Diversification is a well-known aspect of any solid portfolio, even if it’s often misunderstood.

Spreading your investing dollars across a range of options helps expose you to more opportunities for upside and can help you minimize your losses.

Plus, if done correctly, it can even expand your investing beyond conventional options like stocks, bonds, and funds. Investing in farmland is one alternative option that has been growing in popularity with investors.

Knowing why portfolio diversification matters is a must. It’s just as important to know the right way to diversify and what your options are.

When you pursue a broad range of holdings, you empower your portfolio to deliver value no matter the prevailing trends of the broader markets.

Here’s why portfolio diversification matters, how diversification can generate value, and how farmland investing can help investors diversify their portfolios the right way.

Farmland Can Maximize Your Returns

Common investing advice says that a diversified portfolio tends to make a bigger return over time. This is more than conventional wisdom; in fact, there’s an economic theory behind why diversification makes good financial sense.

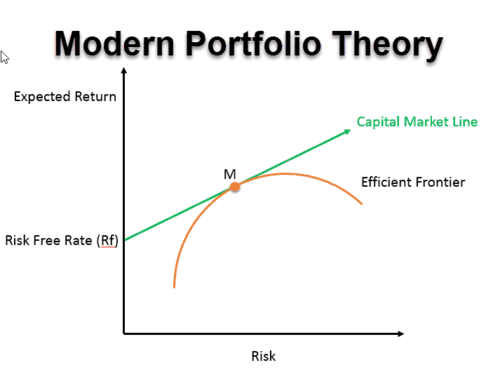

This is known as the Modern Portfolio Theory. MPT is a common way of measuring diversification for various investors and their different risk tolerances.

MPT dates back to the early 1950s when economist Harry Markowitz first published a paper on the subject.

Markowitz suggests that one stock dropping in value within a portfolio can be buttressed by another stock rising by the same amount.

This then cancels out the loss. And, since markets increase in value over time, your overall portfolio will increase in value as well.

There’s much more to it than that (including some pretty serious calculations), but the big takeaway here is that diversification can truly make a difference in your short- and long-term growth.

For many, this looks like a balance of high-risk, high-reward assets (like stocks), low-risk low-reward assets (like bonds), funds that fall somewhere in the middle, and—ideally speaking—alternative investments that correlate with your investing goals

Diversifying through MPT can serve as a guide for designing your portfolio for long-term success.

That is if you do it correctly. Keep an eye on You can soften the blow of short-term losses by canceling them out with gains. Over time, this keeps your money stable and primed for growth.

Farmland Protects Your Portfolio from Volatility

Diversification doesn’t just help you maximize returns—so long as you diversify the right way, that is.

Assets in a diversified portfolio are meant to offset each other in the event that one drops in value. In the short-term, diversification can therefore help your portfolio better handle economic shocks.

The reason diversification can help guard against volatility comes down to correlation factor. Correlation factor measures how closely two or more investments move in tandem with one another.

Investments with low correlation can help reduce portfolio risk since they do not move in parallel with one another.

Investments with negative correlation move opposite of one another, which also makes for an excellent hedge.

So long as the majority of your assets have low correlation with one another, you can give your portfolio a great deal of protection from volatility.

That’s why it’s essential to spread your investment dollars across a range of investments, since this helps keep overall portfolio performance steady.

Farmland Can Unlock Opportunities Outside the Stock Market

There are many diversification strategies, but some of the best include alternative investments. With alternatives, you can enjoy low-correlation opportunities that sit outside the market—making them a prime option for hedging against volatility and increasing portfolio value.

The world of alternative investments is vast. Anything from gold to fine wine fits the description, and each alternative offers a different kind of value proposition.

One one end of the spectrum, Gold serves as a safe haven for investment returns. On the other, derivatives trading serves as a high-risk conduit to quick returns.

If you’re looking to incorporate alternative assets for portfolio diversification, you’ll want to settle on something in the middle of these two extremes.

Alternatives offer several investment options for diversification—but not all of them offer the same value. Many provide a safe haven for funds at the expense of growth potential.

Farmland, for example, is an alternative that offers a hedge against inflation, higher rates of return than bonds, unique value propositions versus real estate, and stable long-term performance.

In fact, the price per acre of farmland has increased in value over the last

How Farmland Makes for a Well-Diversified Portfolio

Diversification can’t be overlooked, nor can it be done poorly. And yet, far too many investors end up pursuing diversification the wrong way.

This can leave you more vulnerable than you thought, and may even position you to lose money over the long term.

Understanding why portfolio diversification matters can lead you down the right path, ultimately helping you understand not just the “why” but also the “how” of diversification.

When looking to diversify, it’s crucial to go beyond the basics. Keeping your investments solely in the stock and bond markets can increase your exposure and make it more difficult to adequately hedge against downturns on Wall Street.

This is where alternative assets, such as farmland, are a must: they help protect you against market fluctuations and can serve as a means to generate value when recession is on the rise.

Farmland investing with FarmTogether makes alternatives easy. The FarmTogether platform unlocks farmland investment opportunities that can diversify your portfolio through fractional ownership of farms across the country.

A once inaccessible asset class, FarmTogether is opening the door for investors and enabling access to this superior alternative and portfolio diversifier.

If you’re an accredited investor, you can begin investing with FarmTogether to help diversify your portfolio.

To learn more about farmland investing and the FarmTogether platform, check out our review here.

Tags:

Tags: