Mortgage notes are a great way to invest in real estate without having the hassle of maintaining it yourself. Read on to learn more about real estate mortgage note investing!

When you buy a mortgage note, not only do you receive monthly payments with both interest and principle. But it also serves as an excellent source for generating passive income that is similar if not identical to what would be received from renting out property!

Also, private lenders are always on the lookout for new customers. If you have a slow or non-paying borrower, they may be willing to give your property one more chance!

Different Types of Real Estate Mortgage Notes

Behind every great property investment is an equally impressive due diligence process. It’s important to be aware of the different types and terms available for your mortgage note, so you can make sure it will work with your investment strategy before signing on any dotted lines!

Fixed-Rate Mortgage Loans

Fixed-rate mortgages are a type of loan that has an unchanging interest rate and monthly payment structure. This makes them popular among people who want to avoid surprises with their finances.

But it also means they’ll have less room for growth in case prices rise over time or something else happens that might affect those rates (such as increased risk).

The Graduated Payment Mortgage

Gradual increases in monthly payments help borrowers manage their debt and make sure they can afford the house.

For example, with a GPM mortgage, you’ll never have to worry about an unexpected large payment decrease because your interest rate stays stable throughout each year’s term thanks to Graduated Payments Mortgage!

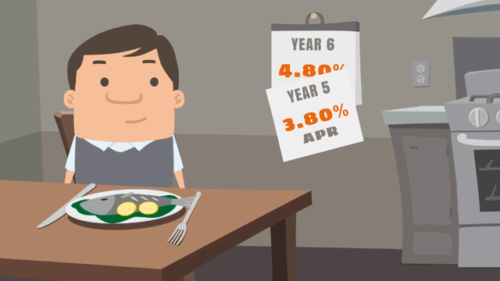

An Adjustable Rate Mortgage

The adjustable-rate mortgage or ARM is a type of lending that has an interest rate tied to third-party indices.

The bank will tie its own floating loans with those offered by the Federal Reserve. And as such, owners may experience increases in payments when rates go up.

The lower of the two numbers is what you’re paying in interest, while the higher number shows how much equity has been built up.

If your lender uses “applied” payments, then make sure to add that amount when computing total costs for both sides!

A Balloon Payment Mortgage

One of the more unique mortgage options is a balloon payment where you have large payments due at specific intervals.

These act in contrast to traditional mortgages which end in an all-encompassing final bill that wipes away your debt completely (and can even include interest). These shorter-term instruments will require regular installment planning from start to finish before they’re finally settled up once again!

Homeowners who are underwater on their mortgage can use a private loan to pay off the balance and avoid losing it. However, there’s always an additional risk that you’ll be stuck with this debt if something happens, such as a job loss or health emergency.

Tips for Success in Note Investing

Some people believe that real estate note investing is the best way to make money in real estate.

They argue that it is a more passive income than other real estate investments, such as fix-and-flips or becoming a landlord. And while there are some truths to these statements, there are also some positives and drawbacks that you should be aware of before you decide to invest in real estate notes.

One of the biggest advantages of real estate note investing is that you can make a lot of money without having to do any work yourself. You simply purchase the note, and then collect the payments each month. The downside is that if the borrower stops making payments, you could be left with a worthless piece of paper.

Another thing to consider is that real estate note investing is not for everyone. If you’re not comfortable with the idea of taking on someone else’s debt, then this might not be the right investment for you. There are also many scams out there, so you need to be careful when choosing a company to invest with.

Conclusion: Real Estate Mortgage Note Investing

Real estate mortgage note investing can be a lucrative way to make passive income. It is important to fully understand all the aspects of this type of investment though and we always recommend you speak to a financial advisor prior to making any large financial investments that could impact your wealth.

Tags:

Tags: