When a company is about to go public, there’s always a lot of fanfare and interest. But many overlook buying pre-IPO stock.

Initial public offerings (IPOs) are exciting for an investor; secondary offerings are also a little less so.

If the prospect of an IPO of securities interests you, you may be wondering how to sneak a sweet slice of that pie before the masses have a chance to sink their teeth in.

In our guide, we’re breaking down how you can invest in pre-IPO stocks.

What Is Pre-IPO Stock?

When a tech startup can go public, it means the company has built itself up to a point where essential elements for large-scale growth are in place.

These factors include a stellar management team, sound financial reports, and good corporate governance.

Before a company’s shares ever enter the market and become available to the general public, an exclusive set of stakeholders has access to them.

These insiders include founders, certain employees, and early investors who assume great risk.

How Private Companies Receive Investments Pre-IPO

With the help of investment banks, a private company usually sells pre-IPO shares to institutional investors at a bargain price.

This is done to raise capital before the company goes public and formally enters the market.

However, not all private companies on the verge of going public issue Pre-IPO stocks.

In 2012, the JOBS Act planned to lower the barriers to entry to this rarefied space by easing securities regulations and changing the laws around IPOs.

In 2016, more opportunities for investing in pre-IPO shares officially opened up in the trading environment for both companies and investors.

Why Buy Pre-IPO Stock?

These days it’s not unusual for major private firms to bide their time before going public: think Uber or Bumble.

And it’s the early accredited investors, the ones privy to “roadshows” that edge in before the initial public offering, who often get high returns and the biggest bang for their buck.

A lot of money changes hands before shares ever become publicly traded.

Startup equity is an alternative asset class.

Diversify Your Portfolio with Pre-IPO Stock

A company’s pre-IPO shares could be just what you need to diversify your portfolio.

Shares issued at this point are also less vulnerable to market shocks, which means low volatility for as long as unlisted stocks remain private.

Of course, investing in private shares comes with a fair amount of liquidity risk, amongst other risks, that may not be for the faint of heart.

And this is without considering the many fraudulent schemes that are currently in circulation on the internet and offline.

Tech startups can go from being minnows to becoming the darlings of the financial world, with sky-high valuations and unicorn status.

Or they can crash and burn…

Private companies acknowledge the risks and encourage investors to buy with a relatively low stock price.

Pre-IPO Stocks Help You Play the Long Game

Pre-IPO stocks hold tons of potential for long-term gains.

You need to perform your own research, though, to accurately gauge the value of this type of investment — privately held companies are not obligated to share every bit of information about themselves.

Also, testing the waters with conservative amounts of cash is a sensible approach.

If you have an aggressive risk appetite, the risks could pay off handsomely in the form of multibagger returns.

But you need to ask yourself whether the better route for you is long-term investing in bona fide blue-chip companies.

Who Can Buy Pre-IPO Stock?

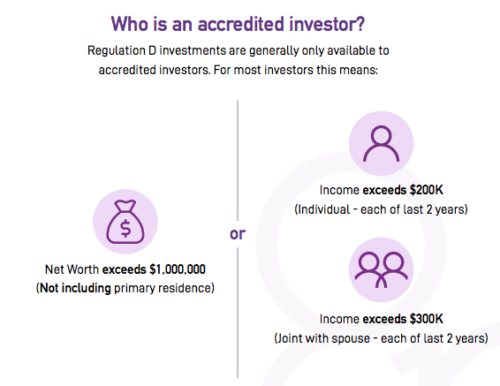

An accredited investor has the requisite know-how to navigate the risks in the pre-IPO space, and this is why such a player can acquire stock before a company goes public.

The traditional, established rules and laws around raising capital protect the average investor who has less technical knowledge of the market.

The good news is you don’t have to be a high-net-worth angel investor like Ashton Kutcher, a Wall Street investment bank, or a massive mutual fund to purchase pre-IPO shares and invest in tech startups.

The piece of legislation signed in 2012 lets private companies bring in 500 unaccredited shareholders for starters.

You may have to meet certain criteria to invest, but as an individual retail investor, you could join the party with small amounts of investment.

Be sure to consider whether the pre-IPO stocks that become available to retail investors aren’t the ones being passed over by institutional investors.

How Do Companies Sell Pre-IPO Stock?

Pre-IPO shares sell in a secondary market.

Angel Investors or Venture Capital Firms

Angel investors and venture capitalists who raise funds and water the seeds of tech startups with capital often get VIP access to large blocks of shares, and they sell these shares in turn.

Pre-IPO Placements

Beyond venture capital and seed and angel investing, there are later-stage early investors who can benefit from pre-IPO placements in the months preceding an IPO.

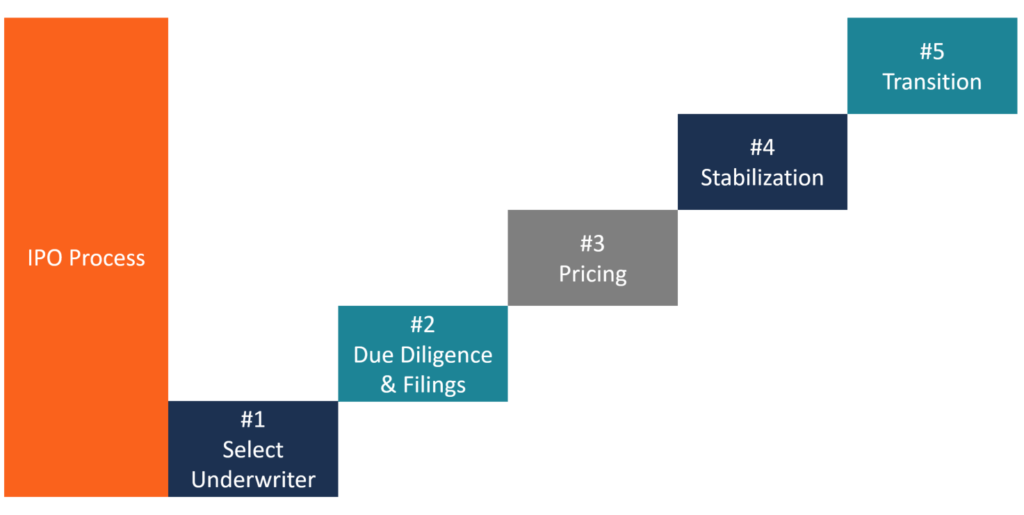

As mentioned earlier, there’s a process where IPO underwriters make large blocks of shares available.

Accredited investors such as private equity firms and big hedge funds that are allowed to invest in pre-IPO stocks benefit from a bargain price because they can offer significant sums of money.

Stock Options

Various other intermediaries and crowdfunding platforms can also obtain large blocks of shares, from early investors, for example, to sell to new external investors.

3 Ways to Buy Pre-IPO Stock

There are three primary ways to buy pre-IPO stocks: work your contact list, use a specialized broker, or buy pre-IPO shares directly from a company.

Keep reading for more information on each method of pre-investing in companies before their IPOs.

Work Your Contact List

As in many other industries, who you know is just as important as what you know.

Your ability to buy unlisted shares will likely be bolstered by a robust network.

With more tech and financial events going digital, you don’t need to be in Shanghai, New York, or Silicon Valley to interact with business incubators, promising entrepreneurs, angel investor firms, and venture forums.

If the trends in various markets and a tech startup’s performance pique your interest, you can always enquire with companies about mid-term and long-term goals.

Use a Specialized Broker

If your contacts can’t assist you, your first port of call will probably be your financial advisor or stockbroker or firms and funds with a niche interest in pre-IPO stocks, such as Equity Zen.

They serve as a bridge between keen companies and buyers, and some firms can have their own stock to sell.

Established brokerages often have accounts at one of the investment banks that get early look-ins.

Between your social network, your broker, and doing your homework, you should be able to wrap your head around the fees and restrictions involved in these capital transactions.

Private equity funds are not managed passively, so fees can be prohibitive.

However, be sure to compare offerings, as you are investing your hard-earned cash, after all.

Buy Pre-IPO Stocks Directly from Companies

ESOPs

You could purchase shares directly from employees with stock options.

Tokenized Equity

Stock tokenization is another way in and one that offsets the liquidity risk.

Some companies offer tokenized equity, and stocks are issued in cryptocurrency.

Sign up on a stock tokenization platform and you could be investing in pre-IPO stocks with ease, and sooner than you expected.

Groundwork

Scout around: make some calls and visit banks, financial institutions, and accounting firms that can point you in the direction of companies that plan to go public.

They might soon be issuing pre-IPO stocks.

A promising startup may be eager for investment and an influx of capital.

Expanding Accessibility

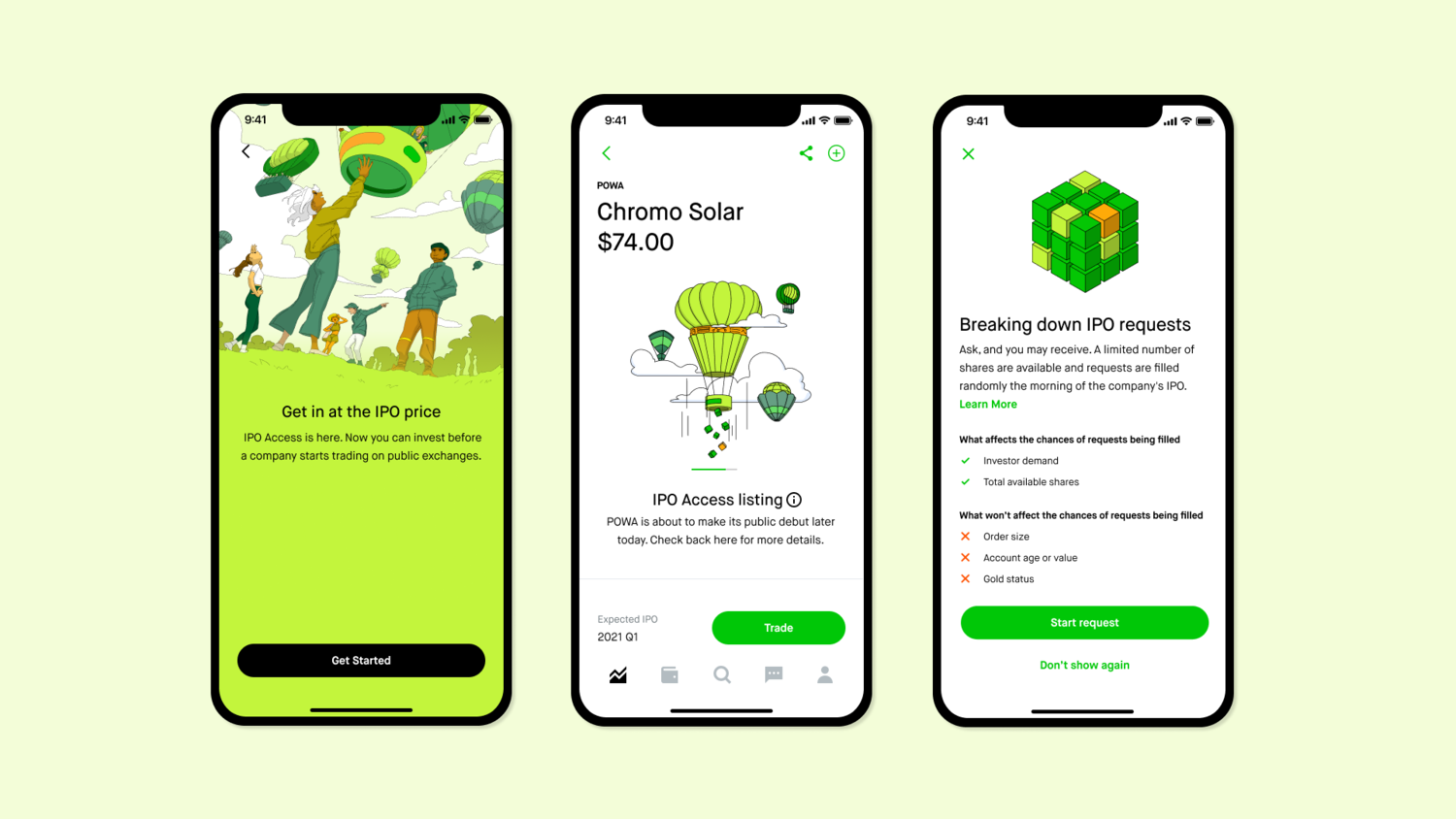

You can also buy pre-IPO shares through Robinhood’s IPO Access product, regardless of your account value or the extent of your investing activity on the platform.

True to its name, the company aims to give less wealthy individual investors a chance to potentially cash in on IPOs.

Recently, Robinhood announced its plans to buck the status quo for its own IPO too.

The stock trading app intends on making a whopping third of its offering, $770 million to be precise, available to its app users.

For context, companies usually reserve less than 5% of equity for regular retail investors.

The company’s investor presentations were open to the public, including the 31 million users across its platforms.

And Robinhood is partnering with Goldman Sachs to facilitate the sale of pre-IPO stocks in a similarly democratized manner.

The tech startup’s employees were allowed to sell a maximum of 15% of their shares to retail buyers as soon as the IPO went live.

Employees would usually be expected to sit tight for a two-quarter lock-in period.

For Robinhood, there are risks attached to this way of operating, including tech glitches and possible lawsuits resulting from unhappy buyers.

But founders Baiju Bhatt and Vlad Tenev want to increase IPO participation for the layman, and it could serve the company well in the long term.

Buy Pre-IPO Stocks Indirectly

You can also indirectly invest in pre-IPO stocks through, for example, a private equity exchange traded fund (ETF) and via venture capital firms that are publicly held.

This means a portfolio with broader exposure, less risk, and the chance to benefit from a company’s gains without as much of an admin headache.

How to Buy Pre-IPO Stock: Final Thoughts

Off-market stock transactions and speculative investments can be risky.

Once you buy shares, your money could be tied up for the long term, and some startups ultimately don’t go on to list on stock exchanges.

Solid companies have had shares that performed and traded badly in the first year or two after an IPO.

And some tech startups flat out fail and cost you your investments.

If a company goes bust, you don’t want to lose big, so you have to be careful and manage your expectations.

Remember, the game has somewhat changed, so you don’t have to be an angel or accredited investor with a high income, and you can spend as little as $100 to $10,000 via modern platforms.

There’s pre-IPO money to be made when the stock price “pops” on day one of trading.

And you can rocket your way to a positive ROI many times over in just a few years.

The income from dividends could be the cherry on top of the cake.

Due Diligence is the Key.

Before you invest in pre-IPO stocks from tech startups or other kinds of companies, you need to do a lot of checks.

Employ the reasonably-priced services of transparent and reliable wealth managers or other third parties during the process.

Consult private placement memos and your colleagues in the industry to confirm your reading of the market’s pulse and the company’s valuation.

Remember, this is not the wild wild west.

Rules exist that govern the trading of pre-IPO stocks and placements, and securities have to be registered or are exempt as per the Securities Exchange Commission or your local state securities regulator’s stipulations.

Get your ducks in a row and you may yet make bank on the first day of the IPO when shares become publicly traded.

Tags:

Tags: