Investing your money wisely can be a fruitful venture. But, when is the right time to start your financial journey? We’ve asked a few experts how to know when you’re ready to start investing. Let’s see what they have to say!

When You Have an Emergency Fund in Place

David Floyd the owner of www.thepestinformer.com says:

“Life is full of surprises. If you plan to invest, you should have at least three months’ worth of costs stashed away in an emergency fund. Having an emergency fund will ensure that you don’t have to dip into your long-term investments in the event of an emergency. Investing and saving can be done simultaneously if you have a decent emergency fund in place.

Avoiding retirement accounts, which have severe rules regarding when and how you can get your money back out of them, is probably the best option if you’re looking to invest in something other than a secure retirement. A taxable brokerage account allows you to take money out at any time.”

Take Your Overall Financial Situation Into Account

Max Benz a CEO at minikredite.org says:

“Many experts recommend starting to invest as early as possible in order to take advantage of compound interest. However, there are a few things to consider before making the decision to start investing. First, it is important to have a solid financial foundation in place. This includes having an emergency fund to cover unexpected expenses and paying off any high-interest debt.

Once these basics are taken care of, you can consider investing. Another important factor to consider is your risk tolerance. Those who are more risk-averse may want to wait until they have more money saved up before investing, while those who are willing to take on more risk may be able to get started with a smaller amount of money.

Ultimately, there is no perfect time to start investing, but doing some research and taking your personal financial situation into account can help you make the best decision for you.”

Saving is Key

Oberon from Very Informed, explains:

“When it comes to investing, there is no “right” age to start. However, there are a few factors that can help you determine whether now is the right time for you to start investing.

If you have a steady income and are able to save a portion of it each month, you may be ready to start investing. Additionally, if you have a good understanding of basic financial concepts and are comfortable taking on some risk, investing may be a good fit for you.

Of course, this is just a general guideline – ultimately, the decision of when to start investing is up to you. If you’re not sure whether now is the right time for you, consider speaking with a financial advisor to get started.”

This Can Help You Hedge Losses

Baruch Silvermann, financial expert and CEO of The Smart Investor, explains :

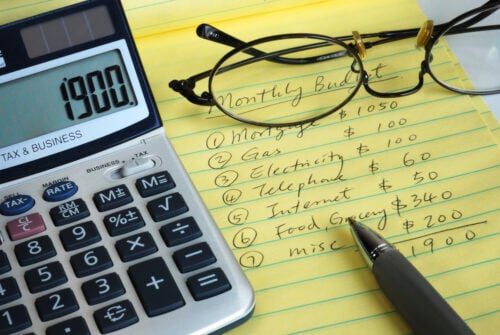

“Firstly, before you start investing, it is a good idea to have already built an emergency fund. Investing can be risky, so you need to only invest money that you will not need in the short term. Imagine a scenario where you buy some stocks and then find you need to have your vehicle repaired or call in a plumber for your home.

However, if you already have an investment fund, you won’t be as dependent on the funds you use for investing, so you can take a little more risk. Another sign that you could be ready for investing is that you stick to your monthly budget and have money left over each month.

If you can pay all your bills and expenses, make regular contributions to your savings account and still have disposable income, it may be time to use some of that money to make investments. As we discussed above, this is a signal that you have money that you can risk, so you won’t be financially compromised if you make a few bad investments when you are still learning the ropes.

Finally, it may be worth starting investing if you have access to an employer sponsored retirement plan. These plans allow you to invest money from each of your paychecks to build towards your retirement. This is a baby step into investing, which can help you to learn more.

Some employers will even match your contributions, so you can really give your retirement plan a boost. If you’re already maxing out your contributions, you could start trading with a taxable investment account.”

When You Have a Long-Term Goal in Mind

Burak Özdemir Founder of the Online Alarm Clock says:

“The right time to begin investing will vary depending on your individual circumstances, goals, and risk tolerance. However, there are a few general guidelines that can help you decide when the time is right for you to start investing.If you have a long-term financial goal, such as retirement, that you are hoping to reach through investing, then it is generally advisable to start sooner rather than later.

The longer you have to invest, the more time your money will have to grow. Investing is not just for people with a lot of money. If you only have a small amount of money to invest, that’s OK. What’s important is to start investing early and to make regular contributions to your investment account. If you’re not sure how to get started, there are a number of resources available that can help.

You can talk to a financial advisor, read books or articles about investing, or even take an investing class. The important thing is to educate yourself about the basics of investing before you start putting your money into the market. Once you have a good understanding of the basics, you can begin to develop your own investment strategy.

There are many different approaches to investing, so it’s important to find one that aligns with your goals and risk tolerance. If you’re comfortable taking on more risk, you may want to consider investing in stocks. This can give you the potential for higher returns, but it also comes with the risk of losing money. If you’re looking for a more conservative approach, you may want to invest in bonds or mutual funds.

These options tend to be less volatile than stocks, which means they may not provide the same level of potential return. However, they also typically involve a lower risk of loss. The most important thing is to find an investment strategy that you feel comfortable with and that aligns with your goals.

Once you’ve done that, you can start thinking about when the right time to start investing is for you. If you’re still not sure, it’s OK to wait a little longer. The important thing is that you make a start sooner rather than later. The longer you wait, the less time your money will have to grow. So if you’re even just a little bit ready to start investing, don’t wait any longer. The sooner you begin, the better off you’ll be in the long run.”

When Your Financial Situation is Stable

Paw from Financer.com says:

“There are a few key indicators that can help you determine whether or not you’re financially ready for investing. The first is to make sure that your overall financial situation is stable. This means having enough money saved up so that you won’t have to rely on loans in the event of an emergency, and ensuring that all of your debts are paid off in full.

Next, it’s important to review your current living expenses and see if there are any areas where you could reduce them without sacrificing quality or affordability. Are there any unnecessary luxury items? Can you cut back on food spending by substituting cheaper alternatives with better nutritional value? Could reducing monthly payments help save more over time? If so, invest accordingly.

Last but not least, be mindful of the future prospect for inflationary rates as this can impact how much money you’ll need to save each month down the line.”

Investing at a Younger Age Can Help You Become a Better Investor Over Time

Haydn Martin owner of Perpetual Prudence says:

“People should start investing as early as possible. Preferably when you’re still young because:

- Practice with low consequences. The amount you’re investing at an early age means that mistakes aren’t hugely costly.

- Learning. Investing is a skill like any other that requires knowledge and, above all, practice. The earlier you practice, by investing, the more familiar you become with the investment environment.

- Building habits. You want to build good personal finance and investing habits early when you don’t really have to. These habits will then be ingrained later on in life when you actually need them.

- Financial rewards. Obviously, investing is financially rewarding. Early investing even more so because time leads to compounding returns, and reduces risk and the required return of your investments.”

It Can Help You gain Needed Experience

Jessica Kats, budgeting & finance expert at Soxy, explains:

“There is no set time for proper investments. But as an expert, I would recommend for people to start as early as possible, especially if they are a beginner. Investing young means you get to see returns accumulate on a consistent basis.

These are called compound earnings, referring to when your investment returns start earning their own return. Compounding allows for snowballing of your account over time. Of course, you will experience ups and downs in the stock market, but young investors often ride out these tough times.

Money takes a long time to stabilize and grow so being young is a huge advantage to have in the investment market. Starting early, even if you have to start small, is the best way to safeguard your future.

When You are Able to Pay Off Debt

Britt Williams Baker, co-founder of Dow Janes, says:

“There are two things you need to check off your list before you’re ready to invest: 1) You need to pay off high-interest debt, and 2) Save up an emergency fund. It’s common to see people want to invest while they still have credit card debt, but the problem with that approach is that holding onto high-interest rate debt actually costs you more than you would make by investing.

It’s like trying to fill up a bucket with holes in the bottom. Now, if you have debt with an interest rate below 7%, like a student loan or a mortgage, you are okay to hold on to that debt and invest at the same time. That’s because you will generally make more than 7% in interest by investing, so it’s a better use of your money to hold on to that low interest rate debt and use your money to invest.

The next thing you’ll want to do is to make sure you have an emergency fund saved up. If something happens and your money is tied up in your investments, you may be forced to sell at a bad time, which is how people lose money investing. People think investing is risky; investing without an emergency fund is risky!

If you do things in the right order, you minimize your risk and maximize your potential returns. Making money from investing is all about laying the groundwork and creating a solid financial foundation before you get started. That way you can take a long-term approach to investing and maximize your returns over your lifetime.”

When You Can Budget Effectively

Jeff Grampp, CFA at Have A Gramp Day says:

“I believe two of the most important steps to take and acknowledge before investing are the following:

Having some kind of a budget that takes care of the “basics” (housing, food, car, insurance, etc.) so you know there is extra money left over to invest and how much. Knowing you have $50 or $100 leftover each month to invest will give you confidence and should allow you to think for the long-term.

The last thing you want to do is start investing and then realize you need the money to pay bills, which may force you to sell at a less than ideal time.

Also, pay off all higher cost debt first. If you’re carrying a balance on credit cards you should not invest, you should pay that off first. The reason is that credit cards typically have extremely high interest rates so by paying off credit cards you are still “investing” in yourself by lowering your future payments.

If your credit card interest is say 15% it’s going to be very hard to invest at a higher rate than that and you’re guaranteed to “earn” that return when paying off your credit cards or other high cost debt, which I would say is anything above 10% or so.”

Once You Develop Healthy Spending Habits

Rohan Kadam owner of Bikingknowhow.com says:

“My parents always advised me that one should start investing early. According to my parents, developing the habit of investing money early will help one develop better spending habits and make better purchase choices. My father introduced me to some ways for me to start investing money. I was introduced to concepts of the stock market, opening a ROTH IRA, and a 401K account. This was very fascinating for me.

I discovered that, unlike Cash which has a fixed value, a Stock has a variable value. Stock prices can either go up or down depending upon the economy and performance of the market. Doing thorough research and choosing the right investment options did ultimately make my money grow.”

Saving is Key

Oberon, from Very Informed, says:

“When it comes to investing, there is no “right” age to start. However, there are a few factors that can help you determine whether now is the right time for you to start investing.

If you have a steady income and are able to save a portion of it each month, you may be ready to start investing. Additionally, if you have a good understanding of basic financial concepts and are comfortable taking on some risk, investing may be a good fit for you.

Of course, this is just a general guideline – ultimately, the decision of when to start investing is up to you. If you’re not sure whether now is the right time for you, consider speaking with a financial advisor to get started.”

When You’re Eager to Gain Knowledge from Your Own Experiences

Raphael Gauthier, CEO of Play To Earn Diary, tells us:

“You recognize that you don’t know everything, but you’re willing to take action on something you do know while continuing to learn. From where I see it, Investing offers a plethora of educational opportunities, including learning how to pick a financial adviser, how to assess a growth stock, what sorts of managed portfolios are available, and why and how to resist selling in a market decline, and much more.

It’s infuriating and upsetting that you must have to educate by putting your hard-earned money on the line. However, real-life teachings, rather than textbook lessons, are much more likely to linger with you. The crucial thing is being able to derive insights from those experiences, both good and negative, to gain knowledge and progress as an investor.”

Before You Begin Investing, Set Goals

Charlie Garcia, Chief Editor at WP Dev Shed, explains:

“Investing is a trip that is easier to navigate if you determine where you want to go. Goals provide direction and concentration in this situation. Start with short-term objectives, such as saving for a major trip, a wedding, or even a house deposit on a home.Once you’ve demonstrated to yourself that you really can accomplish a short-term objective, longer-term goals, such as retirement planning, become a little more attainable.”

And Commit to Those Goals

Evelyn Smith, founder and CEO of Foxbackdrop, says:

“Generally, there is no set age at which you should begin investing. Some begin very young, while others start well into their 40s or 50s. It’s all about your specific circumstances and when you’re ready to start investing.

Having said that, there are a few signs to look out for that typically mean you are ready to begin. Here they are:

- You end up with some extra money every month even after paying all your bills. This means you have enough money remaining after covering all your major expenses.

- You’re ready to commit to financial goals. Your investing journey should only begin when you know where you are headed and are prepared to work hard to meet your goals.

- You have access to a retirement plan. If you can contribute to an employer-sponsored retirement plan like a 401K, that means you have already taken a step toward investing.”

When You are Ready to Grow Your Wealth

Final Words: How to Know When You’re Ready to Start Investing

There are a few things that can signify when you’re ready to start investing. Most importantly, it’s vital to make sure you have the financial means to begin your investing journey. Aside from taking the advice above, it is always good to speak with a qualified financial advisor before making any significant financial decisions.

Tags:

Tags: