If you’ve been trading for any amount of time, you don’t need to be told that beating the market is about more than strategy.

Your mindset also plays a big role in your success, so we’ve compiled a list of the best trading psychology books for 2021.

A lot of trading comes down to how honed your trading psychology is.

It’s all about building your mental strength, so you stick to a plan and monitor your own actions and reactions.

Patience, discipline, and impulse control are all psychological traits that can be developed and strengthened by traders over time.

So a guide on psychology can be a trader’s best friend.

If you want to be profitable, read all about the best trading psychology books below!

Why You Should Read the Best Trading Psychology Books Available

All of the best psychology trading books have one thing in common: they give the best wisdom and insight to new and experienced traders.

While trading strategies are important, so is understanding how you act and react to big gains, steep losses, and overall stress.

It doesn’t matter if you’re day trading or playing the long game, performance is almost always impacted by psychology.

These books are your guide on how to free yourself from emotions that may be holding you back as an investor.

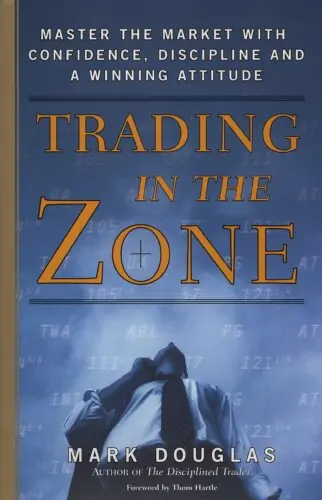

1. Trading in the Zone by Mark Douglas

Trading in the Zone is often at the top of people’s lists of books on trading psychology.

Mark Douglas is a skilled author, experienced trader, and trading psychology pioneer.

Mark Douglas began trading in the 1970s when he left his job as an executive at a commercial insurance firm to become a broker for Merrill Lynch in Chicago.

He studied hard and became a licensed broker and continued to trade for several years.

As a broker, he understood that most people couldn’t truly predict what the stock market would do — regardless of how strong their trading strategy is.

This sparked his psychological interest, and he began to document the psychological side of every trade that he made.

That documentation led to his first book, The Disciplined Trader (number 7 on our list).

He continued his documentation for years and began teaching others his strategies and what he’d learn from his self-analysis.

The result is his book, Trading in the Zone.

While this may not be his first book, it is certainly the first book most traders should read.

It helps new traders focus on their positive and negative psychological traits.

What’s more, the book teaches you how to strengthen positive traits and shut down negative ones.

This mastery can help any good trader become the best trader they can be.

>> Click Here To Check The Price Of Trading In The Zone! <<

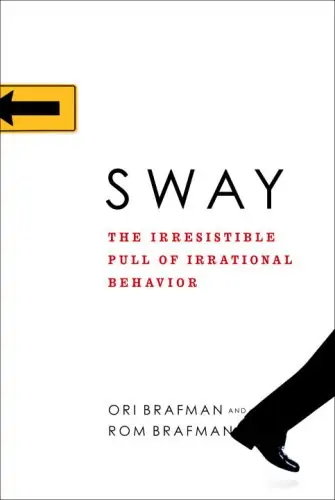

2. Sway: The Irresistible Pull of Irrational Behavior by Ori Rafman and Brom Rafman

Sway is as interesting a human psychology book as it is a trading psychology book.

It takes psychological concepts from other parts of life and likens them to trading psychology.

This trading psychology book will clearly interest readers who may not have any interest in trading and investing.

Sway’s writing covers commitments to negative scenarios, risk-taking in decision-making, diagnostic bias, and the chameleon effect.

The chameleon effect is a particularly interesting psychological concept that affects traders.

Under the chameleon effect, people are more likely to display traits that are assigned to them.

This can be positive or negative, depending on the traits being assigned.

If you’re looking for a solid book about the psychology of trading as well as other psychological aspects of life, check out Sway.

>> Click Here To Check The Price Of Sway! <<

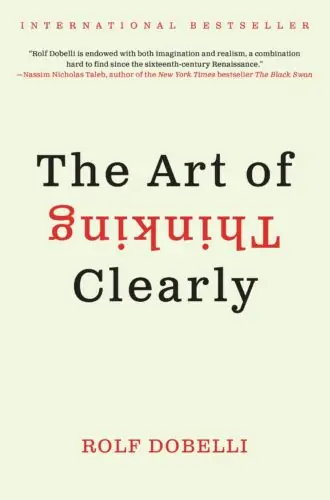

3. The Art of Thinking Clearly by Rolf Dobelli

When it comes to trading psychology books, The Art of Thinking Clearly is unique in its structure.

The author, Rolf Dobelli, presents extensive information on how to improve a trader’s psychological approach.

These chapters are only a few pages long and are about a psychological pitfall that traders may experience when trading on the stock market.

This book helps you improve your trading by detailing all of the decisions that can put a halt to your growth and development in the financial markets.

Some of the chapters include the following:

- Don’t Take News Anchors Seriously

- Why Watching and Waiting is Torture

- How to Relieve People of Their Millions

If you’re looking for a resource with short chapters that can help you with your trading decisions (particularly what decisions to avoid), then reading this book can help.

>> Click Here To Check The Price Of The Art Of Thinking Clearly! <<

4. Trading Psychology 2.0 by Dr. Brett Steenbarger

Dr. Steenbarger is famous in the trading world, and he’s likely the closest to a trading psychologist on this list.

His trading success has made him an authority on the subject.

As a trading coach, his goal has been to help traders in real-world situations by blending his expertise in psychology with his high performance in the stock markets.

Not only does Dr. Steenbarger work for highly successful trading firms on Wall Street, but he also teaches as a professor at the State University of New York.

His class emphasizes powerful therapies for the mentally well.

Dr. Brett Steenbarger believes that once traders have reached their peak, it’s important to stay there.

And a trader’s strategy and healthy habits are how successful traders can keep winning in the markets.

If you want a technical analysis of human psychology applied to the art of trading, Trading Psychology 2.0 is your best bet.

>> Click Here To Check The Price Of Trading Psychology 2.0! <<

5. Market Mind Games by Denise Shull

Market Mind Games is a must-read, highly scientific book written by Denise Shull.

Rather than focusing on anecdotal information and individual practical experiences, it’s written more like a scientific research journal.

Its unique perspective is why many traders find it to be one of the best books on psychological strategy.

While it still draws from Shull’s experiences, it analyzes them using biological and psychological reasoning, assigning them to the emotions felt while trading.

It’s a highly analytical trading book that many traders can benefit from.

Shull explores emotional interference in the trading world as well as how to avoid the behaviors that ultimately conflict with good decision-making.

It teaches traders to become more self-aware and profitable by using science to predict outcomes.

According to Shull, one of the biggest issues that traders face is that they believe a good feeling or a good hunch will lead to profits.

Even though some emotions are positive, this doesn’t mean that having these feelings will result in success within the markets.

She’s a performance coach who uses modern psychological techniques in her teaching that are designed to boost profits and reduce risk when trading.

As such, she has become quite sought after by more than one hedge fund for her skills.

Her work isn’t just with top traders; she also works with professional athletes.

Overall, her focus is on winning and avoiding risk — no matter where it needs to happen.

>> Click Here To Check The Price Of Market Mind Games! <<

6. Market Wizards by Jack Schwager

While this book may not be entirely about trading psychology, it is a very popular trading book that can give you the tools to increase your profits.

Market Wizards focuses on interviews with advanced traders of all kinds.

The author, Jack Schwager, describes these people as “market wizards.”

Each chapter is an interview with a high-performing trader.

These traders aren’t just successful, however, they’re the most successful traders in their areas and of their generation.

While there is no emphasis on the psychology of trading, you can pick up on the impact that their attitudes and outlooks have on their strategies.

Schwager delivers a guide that can be used by traders of all backgrounds.

Nearly all of the market wizards in the book attribute their success within financial markets to their strategies and good trading psychology.

When reading the book you’ll find plenty of pieces of wisdom and advice provided by the experts and top traders being interviewed.

Schwager does a fantastic job of putting together all of the information any new trader needs to start crafting a winning strategy.

If you’re looking for guidance, grab a copy of this book, it’s a must-read.

>> Click Here To Check The Price Of Market Wizards! <<

7. The Disciplined Trader by Mark Douglas

As you might guess, this book is all about the discipline it takes to be a successful trader.

Where Trading in the Zone is more about the further lessons that Douglas taught himself while trading, The Disciplined Trader is specifically about self-discipline.

This book was published in 1990 and was one of the first trading books to focus heavily on trading methodology.

It is also one of the most popular trading books on the market and has been for quite some time.

While other books seem stiff and educational, this one has a conversational tone, making it far easier to read for most people.

When reading about Douglas’s struggle with self-discipline and other psychological traits, you’ll likely have a few epiphanies about your own methods in trading.

>> Click Here To Check The Disciplined Trader! <<

8. Trading to Win by Dr. Ari Kiev

If you want to trade in the market with confidence, Trading to Win is a good way to prepare yourself.

The author, Dr. Ari Kiev, worked with professional athletes and Wall Street traders to help them achieve peak performance.

Unfortunately, Dr. Kieve passed away in 2009, but not before publishing an impressive book for day traders.

In the 1970s, Dr. Kiev’s helped patients with issues that affected their confidence, self-worth, and performance.

He worked with them to improve their self-reliance and coping mechanisms.

Doing so made them more adequately prepared to overcome obstacles in their lives.

While studying at Harvard, his passion for sports led him to examine the psychological barriers in athletes.

His work speculates that many athletes faced the same issues with self-doubt that many of his medical patients dealt with.

Using similar techniques that he would employ in a medical setting, he helped train athletes to overcome these issues.

Dr. Kiev was then approached and asked to apply his work to top-level Wall Street traders.

The coaching resulted in these traders improving their techniques to make money.

Dr. Kiev continued to study the psychology behind the decisions made by these top-level traders, resulting in a huge body of work that spanned over 2 decades.

This is the best book in his bibliography if you want to trade with confidence and be free from doubt.

>> Click Here To Check The Price Of Trading To Win! <<

9. Reminiscences of a Stock Operator by Edwin Lefèvre

Reminiscences of a Stock Operator proves tried and true techniques still have a place in the modern world.

The book, written by Edwin Lefèvre, focuses on the life of Jesse Livermore. Jesse Livermore was a legendary trader that many people aspire to be like.

Lefèvre writes Livermore’s story beautifully, in a way that only classic storytelling can accomplish.

The book provides a deep analysis of what it takes to trade successfully.

It also doesn’t shy away from what actions can ruin a trader.

The book is a must-read for any aspiring trader, whether or not their interested in long trades or day trading.

If you’re just beginning to think about day trading, reading this book needs to be on your to-do list.

It gives you a practical look at the life of a highly successful trader.

The story of Jesse Livermore is an important one in the world of day trading.

Although the book was first published in 1923, it still holds a place as one of the most valuable trading books available.

>> Click Here To Check The Price Of Reminiscences Of A Stock Operator! <<

Honorable Mentions

In addition to our list, here are two more books you should consider picking up after reading our entries.

- Trade Your Way to Financial Freedom by Dr. Van K. Tharp (breaking bad trading habits)

- The Daily Trading Coach by Brett Steenbarger (101 lessons to improve trading habits)

These books offer fantastic supplemental strategies to improve your trading.

Best Trading Psychology Books: Final Thoughts

The main goal of any trader is to maintain consistent profits and minimize risk when trading.

To achieve this, you must have effective trading strategies, and you must nurture a healthy mindset.

Being profitable is great, but if you can’t maintain the necessary mental health to enjoy wealth, then making money means next to nothing.

When you control your emotions, you control your success.

Whether you’re planning on starting a hedge fund becoming, day trading, or becoming a daily trading coach, the books on this list offer a solid look at the psychology of trading.

These books provide wisdom and insights on the most important habits that a trader should abide by.

Consider picking up any (or all) of the titles on this list of best books if you want to trade effectively and free yourself from the emotions holding you back.

Tags:

Tags: