Recent Bill Bonner predictions for 2025 spotlight troubling signs for America’s entire energy system. But is he really on to something? Get the full scoop on Bill Bonner’s prediction with my “America’s Nightmare Winter“ review.

What Is Bill Bonner’s “4th and Final Prediction”?

Bill Bonner’s “4th and Final Prediction” is that the US could be on the cusp of an energy and financial crisis magnitudes more severe than anything seen in recent history.

Bonner also warns that the effects could be multiplied by reckless government spending and an insistence on switching to green energy while the tech is still in its infancy.

In his own words, Bonner says:

“The Elite Establishment is playing two dangerous games at once…

They are aiming to change the way a modern economy works, by mandating a complete switch to “green energy”… while paying for it with unlimited amounts of new “paper” money.”

In short, he’s not optimistic about the White House, US Treasury, or the Federal Reserve putting the economy on the right track.

He and True Wealth’s Steve Sjuggerud have teamed up to provide a blueprint for navigating these events if they unfold.

It’s all laid out in Bonner’s “America’s Nightmare Winter” presentation.

I’m going to dig deeper into Bonner’s warnings and predictions, as well as True Wealth’s latest deal.

Before I dive into it, let’s take a look at the mind behind this market forecast.

Who is Bill Bonner, and what are his credentials?

>> Get the full scoop on Bonner’s predictions <<

Who Is Bill Bonner?

Bill Bonner is a renowned financial author, investor, and stock market analyst. He’s also the founder of Agora Inc.

For the uninitiated, Agora is an extensive network of publishers, many of which are in the investing space.

Bonner founded Agora in 1978. He’s played a pivotal role in the company’s success and has helped it rapidly expand its network over the last few decades.

Today, Agora is one of the largest independent market research publishers in the world.

Agora’s success has earned Bonner widespread recognition for his role in the financial publishing space. Some awards he has won include “Entrepreneur of the Year” and Direct Marketing “Man of the Year.”

In addition to Bonner’s many awards, he’s seen massive success as an author. He’s written two New York Times Best Sellers, including Financial Reckoning Day and Empire of Debt. Empire of Debt was also a Wall Street Journal Best Seller.

Bonner helms several investment research services, including Bill Bonner’s Diary, Bonner Private Research as well as The Bonner Letter.

Bonner’s Three Past Predictions

Before Bonner recently issued what he calls his “Fourth and Final Warning,” he predicted three enormous market events.

His first market prediction was back in the 1980s when he warned others about the Japanese stock crash.

Bonner was much quicker to the draw than most. Unfortunately, Japanese stocks have not fully recovered — even after 33 years.

Let’s take a look at Bonner’s second big prediction.

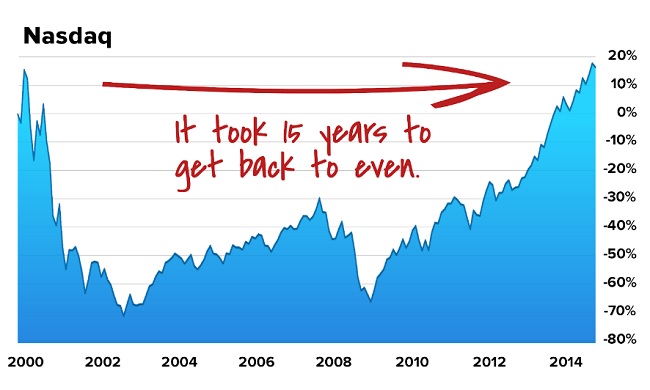

In the late nineties, he warned folks about the impending bust of the dot-com bubble.

“In fact, there was probably no one in America who wrote more about the dot-com fallacy than me during that era. I covered it almost daily for several years, in what many say was the first commercially successful and profitable Internet blog.”

Bonner understood early on that rampant speculation paired with a bullish technology market could be a recipe for disaster.

Many knew that the party might not last forever and that there could eventually be a correction. However, few anticipated the magnitude of the collapse around the corner.

Bonner issued his third warning back around 2005 when he spotted the signs of a potential bubble growing in mortgage finance and real estate.

In fact, he shared his warning in one of the Best Sellers mentioned earlier, Empire of Debt.

Bonner wrote about a crash “that will take down house prices and the stock market, but leave the dollar and bonds with little damage.”

And regarding his “4th and Final Warning,” he says that “America’s Nightmare Winter” could impact much more than isolated sectors or industries:

“My other big warnings to date really only affected investors (and homeowners, in the case of the mortgage crisis).

The looming crisis I want to tell you about today, however, will affect everyone. And in ways that will be difficult for you to avoid.”

I’ll cover this in the next section, so stayed tuned.

Bill Bonner’s Warning: “America’s Nightmare Winter”

As mentioned, Bill Bonner’s recent presentation, “America’s Nightmare Winter,” predicts that the US could be on the verge of an energy crisis and financial collapse.

Or as he puts it:

“Someday in the future… perhaps on a particularly cold night…

… America’s entire energy system will collapse.

Fuel won’t get delivered. Rolling blackouts will sweep the land. Pipes will freeze. Food in the freezer will go bad. You may shiver in the dark… praying for a little power – for weeks.”

With rampant inflation and a potential energy crisis looming on the horizon, Bonner believes this might also cause an economic perfect storm.

There is a silver lining, however. He says that this could also be a once-in-a-lifetime opportunity for those with enough foresight to act.

He and his team recommend that Americans consider taking four steps to avoid the potential fallout. Additionally, they have identified a number of assets that could be the key to surviving the recession.

I’ll dive into these steps, as we go. But first, let’s take a closer look at the crisis Bonner believes might be unfolding.

>> Access True Wealth‘s market analysis <<

“The Worst Crisis”

The US dollar is inflating at a record pace, and Bonner predicts that this might just be the start of a period of unprecedented inflation.

US government deficit spending and reckless economic policies could drive the dollar into a hyperinflationary cycle.

The effects of widespread inflation at this level could be devastating to all facets of the US economy.

Additionally, the government is tightening its grip on the American energy industry, which might also raise energy and raw material prices.

Bonner believes one of the biggest contributors is the push to adopt green energy technology that is still in its infancy.

Also, to be clear, Bonner anticipates that green energy could be a major player in energy production down the road — just not today or tomorrow.

“We all want green energy to work. And eventually… in 50 years or so, it probably will.

But today the reality is these green energy technologies are simply not ready to provide the bulk of our power, no matter what we’re willing to pay.”

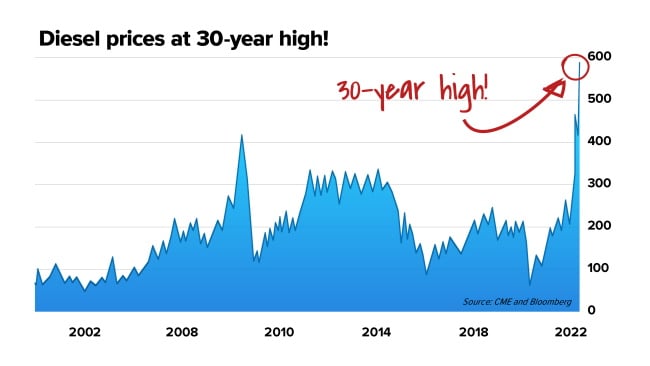

Let’s take a look at gas prices, more specifically diesel, to put Bonner’s warnings about an energy crisis into perspective.

Based on current projections, the price of diesel fuel alone could reach $40 per gallon in the near future.

A rise in fuel prices may result in higher costs for consumers, as harvesting and transporting goods become more expensive.

Food, fuel, and other necessities could become more difficult to access, further stressing the economy and social stability of the country.

If this cycle continues, he believes millions of Americans’ life savings could potentially disappear.

We already caught a glimpse of this within the last year, but Bonner warns that this could accelerate even further.

As mentioned above, Bonner has a game plan that he believes could help those in the know thrive during this potential downturn.

However, his strategy departs from conventional wisdom. He doesn’t recommend trying to scoop up stocks on the cheap and patiently waiting for financial markets to rebound.

Here’s why Bonner believes “buying the dip” might not be the best play.

Why Bonner Thinks Buying the Dip Might Be a Bad Idea

It is no secret that the stock market has struggled in 2022.

According to conventional logic, the recent pullback could be a great opportunity to “buy the dip.” However, Bonner strongly disagrees given the current context we live in.

Rather than buying the broad market, Bonner believes the key is to put money in the right place at the right time.

This may sound counterintuitive, but he lays out his case by looking back to market conditions in the 70s.

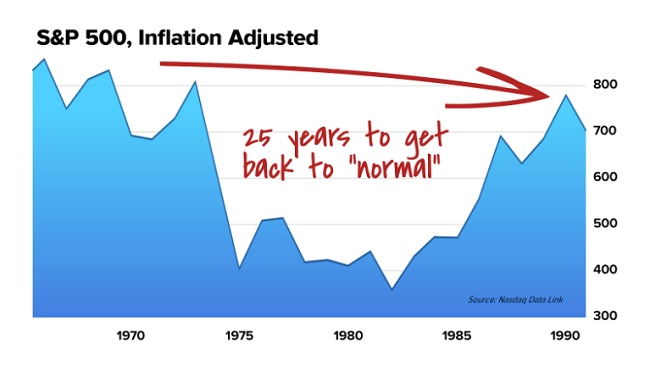

During the 1970s, disastrous government policies sent the S&P 500 spiraling. It was around this time that Lyndon Johnson began a spending spree and took on huge budget deficits.

This caused an immense bout of inflation with lasting effects on the US economy. At one point, the US Dollar almost lost its place as the world’s reserve currency.

When inflation is taken into account, it took 25 years for the S&P 500 to surpass its 1968 high on a real-time basis.

This means those who “bought the dip” in the 70s could have waited a long time to get their money back.

During this time, international confidence in the US Dollar sank so low that the federal government had to begin issuing bonds denominated in Swiss Francs to fund its debts.

As a result of unchecked inflation, the cycle culminated in stagflation.

When this cycle swept through America, it lasted 14 years, but Bonner says that “America’s Nightmare Winter … could be much worse than last time.”

His Four-Step Plan

Bill Bonner has a four-step plan that he believes could help grow and protect wealth during “America’s Nightmare Winter.”

The four steps are outlined in these special reports:

- Buy the Best Assets Now Soaring in Value

- A Unique Way to Protect Your Wealth

- The Secret Currency – How to Make 500% from the U.S. Govt’s Second Currency

- The Art of Speculation

Under this deal, you’ll also receive a steep discount on True Wealth, a bonus subscription to Bonner Private Research, and a money-back guarantee.

Now that you know more about Bonner and his prediction, let’s switch gears and check out the lead of True Wealth.

Who Is True Wealth’s Dr. Steve Sjuggerud?

Dr. Steve Sjuggerud is an expert analyst that has built a reputation for his stellar stock picking.

He has worked as a stockbroker, hedge fund manager, and vice president of a $50 million global mutual fund.

Like Bill Bonner, Steve is lauded for his ability to anticipate market events well in advance.

He accurately predicted some of the biggest financial events of the past two decades, including the recovery of the housing market, the “Bernanke Asset Bubble,” and many others.

The experience Sjuggerud brings to the table sets him far apart from other gurus. He is best known today for his work in research, including:

- True Wealth

- True Wealth Systems

- True Wealth Real Estate

All in all, Steve is an impressive analyst with a strong track record in the research space.

>> Discover Steve’s LATEST recommendation <<

What Comes with True Wealth?

True Wealth’s “Nightmare Winter” bundle offers much more than monthly stock picks.

Keep reading for a breakdown of this service’s features.

True Wealth Newsletter

Each month, True Wealth delivers a monthly stock-picking newsletter that features trade recommendations, expert analysis, and more.

When you sign up, you’ll receive reports right away, and the member portal lets you access previous issues.

A wide variety of investments are covered in True Wealth‘s research, including stocks, ETFs, real estate trusts, and alternative investments like gold.

Model Portfolio

The True Wealth model portfolio includes stocks, ETFs, and other investment assets in a recommended portfolio structure.

There are typically 25 open positions in the portfolio at any given time. However, this could vary.

Members have ongoing access to these model portfolios, so you’ll always have plenty of options to explore.

True Wealth Archives

The True Wealth membership also includes a huge collection of videos and other investing resources.

Although some of the reports are dated, you can still learn a lot about effective investment strategies from them.

I’m a fan of services that offer archives for past work, so I’ll give True Wealth points here for including them in this deal.

Bonner Private Research Subscription

Joining True Wealth under the “America’s Nightmare Winter” deal also offers new members a one-year subscription to Bonner Private Research.

These reports are delivered on the fourth Thursday of every month.

Each issue provides members with the latest market news and expert analysis from the Bonner Private Research team.

It also provides unique insight into how to help grow and protect wealth against the coming chaos.

>> Get one year of Bonner Private Research <<

New Member Bonuses

Under the latest deal, members receive a whole host of additional research and analysis.

Read on for a look at each one.

Buy the Best Assets Now Soaring in Value

In the first report, Steve Sjuggerud directs readers’ attention to a group of assets that he says have made “a massive move up” while many stocks have struggled.

Even better, he believes that these they show no signs of slowing down.

There’s another reason Steve is particularly optimistic about these opportunities.

In the past, he and his team’s picks in this sector have soared as high as 134%.

A Unique Way to Protect Your Wealth

Bill reveals a secret approach he’s used to help protect his wealth over the years.

He’s tight-lipped about this strategy. However, he does offer a few details.

It has nothing to do with opening a foreign bank account, and he believes it could prove especially prudent “to (legally) get some money beyond the U.S. government’s reach” if a crisis unfolds.

If you want to know more, the report offers a complete blueprint for taking advantage of this opportunity.

The Secret Currency – How to Make 500% from the U.S. Govt’s Second Currency

The third report in the bundle also comes from the mind of Steve Sjuggerud. It includes details on a unique way to buy gold and silver without owning physical metals or trading stocks.

This investment’s unique characteristics might make it an ideal alternative to gold, silver, and other cumbersome safe harbor assets.

And the last time Salomon Brothers included this investment vehicle in its annual survey, it ranked #1 over a 20-year span with an annual return of 17.3%.

The Art of Speculation

In this report, Bill shares ideas from a famous contrarian investor from Britain named Tom Dyson, who could help everyday folks cash in on this momentous wealth-building opportunity.

Dyson has a superb track record of success.

Just recently, he recommended eight shipping stocks that provided the potential for average gains of 114%.

This report could help you master the same techniques that made Dyson a legend among contrarian investors, and you get it free when you join True Wealth.

100% Satisfaction Guarantee

Under the latest deal, True Wealth members have access to a 30-day money-back guarantee.

This means you have 30 days to test drive the service. If you don’t feel that the newsletter is a good fit, you can opt for a full refund of the subscription cost.

Thirty days is the industry standard, so True Wealth’s satisfaction guarantee matches up with many competitors in the industry.

This window might not be long enough to see a position to its conclusion. However, it could provide enough time to check out the quality of analysis on offer.

>> Join under Steve’s 30-day guarantee <<

Pros and Cons

Steve Sjuggerud, True Wealth, and Bill Bonner put together a pretty impressive deal, but there are some downsides.

Pros

- 80% discount on the first year

- 30-day 100% satisfaction guarantee

- Four research reports

- One year of Bonner Private Research

Cons

- No chatroom or community forum

What Are People Saying About True Wealth?

Currently, there do not appear to be any reviews or ratings specifically on Bill Bonner and Steve Sjuggerud’s “America’s Nightmare Winter” bundle.

That said, there are reviews of True Wealth on Stock Gumshoe. In fact, the newsletter has locked in a solid 4/5 rating.

Here’s a look at the rating on the site.

Something else to note is that there are about 630 reviews, which, I think, is a pretty good sample size.

How Much Does It Cost?

Typically, a subscription to True Wealth with these added features costs $300. However, for a limited time, new members can sign up for $49 for the first year.

This adds up to more than an 80% discount.

Considering everything that comes with the package, the 30-day money-back guarantee, and the discount, this is a pretty exceptional deal.

There are plenty of alternatives on the market that cost more and provide much less upfront value.

Final Verdict

We’ll have to wait and see if Bonner’s “America’s Nightmare Winter” predictions unfold as he anticipates they could.

That said, he lays out a strong case.

With Bonner’s analysis and Steve Sjuggerud’s expertise, you have an exceptionally strong pool of talent to draw insights from.

New members can access even more insights straight from Bonner and team with the complimentary Bonner Private Research subscription. Better yet, it lasts for an entire year.

Given everything on offer, True Wealth is a fantastic deal and worth close consideration.

>> Get 80% off your first year of True Wealth <<

Tags:

Tags: