Inflation can wreak havoc on anyone’s finances as prices rise and the dollar’s value drops to new lows. All hope is not lost, as several methods exist to shield investment income from dangers. This article explains in detail five strategies to inflation-proof your investment portfolio.

5 Strategies to Inflation-Proof Your Portfolio

1. Fixed Income Treasury Inflation-Protected Securities (TIPS)

Treasury inflation-protected securities (TIPS) are U.S. government bonds explicitly designed to ward off the adverse effects of ever-increasing interest rates. These fixed-income assets mirror changes in the Consumer Price Index (CPI), a standard for measuring inflation in the United States.

This link to the CPI helps ensure this investment strategy doesn’t succumb to rising inflation. The Treasury Department adjusts the value of TIPS each year to compensate. When interest rates rise, the principal follows. Should interest rates dip, the principal will also go down but never fall below face value.

TIPS pays out interest twice a year at a variable amount depending on the inflation rate and resulting principal. It’s possible to add TIPS to an investment portfolio for 5, 10, or 30-year terms. The interest rate reflects the length of the investment.

On the downside, TIPS are typically more costly than the conventional bond market and tend to pay out at lower interest rates because they are somewhat inflation-proof. TIPS are also subject to taxes at the federal level, both on the principal and the amount gained from interest.

You can use an exchange-traded fund (ETF) or mutual funds to obtain a diversified TIPS portfolio for a different approach to these fixed-income opportunities. Keep in mind that ETFs trade on the stock market and are susceptible to additional risk.

2. Gold or Other Precious Metals

Gold has long been a favorite investment for inflation protection. The asset has traditionally fared very well during times of high inflation, even as other asset classes struggle. The precious metal is scarce, and the limited supply helps hold things steady when inflation hits.

As inflation rises, many investors turn to gold as it tends to hold value well. In many ways, it’s considered an alternative currency as inflation erodes the dollar or euro. Once inflation recedes, investors can stick with gold or reinvest in rising currency rates.

Gold isn’t the only metal worth considering. Silver plays its role as a precious metal and is instrumental in electronics products and new technologies. Silver can rise higher or drop lower than gold in terms of value, depending on industry demand.

Precious metals such as platinum, palladium, and copper each serve a purpose in specific sectors and have industrial value. As a result, surging inflation may play more of a role with these precious metals than others.

Physical gold has merits but doesn’t accrue interest while you hold onto it. There may also be costs associated with storing the metal in a secure facility if you’re not planning to keep it yourself.

Be aware that stock prices are not inflation-proof and can benefit or suffer accordingly.

3. Real-Estate Investment Trusts (REITs) and Various Real Estate Investments

Real estate can be surprisingly resilient to rising inflation rates, holding or increasing value as other asset classes falter.

A real estate investment trust is one such area offering inflation protection. Buying into REITs doesn’t require actual property ownership but allows investors to reap some benefits. Fortunately, REITs are more affordable real estate investing strategies that don’t require the capital needed to buy a property.

REITs usually own many income-producing real estates where investors see returns from property sales and rental income.

Real estate is a tangible asset, and there’s also potential for income from renting out properties an investor owns. Property values are tied to the Consumer Price Index and tend to increase during inflationary periods.

This upward swing allows a landlord to charge a higher rental income. The rent increase should combat rising prices across other areas from higher inflation.

It’s worth keeping in mind that both REITs and homeowners must pay property taxes that can also increase substantially when the inflation rate is high. These rising prices can offset gains to an investment portfolio by a significant margin.

4. Commodities

Commodities cover a large variety of inflation-hedged asset classes, from raw materials to food and energy sources. Such products tend to see rising prices during inflationary periods and can hedge inflation risk. These increases often indicate upcoming economic growth.

These materials are often integral parts of our daily lives, and anything from these asset classes continue to be bought even during times of high inflation. Individuals still need to eat, travel from place to place, and fuel their homes.

Products requiring grain increase in price as the base item feels the effect of inflation. This principle holds for things such as crude oil, cotton, and plastics. Such increases can boost share prices to a higher level.

5. Value Stocks

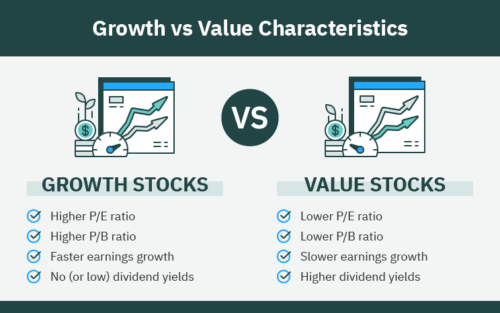

A value stock represents a company that’s trading for lower than both the financial markets, and its business model indicate its worth. When purchasing shares of a value stock, most investors believe the price will rise over time to reach an anticipated value.

Unlike growth stocks, which tend to suffer during inflation, value stocks usually fare pretty well. They are not affected by an unfavorable interest rate or changes in sale volume. As other securities stumble, value stocks have risen even when inflation rears its ugly head.

When looking for value stocks on the market, price-to-earnings and debt-to-equity ratios often reveal how a company stacks up. Generally, lower numbers tell that a stock may be valued lower than it should be.

Remember, it is always possible prices could drop further once you have picked up the stock. These value traps lead to lost income when price estimates don’t measure up to reality.

In most cases, it’s best to hold value stocks for at least eight weeks, but each security can take up to a year to catch up to its predicted worth.

Final Words: 5 Strategies to Inflation-Proof Your Portfolio

Protecting your portfolio from inflation doesn’t require secret knowledge or special financial instruments. Simply having the right investment mix can hedge the adverse effects inflation can sew through inflation-proof assets and the right amount of diversity. No investor should dump all their eggs in one basket during nominal market conditions, let alone when inflation fears abound.

Tags:

Tags: