the industry, Stansberry Research.

Under the current limited-time deal, you’ll also get the bonus reports and unrestricted access to Eric Wade’s research archives. Combined, these resources include dozens of promising stock picks.

Eric’s monthly newsletter is extremely informative, and the steady stream of stock picks it provides will keep you busy with plenty of trade opportunities to explore.

Plus, the daily Stansberry Digest newsletter is a great addition to my morning trading routine.

After a thorough Stansberry Innovations Report review, I can confidently say this is an excellent research service, and you can’t go wrong at just $79 for your first year.

Tags:

Tags: