If you follow the stock market at all, then you know that the 2025 investment trend is undeniably breakout stocks. Keep reading to learn everything you need to know about breakout stocks.

From crypto stocks to GME, breakout stocks hold much profit potential for savvy traders who understand when to get in and when to get out.

Though, if the strategy was simple, everyone would do it.

Breakout trading takes talent and tools, like using price charts to identify price patterns.

Some people say that history repeats, but in the bull market, investors say that it rhymes.

There are identifiable patterns that can predict breakout stocks, and it’s up to you to find them.

Read on to learn everything you need to know about identifying breakout stocks.

What Is a Breakout in Stocks?

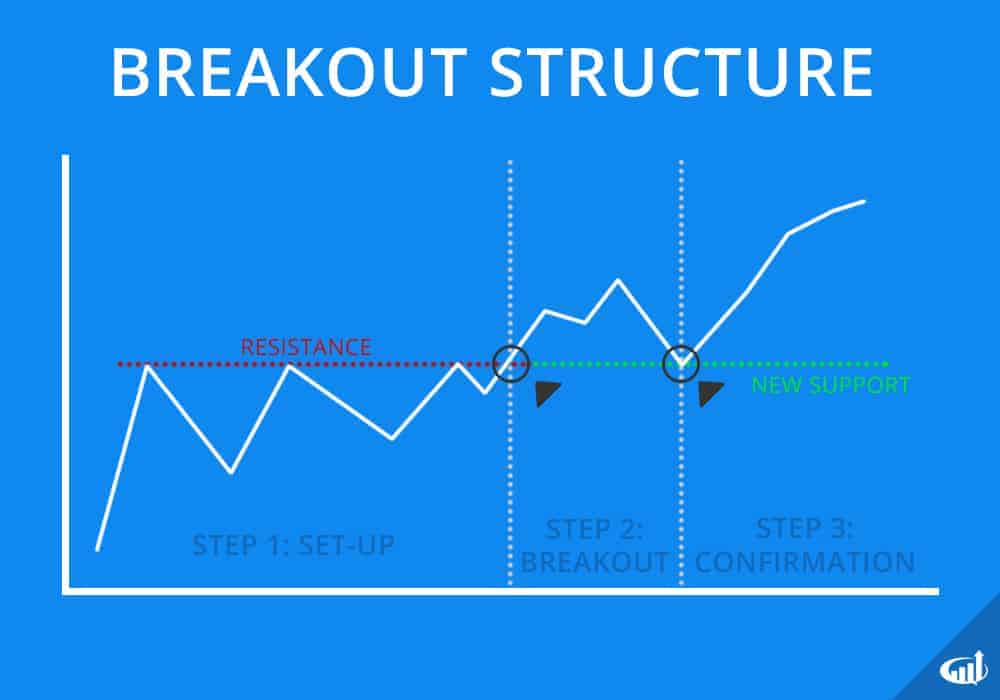

A breakout stock is traditionally defined as when a stock’s price starts to move ahead of the accepted resistance level.

The resistance level is the highest level a stock has ever reached, so a breakout stock occurs when the price of the stock passes beyond that.

Many investors refer to this as when the price breaks.

The funny thing about breakout stocks is that most don’t immediately fall once they break their resistance level.

In fact, once they break the ceiling so to speak, they usually continue to jump up due to an increase in volume or interest before the price drops.

The goal of breakout trading with stocks is to successfully recognize patterns so you can jump in just as the stock breaks the resistance level and have a set exit time in mind.

This helps ensure you don’t get burned and make a losing trade on a false breakout.

Increased company interest, increased volume, or an unexpected news story are all events to watch for and incorporate in your breakout strategy.

So monitoring these indicators will help you determine if a stock is getting ready to make major price moves.

How to Find Breakout Stocks

So the million-dollar question is how to find breakout stocks in 2025.

The answer (like most things in the stock market) is a bit complex, a bit instinctual, and a bit of luck.

To start using this powerful investment technique, you need to understand what key indicators to look for.

Key Indicators a Stock Is About to Breakout

While it would be nice if a quick Google search could tell you the latest breakout trend, this isn’t the end all be all of breakout trading.

Instead, research, data, and technical analysis are probably the best tools to keep in your trading arsenal to start seeing the patterns that lead to a breakout stock.

This is usually where most active investors start and will help you stay in front of price swings.

With this in mind, it may be helpful to learn about three key indicators that tell you if a stock is about to break out.

If you’re new to trading, you’ll want to pay close attention to these indicators to help you stay away from a false breakout or a trend reversal.

Breakout Stocks: Volatility

If you’re looking to identify breakout stocks, put volatility at the top of your list.

Volatility is a necessary evil of the stock market, and it can be your best friend or your worst enemy.

Almost all great breakout trades come with a sudden increase in volatility.

However, you need to be careful trading because a volatile stock’s price rises very fast and can drop just as quickly.

A stock’s price can change multiple times in one day, so you must learn to follow the data and study the moving average during your trading period.

Working with the right trading platform that has built-in alerts can help you stay on top of volatility.

It can also help you balance the risk/reward ratio a bit by setting exit points to help you get out before the crash occurs.

Breakout Stocks: Volume

Many investors consider volume to be one of the major indicators of impending opportunities.

Once the volume jumps, a subsequent breakout may follow.

High volume does not always mean a breakout is pending, but low trading value pretty much guarantees that it won’t.

Keep this in mind when you’re trying to find a successful breakout stock.

It is easy for hundreds of millions of shares to trade in just 24 hours, so how do you identify a new breakout stock?

You can see which stocks are gaining momentum out of the blue with the right platform.

Breakout Stocks: Support and Resistance Levels

When learning how to identify a breakout trade, resistance level, and defined support level are extremely important.

These are the key price points that actually define a stock as a breakout.

If you notice a pattern of a stock consistently breaking through resistance and/or support levels before regrouping, then it might be poised to breakout.

Once a stock consistently jumps upwards, the buyers are now controlling its rise in price.

This could mean that it’s time to join in and ride the wave for a bit as it surpasses both the known resistance levels and support levels.

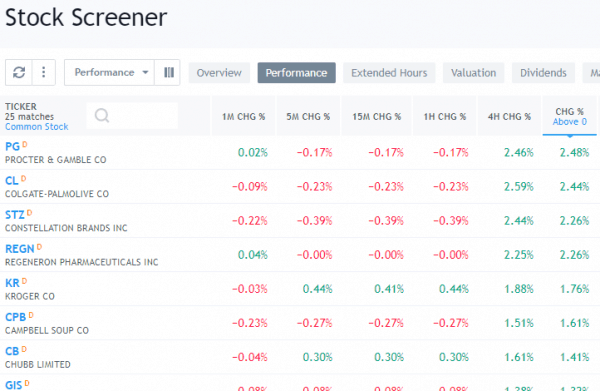

Use a Stock Screener to Find Trends

Even if you spend all day on the computer checking the stock market, you can’t expect to monitor the movement of every stock.

Therefore, a stock screener is an invaluable investment research tool for traders looking for breakout signals.

Stock screeners help you sort out the stocks and steer you clear of undesirable markets that aren’t going to develop any viable results.

It takes on the role of scanning markets and watching for a developing trend.

Usually, a breakout stock has a price action that is hovering slightly below or slightly above support and resistance levels, and a stock screener can help you spot this trend.

More on Finding Breakouts with a Stock Screener

Your stock screener’s job is to alert you of a price jump and react at the stop loss point you denote.

The stock screener will look at stocks that show this slight movement and then monitor even closer for signs that upward momentum is starting to build.

If the screener spots a trend of the stock moving up, it will send you an alert that lets you know it’s time to take action.

Most stock screeners allow you to set filters to control the screening process so you can more accurately identify a trend that is in line with your metrics.

As a breakout trader, optimal filter settings include equity, price greater than “X” (your ideal buy-in amount), and volume greater than 2,000,000.

Check Reliable News Sources

Part of how to find breakout stocks includes knowing why stock prices are moving upwards.

Often, breakouts occur from unexpected media coverage that places a company in the spotlight.

Jumping into the breakout early can help you ride the tide of good fortune along with the company.

This is exactly what happened at the beginning of the year with plenty of crypto-related stocks.

In fact, ever since the huge bitcoin market value jump, crypto stocks are on fire and a great example of a market that a hip breakout trader would be wise to watch.

Breakout Stocks Can Be Found Anywhere

Of course, breakout trades are not limited to just crypto markets and can happen to large publicly traded organizations as well as penny stocks.

Another good place to watch is biotech stocks because they are highly speculative and benefit greatly from some positive press.

Something as simple as a clever product placement in a leading television show and light coverage following the appearance is all it takes to send a stock soaring upwards at a highly profitable rate.

One of the most important things to remember while day trading is that any stock and any market can produce a breakout stock worth jumping into.

So don’t make your parameters too narrow while studying a trend or range on a chart.

Use Social Media to Find Trending Stocks

Given how social media platforms have redefined the way we digest information, it stands to reason that they can be a great resource and a technical indicator of trending stocks.

Similar to staying on top of the news cycle, the best way to use social media is to stay on top of trending topics and hot social media gossip so you can get your bite of the apple.

You aren’t going to get in on any hot trades at the start by just searching for trending stock tips alone.

But if you stay on top of trending topics you can hopefully find stocks that are emerging and getting close to passing their resistance level.

A Study in Breakout Stocks: GameStop

A great example of the potential of social media to create breakout stocks is Elon Musk and GameStop.

One innocuous tweet by the billionaire sent GameStop shares surging to a never-before-seen day high that settled at more than an 800% jump.

This tweet by Musk, in combination with hype built-in by Reddit, caused a chain reaction that ignited a buying frenzy.

This is much more valuable than the stock is really worth.

It is unlikely that the stock will maintain its current value for a long period of time, but for smart breakout traders who moved fast, it doesn’t matter.

Those who jump in at the beginning and jump out soon will make a nice tidy profit.

Find Influencers and Note Their Stock Choices

If you want to learn how to find breakout stocks on social media, pick a few huge influencers and follow their picks.

A good place to start your search is Twitter.

The influence of some of the largest social media starlets extends way past teens and college kids.

A lot of the most notable influencers, like Elon Musk, have the ability to channel their popularity and move a stock with just a mention.

So if you see a tweet go out, it may be wise to jump in early and wait for the rest of their followers to push the stock into the breakout zone.

How to Find Breakout Stocks: Final Thoughts

If you want to find breakout stocks, the best thing you can do is learn to be omniscient.

Unfortunately, that’s not in the cards for you.

In the meantime, you should use some trading tools and alert systems to help you learn where to channel your energy.

The most important quality of a breakout trader is being present because breakout trades can quickly rise and fizzle out.

When you start trading, you need to invest time in sharpening several strategies that can help you monitor and identify potential breakout stocks from all over the national and global market.

Improving your Strategy for Finding Breakout Stocks

Investing in developing your strategies before you begin trading can help you find breakout stocks before they boom.

Using a stock screener tool is an excellent way to keep an eye on known markets.

A screener will help you spot news and social media trends so you can stay on top of pop-culture-spawned breakout stocks.

The most important lesson you need to learn is that every single stock has the potential to be a breakout stock.

Also, don’t count anyone out if the market conditions look ripe and trading volume is high.

Tags:

Tags: