Read on for our picks of the best artificial intelligence stocks under $1 to buy now.

According to a report by Grand View Research, the worldwide artificial intelligence market was valued at $39.9 billion in 2019 and is expected to grow at a combined annual growth rate (CAGR) of 42.2% from 2020 to 2027.

Major tech companies are taking advantage of this growth and are diving deeper into the pool of artificial intelligence.

Good AI stocks could increase in value and lead to excellent returns down the road.

So when it comes to investing in the stock market, every growth investor might want to explore the artificial intelligence sector.

For long and short-term plays on the AI market, small-cap artificial intelligence penny stocks hold plenty of potential.

Our penny stock picks include AI stocks of companies producing chips for the AI market, big data and data analytics stocks, SaaS, and pure AI companies.

Best AI Stocks Under $1

CooTek Inc. (NYSE: CTK)

CooTek is a Shanghai-based mobile internet company offering a suite of AI-powered applications across various categories.

Hi Shou is a health-focused app featuring exercise routines, water intake tracking, and weight loss recipes.

TouchPal Smart Input is an AI-driven mobile input method supporting multiple languages, with over 100 million users.

The company also provides reading software and several online games.

Recently, CooTek entered the metaverse industry with the launch of its new game, Hotties, in December. The game has achieved over 2.5 million downloads and is currently ranked No. 3 among top iOS games in the United States.

As of May 30, 2025, CooTek’s stock price is approximately $0.03. The company’s market capitalization is around $166 million.

Predictive Oncology (NASDAQ: POAI)

Predictive Oncology Inc., based in Minnesota, is a data and AI-driven discovery services company specializing in predictive models of tumor drug response. Its subsidiary, TumorGenesis, employs unique methods to cultivate ovarian cancer cells, contributing to an extensive database of 98 different types of ovarian cancer cells.

These AI tools aim to identify various tumor cell types and develop tailored treatments for patients, potentially revolutionizing cancer treatment.

The company has recently announced plans to launch an AI-powered drug discovery market, positioning itself as a potential leader in this growing field, which is expected to expand by $20 billion over the next three years. Revenue generation from its PeDAL platform is anticipated to commence later this year.

Despite experiencing volatility in 2021, POAI’s share price has increased by 33% since the beginning of the year. Currently trading at approximately $0.91, the stock remains below the $1 mark, indicating potential for growth if the company’s initiatives succeed.

Investors should monitor developments related to the company’s AI-driven platforms and strategic partnerships, as these factors could influence future performance.

Remark Holdings, Inc. (OTC: MARK)

Remark Holdings is a global technology company specializing in artificial intelligence (AI) and computer vision solutions. The company focuses on developing AI-driven applications for various sectors, including public safety, retail, and healthcare.

Recently, Remark announced a collaboration with Google Public Sector to accelerate computer vision AI innovation in New York State. This partnership aims to enhance public sector projects across the state by leveraging Remark’s advanced AI technologies .

Financially, Remark Holdings reported a market capitalization of approximately $4.15 million, with trailing twelve-month revenue of $4.63 million. The company’s stock is currently trading at $0.06, reflecting its status as a penny stock .

Inuvo Inc. (NYSEAMERICAN: IN UV)

Inuvo is a U.S.-based advertising technology company specializing in AI-driven solutions. Its flagship platform, IntentKey, utilizes patented AI to align brand messaging with user intent, enhancing targeting and engagement.

In Q1 2025, Inuvo reported record revenue of $26.7 million, a 57% increase from $17.0 million in Q1 2024. Gross profit rose by 41% to $21.1 million, with a gross margin of 79%. The company narrowed its net loss to $1.3 million, or $0.01 per share, compared to a net loss of $2.1 million in Q1 2024.

Adjusted EBITDA improved to a loss of $22,000, a significant improvement from a loss of $1.0 million in the same quarter last year.

In Q4 2024, Inuvo achieved a record revenue of $26.2 million, a 26% year-over-year increase. Net income for the quarter was $141,000, with an adjusted EBITDA of $1.2 million. For the full year 2024, revenue increased by 13% to $83.8 million, and the net loss decreased by 45% to $5.8 million. Adjusted EBITDA loss improved sixfold to $816,000.

As of May 2025, Inuvo’s stock is trading at $0.3958, reflecting investor confidence in the company’s growth trajectory.

Powerbridge Technologies Co,. Ltd. (NASDAQ: PBTS)

Powerbridge Technologies, now operating as X3 Holdings Co., Ltd., is a Chinese technology firm that provides software applications and technology solutions to corporate and government customers.

The company develops and maintains cloud-based Powerbridge BaaS Services (blockchain-as-a-service) for participants in the global commerce ecosystem.

Its technological platforms, including the Powerbridge System Platform and Powerbridge SaaS Platform, are utilized in various sectors such as transaction processing, blockchain logistics, insurance, and loans.

In recent years, Powerbridge has expanded its portfolio by acquiring 5,600 crypto mining machines to bolster its PowerCrypto holdings. Additionally, the company ventured into the metaverse industry with the establishment of MetaFusion, aiming to use metaverse and NFT technology to transform transport and leisure services. MetaFusion focuses on NFTs of cultural intellectual assets, with an expectation to generate an additional $15 million in operating income over the next three years.

The company has undergone share consolidations to maintain its Nasdaq listing, including a 1-for-30 share consolidation effective June 8, 2023 . Analyst forecasts suggest a potential stock price range between $1.43 and $1.96 by December 2025 .

As of May 30, 2025, Powerbridge’s stock is trading at approximately $1.29, with a market capitalization of around $284 million.

AI Penny Stocks Under $1

Remark Holdings, Inc. (NASDAQ: MARK)

Remark Holdings, Inc. is a global technology company specializing in artificial intelligence (AI) solutions aimed at enhancing safety, efficiency, and intelligence across various sectors. The company’s AI-driven platforms are utilized in retail, public safety, and workplace environments, offering tools for real-time analytics and decision-making.

Additionally, Remark owns digital media properties, including Bikini.com, which focuses on a luxury beach lifestyle.

The company has experienced a 35.5% increase in stock price over the past two weeks, indicating a potential upward trend. In December 2021, Remark secured a $30 million debt financing deal with Mudrick Capital Management, L.P., aimed at paying off certain debts and liabilities and providing working capital for existing operations.

As of May 30, 2025, Remark Holdings’ stock is trading at approximately $0.06, with a market capitalization of around $4.15 million.

Wearable Devices Ltd. (NASDAQ: WLDS)

Wearable Devices Ltd. is an Israeli technology company specializing in AI-powered touchless sensing wearables. Their flagship product, the Mudra Band for Apple Watch, allows users to control devices through subtle finger and wrist movements.

The company has partnered with Qualcomm Technologies to enhance extended reality (XR) experiences using their Mudra Neural Technology.

In 2024, Wearable Devices reported initial revenues of $394,000 from sales of the Mudra Band and business-to-business collaborations. They also introduced the Mudra Link, a neural interface wristband for Android devices, which is currently available for preorders with an official launch expected in the first quarter of 2025.

The company has secured patents for its gesture and voice-controlled interface technology in both the United States and China, expanding its intellectual property portfolio globally.

As of May 30, 2025, Wearable Devices’ stock is trading at approximately $1.69.

Robotics Stocks Under $1

Artificial Intelligence Technology Solutions Inc. (OTC: AITX)

Artificial Intelligence Technology Solutions is a US-based artificial intelligence solution provider for mobile electronic services, including AI and robotics solutions.

This company offers after-market upgrades for electronics, audio, and video for boats, automobiles, and recreational vehicles.

It works through three subsidiaries to deliver its robotic solutions to businesses.

Furthermore, Artificial Intelligence Technology Solutions create software products that empower businesses to reach new heights.

AITX financials show a favorable trend, as revenue and net income are steadily increasing.

The company’s sales increased by 315% or over $800,000 in 2021.

Also, the firm invested substantially in R&D and production to prepare for the launch of RAD 3.0 and ROAMEO.

The company raised about $9.4 million in debt and an additional $8.5 million in common shares during the nine months ending November 30, 2021.

This money will help the company to expand its R&D and operation.

The current ratio improved from 0.27 at the end of February 2021 to 0.96 at the end of Q3, November 30, 2021.

The current ratio gauges a company’s capacity to pay down short-term debt using current assets.

This represents a major improvement in the company’s liquidity.

Share prices could catch up to this forward momentum in the near future.

Should You Buy Artificial Intelligence Stocks?

Many retail investors are asking the same question, and the truth is that there’s no simple answer.

Whether you should buy artificial intelligence stock really depends on your investment goals and risk tolerance.

This is an emerging tech that’s beaming with potential, but many companies in their field need to prove themselves.

Still, with the rising importance of artificial intelligence, it’s definitely worth your consideration — especially if you can grab some of the best stocks at an affordable price point.

Artificial intelligence stocks are rarer than you might imagine right now.

Although many tech companies are gravitating toward AI initiatives and machine learning, few public artificial intelligence stocks exist.

Even so, stocks under $1 can be a great launching point for new traders if the odds look good.

Day traders who crave volatility will find some at these low share prices.

AI Penny Stocks Under $1: What to Look for

It might be challenging to determine which ones to invest in, especially if you’re looking at several AI penny stocks at once.

Individual equities may be a suitable alternative for your portfolio, but there are certain things you should look for when purchasing AI stocks.

Check the Company’s Market

When keeping an eye out for AI stocks, you should check if the company is in a growing market.

Make sure that the market they are in is competitive.

Furthermore, focus on companies that are using artificial intelligence to improve products or gain a strategic edge.

Research the Company’s Stock History

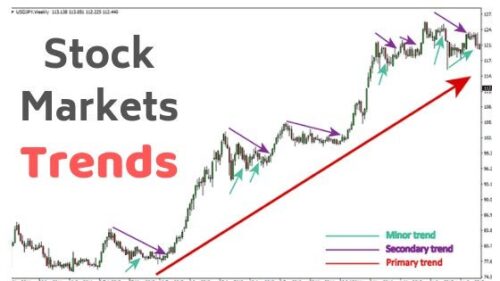

When buying AI stocks, you should always check their history by looking at their stock chart.

If the company is publicly traded and listed, the stock chart will appear at the top of the search results.

This is an excellent place to start if you are looking for stocks specifically for their volatility.

Check for Stock Trends

When analyzing a stock chart, check for a significant period where the price drop has slowed or drifted.

Also, take note of the current price.

Then find out how it has fared in the past weeks, months, and years.

This method will help you to identify patterns for the given stock.

Where to Buy Artificial Intelligence Penny Stocks Under $1

More and more investors are looking to AI penny stocks to diversify their portfolios, using them as an opportunity to earn solid gains in the short or long term.

However, many newcomers in the market for stocks valued at less than $1 are lost about where to find them.

This is understandable, as many stock screeners don’t even have an AI filter because the tech is so new.

If you’re interested in buying artificial intelligence stocks, check out some of these platforms.

eToro

eToro is a US-licensed and regulated online broker with multiple licenses from other international bodies across the world.

The platform serves over 20 million traders globally and has been rated the best social and copy trading system provider.

It was first established in Tel Aviv, Israel, where the company is currently headquartered, before being established in many other countries.

Currently, eToro operates in the US under SEC regulations and has licenses to operate in more than 100 countries worldwide.

eToro trades majorly in Tier 1 stocks ranging between $1 and $5.

Stash US Broker

Stash is a new school online broker that provides brokerage services to beginners in the US.

Like eToro, Stash offers Tier 1 stocks.

Trading on the Stash US Broker platform enables users to start their trading careers by taking small steps and increasing the size of their trades as they gain confidence.

When purchasing penny stocks through the online trading platform, individuals are charged $1 in fees, higher than other competitors in the US.

Robinhood

Robinhood is a US-regulated platform that offers commission-free brokerage services for stock trading, penny stocks, CFDs, options, and cryptos.

Unlike many brokers, the Robinhood platform abhors strict minimum deposit requirements, making it easy for investors to deposit any amount of money they need to buy penny stocks in the US.

We have seen how artificial intelligence will take over the world in the next few decades, so buying AI penny stocks could be a wise investment.

Artificial Intelligence Stocks Under $1: Final Thoughts

Artificial intelligence has remained a hot topic for a while now and will continue to make waves in years to come.

While the public markets have relatively few AI stocks to choose from, this will likely change when the space becomes more saturated with competing companies.

For now, $1 artificial intelligence stocks provide an affordable entry point into the industry.

The artificial intelligence sector’s rapid growth could be a profitable investment opportunity, and widespread adoption of this technology may come sooner than you think.

AI Stocks Under $1 FAQ

Read along for our answers to the most commonly asked questions about artificial intelligence stocks.

What Is AI?

Artificial intelligence is the process of programming a computer to make decisions for itself. This can be done through numerous methods, including but not limited to machine learning, natural language processing, and predictive modeling.

Why Are AI Penny Stocks So Popular?

AI penny stocks are popular because they offer investors the opportunity to get in on the ground floor of what could be the next big thing. Many believe that artificial intelligence is going to play a major role in the future of technology, and investing in AI penny stocks is a way to get exposure to that growth.

What Are the Advantages of Trading AI Stocks?

AI stocks are all the rage right now, and for good reason. Many companies and investors alike see the potential AI brings to the world, and they want to tap into the benefits for themselves.

Many of the top Fortune 500 firms have AI implementation plans on the radar. With such a rush coming down the pipe, new tech companies specializing in AI can rise up and enjoy some of the spoils.

These new AI companies open the door for trade opportunities in a space with just as much long-term growth potential. Everyone’s clamoring for a piece of the business, but not everyone will make it.

Following the hype surrounding a specific technology or business can send share prices to new heights. Following these trends can lead to the gains traders are always on the hunt for.

That said, it’s still crucially important to dodge the potholes along the way. Many AI startups with plans of grandeur will never make good on their word.

As with any other sector, check for solid use cases and a solid financial platform to stand on. Trade based on insights, patterns, and actually data instead of just speculation.

What Is the Best AI Stock Under $1?

Artificial Intelligence Technology Solutions Inc. offers a great opportunity for investors seeking to invest in AI penny stocks. The company has a market capitalization of just over $85 million and has recently been making waves due to its consistent growth in revenue. Last year, the company recorded an 85% increase in sales.

Why Are AI Penny Stocks so Volatile?

AI penny stocks are volatile because they are still in their early stages of development. Many of these companies are still trying to prove their viability and may not have a proven track record. As a result, their stock prices can be quite volatile, rising and falling rapidly in response to news and speculation.

Is It Wise to Invest in AI Penny Stocks?

That depends on the individual investor. Some people may feel comfortable investing in AI penny stocks because they believe in the long-term potential of the industry and the high rewards that they will yield. Others may prefer to invest in more established companies that are less risky.

Tags:

Tags: