Investing in foreign real estate can help diversify risk and protect capital. Alexander Volik, analyst at Tranio, explains how investors can benefit from real estate investment.

Volik compares and reviews the various ways to invest in foreign real estate: direct ownership of property, shares in a real estate investment trust, units in the portfolio of a private equity fund, and crowdfunding.

How investing in real estate can help diversify risks

The real estate market stands apart from other investment options due to its weak correlation with financial products like securities, bonds, and other traditional assets.

This can help an investor significantly diversify portfolio risks.

Three features of real estate investment:

- Real estate provides predictable cash flow.

- Real estate is a tangible asset that gains value over time.

- Real estate investment can protect investors from inflation and other investment losses: GDP grows → real estate demand goes up → rental rates increase → real estate prices rise.

What are the benefits of investing in foreign real estate?

Investing in real estate abroad can hedge portfolios against national and political risks, local market downturns, and natural disasters.

Foreign real estate is also an effective vehicle to move money across borders while maintaining capital value.

It can also give investors the opportunity to gain citizenship or a residence permit.

Why invest in Real Estate: Return on real estate investments

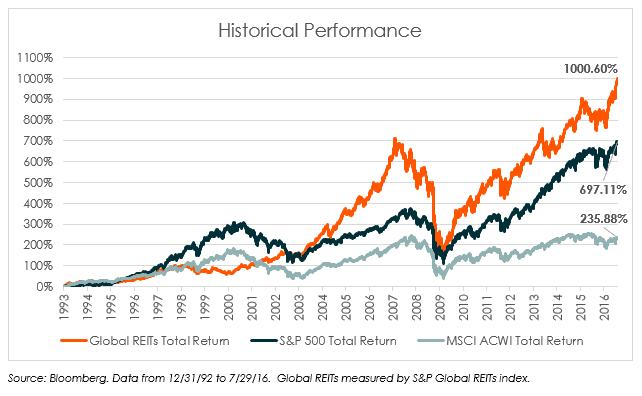

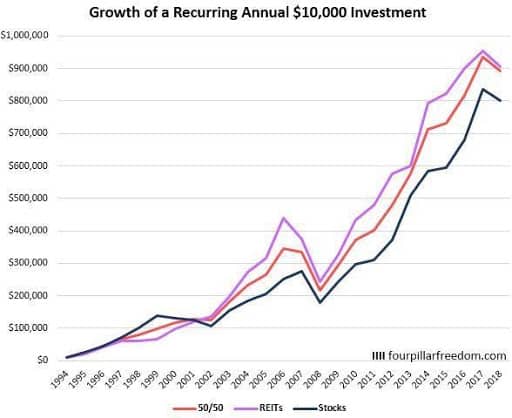

Over the last 20 years, real estate as a class of assets has significantly outperformed the stock market.

For example, US REITs (real estate investment trusts) earned an annualized return of 11.8% over the last two decades, compared with 8.6% returns posted by the S&P 500 in the same time period.

Although the growth rates of both real estate and equities indicate an upward trend over the long term, historic data shows that real estate rebounds quicker after crises, making it an attractive investment option.

An investment portfolio that includes both stocks and real estate is more stable than either asset class alone.

As indicated by the orange curve on the graph, this portfolio mix is more resilient to changes in the market environment.

There are four ways to invest in real estate: direct holdings, shares in a private or public real estate investment trust (or REIT), investment in real estate using private capital (real estate private equity or REPE), or investment through crowdfunding.

Each investment strategy has different returns and risks. Here are the pros and cons.

Why invest in Real Estate: Direct holdings in real estate

The ‘buy and hold’ strategy works for residential rental properties and commercial real estate, such as shops, cafés, warehouses, and hotels managed by a famous operator.

Profit: the investor makes a profit by collecting rental payments or by reselling.

Pros: the investor owns the property and can therefore choose how to make a profit and when to sell.

Cons: the investor is responsible for any hidden encumbrances and property defects, property management, tenant relations, legal arrangements, tax reporting and visits to the property.

Why invest in Real Estate: Real estate investment trust (REIT)

A real estate investment trust or REIT is a trust that invests in real estate. The investor buys shares and holds units in the portfolio of properties held by the trust.

The trust may invest in hypermarkets, senior care homes, and land developments that buy land, forest areas, or construction projects.

There are also trusts that focus on specific types of real estate, such as supermarkets.

Profit: the investor makes money from price fluctuations as well as dividends. REITs allocate 90% of their revenue to dividend pay-outs.

Pros: the investor receives cash inflow from rentals despite not owning the property.

The investor also receives dividend payments and capital gains from a diversified portfolio of multiple properties.

Cons: the investor does not choose the properties and the commission fee for management of shares is not always calculated transparently.

There are two types of REITs: private and public.

Private REITs are exempt from registration with the Securities and Exchange Commission (SEC).

Their shares are not listed on the stock exchange and may only be acquired by qualified and accredited investors.

The minimum amount to invest in shares of private REITs is between $10,000 to $100,000.

Public REITs sell shares on the open market. The average price of a share does not exceed $100.

Investors can quickly sell shares in a public REIT on the open market, even while the underlying assets with billion-dollar values are managed by professionals.

Information about the activities of a public REIT is publicly available.

Private and public REITs may directly provide mortgage loans to projects in order to buy properties or they may acquire mortgage-backed securities (MBS). While the risks are high, the investor is also set to earn big dividends.

Also Read: Farm Together Review

Why invest in Real Estate: Real estate private equity (or REPE) fund

Real estate private equity (REPE) is a class of assets used by funds to make direct investments into real estate.

REPE funds are not traded on the stock exchange and are only accessible to accredited and qualified investors.

The barrier to entry is an investment amount of at least six figures in US dollars.

Profit: most private equity income is earned through lucrative investments and profit-taking in the form of capital gains and/or carried interest from each project.

Pros: private equity companies invest in real estate assets, which include revenue-generating facilities and such exotic instruments as options and refinancing.

Cons: such funds have high entry barriers, low liquidity, and require long holding periods, making the exit process complex. A lot depends on the expertise of the fund’s team.

Why invest in Real Estate: Crowdfunding

Crowdfunding is a way to raise money for specific projects through an online platform. In real estate, crowdfunding is a relatively new concept.

The capital raised through crowdfunding is used for the acquisition, development, or renovation of a property, which can then be resold or used to generate rental income.

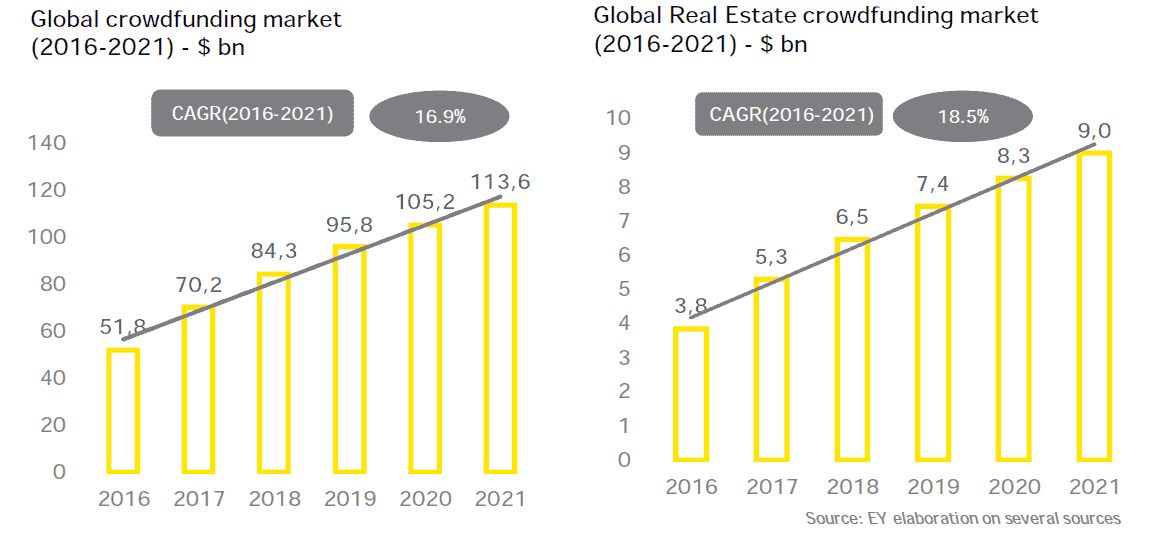

Over the last four years, the crowdfunding market has grown dramatically, with crowdfunding for real estate outperforming the overall market.

|

The overall crowdfunding market is growing at a compound annual growth rate (CAGR) of 16.9%. |

The real estate crowdfunding market is growing at a compound annual growth rate (CAGR) of 18.5%. |

Profit (equity crowdfunding): An investor putting capital into equity crowdfunding is considered a partner and can receive up to 20% annual income upon the completion of the project.

However, such investors take on a higher risk exposure as compared to debt-based crowdfunding.

There are fewer equity crowdfunding projects than debt-based ones.

Profit (debt-based crowdfunding): the investor receives a fixed return on investment of 8–12% through debt-based crowdfunding while being exposed to lower risk.

Pros: the investor chooses projects to invest in according to their own investment goals and preferences.

Cons: the investor does not influence the project development.

Real estate investments compared

We have reviewed real estate investments using ten parameters below.

Each real estate investment vehicle has been assigned a score from 1 to 5, where 5 indicates the most favourable score.

| Parameter | Direct holding | REIT | REPE fund | Crowdfunding |

| Correlation with the stock market |

5 The property price is not pegged to the broad market |

4 REIT’s stock quotations can be impacted by market sentiment |

5 Returns and profit depend on project development |

5 Returns depend solely on the project |

| Predictability of cash flow |

4 Depends on the occupancy of the property being managed by the investor |

4 While the price of the underlying asset is difficult to predict, dividends can be forecast in advance |

3 The majority of profit and returns are only realised on exiting the project and these are difficult to forecast |

3 The investor knows the profit entitlement but cannot influence the project (in the case of debt-based crowdfunding) |

| Hedging against country risks |

5 The investor is fully hedged as the property is physically located in a different jurisdiction |

3 The earnings return to the jurisdiction of the investor’s broker |

3 Earnings may be repatriated to the investor’s foreign legal entities,depending on the structural organisation |

2 The investor receives earnings via the crowdfunding platform into accounts opened in a particular jurisdiction |

| Protection against losses and damage |

5 The property is under full ownership of the investor |

4 A diversified real estate portfolio generates steady dividend income, but remains exposed to stock market downturns |

3 The investor owns real estate or shares in the project company as collateral. However, liquidation and indemnification may be time-consuming. |

1 There is no protection, issues are resolved through the crowdfunding platform |

| Citizenship and residence permit |

5 The investor may be eligible to obtain foreign citizenship or a residence permit. |

1 None |

1 None |

1 None |

|

Influence on the project |

5 The investor selects the property, type of control and method of payment |

1 The investor does not select the property or payment methods |

3 The investor may influence the selection of properties depending on conditions put forth by the fund |

3 The investor selects properties out of those available on the platform |

| Complexity of investing |

1 It is necessary to arrange asset holding abroad and to visit the property |

5 Everything is done online through the broker’s terminal |

3 The barrier to entry is high: the investor may need to establish an investment structure, such as by incorporating a company |

5 Everything is done online on the crowdfunding platform |

| Liquidity |

2 Depends on the attractiveness of the property. A sale lasts 6+ months. |

5 The shares in a public trust can be easily sold on the open market at any moment |

1 It is difficult to resell participation in a club deal to another investor |

1 One investor may not be permitted to resell shares to another investor |

| Return potential |

4 Gross return: 3–15+%, depending on the strategy (rent or add value) and engagement of the investor into the project |

3 Gross dividend yield: 3–5%. There is potential for capital gains boosting returns by up to 8–10% |

5 The investor receives certain returns of 5–8% per annum. Allocation of the remaining profit will generate an aggregate of 15% returns per annum. |

3 Return potential: 8% on average. Returns are restricted by the initial conditions. |

Foreign real estate investment in a nutshell

Direct holding of real estate:

- the highest protection against losses and damage,

- return of 5–6%, sometimes more,

- the investor must put a lot of effort into the project,

- it is relatively difficult to scale up this strategy as there are few projects with promising returns in the market.

REITs:

- easy route to invest in real estate,

- lower protection against losses and damage,

- minimum engagement required of the investor,

- 3–5% return expected, with potential for capital gains boosting returns up to 8–10%.

Club deals through REPE funds:

- lower protection against losses and damage,

- lower engagement required of the investor,

- higher expected return: up to 15%,

- there is scale-up potential.

Crowdfunding:

- easy route to invest in real estate,

- 12% expected return, higher as compared with direct property holdings,

- the investor is not directly connected with the project and may not influence it in any way.

Tags:

Tags: