Weiss Ratings’ proprietary stock analysis system is at it again, sounding warning bells about another AI boom that could mint another set of millionaires or cause portfolios to crumble.

Is this system’s research really on point? I investigate in this Weiss Ratings Plus review.

What Is Weiss Ratings Plus?

Weiss Ratings Plus is a premier service published by none other than the minds at Weiss Ratings.

It’s designed to provide actionable research and insights through data-driven systems that cut through the crap to deliver unbiased ratings.

Built upon the company’s proprietary ratings system, it uses thousands of algorithms to study 50,000+ stocks, ETFs, mutual funds, crypto, and the like.

The results are crystal-clear A-F ratings indicating whether a stock is in buy, hold, or sell mode.

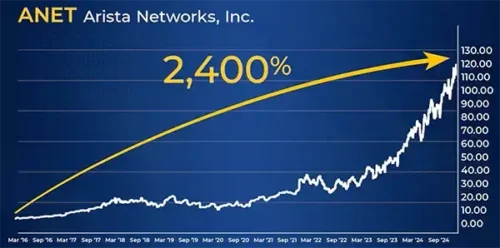

Users benefit from precise and to-the-minute notifications when it’s time to take action, which has earned an average of 303% returns on buy ratings over the past 22 years.

There are also a slew of customizable features and tools for getting the most out of the software, but more on that later.

First, what’s the current focus for the Weiss Ratings team?

>> Curious? Click to Know More <<

Weiss Ratings’ Presentation: AI’s Second Wind

Artificial intelligence is the latest great breakthrough of our time, leading to all sorts of new companies vying for space in the ever-expanding market.

That surge paid off in spades for early adapters, creating more than 500,000 new millionaires in the United States alone.

I’ve been watching the sector for some time now, wondering if latecomers to the party missed their chance to participate.

As it turns out, the experts at Weiss Ratings estimate that AI is about to catch its second wind that could lead to an even bigger boom than the first time around.

If they’re right, that’s something we all want to be on the forefront of. With several new catalysts on the way, it looks like we don’t have a ton of time to prepare.

>> Try RPL-AI Second Wave Now <<

What’s Fueling the Next Wave of Innovation

It comes as no surprise to me that our country’s current administration is an important factor.

Like him or not, President Trump’s voice carries further than most.

He’s one of the most pro-business, pro-tech, and pro-innovation presidents we’ve seen in some time.

Moreover, the team he’s assembled is rallying to the cause.

They’re all actively involved in these endeavors, building out the infrastructure for AI with new power plants, data centers, and all the other key components to make this new software more successful than ever.

We’ve also seen them clearing away regulations that stand in the way of bringing new technologies like AI into the mix that have been keeping the software moving at a snail’s pace.

Recent developments by Chinese companies have also lit a fire under our butts to be the best, no different from the Soviet Union and the space race over 60 years ago.

How To Cash In on AI’s Big Boom

There’s a lot happening in artificial intelligence, but that doesn’t mean every investment is a good one.

For every company we see rising to the challenge, many more disappear into the recesses of the market, never to be seen again.

That’s why it’s so important to play our cards right, lest our hard-earned capital go down with the proverbial ship.

Enter Weiss Ratings. It has been on the cutting edge of stock breakouts for decades thanks to a proprietary ratings system, and it’s unearthed a number of exciting opportunities from the upcoming AI surge alone.

You can get instant access to these insights and a whole lot more by signing up for their service, Weiss Ratings Plus. Join me as I unpack everything that you get for signing up.

>> HUGE 79% Discount If You Join Now <<

Weiss Ratings Plus Review: What’s Included in RPL-AI Second Wave?

Here are all the features that come with a Weiss Ratings Plus membership:

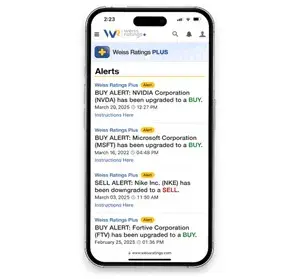

The Weiss Ratings system is constantly scanning its long list of over 15,000 stocks for even the most subtle changes that could push it into “buy” or “sell” status.

It runs over one billion calculations every day to make this determination, sometimes looking at metrics we wouldn’t even think to check.

Should a shift happen that you should take action on, you’ll get an immediate notification in your inbox so you know what to do and when to do it.

After all, getting in and out at the right moment is over half the battle when it comes to landing those returns.

The platform’s completely customizable too, so you can change what you get notified about.

For me, it’s a breath of fresh air that takes away a lot of the stresses in my investment strategy.

Custom Reports

After signing up for Weiss Ratings Plus, you receive a unique portal access where you can search up any stock name or ticker symbol you want to see its up-to-date grade.

You’ll also see how the security performs against a handful of key indicators such as growth or dividends that further help you make an educated decision on what moves to make, akin to what the Motley Fool does with its data.

If that’s not enough, it’s possible to create custom reports using only information you deem necessary in each of your inquiries to give you the biggest bang for your buck.

I’ve found the tool super simple to use, since all you need is a company name to get the data you need at your fingertips.

My favorite part is that there are no limitations on how many requests you can make or how many custom reports you can run, giving you unprecedented freedom while using the tool.

Comprehensive Stock Market Insight

I love using the platform to dig up information on my top stock picks as well.

Within the Weiss Ratings system, you’re free to check on the history of any ticker you’re interested in and see where it’s moved up and down over the years.

You can broaden your search to entire industries or sectors if you’d like to see which area’s doing the best, or stocks within them trending upward that you may have overlooked.

This is real, hard data that gives clear insights into the stock market.

There are also a ton of filters you can play with, and comparative searches that I personally enjoy the most.

The team also hands out a Weiss Ratings Plus Masterclass series that gives a thorough behind-the-scenes take on how the entire platform works.

There’s nothing I appreciate more than already making a simple system even more accessible. Knowing how to unlock the secrets of each feature is a huge win in my book.

While you’re watching, the crew provides actual examples on-screen that allow you to see firsthand how they execute searches and find hidden opportunities. Show me another service that does that. Go ahead, I’m waiting.

By the way, the content is crisp and clear, meaning just about everyone can benefit with little to no prior experience.

I often go back to the video series for a refresher, and I’m thankful it’s there.

Access to Customer Care

Access to Customer Care

Customer care is an important part of any service for me, and Weiss Ratings Plus does not disappoint.

They provide a toll-free number for the U.S. and an alternative option for calling from overseas during normal business hours from 9 am to 5:30 pm Eastern time.

I’ve never been able to hide my dislike of automated assistants, so being able to reach a real person means a lot to me.

In my experience, they’re quick to answer, and I’ve never had an issue with language barriers or unclear conversation so I can get off the phone fast.

It’s also possible to email the team at any time with questions or concerns you might have.

You won’t get an immediate reply, but I’ve never been kept waiting long.

>> Already made up your mind? Click Now! <<

Weiss Ratings Plus Special Reports

Right now, you can score each of these special reports for free by joining Weiss Ratings Plus:

In anticipation of AI’s next big boom, the Weiss Ratings team has been hard at work cataloging the stocks they feel will surge the highest this year.

They’ve compiled the top ten in this bonus report that are recent converts to “buy” status that you can move on right away.

The report shares the names and ticker symbols of each opportunity, along with a detailed explanation of why each one made the list.

I haven’t heard of some of these, and I’m not sure I would have found them without help from Weiss Ratings.

To me, that’s where a service such as this really shines. I don’t need it to find stocks for me that I already know about.

With any big boom, there are always stocks that get lost in the shuffle or fall by the wayside because they can’t keep up with emerging trends.

Since Weiss Ratings is as instrumental at finding good picks as it is the bad, the team has pinpointed five stocks they believe will let us down.

One of them was a big surprise for me, but I wasn’t about to keep it in my portfolio and risk losing all the gains I plan to make with the system’s top recommendations.

Weiss Ratings does a great job here of explaining why each pick looks to be a bust in the coming months. That gave me the confidence I needed to sell before it’s too late, which admittedly is hard for me to do.

Weiss Ratings is one of the first systems to rate cryptocurrencies along with stocks.

Those buy and sell alerts I’ve been talking about work for these coins as well, making it that much more useful for generating wealth.

The team went ahead and used the platform to predict the top-rated cryptos for 2025, showcasing that research in this special report.

Even if you’re not into crypto yet, the insights here reveal what each of these digital currencies are and why they could explode this year.

You’ll have the tools you need to make trades in another sector that could win big in the coming months.

The bonuses keep on coming, this time with an exclusive X-Lists trifecta of content you can’t get anywhere else:

- The World’s Weakest and Strongest Banks

- America’s Weakest and Strongest Stocks and ETFs

- The World’s Weakest and Strongest Cryptos

I’ll never turn down freebies, and these guides unlock the ability to look up just about everything Weiss Ratings evaluates.

In my opinion, they’re super helpful to make laser-fast judgments about which investments and institutions to lean into or avoid.

You’ll likely use them as often as I do, which is why I never keep them far from my digital reach.

>> Try RPL-AI Second Wave At A Special Price TODAY! <<

Pros and Cons

After checking out every nook and cranny, here are the top pros and cons I’ve uncovered for Weiss Ratings Plus:

| Category | Details |

|---|---|

| Pros |

|

| Cons |

|

>> Claim Your SPECIAL DISCOUNT Now <<

Weiss Ratings Plus Pricing and Refund Policy

Weiss Ratings Plus Pricing and Refund Policy

The Weiss Team values this bundle at $465, but you can get it all for just $99 with a Premium Membership if you act now.

You’re saving a whopping 79% off the cover price, which boils down to less than $2 per week for complete access to everything on offer here.

Just being transparent, that’s an incredible price point for the amount of content you receive here.

Plus, that membership fee will never change as long as you stay a member, meaning you’re locked in at this low rate for the rest of your days when it comes time to renew.

If you’re only interested in the special reports and not Weiss’s service, you can snag those for a one-time fee of $49.

While pricing is straightforward, I’ll be the first to admit that Weiss Ratings Plus‘s refund policy is a bit confusing.

Subscribers can cancel a Premium Membership at any time during their year of use for a prorated credit, so it is dependent on when you throw in the towel.

If you opt only for the report set, there is no refund on the money you’re putting down.

Is Weiss Ratings Plus Worth It in 2025?

I like newsletters as much as the next guy, but Weiss Ratings Plus foregoes such content in favor of cold, hard data that you can use to determine at a glance if a stock is a buy, sell, or something in between.

The system spits out when opportunities are ripe, but you’re also given the keys to play with it as you like, unlocking the potential to find even more stocks you wouldn’t have otherwise.

Each special report helps steer you in the right direction if you need some help, culminating with a step-by-step Masterclass that reveals how to get the most out of this package.

To cap it all off, the Weiss Team is practically giving everything away with its $99 per year price tag that will never go up as long as you remain a member.

Sign up for Weiss Ratings Plus today if you don’t want to get left behind as AI (or any other breakthrough) goes center stage.

Weiss Ratings Frequently Asked Questions (FAQ)

Can Weiss Ratings Plus be used alongside other investment advisory services?

Yes. Many investors use Weiss Ratings Plus as a data-driven filter alongside other newsletters to confirm or challenge stock ideas. It works well as a second-opinion tool.

How much time does a typical subscriber need to use Weiss Ratings Plus effectively?

Most subscribers only need 10–20 minutes per week to review alerts and check ratings. It’s designed for minimal daily maintenance.

Does Weiss Ratings Plus offer tools for screening or comparing multiple stocks at once?

Yes. The platform allows you to filter and compare stocks based on safety, performance, volatility, and ratings history — helpful for building your own watchlist or portfolio.

Can Weiss Ratings Plus help identify overvalued or high-risk stocks to avoid?

Absolutely. The service is strong at flagging weak or deteriorating stocks using its “Safety” and “Risk” ratings, helping investors avoid potential blow-ups.

Does Weiss Ratings Plus work well for passive index fund investors?

Surprisingly, yes. Even index investors use it to understand market health, risk levels, and sector trends. It helps determine when markets are more favorable or risky.

How frequently does the AI model get updated or recalibrated?

Weiss Ratings regularly updates its algorithms based on new data, market conditions, and historical backtesting. Updates are usually seamless and don’t require user action.

Is there a learning curve for using the rating tools and dashboards?

A small one — but Weiss provides tutorials, walk-throughs, and definitions that make it beginner-friendly within a day or two.

Can I export stock ratings or watchlists to Excel or Google Sheets?

Some subscription tiers allow data exports for subscribers who want to analyze stocks independently.

Does Weiss Ratings Plus include sector or industry analysis?

Yes. Several tools show trends by sector and include sector-level safety ratings, which help identify industries that are strengthening or weakening.

Does the service work for international stocks, or U.S. only?

Weiss Ratings primarily covers U.S. stocks, but certain tools may include limited international coverage depending on the exchange.

Weiss Ratings is known for offering multiple research tiers, so subscribers may receive optional upgrade promotions. The base subscription is functional on its own.

What type of investor gets the least value from Weiss Ratings Plus?

Day traders and ultra-short-term traders usually prefer real-time tools, whereas Weiss Ratings is more aligned with swing, position, and long-term investing.

Does Weiss Ratings Plus include backtested results for its ratings?

Some performance metrics are available, but full backtests are not always included. Subscribers often rely on historical rating changes to infer trends.

Can Weiss Ratings Plus help retirees or income-focused investors?

Yes — it’s particularly useful for assessing the safety and long-term stability of dividend stocks and income-focused holdings.

Does Weiss Ratings Plus provide alerts when a stock’s safety rating drops?

Yes, rating changes — especially downgrades — often trigger alerts so investors can adjust their portfolios proactively.

How transparent is Weiss about how their AI makes decisions?

Weiss provides general methodology (e.g., momentum, volatility, earnings strength), but like most financial AI systems, it does not disclose every variable.

Are Weiss Ratings Plus alerts real-time or delayed?

Alerts are not real-time. They’re delivered after ratings updates, typically daily or weekly — suitable for non-day-trading strategies.

Tags:

Tags: