Graphene has been called the “wonder material” of the 21st century.

With such unique properties, it has the ability to transform countless industries.

From electric vehicle batteries to medical devices and semiconductors, graphene is steadily moving from the lab to the marketplace. Investors are paying attention, especially through smaller, speculative plays known as penny stocks.

In this article, we explore the eight best graphene penny stocks to consider buying right now.

Each one is priced under five dollars and represents a different angle of the graphene revolution.

While the upside potential can be significant, these companies remain risky, so it’s important to approach them with realistic expectations and a long-term perspective.

TL;DR: Top Graphene Penny Stocks of 2025

- Nouveau Monde Graphite Inc (NYSE: NMG): Developing sustainable graphite and graphene solutions.

- Novonix Limited (Nasdaq: NVX): Battery technology company with graphene-enhanced materials.

- Westwater Resources Inc (NYSE American: WWR): U.S.-based anode-grade graphite and graphene project developer.

- Syrah Resources Ltd (OTC: SYAAF): Graphite miner with graphene initiatives and EV exposure.

- Archer Materials Limited (OTC: ARRXF): Graphene-based semiconductors and biosensors in early stages.

- NanoXplore Inc (OTC: NNXPF): North America’s largest graphene producer with automotive focus.

- Directa Plus PLC (OTC: DTPKF): Italian graphene company with a focus on textiles and the environment.

- Graphene Manufacturing Group (OTC: GMGMF): Developing graphene aluminum-ion batteries and coatings.

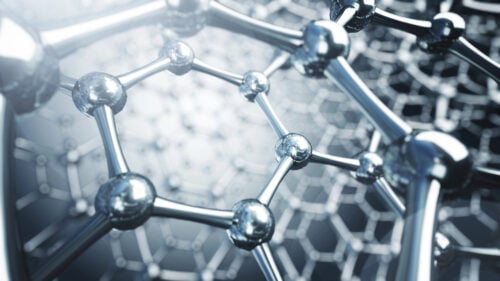

What Is Graphene, and Why Does It Matter?

Graphene is a single layer of carbon atoms arranged in a hexagonal lattice. This structure gives it extraordinary properties.

It is incredibly strong yet lightweight, transparent yet conductive, and flexible while remaining durable.

Because of these qualities, it has the potential to change the way we think about electronics, energy storage, aerospace, construction, and even healthcare.

For example, in batteries, graphene can enhance charging speeds and extend battery lifespans.

In electronics, it may lead to faster, smaller, and more efficient chips.

The aerospace industry is looking at graphene composites to reduce weight without compromising strength.

In medicine, researchers are studying graphene for drug delivery and biosensors.

While many of these applications are still in development, real-world adoption is progressing.

That is why companies in the graphene space have captured the attention of retail investors looking for the next big breakthrough.

The 8 Best Graphene Penny Stocks To Watch Out For

Nouveau Monde Graphite Inc (NYSE: NMG)

Overview

Based in Quebec, Nouveau Monde has set its sights on becoming a key supplier of advanced anode materials in North America.

What sets the project apart is its emphasis on sustainability, with plans to power operations using renewable energy sources and minimize environmental impact, an approach that resonates strongly with automakers looking for greener supply chains.

Growth Catalysts

The global electric vehicle boom is the driving force behind much of the excitement here.

Carmakers are scrambling to secure raw materials, and NMG’s Canadian base offers a politically stable and strategically located option that can feed EV gigafactories popping up across North America.

The company has inked agreements with big industry players, which gives some validation to its approach.

Another factor in its favor is government policy, as both Canadian and U.S. officials continue to provide incentives for domestic battery supply chains.

If graphene-enhanced anode materials gain broader traction, NMG could expand its reach beyond batteries into high-performance electronics and composites.

Risks

Despite its promise, the path forward is expensive and complex. Constructing mines and advanced processing facilities requires billions in capital, and delays or overruns are common in large industrial projects.

The company is still years away from generating significant revenue, meaning it relies on external financing and partnerships to sustain its operations.

Investors must also weigh the competition, since numerous other players in Canada and the U.S. are working to secure their place in the battery materials market.

Conclusion

For those seeking early exposure to the North American EV supply chain, this is a speculative but potentially rewarding bet.

Success hinges on NMG’s ability to execute on its large-scale projects and secure long-term buyers.

If it delivers, the company could emerge as one of the leading producers of sustainable battery and graphene materials in the Western hemisphere.

Novonix Limited (Nasdaq: NVX)

Overview

Novonix, headquartered in Brisbane with major operations in the U.S., is carving a niche in advanced battery materials.

What makes Novonix stand out is its focus on providing a domestic alternative to Asian suppliers, aligning itself with government policy in both the U.S. and Australia that favors local supply chains.

Its facilities in Tennessee are designed to serve automakers and battery producers who want reliable, non-Chinese sources of anode material.

Growth Catalysts

The accelerating demand for electric vehicles and energy storage systems is the backbone of Novonix’s growth story.

Its U.S.-based facilities are positioned to benefit from federal incentives aimed at strengthening domestic EV supply chains.

On the technology side, the company has been working on graphene-enhanced solutions that could make batteries charge faster and last longer.

If those applications gain commercial traction, they could provide a meaningful edge in a market where performance is everything.

Continued investment in R&D, along with long-term supply contracts, could turn Novonix into one of the key mid-tier players in advanced energy materials.

Risks

The company faces the same hurdles as most in this sector: scaling production profitably while competing against larger and more established players.

Costs are high, and any delays in ramping up facilities could hurt investor confidence.

Securing enough long-term offtake agreements is also critical, as without steady demand, its business model will be under pressure.

Market volatility in the EV industry can add further uncertainty, especially if adoption rates fluctuate.

Conclusion

For investors seeking exposure to the battery materials supply chain, Novonix offers a unique combination of strategic positioning and technological promise.

It is not without risk, but if the company delivers on its production plans and graphene-enhanced materials find their market, NVX could evolve from a speculative bet into a meaningful supplier in the EV ecosystem.

Westwater Resources Inc (NYSE American: WWR)

Overview

Westwater Resources began as a uranium company but has fully pivoted toward graphite and graphene materials, aiming to become a key domestic supplier of battery-grade products in the U.S.

Alongside this, it is building a processing facility designed to produce anode-grade material for lithium-ion batteries, with potential applications in graphene-enhanced technologies down the line.

This focus aligns with the broader goal of reducing U.S. dependence on overseas sources of critical materials.

Growth Catalysts

Support from U.S. government policies emphasizing domestic energy independence provides an important tailwind.

Automakers and battery manufacturers are under pressure to secure local supplies of key materials, and Westwater’s location in Alabama puts it within reach of multiple EV factories in the Southeast.

Its transition from uranium to graphite has also brought new partnerships and investor interest. If the processing plant comes online as scheduled, it could mark a pivotal shift from being a pre-revenue developer to a commercial supplier.

Graphene applications may add long-term upside, as the company explores advanced uses of carbon-based materials beyond standard battery anodes.

Risks

Execution remains the biggest challenge. Building a processing facility from scratch is capital-intensive and subject to delays, while permitting and environmental hurdles can complicate progress.

The company also lacks a long history in graphite, which may make it harder to win long-term contracts compared to more established peers.

Funding is another recurring concern, as development-stage companies often need to raise capital, which could dilute shareholders.

Conclusion

WWR is a speculative play on the U.S. drive to secure its own supply of battery materials.

Its success depends heavily on execution at the Coosa Project and its Alabama processing plant.

If it meets milestones and lands binding offtake agreements, it could become a valuable part of the domestic EV supply chain.

For now, investors should view it as a high-risk, high-reward opportunity tied closely to government policy and the growth of the EV industry.

Syrah Resources Ltd (OTC: SYAAF)

Overview

Syrah Resources is a rare example of a company already operating at commercial scale in the graphite and graphene space.

Headquartered in Australia, its flagship Balama mine in Mozambique is one of the largest natural graphite operations in the world.

Beyond mining, the company has established a downstream processing facility in Vidalia, Louisiana, aimed at producing active anode material for lithium-ion batteries.

While graphite is its mainstay, research and partnerships have extended into graphene-enhanced products, giving it a foothold in the broader advanced materials market.

Growth Catalysts

Syrah’s established production base provides credibility that many smaller peers lack. Supply agreements with Tesla and other automotive companies validate its strategic importance in the EV supply chain.

The Vidalia facility is particularly significant, as it represents a U.S.-based source of processed anode material at a time when policymakers are eager to localize supply.

If demand for EV batteries continues to surge, the ability to provide both raw graphite and processed materials will strengthen Syrah’s competitive position.

Longer-term, graphene applications in coatings, composites, and electronics could expand the company’s opportunity set well beyond energy storage.

Risks

Operating a massive mine in Mozambique exposes the business to geopolitical and logistical risks, including infrastructure challenges and political instability.

Like other resource companies, Syrah’s margins are sensitive to commodity price swings, which can impact profitability even with strong demand.

Building and scaling the Vidalia plant requires consistent capital, and any delays could undermine its strategic U.S. advantage.

Investors should also recognize that while graphene holds promise, commercial-scale adoption remains uncertain.

Conclusion

Syrah Resources offers a combination of proven scale and speculative upside.

For investors interested in graphene penny stocks, it provides exposure not just to a potential breakthrough material but also to the critical graphite supply chain that underpins the EV revolution.

While risks tied to geography and execution remain, Syrah stands out as one of the more mature players in this otherwise early-stage sector.

Archer Materials Limited (OTC: ARRXF)

Overview

Archer Materials is an Australian technology company focused on leveraging advanced materials for breakthrough applications in quantum computing and biosensing.

Instead of competing directly in the battery space, Archer is developing graphene-based chips and biosensors that could become critical to next-generation healthcare and electronics.

Meanwhile, its biosensor research is geared toward developing ultra-sensitive diagnostic tools that could revolutionize point-of-care testing.

Growth Catalysts

The potential of Archer’s research lies in its intellectual property and partnerships.

Collaborations with research institutions and universities add credibility, while early patent approvals help establish defensible technology.

The 12CQ project stands out because it positions Archer in a market where governments and large corporations are investing billions.

If successful, graphene-enabled quantum chips could significantly outperform traditional silicon-based solutions.

On the healthcare side, biosensors that use graphene’s conductivity and sensitivity could enable faster, cheaper, and more accurate diagnostics.

With the growing global demand for quantum computing and digital healthcare solutions, Archer’s dual focus provides multiple paths to value creation.

Risks

Archer is still at an early stage, meaning commercial revenues are limited and timelines for product readiness are uncertain.

Quantum computing and advanced biosensors are highly complex, and progress often takes longer than expected.

The company will likely rely on continuous funding to sustain research, which may dilute shareholders.

Competition is also fierce, with global tech giants investing heavily in the same sectors.

For retail investors, this means patience is required, as real-world commercialization could still be years away.

Conclusion

ARRXF offers a speculative entry point into frontier technologies where graphene could play a pivotal role.

While it does not provide the near-term exposure of mining or materials companies, its long-term upside could be transformative if its technologies succeed.

Investors with a tolerance for uncertainty may see Archer as a unique way to bet on the intersection of graphene, quantum computing, and biosensing.

NanoXplore Inc (OTCQX: NNXPF)

Overview

NanoXplore, based in Montreal, is the largest graphene producer in North America and a rare example of a company already generating significant commercial revenue from the material.

By integrating graphene into everyday polymers, NanoXplore aims to improve strength, durability, and conductivity, offering industries a scalable way to benefit from advanced materials without redesigning entire processes.

Growth Catalysts

The company’s growth is fueled by its ability to deliver graphene-enhanced plastics at scale.

Partnerships with automotive manufacturers and industrial clients provide stable demand, as these industries increasingly seek stronger and lighter materials to improve performance and efficiency.

Its joint venture with Martinrea International, focused on graphene-enhanced automotive parts, underscores its commercial credibility.

As environmental standards tighten, graphene’s ability to reduce weight and improve fuel efficiency gives NanoXplore an edge.

Beyond automotive, opportunities in electronics, energy storage, and infrastructure could expand its addressable market.

Risks

Although NanoXplore is more advanced than many peers, challenges remain. Scaling production to meet growing demand requires significant capital investment.

The competitive landscape is also intensifying, with global firms pursuing similar goals. Margins may be pressured if competitors drive down prices before broad adoption takes hold.

As a mid-cap company, NanoXplore still faces financing and execution risks, even though it is further along the commercialization curve than most graphene penny stocks.

Conclusion

NanoXplore offers a unique opportunity among graphene penny stocks because it combines scale, commercialization, and a strong foothold in key industries.

Its ability to embed graphene into everyday polymers gives it a broad addressable market.

For investors seeking a balance between speculative upside and existing traction, it represents one of the most compelling names in the sector.

Directa Plus PLC (OTC: DTPKF)

Overview

Directa Plus, headquartered in Italy, is one of the few graphene companies already selling commercial products at scale.

Its focus lies in textiles, environmental solutions, and industrial applications, with its G+® graphene technology integrated into fabrics, filters, and composites.

Directa’s vision is to make graphene accessible in everyday products, from clothing to water treatment systems.

Growth Catalysts

One of the biggest advantages for Directa Plus is that it already has customers. Its graphene-enhanced textiles are used by fashion and sportswear brands, giving it exposure to consumer markets.

Beyond clothing, its materials are being applied to oil spill recovery and water purification, two areas where efficiency and sustainability are in high demand.

The company has also partnered with tire manufacturers to test graphene additives that could improve durability and performance.

Expansion into the U.S. market, along with growing recognition in Europe and Asia, adds further growth potential.

As industries increasingly seek greener solutions, Directa’s environmental applications may gain particular traction.

Risks

Even with commercial products, challenges remain. The path to profitability is still difficult, as scaling production and distribution requires capital and time.

The textile market is competitive, and widespread consumer adoption of graphene-based clothing is not guaranteed.

Environmental and industrial applications, while promising, require regulatory approvals and long testing cycles.

As with most small-cap firms, funding is an ongoing need, which may lead to shareholder dilution if revenues do not accelerate quickly enough.

Conclusion

Directa Plus offers a more tangible way to gain exposure to graphene, as its products are already in circulation. Its diversification across textiles, environment, and industry gives it multiple potential growth paths.

While risks tied to scaling and market acceptance remain, it stands out as one of the few graphene penny stocks with visible real-world adoption.

For speculative investors, this blend of commercial traction and growth opportunity makes it a notable candidate in the sector.

Graphene Manufacturing Group (OTC: GMGMF)

Overview

Graphene Manufacturing Group, based in Brisbane, Australia, is focused on producing clean, sustainable graphene and applying it to practical industries.

Its proprietary production process uses natural gas to produce graphene, offering an environmentally friendlier alternative to traditional chemical or mining-based methods.

This integrated approach allows it to target multiple industries simultaneously.

Growth Catalysts

The most exciting catalyst for GMG is its work on graphene aluminum-ion batteries, which promise faster charging and greater energy density compared to conventional lithium-ion technology.

If successful, this innovation could disrupt energy storage markets. The company is also advancing graphene-enhanced cooling systems for commercial and residential buildings, tapping into the global demand for energy efficiency.

Its lubricants and protective coatings, already in testing phases, show potential for industrial adoption.

Partnerships with universities and government research programs provide additional credibility and access to new funding streams, while its OTC listing gives U.S. investors direct exposure to this growth story.

Risks

Like most graphene firms, GMG faces uncertainties around scaling production and proving long-term commercial viability.

Its aluminum-ion battery technology is still at an early stage, meaning timelines for mass adoption are uncertain.

Competition from established lithium-ion players and other graphene innovators is intense.

Additionally, as a small-cap company, GMG relies on consistent funding and may need to issue new shares, creating dilution risk for investors.

Conclusion

GMGMF is one of the more innovative graphene penny stocks available to U.S. investors. With its diversified product pipeline and focus on breakthrough battery technology, it offers speculative but intriguing upside.

Success depends on turning prototypes into commercial products, but for investors willing to embrace risk, GMG adds a fresh dimension to a graphene-focused portfolio.

Should You Buy Graphene Stocks?

Graphene stocks are not for everyone. The potential upside is exciting, but the risks are high.

If you believe in graphene’s long-term role in industries like EVs, electronics, and healthcare, a small allocation may make sense. But these should never form the core of your portfolio.

Are Graphene Penny Stocks a Good Investment?

Penny stocks are always speculative, and when tied to emerging technologies, the risks multiply.

Graphene stocks can be appealing investments due to the material’s unique properties and wide-ranging potential applications across various industries.

As research progresses, new graphene-based products and technologies are emerging, increasing demand and growth opportunities for companies working with the material.

In short, graphene penny stocks may reward early believers if commercialization accelerates.

However, timelines are uncertain, and not all companies will survive.

That’s why it is important to tread carefully with graphene investing. After all, investing in graphene stocks, like any type of stock, can be risky.

For most investors, the prudent approach is to keep exposure small and view these as optional bets rather than reliable investments.

FAQs

What Industries Will Graphene Impact Most?

Graphene is set to reshape electronics by enabling faster, more efficient devices with greater flexibility than traditional materials.

The medical field could see major advancements through graphene-based sensors, drug delivery systems, and stronger yet lighter medical devices.

Energy industries may benefit the most, with graphene improving battery storage, solar panels, and even water filtration technologies.

Who Is The Leader For Graphene Production?

Several companies are emerging as leaders in graphene production, with China-based firms holding the largest share thanks to their ability to manufacture at scale.

In Europe, companies like Directa Plus and Versarien are recognized for advancing commercial uses of graphene across textiles, construction, and composites.

In the United States, firms such as NanoXplore and Global Graphene Group are pushing forward with applications in energy storage, electronics, and advanced materials.

Who Is The Leader In Graphene Battery Technology?

Global Graphene Group (G3), a materials science company based in Dayton, Ohio, is widely regarded as a global leader among start-ups in the field of graphene batteries.

With its proprietary and patented graphene material, this innovative company is at the forefront of the rapidly growing market for advanced battery technologies.

Conclusion

Graphene remains one of the most exciting materials in development today.

Its potential uses span across industries and could transform how we build, store energy, and even heal.

For investors, graphene penny stocks provide a way to get early exposure, though the risks are significant.

The eight companies covered here offer different angles of this story, from mining and materials production to advanced electronics and textiles.

If you choose to invest, treat these as speculative bets and size them accordingly.

The future of graphene may be bright, but patience and discipline are essential for investors in this space.

Tags:

Tags: