Traders might sometimes see their holdings halted by the stock exchange, stopping all trade. While it is very disconcerting as a stockholder, why do stocks get halted at all? What are the triggers, and does it spell trouble? We checked out the reason, and here are the answers.

What Is a Trading Halt?

A trading halt is the temporary suspension of either one or several shares.

It can happen at a single exchange or on multiple stock markets.

Trading halts may cause open orders for the security to be canceled.

Similarly, all options with it as their underlying asset might be exercised.

These stoppages can be regulated or non-regulated (we will explain this in the next section).

These halts can occur at any time during the day. But usually, they are executed at the opening of trade.

Most often, they do not last more than an hour. However, it can go longer depending on the reason it was done.

Again, trading halts might be implemented several times a day on the same share.

A larger restriction on all transactions might get triggered when a benchmark index such as the S&P 500 suffers a severe fall during intraday trade.

This phenomenon is known as a circuit breaker, which we will also help you understand.

Why Do Stocks Get Halted?

Stocks can get halted due to regulatory or non-regulatory issues.

It could be done in anticipation of major announcements, to correct an imbalance in orders due to a technical glitch, or for several other reasons.

Regulatory Stock Halt

A simple example could be suspending a security to ensure that material news regarding a firm is properly circulated.

For example, in 2010, the Australian stock exchange halted trading in Sundance Resources Ltd because of a request from the firm.

There had been a tragic incident regarding a flight that had gone missing with six of their executives, including the CEO.

The company wanted the news to reach all market participants properly.

There could be several other such instances:

- Mergers and acquisitions

- Legal decisions

- Management change

- Regulatory approvals (especially for drug manufacturers)

The purpose of such halts is to stop any profiteering that might arise out of an imbalance of information.

Non-Regulatory Trading Halt

These can happen because there is too big of an imbalance between buy and sell orders.

(Only applicable to the New York Stock Exchange, not Nasdaq)

Typically, this occurs when the market opens after a piece of major news has been released.

It may cause too many traders to place only one type of order (buy or sell).

In such a situation, the exchange would try to correct the imbalance by restricting trade for a few minutes.

The key difference between these and regulatory halts is that they are implemented across all exchanges, not just the one where they originated.

Suspension of Trading by The SEC

It is also possible for the Securities and Exchange Commission (SEC) to suspend trading in any publicly traded stock.

The halt can last for a period of up to ten days, but this is a very rare occurrence.

It happens if the SEC believes the public might be at risk in trading the security.

For example, if the company’s financial health is weak or it has failed to file compliance-related reports, the commission may take action to stop trading in the security.

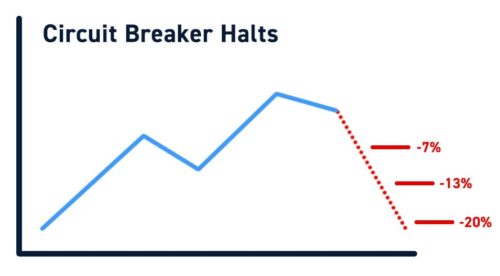

Market Wide Trading Halts (Circuit Breakers)

When a particular stock, or perhaps a whole index, sees a substantial decline in prices during intraday trading, a circuit breaker is triggered.

Exchanges have rules to ensure that these halts do not fuel panic in the markets.

For example, the NYSE has three circuit breakers for the S&P 500 at 7%, 13%, and 20%.

While the first two invite a 15-minute halt, the third will cause all activity to be suspended until the next trading session.

Not just indexes; each security also has its own individual circuit breakers.

For example, there might be a rule on a 10% drop in some stock in a 5-minute duration.

The limits are decided based on how severe the decline is, how quickly it happens, and the valuation of the share.

Brokerage Trading Halts

When there is an imbalance in buy and sell orders, brokerage firms can sometimes get impacted.

They might be unable to pay the clearinghouse for a particular security.

In such situations, a trading halt can be triggered by them.

How Long Do They Last?

Typically, nonregulatory stock halts only last a few minutes until order imbalances are corrected.

Market-wide trading suspensions might stay on for an hour or even more, as the intention is to allow a piece of significant news to propagate to the public.

A trading suspension implemented by the SEC can last until it deems the security fit to trade again on the stock market.

Who Can Trigger One?

As explained earlier, there are three possible sources of a stock halt:

- The primary exchange where a share is listed

- A brokerage trading the security

- The SEC

Each such suspension has a code assigned to it.

It is possible to ascertain the source and reason behind the trading halt by checking what the code means.

We discuss some of them below.

NASDAQ Stock Halt Codes

As mentioned before, each stock exchange has a list of codes that are assigned to shares that have been halted.

Some of the common ones used by NASDAQ are mentioned below:

T1: Halt due to News Pending: Trading is halted pending the release of significant (or material) news.

T2: Halt – News Released: Trading is halted to allow investors to assimilate news released.

T5: Single Stock Trading Pause in Effect: Trading is halted due to a 10% or more price change in a security within a five-minute period.

T12: Halt – Additional Information Requested by NASDAQ. Trading is halted pending receipt of additional information requested by NASDAQ.

H10: Halt – SEC Trading Suspension: Trading is halted by the SEC (Securities and Exchange Commission).

Are They Illegal?

Stock halts are not illegal.

They are put in place to ensure a fair market and protect investors.

These suspensions allow news to spread to all traders so that they can take informed positions.

Halting trading also helps to fight order imbalances.

Sometimes, the SEC may even use this method to stop a security about whom it has concerns from being traded.

Do Stocks Go Down after a Halt?

Not always, but in some cases, stocks may go down once they are suspended.

There are particular halt codes, such as T12, which might signify trouble.

This code signifies that the exchange has put the security on hold pending further information.

For example, DryShips Inc. (NASDAQ: DRYS) was suspended in 2016 with the T12 code. This penny stock saw a stunning rise in a week by nearly 2300%, after which trading was put on hold.

This penny stock saw a stunning rise in a week by nearly 2300%, after which trading was put on hold.

In such cases, the market usually goes for a correction afterward, and the stock is likely to crash.

Meme Stocks and Market Halts

Recently, the proliferation of meme stocks has become a catalyst for trade suspensions.

One of the clearest examples was Gamestop (NYSE: GME) in 2021.

The share hit the circuit breaker nine times on the 25th of January, and again on the 28th.

On the second occasion, it was accompanied by AMC Entertainment Holdings (NYSE: AMC) and other meme stocks.

The huge price volatility of the share caused the exchanges to halt trading.

The story behind these stocks was equally impressive.

Their meteoric rise was powered by amateur retail investors on Reddit messaging boards.

Concerted action by individual traders was able to thwart large-scale shorting by institutional ones.

It created a rally in a security that otherwise did not have strong fundamentals.

Is It Good When a Stock Is Halted?

While it may cause a great deal of anxiety in investors, stock halts are actually good for them.

They are designed to level the playing field and protect small traders.

These suspensions ensure that critical news reaches everyone and does not become a tool for the few in the know to manipulate shares.

It also makes sure that other exchanges are aware of what is happening so they can align their market participants accordingly.

How To Deal With Halts?

While nothing can be done once a halt occurs, investors should look for shares that are likely to get suspended.

For example, when a share’s price moves by a large percentage in its five-minute moving average, it could be a warning sign.

News halts are challenging to predict.

However, if there is an expectation of a court ruling or FDA approval, it might be possible to identify when they will happen in time.

It may be better to exit the position if there could be an impending trading halt in the wings.

Final Thoughts

Trading halts are designed to keep markets fair and transparent.

They help ensure that small investors are not impacted by huge stock price volatility or market manipulation.

Moreover, sometimes halts are just temporary suspensions designed to bring markets into balance and avoid panic selling.

On other occasions, they are a harbinger of major corporate transactions or some important news regarding the security.

Despite the negative spin often given to them, these suspensions are actually suitable for all market participants.

For retail traders, it is important to monitor the volatility of their stock holdings.

If they find some share that sees significant price movements in a short time, it is best to exit the position quickly.

After all, once a market halt hits, there is nothing much that can be done until it is lifted.

Tags:

Tags: