In times of fear and international conflict, knowing how to invest and what to invest in can be hard. The war in Ukraine and other international conflicts happening in the first half of 2022 brings greater risk to investments in the stock market.

The problem with investing during times of international strain is that many people allow their emotions to drive their decision-making, which results in poor investment decisions and higher risk that can have negative effects in the long term.

Unfortunately, when many people make emotion-driven investment decisions due to the uncertain nature of events, there is irrational price movement and inflated or deflated stock prices.

Successful investors tend to be the ones that step back and make wise investment decisions that will perform well once the conflict subsides.

Fortunately, by looking at performance during past conflicts, inferences about future stock market performance can be made. Knowing what worked well for investors in similar times helps investors today make decisions based on facts and precedent rather than noise and fear.

Investors who understand the psychology of investors during times of conflict can develop a list of rules to follow in order to protect themselves during turbulent times.

Let’s take a closer look at how successful investors navigate the stock market during times of strained international relations.

Image by Natanael Ginting on Shutterstock

Regardless of Turbulence, Success Is Rare

It’s often repeated among investors that 95% of traders fail. While this figure might not be supported by any research (according to eToro, it’s 90%), the core of the idea is that the vast majority of traders lose money.

So whether trading in a turbulent market or a “normal” one, the odds are not in the investor’s favor.

For those who understand this, it’s easier to look long-term and step back from the confusion that international conflict brings. The stock market will run in whatever way it does, and short-term movement has no real meaning in the long term.

If Everyone Is Selling, That Doesn’t Mean They’re Right

Turbulent times can scare people out of otherwise winning investments, which shouldn’t be the case. Precedent shows that there is no real reason for an investor to get involved with their portfolio unless there is a thesis change in an investment.

So unless the reason they invested in the company in the first place disappears, there is no historically-based reason to sell.

Even if a large number of people are selling and the price is moving lower and lower, in the long term the price will mirror the value of the stock. In fact, the traders who are selling are just as likely to be right as they are to be wrong — as they have the same extremely low odds of success as anyone else.

This reveals what the market moves really are: noise.

Short-term movements are just as easily reversed, and if an investor makes an important decision based on noise it has the potential to hurt them when the markets switch direction, as they usually do.

It’s Risky to ‘Trade the Conflict’

Risky investments usually don’t play out well in times of strained international relations. An international issue that is in all the headlines today can resolve quickly, and strong relationships between countries can deteriorate faster than someone can sell their investment or cover their short.

Historically, volatile investments during conflicts are less likely to pay off than safer, long-term investments — even if the upside isn’t as large in the short term.

Successful investors tend to be the ones that look at the potential repercussions the international conflict can have and do what they can to make sure their investments aren’t negatively impacted by the conflict.

Although stepping back while others are making large sums of money trading the conflict may not be attractive to some investors, it is important to understand that there are just as many people losing large sums of money from these risky investments.

It’s like trying to stay ahead of the wildly changing Bitcoin prices. An investor may have a windfall today and lose their shirt tomorrow.

Historically, a portfolio that is structured to avoid unnecessary risk will succeed much more often in the long run than one with a few big wins from much riskier investments.

Unfortunately, the media hypes up the success of these few short-term traders who prosper, which makes trading much more enticing than it really is. So, many investors find their best success by stepping back, choosing investments carefully, and avoiding being influenced by the short-term swings of the market.

International Conflict Changes ‘Sure Bets’

When an investor looks at the markets and makes decisions on how to respond, it’s important to understand that due to the fast-changing nature of foreign relations, things that might be considered set in stone during times of peace could change at the flip of a coin during times of strained international relations.

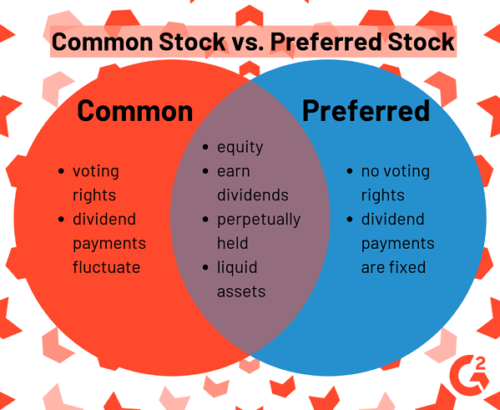

For example, if rates were expected to increase by a specific amount before an international conflict they could just as easily be decreased if something changes that could warrant that. It may be popular to buy preferred stock or common shares in tech companies, for example, but this might need a second look in uncertain times.

Understanding that unexpected things can happen during global crises is essential to navigating the stock market during times like this. As traders push the markets up and down, the economic risk of whatever event is going on is being calculated in real-time. However, this doesn’t mean the traders are correct.

Timing Is More Difficult

Due to the fast-moving nature of international events and the stock market, it can be extremely hard to pick the correct entries and exits without buying or selling too early or too late.

Timing the market is very hard and trying to do it in turbulent times can be even harder. Successful investors generally buy and sell only if there is a thesis change for an investment, not because the market is swinging in a specific way that may cause fear.

Investors who are able to step back and look at their investments from an unbiased perspective have an easier time planning for unexpected events.

Watching the News Becomes a Priority

Although keeping up to date with current events may be stressful for some, investors who watch the news as much as they watch the stock tickers can make more informed plans.

If an investor holds a stock that has the potential to be affected by strained international relations, keeping up to date with the news allows them to do a risk analysis and determine if the change in the market has the potential to affect the original reason they bought the company.

Investors who can weather these situations generally plan for the unexpected as much as possible, and have a portfolio that’s diversified enough that if something unexpected does happen it won’t have a large impact on its long-term growth.

Historically, investors who sell a company during a time of economic turbulence lose out because things usually return to normal. However, staying up with the news allows investors to make sure there are no huge changes in the quality of the investments, and it helps them think logically about what the conflict means for their portfolio.

They stay away from concentrated bets that have a large downside and closely analyze their portfolio to make sure that the amount of risk is manageable both in the long term and short term.

The Past Is Future

The good thing about most current events is that they have happened before. History usually repeats itself and so do the reactions of markets.

For example, when Russia invaded Ukraine in February 2022 global markets took a large hit, with the S&P 500 dropping 10% from its peak. But a month later the markets rebounded and the S&P 500 was trading at levels higher than before the attack. While of course there remains a need to protect your portfolio as this war continues with no end in sight.

As with all events, the stock market attempts to price in what the general sentiment of the public is regarding the problem. However, same as with all events, this general sentiment can be wrong. A common saying is “buy the fear, sell the hype,” and this can be applied to problematic international relations.

Historically, during the runup to most wars prices generally decreased, but when the war started the prices began to rise. Uncertainty is what moves markets, and investors who make the right decisions generally are those who can step back and see how markets usually perform during times like this.

Public markets can be volatile, especially during times of international conflict and strained relations. Historically, the investors that do well during these times follow a list of rules and never invest based on emotion.

Fortunately for investors, markets have been conditioned not to react in a manner that could cause large problems.

According to Mohamed A. El-Erian, Chief Economic Advisor at Allianz, this for two reasons: “First, the belief that there would be no significant subsequent intensification of the initial shock; and second, that central banks stood ready and able to repress financial volatility.”

The advice he gave when a U.S. airstrike killed a top Iranian general in 2020 was to emphasize investments that are “anchored by robust balance sheets and high cash flow generation, resisting the strong temptation for large-scale shifts away from U.S. assets.”

Tags:

Tags: