Should you invest in dividend stocks? Read on to see the pros and cons of this type of investment!

Today, dividend stocks seem old-fashioned to many new and experienced investors.

Instead, they would rather invest in cryptocurrencies, non-fungible tokens (NFTs), SPACs, or IPOs. These asset classes are trendy.

They are offering significant gains seemingly overnight.

However, they are also volatile and risky for many investors. A tradeable asset that fluctuates rapidly can cause you to lose sleep.

For instance, Bitcoin (BTC) is the most popular and liquid cryptocurrency. However, it fluctuates by thousands of dollars in some days and weeks.

For example, on December 4th, 2021, Bitcoin was down 20% in a matter of minutes.

For some investors, this volatility is too much to worry about.

In addition, Bitcoin and other assets do not generate a passive income stream, a significant disadvantage if an investor does not want to sell their initial investment.

On the other hand, dividend stocks are more conservative.

In addition, they provide a passive income stream. Investors can even live off dividends if they follow a dividend growth or high-yield strategy.

This point is one reason to invest in dividend stocks, and there are several others too.

Dividend Basics

Before we discuss why you should invest in dividend stocks, let’s first answer the question, what is a dividend stock?

A dividend stock periodically pays cash distributions to shareholders at the basic level.

Companies pay dividends from profits. In the US, dividends are usually paid quarterly. In Europe or Japan, dividends are typically paid semi-annually or annually.

Dividends are income to shareholders. Besides cash payments, dividends are paid in stock, but this is less common.

Companies also pay special dividends. For example, Costco (COST) is one company that pays a regular cash dividend and a periodic special dividend.

The special dividend is often much larger than the regular cash dividend. For example, in 2020, Costco paid a $10 per share special dividend.

Companies pay dividends to shareholders to return cash to their investors.

Now that you understand the basics of dividends, here are four reasons you should invest in dividend stocks.

4 Reasons to Invest in Dividend Stocks

Dividend Stocks Provide a Passive Income Stream

Unlike cryptocurrencies, NFTs, gold, and other assets, dividend stocks provide a passive income stream to investors.

This fact is an essential point if you are trying to replace your salary for retirement.

Companies returning cash to shareholders have two options: dividends and share repurchases.

Dividends are direct cash payments to shareholders.

This money goes into your brokerage account or bank account.

Investors can also use the dividends to purchase more shares on the same stock. This concept is the basis of dividend growth investing.

Investing in stocks paying a growing dividend each year and reinvesting the paid dividends is a way to compound returns.

The passive income stream starts small but eventually snowballs.

For instance, suppose you initially invested $5,000 in stock XYZ with a 3% dividend yield at a share price of $50 per share.

You own 100 shares to start. Now, suppose you are reinvesting the dividends and adding $1,000 per year, the stock appreciates 3% annually, and the dividend grows 3% each year.

These are conservative assumptions.

In year 1, the stock price is $51.50, the annual dividend is $150, and the ending value is $6,278.94.

If an investor is patient, in year 10, the stock price is $67.20, the annual dividend is $583.29, and the ending value is $21,527.72.

Finally, at the end of year 20, the stock price is $90.31, the annual dividend is $1,516.08, and the ending value is $49,971.14.

Now imagine an investor owning 10 to 20 stocks like this. The passive income stream is solid and can be used in retirement.

Dividend Stocks are Less Volatile

Another reason you should invest in dividend stocks is that they are less volatile than non-dividend-paying stocks.

Research on average annual returns and volatility by dividend policy has shown this point to be valid over time.

For example, between 1973 and 2020, companies growing or initiating dividends had annualized returns of 13.20%, a beta of 0.88, and a standard deviation of 16.08%.

On the other hand, stocks just paying a dividend had a 12.83% total annual return, a beta of 0.94, and a standard deviation of 16.81%.

A higher beta and standard deviation indicates more volatility.

However, companies not paying a dividend only had annualized returns of 12.18%, a beta of 1.18, and a standard deviation of 22.12%.

Companies cutting or eliminating dividends performed even worse. Their total annual returns were 10.20%, a beta of 1.18, and a standard deviation of 24.47%.

The conclusion is dividend stocks perform better with lower volatility over time.

Dividend Stocks Perform Better in Down Markets

The third reason you should invest in dividend stocks is they perform better in down markets compared to stocks without dividends.

According to Investopedia, dividend stocks performed better in two of the three bear markets in the past 20 years.

The one exception was the bear market during the COVID-19 downturn.

However, dividend stocks performed better than ones not paying a dividend during the dot-com bust and the sub-prime mortgage crisis.

Both of these events were longer bear markets, unlike during the COVID-19 downturn.

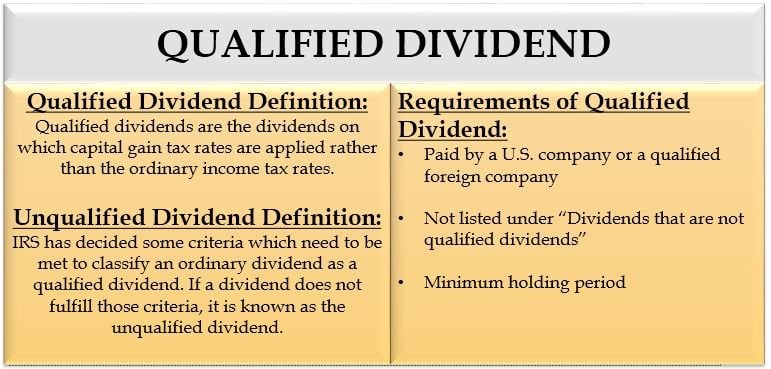

Dividend Stocks are Tax Efficient

Lastly, dividends may be tax-efficient compared to regular income, depending on the tax bracket.

For instance, the tax rate on qualified dividends is 0% if your income is less than $40,000 for single filers and $80,000 for joint filers in 2021.

Qualified dividends are ones meeting specific criteria stated by the IRS.

Qualified dividends are taxed at a rate of 15% or 20% for higher-income earners.

However, qualified dividend tax rates are lower than regular income tax rates in almost all cases, especially for high-income earners.

For example, an individual earning $80,000 per year pays a regular income tax rate of 22% in 2021.

This rate is before deductions and credits. However, the qualified dividend tax rate is only 15%.

Similarly, a couple filing a joint return with an income of $200,000 pays a regular income tax rate of 24%. Again, the qualified dividend tax rate is only 15%.

Keep in mind that non-qualified dividends are taxed at the higher regular income tax rate, which could be a disadvantage.

Dividend Stocks: Final Thoughts

Dividend stocks have several advantages compared to stocks not paying a dividend or other asset classes.

There are four reasons discussed above why you should consider investing in dividend stocks.

Author Bio: Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor and blogger on dividend growth stocks and financial independence. Some of his writings can be found on Seeking Alpha, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, Entrepreneur, FXMag, and leading financial blogs. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. He was recently in the top 1.5% (126 out of over 8,212) of financial bloggers as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.

Tags:

Tags: