Stock trading can feel like a juggling act at times. It can be borderline impossible to figure out the next breakout stock, follow news alerts, and track gains all at the same time.

StocksToTrade tries to solve that problem with a suite of tools designed to make your investing life easier, but does it actually deliver?

My StocksToTrade review will give you the lowdown on all this platform has to offer.

StocksToTrade Review: Overview

Timothy Sykes founded StocksToTrade in 2009 after enjoying a lot of personal success in the stock market. Not wanting to keep that knowledge to himself, Sykes created a one-stop stock trading software platform with all the tools we would need to thrive.

There’s just one membership plan to choose from, but it enables access to all of the features StocksToTrade offers.

What is StocksToTrade?

As a cloud-based software program, it’s easy to access StocksToTrade from wherever you have internet.

I can jump on while stuck in traffic, waiting to pick up my kid from swimming, or from the beach.

To be an all-in-one platform, StocksToTrade even links up with some of the top brokerage firms to allow you to trade right on their site. As a result, it’s possible to perform stock trading with a large quantity of data and tools right at your fingertips.

Speaking of trading, I’m impressed by the number of features from scanners to charting and news that help me make smarter investments.

Is StocksToTrade Legit?

The trading software platform has been around since 2009, with well-known professional traders Timothy Sykes and Tim Bohen at the helm. Sykes and Bohen still lead the platform and continue to improve on its services.

The trading platform has connections with powerful brokerages such as ETRADE and Tradier Brokerage to further vouch for its legitimacy.

>> Already sold on StocksToTrade? Click HERE to sign up for an account TODAY! <<

StocksToTrade Review: Investing Strategy

Data’s the name of the game for StocksToTrade, but you don’t have to crave numbers to get a lot out of the platform.

I don’t mind digging into its methodical approach to finding stock opportunities, but some of its tools can find you recommendations in seconds through a sophisticated suite of indicators.

You’ll even get straightforward entry and exit strategies if you’re not up on all the lingo to maximize your chances at profit.

Sykes is perhaps best-known for his penny trading adventures, so StocksToTrade leans heavily into that as well if that’s your jam.

All in all, I think it’s a great approach to slinging stocks, straight from the headspace of a guru who’s done it successfully for years.

Next, I’d like to break down each of its features so you can get a deeper look at what the service offers you.

StocksToTrade Review: Features

This isn’t an exhaustive list, but StocksToTrade incorporates the following to help you conquer the market:

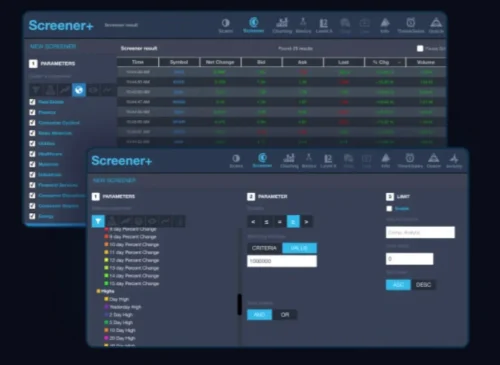

Scanning Tools

With a database of more than 19,000 stocks, having a slew of scanning tools to help you sort through them is a huge win in my book.

They’re remarkably easy to use in my opinion, despite the sheer amount of data pouring through them to find opportunities.

You’ve got a handful of pre-defined scans created by Tim himself, but you’re free to go deeper than that if you want.

The goal here is to find stocks that wouldn’t normally appear on your radar, and the platform performs this well.

Once recommendations are in hand, you’re free to curate watchlists to keep an eye on things.

Stocks To Trade Review: ORACLE

Stocks To Trade Review: ORACLE

ORACLE sees through the haze and gives focused information about a stock with nothing more than a click.

It’s proprietary software that runs 24/7 in real-time, pulling up all sorts of key data that can help you determine whether or not to invest.

All you need is the name of a company or a ticker, and the system kicks into high gear for you, spewing out (in a good way) quotes, recent news, and other details that can affect present and future stock price.

Charting

Charting

There’s no such thing as good trading software without charts, and StocksToTrade delivers here in spades.

This powerful tool features a lot of customization options, including the ability to choose between bar charts, line charts, and candlestick charts.

Furthermore, you can play with timeframes, giving insight into how a stock performed five minutes ago or last month.

Charts come jam-packed with momentum indicators such as pivot points, moving averages, and more.

Once I find info I like, I color-code it for quick access next time around to save time.

Watch Lists

One of my favorite StocksToTrade features is that I can set up as many watch lists as I want, even categorizing them so I can sift through them in record time.

You can set them and leave them, since the system will prompt you any time something falls into (or out of) the criteria you’ve defined.

The data lives out on the cloud, so it’s not tied to your office computer or phone, and you can access it from anywhere.

I really appreciate the freedom to live my life while still being constantly connected to my investments.

Live News and Twitter Updates

News can make or break a stock, which is why StocksToTrade filters news from several top sites, like the Wall Street Journal, MSN Money, Seeking Alpha, and Yahoo! to provide top trade ideas in real-time.

The fun doesn’t stop there, as the platform taps into social media feeds such as Twitter for breaking trade information as well.

It gets even better than that – you can filter all that noise for specific keywords, stocks, or time frames.

The best part for me is that it’s all done in real time. None of this “delayed 15 minutes” rubbish that always leaves you in a state of catch-up.

Level 2

Level 2 data lets you peek behind the curtain to see what price buyers and sellers are willing to trade stocks for.

I consider it a list of orders waiting to be filled, and the notion tells me if a particular company is in high demand or not.

There’s nothing unique about StocksToTrade’s Level 2 info that I can see, but it’s a feature I love using, and I’m glad it’s here.

When the goal is an all-in-one trading platform, adding in extra tools is clearly a huge step in the right direction.

Broker Integration

Most trading platforms give you all the data but require you to go elsewhere for the actual trading. Counterintuitive, if you ask me.

StocksToTrade integrates directly with Tradier Brokage and Interactive Brokers, so you can do it all right within the software, saving you time, stress, and potential for error while switching from one program to another.

Now that I’ve had my cake and eaten it too, it’s going to be very hard to use services without this connection.

Paper Trading

I’ve never been able to learn an entire platform overnight, and in my impatience, I tend to make costly mistakes.

Sykes and his crew eliminate that by offering paper trading with $30,000 in fake money to perform trades and learn how each of the tools work.

There’s absolutely no difference from trading real money, except there’s no risk of losing anything when you err (and trust me, you will).

As you dial in a strategy, it takes a few clicks to switch over to real investments and let the system work for you.

>> Like all that StocksToTrade has to offer? Click here to sign up NOW! <<

StocksToTrade Review: Platform Differentiators

StocksToTrade has carved a niche for itself with a comprehensive suite of features, from its Level 2 data to ORACLE and paper trading.

You can tell that the team put a lot of thought into these offerings to make sure we’re as equipped as possible to earn money while trading.

After all, if we win, the platform wins too.

With the ability to trade right within the platform, you’ve at least in theory got everything you need in one place, saving money and headaches.

I haven’t even touched on it yet, but StocksToTrade also has a comprehensive set of trading guides and additional resources to keep you in the know about its tools and essentials you need to better understand trading as a whole.

StocksToTrade Review: Cancellation Policy

There are no refunds for a StocksToTrade subscription once you make a purchase, so keep that in mind before you pull the trigger.

If you do need to cancel, you’ll still have access to all the tools until the end of your contract, when everything abruptly shuts off.

I’ve heard instances where you can request a refund within the first three days of your initial payment, but I haven’t tested this out myself.

StocksToTrade 14-Day Trial Review

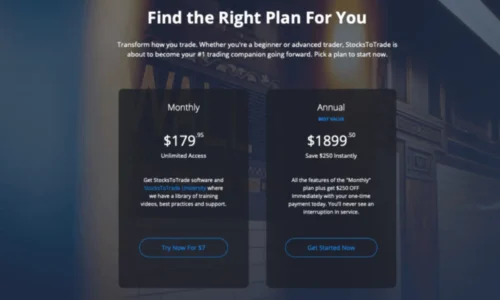

While you won’t get a free shot at StocksToTrade, the powers that be offer a 14-day trial for just $7, which is close enough to free in my opinion.

The two-week interval should be enough time for you to feel out what the software entails and see if it meets your needs.

You’ll have full access to all the platform’s tools, too, so this isn’t some demo version of a game where you only get the first level.

Should you not cancel your membership during the 14-day trial, StocksToTrade will automatically bill you on day 15 the cost of a full month’s membership.

StocksToTrade Review: How Much Does It Cost?

StocksToTrade Review: How Much Does It Cost?

StocksToTrade has only one plan, so you’re either all in or all the way out. I appreciate the lack of gimmicks or upsells here that can get very frustrating, very quickly.

The only decision you have to make is the duration of the plan, with monthly memberships at $179.95 or $1,899.50 for a full year.

You’ll save over $250 by buying a year upfront, so that’s definitely worth considering as long as you have confidence that the platform meets your needs.

Whatever you choose, you’ll continue to pay that rate unless you ever decide to cancel.

>> Ready to sign up for a StocksToTrade membership today? Click HERE to get started! <<

StocksToTrade Review: Pros and Cons

StocksToTrade has a lot going for it, but no system is perfect. Here are my top pros and cons:

| Category | Details |

|---|---|

| StocksToTrade Pros | • ORACLE proprietary scanning software algorithm • Heavily customizable scanner features • Top charting tools • Trade alerts feature • Unlimited watch lists • Social media and breaking news feeds • Includes Level 2 data • Paper trading |

| StocksToTrade Cons | • No free trial • Broker integration is still a bit limited • Cost can be prohibitive to some |

StocksToTrade Review: Is It Right for Me?

If you’ve never seen a stock before, you will be in immediate shock when you boot up StocksToTrade for the first time.

There are numbers and data (that you can customize) all over, but putting things into perspective takes time.

It’s awesome that Tim and his team spend so much time on educational materials to help you start on the right foot, and tools like ORACLE make it easy to search one ticker at a time.

Advanced users or those who have mastered the platform’s basics have a plethora of deep-dive tools to immerse themselves in.

That includes Level 2 data, more comprehensive indicators, and, in many ways, whatever you can come up with.

Once you’ve spent a little time on the inside, you’ll see how easy it is to navigate and how linking your broker into the app makes all the sense in the world.

Professional trader Tim Bohen uses the site for his trades daily, so you can be sure each tool was designed with even the expert trader in mind.

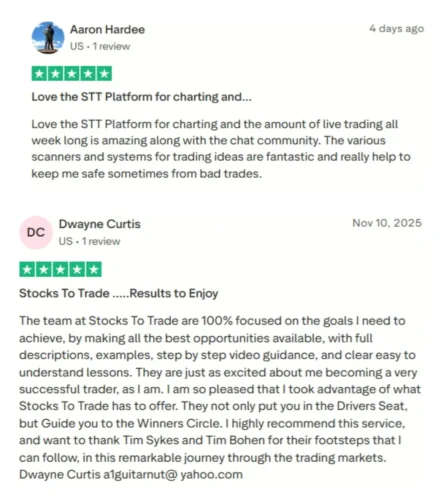

StocksToTrade Reviews by Members

StocksToTrade has several positive comments on its Twitter account, with subscribers sharing their trading success stories. Its TrustPilot rating currently sits at 4.0 stars with more than 907 active reviews.

I pulled some of the recent ones:

The general vibe is very positive, with the tools performing as advertised.

I’m not surprised by mentions of a learning curve; I definitely felt that too when starting out.

Not everyone’s experiences will line up with these, but it’s encouraging to hear that a lot of people share my take on what StocksToTrade can do.

StocksToTrade Review: Is It Worth It?

There’s a lot of love within StocksToTrade’s massive tool chest, and the best way to figure that out for yourself is to start with the 14-day trial.

I spend a healthy amount of time (my wife may not agree with this) using the scanners to find trades to make, and although I can design my own, I still defer to ORACLE a lot.

It will be very difficult to look at platforms that don’t integrate brokerages in the same way after using this, because it just makes sense this way.

Plus, you’ve got the backing of two trading gurus who have done very, very well for themselves working from behind the scenes.

The sticker price will scare some people off, but if you can move past that, the powerful features here can help you make that money back.

I believe StocksToTrade is worth every penny, and I think you owe it to yourself to find that out as well.

StocksToTrade Frequently Asked Questions (FAQ)

How does StocksToTrade’s trial work, and what are its limitations?

Covers the different trial tiers (e.g. $7 basic, $17 for news & chat) and what features are restricted. support.stockstotrade.com

What are the most valuable features included in a StocksToTrade subscription?

Real-time Level 1 (and optional Level 2) data, strategy scanners, custom alerts, SEC filings, news stream, charting tools, and paper trading.

Is StocksToTrade suitable for beginners, or is it more geared toward experienced day traders?

Because of its robust tools, it may have a learning curve, but paper trading and built-in scans make it usable for newer traders.

Beyond the subscription, users should check if they need paid add-ons (like Level 2 data) and whether trial plans auto-convert.

How reliable is StocksToTrade’s customer support?

While many users praise the platform, some reviews (e.g., on Trustpilot) mention slow response times and occasional service issues.

Can StocksToTrade integrate with brokerages or external data sources?

Yes — it supports brokerage integration and real-time data across key U.S. exchanges.

Bonus nuance: For users connecting with Interactive Brokers, check whether there are additional data-feed fees.

Does StocksToTrade offer tools to identify risky or low-quality stocks?

Yes — with custom scans, news filtering, and SEC filings, users can more easily flag stocks with red flags.

How does StocksToTrade handle market news and SEC filings?

The platform provides a real-time, criteria-based news stream and a direct feed of SEC filings.

Is there a paper trading option to practice without risking real money?

Yes. StocksToTrade includes a paper trading / simulated trading tool so you can test strategies without risk.

What happens if I cancel my StocksToTrade subscription during or after the trial?

According to their policy, trial plans convert to paid subscriptions if not canceled. Refunds depend on the terms, which may not apply to trial fees.

Does StocksToTrade have community or chatroom access, and how valuable is it?

Yes — some plans include chat rooms like “Breaking News Chat” and “Small Cap Rockets,” which many users leverage for real-time insights.

Are there any common complaints or controversies about StocksToTrade?

Some users and third-party sites allege upselling, questionable business practices, and even a court case.

Others have reported issues with platform stability or data glitches.

How suitable is StocksToTrade for swing trading vs. day trading?

While it supports both, its real-time data, scanners, and alerts make it particularly powerful for short-term / day trading.

Can you export data, watchlists, or scan results from StocksToTrade?

Depending on your plan and usage, you might export watchlists or scan outputs — users often want to analyze off-platform.

Is StocksToTrade a good investment for long-term use, or is it more of a short-term tool?

This depends on your trading volume, strategy, and how much value you derive from its scanning and real-time tools.

Tags:

Tags: