Real estate offers many different investment opportunities, some of which are passive and some that require more of an active role. While passive real estate investing provides more steady returns with less effort, many investors use active investing to maximize their returns.

But what are the most profitable types of active real estate investing? Continue reading to learn the investment strategies you can implement to increase your income and grow your portfolio!

Passive vs Active Real Estate Investing

When comparing passive and active investing, it is helpful to understand what each one entails. Passive investing involves funding real estate projects without being directly involved in the day-to-day operations. Some of the most common strategies investors use for passive real estate investing are crowdfunding and REITs.

In contrast, active real estate investors are much more involved with their investments, with tasks ranging from sourcing deals to making repairs and managing tenants. While there is undoubtedly more work and risk involved with this approach, savvy investors can achieve stellar returns by locating deals that aren’t available through passive investing channels.

Although more risks are involved with active real estate investing, such as paying too much for a problem house or dealing with difficult tenants, we’ve laid out some keys to success in this article.

Long-Term Rental Properties

Owning rental properties is likely the most common form of active real estate investing. This strategy involves buying a house, perhaps making updates and repairs, and leasing it to tenants that plan to live there for at least a year.

There are several nuances as to how you can structure your rental property business.

One decision you must make is if you will hire a property manager. A property manager will typically charge ten percent of the monthly rent to handle all of the day-to-day operations of your rental house, such as managing tenants and addressing maintenance issues.

While hiring a property manager will allow you to be much more hands-off as a landlord, this strategy still isn’t completely passive. There still may be issues that will require your time and attention, and it will certainly require effort to find more deals to grow your portfolio.

Some landlords look for houses that are rent-ready at the time of purchase, while others buy properties in need of repair. In general, houses that need work have the potential to produce the highest returns since they can be purchased for lower prices and then increased in value.

A common strategy that landlords use on properties that need repairs is the BRRRR method.

BRRRR Method

BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat. This strategy works great for rental properties that can be purchased at a low price and improved.

When implementing the BRRRR method, the first step is to locate a property that needs some repairs or updates but would make a great rental after improvements. Next, you must complete the necessary improvements to get it rent-ready.

Don’t go overboard here, though, because what you spend on updates will affect how much you have invested in the deal.

Once the house has been renovated, it’s time to list it for rent. It is crucial to get as much rent as you can. Not only will the rent price directly affect your monthly cash flow, but lenders will often look at the lease agreement to determine how much they are willing to lend on the property.

After the house has been rented, you can reach out to a lender to perform a cash-out refinance. Most lenders will loan up to 75 or 80% of the home’s appraised value. The proceeds from the new loan can then be used to replace the money used for the purchase and rehab.

Since the refinance loan replenishes the funds laid out at the beginning of the project, you can then start another project and repeat the process as many times as you want.

While it is possible to pull all of your capital out of a deal using the new loan or even make some profit (which is tax-free, by the way), it is not always feasible. On some properties, you may have some capital left in the deal.

However, if you planned your project correctly by purchasing the house at a good price and managing the rehab process effectively, your cash-on-cash return will likely be very high.

This is one of the beauties of real estate investing. It allows you to leverage other people’s money to limit the amount of your own capital invested to maximize your returns.

Fix & Flipping

Who doesn’t love seeing an old, outdated house get transformed into something straight out of a magazine?

While this can certainly be an exciting part of flipping houses, there is way more to this investing strategy. It is more important to run a profitable business than take impressive before and after photos.

Flipping houses involves buying properties that need work, renovating them, and selling them for a profit. The main point of fixing and flipping a house is adding value through renovations. The difference between the home’s sales price and purchase price must be substantial enough to cover the rehab expenses while still paying you a decent profit.

Flipping doesn’t always have to involve starting with a dilapidated house. There are plenty of times that house flippers buy a home in decent condition, make minor cosmetic repairs, and then put it back on the market.

What Profit Can You Expect from Flipping Houses?

The average net profit for a flip is around $30,000. However, this can vary greatly depending on how good of a deal you got when you bought the property. It is not unheard of for a house flip to generate a profit of $100,000.

In general, the more work required to renovate a house, the more profit you should be looking for. Not only will these projects take more of your time, but they are also much riskier because unforeseen issues are much more likely to come up.

Assuming a house will sell around the current median sales price of $428,000 and the rehab budget is $50,000, a flipper would likely try to buy it for about $250,000. If the flipper purchased the house in cash and completed the project in four months, even if they ended with a net profit of only $30,000, their annualized ROI would be around 30 percent!

As you can see, flipping houses can provide substantial returns. However, everything hinges on properly running the numbers on potential deals. The two most common methods for evaluating flip houses are the 70% rule and taking a more granular approach and looking at each expense.

What is the 70% Rule in House Flipping?

According to the 70% rule, the target purchase price for a flip house can be calculated by multiplying the After Repair Value (ARV) by 70% and then subtracting off the cost of repairs. The example above for the house at the median sales price was calculated using the 70% rule.

The 30% of the ARV that is subtracted off when using the 70% rule considers acquisition expenses, holding costs, closing costs, and your profit. This allows flippers to quickly run the numbers on a potential deal to know if it is worth pursuing further.

An Alternative to the 70% Rule

While the 70% rule is straightforward to use and allows flippers to run numbers quickly, it often broad brushes all of the expenses involved. This can lead to being over or under-conservative on the numbers.

For example, the 70% rule doesn’t consider whether you will buy the house in cash or use financing, even though this can significantly affect your holding costs. Also, the profit percentage stays the same regardless of the house’s value. Most flippers would prefer to build their actual desired profit into their purchase price instead of relying on the formula to do it for them.

Taking a more granular approach to calculating the offer price on a flip house takes a little more effort, but it gives you much more control. With this approach, start with the home’s ARV and subtract off all expenses and your desired profit to get your maximum purchase price.

Here are the usual expenses that must be accounted for on a flip house:

- Acquisition expenses (loan origination, home inspection, purchase closing costs)

- Rehab costs

- Holding costs (loan payments, taxes/insurance, utilities, etc.)

- Staging costs, if applicable

- Selling closing costs

- Agent commissions

Short-Term Rentals

Short-term rental properties have become extremely popular in recent years, especially in areas that see a large amount of travel. One of the primary benefits of managing short-term rentals instead of long-term is that the cash flow is often significantly higher.

Short-term rentals typically have a nightly rate comparable to hotels and other extended stay venues. Because of this, the monthly rental income can often be twice that of a standard long-term lease.

Since the monthly operating expenses are comparable between short and long-term rentals, the increased rental income can make your cash flow go through the roof!

Short-term rentals are likely the most active of all the active real estate investing strategies. Because there is frequent turnover between guests, great care must be taken to manage bookings and schedule cleanings between each stay.

Investors intrigued by the stellar cash flow of short-term rentals but don’t want the headache of managing them should find a property manager specializing in these types of investment properties.

They will charge a percentage of the monthly rental income. But if you factor that in when you are running your numbers and the returns are still high, then go for it!

When running a short-term rental business, there are two main options: Airbnb and corporate housing.

Using Airbnb for Short-Term Housing

Until recently, the only option for travelers needing short-term lodging when traveling was booking a hotel room. However, many travelers now look for an Airbnb in the city they’re traveling to because they prefer the comfort and extra amenities they provide.

Why not use this to your advantage in your investing strategy?

Getting your property registered on Airbnb is likely your best option to get the most visibility. That is the key when running short-term rentals because you want to minimize vacancies as much as possible.

One major key to success when using Airbnb is quickly getting five-star reviews. Not only do potential guests look at reviews when considering where to stay, but high reviews will push your house up in the algorithm. Many experienced Airbnb hosts offer incentives to guests for leaving a great review.

Corporate Housing

For investors that are skeptical of Airbnb guests but still want the income of a short-term rental, corporate housing may be a good option. Instead of using Airbnb as your source for guests, you can reach out to businesses and offer your houses as temporary residences for employees that travel to your town for work.

Offering properties as corporate housing works well in areas that see a large amount of work travel. If most travel to your area is for vacation, it is probably best to stick with Airbnb.

One of the benefits of the corporate housing model is that the stays are generally longer, which results in fewer vacancies. Business travelers often have to travel for weeks or months at a time, which turns your short-term rental into a “medium-term” rental.

Wholesaling Real Estate

Did you know that you can make money from real estate without actually owning it? It doesn’t require getting your real estate license and becoming an agent either.

It’s called wholesaling!

Wholesaling real estate involves locating a profitable deal, getting it under contract to purchase, and finding an investor that wants to buy the deal from you. Most wholesalers make between $5,000 and $10,000 per deal, and many times it doesn’t require any money upfront.

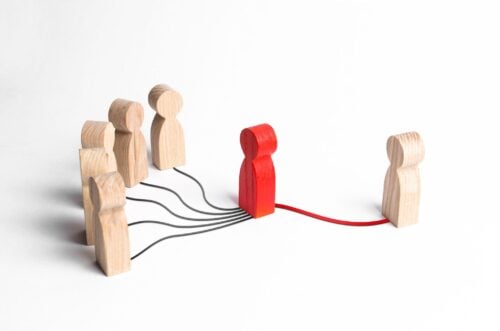

The key to being a successful wholesaler is having a continuous influx of leads for new houses to buy and negotiating purchase prices that flippers and landlords are happy with. The best wholesalers have a large list of buyers and know exactly what they are looking for. Their job is to simply find deals that fit their buyers’ criteria and bake in their own profit to the purchase prices.

There are two main ways to wholesale real estate: assignments and double closings.

Assigning Contracts

Wholesalers who don’t want to use their own money rely on assigning their purchase contracts to other investors such as flippers and landlords. The wholesaler’s agreement with the seller includes a clause that states they have the right to assign the contract to another buyer.

It is then the wholesaler’s job to find a buyer that is willing to pay a fee to purchase the contract and have it assigned to them. Often called the assignment fee, that fee is the profit the wholesaler receives. They receive a check for this amount when the new buyer closes with the original seller.

While the assignment is an excellent tool for any wholesaler to have in their toolbelt, they shouldn’t solely rely upon it.

The main reason for this is that there has recently been quite a bit of hostility against wholesalers. Even the National Association of Realtors is pressuring to make it illegal to advertise properties that you don’t own without a license.

The main reason that wholesalers have gotten so much negative attention lately is that many of them will get houses under contract and then back out if they can’t find a buyer. This can really put sellers in a bind, especially if they are facing a financial hardship like foreclosure.

The best remedy for this is to have a list of buyers that you know are ready to buy and negotiate the types of deals that they are looking for. On top of that, you shouldn’t get a house under contract if you don’t have the means to purchase it yourself if you need to.

Double Closing

Instead of having the end buyer step into your place and close the deal with the seller, you can perform two back-to-back closings. In the first closing, you buy the property from the seller. In the second, you sell it to the end buyer for a higher price and profit from the difference after paying associated closing costs.

Many title companies will not allow the money from the end buyer to fund the first closing. In these cases, you will need access to the capital to get the deal done. This could be from a transactional lender, a private lender, or your own cash.

One slight twist to the double closing is when the wholesaler purchases the property and doesn’t sell it right away. There are several reasons why they may do this. They may have given the seller time to move out but wanted to go ahead and close because of a pending foreclosure. They may also want to make minor updates to the house before marketing it to investors.

Once again, this approach will require access to a significant amount of capital. However, if you purchase a house for $200,000 and sell it in a month for a profit of $10,000, your annualized ROI is 60 percent!

Not bad!

Ready To Maximize Your Returns With Real Estate Investing?

Actively investing in real estate can undoubtedly grow your portfolio and provide returns that are difficult to find anywhere else.

However, it requires knowledge, hard work, and patience. One of the primary skills needed to be successful in real estate investing is sourcing deals and evaluating them for their profitability.

It is not very feasible to dabble in active real estate investing and become successful. The investors that have become wealthy from it have spent a significant amount of time honing their skills and finding what works best for them.

If you are intrigued by the profits and returns presented here, just know that they are possible if you are willing to put in the work. Before you know it, your finances could change completely from your investments in real estate.

Amazing deals are out there! It’s just up to you to find them.

Author Bio: Jordan Fulmer is the owner of Momentum Property Solutions, a house buying company in Huntsville, AL. They specialize in buying houses in tough situations and renovating them to either sell or rent. Jordan also runs the SEO side of their business and regularly writes content about real estate investing, home improvement, SEO, and general real estate topics.

Tags:

Tags: