Artificial Intelligence Stocks Under $1 are catching attention as investors hunt for early-stage growth plays in one of the fastest-growing tech sectors.

While major AI names dominate headlines, smaller companies are quietly building real innovations in robotics, cloud software, and smart analytics.

These sub-$1 stocks carry higher risk, but also offer the chance to invest in AI-driven ideas before they mature.

In this article, we’ll explore six promising Artificial Intelligence Stocks Under $1 for 2025, each with unique technology, potential catalysts, and important risks every investor should understand before jumping in.

TL;DR: Best AI Stocks Under $1 (Updated)

- Avant Technologies Inc (OTC: AVAI) – Owns Avant AI, advancing biotech and intelligent infrastructure.

- Cycurion Inc (NASDAQ: CYCU) – AI-powered cybersecurity provider securing networks and data.

- Remark Holdings, Inc. (OTC: MARK) – AI analytics company focused on computer vision solutions.

- reAlpha Tech Corp. (NASDAQ: AIRE) – AI-driven real estate investment and property technology firm.

- Blaqclouds Inc. (OTCMKTS: BCDS) – AI-based cloud security and data protection platform.

- Actelis Networks Inc (NASDAQ: ASNS) – AI-enhanced networking solutionsfor smart cities and IoT.

Best AI Stocks Under $1

Avant Technologies Inc (OTC: AVAI)

Overview

Avant Technologies is an emerging company working at the crossroads of artificial intelligence and biotechnology.

It focuses on developing, acquiring, and partnering with innovators that enhance AI systems, healthcare technologies, and high-performance computing infrastructure.

The firm also owns Avant AI, a proprietary artificial intelligence platform designed to deliver data-driven insights and adaptive learning across multiple industries.

Through this system, the company aims to create scalable applications that can be used in healthcare, analytics, and high-performance computing.

The company’s broader strategy is to participate in sectors shaping the future of automation and longevity science, aiming to become a platform that connects these fast-growing fields under one roof.

Growth Catalysts

The most promising drivers come from its twin focus on AI and biotechnology. Avant has been expanding its research into the Klotho protein, which has been studied for its potential role in aging and regenerative medicine.

At the same time, the company is pursuing next-generation computing infrastructure designed to handle the massive data loads required by AI.

These two areas, intelligent systems and human performance enhancement, have long-term demand and global relevance.

If Avant can execute even part of its strategy, it could secure a niche in markets expected to grow exponentially over the next decade.

Conclusion

Avant Technologies remains speculative but operates in spaces that are both relevant and forward-looking.

The combination of AI and life sciences adds an innovative twist to its story.

For patient investors who understand early-stage technology risks, it represents a small but intriguing way to gain exposure to two industries that are shaping the 21st-century economy.

Cycurion Inc (NASDAQ: CYCU)

Overview

Cycurion Inc is a cybersecurity and information-technology company that combines human expertise with artificial intelligence to protect digital assets across both public and private sectors.

Headquartered in Virginia, the company delivers a full suite of services, including network defense, cloud security, threat analysis, and virtual Chief Information Security Officer (vCISO) programs.

Its approach blends advanced AI algorithms with human oversight, allowing for faster detection of threats, more accurate risk assessments, and adaptive defenses that learn from new attack patterns.

This integration gives Cycurion an edge in a cybersecurity industry where automation and intelligence are increasingly critical.

Growth Catalysts

The global cybersecurity market continues to expand as governments and businesses race to protect sensitive data from more sophisticated threats.

Cycurion’s use of AI-driven analytics enhances its ability to identify and neutralize risks in real time, making its services more effective and scalable.

Its existing relationships with government agencies and enterprise clients provide a foundation for recurring revenue and credibility within the highly regulated defense and compliance space.

By combining automated monitoring tools with expert-led strategy, the company can tailor its solutions to different industries, from finance and healthcare to critical infrastructure.

As AI continues to redefine how cybersecurity operates, Cycurion’s hybrid human-plus-machine model positions it well for future contract growth and technology licensing opportunities.

Conclusion

Cycurion represents a speculative but forward-looking opportunity in the cybersecurity sector.

Its integration of artificial intelligence into network defense is more than a buzzword—it’s a practical advantage that enhances speed, accuracy, and adaptability.

While still a small-cap player, the company’s expanding service portfolio and AI-based threat-detection platform give it a strong position in one of the world’s fastest-growing technology fields.

If you’re seeking exposure to the convergence of cybersecurity and artificial intelligence, Cycurion deserves a place on the watchlist.

Remark Holdings, Inc. (OTC: MARK)

Overview

Remark Holdings delivers artificial intelligence-powered analytics and computer-vision technologies through its platform of video tools and smart-agent solutions.

Its Smart Safety Platform (SSP) is built to detect objects, behaviors, and events in real-time video feeds, and supports deployment in both cloud- and on-premise formats.

The company serves clients across retail, public-safety, and enterprise sectors, positioning itself in a growing segment where AI-based surveillance and analytics are increasingly used.

Despite its micro-cap status and OTC listing, the technological focus aligns with broader AI adoption trends in safety and security.

Growth Catalysts

One driver for potential growth is the expanding demand for advanced video analytics systems in smart-city, retail-and-security applications.

As businesses and municipalities look to automate monitoring and risk detection, the ability of Remark’s platform to integrate AI models for facial recognition, behavior analysis, and object tracking becomes relevant.

Additionally, Remark holds differentiated intellectual property in AI and computer vision, which could translate into partnership or licensing opportunities with larger systems integrators.

The nature of SaaS-style delivery and subscription models also offers a prospect of recurring revenue if the company can convert pilot projects into scaled deployments.

Conclusion

Remark Holdings represents a speculative play within the realm of AI-driven video analytics and smart-safety solutions.

While it has a compelling technology narrative and growing markets behind it, the challenges of scale, cash-flow, listing status, and competition remain significant.

For investors accepting high risk, it may serve as an intriguing entry into niche AI applications, but it should be treated as a small, experimental position rather than a core holding.

reAlpha Tech Corp. (NASDAQ: AIRE)

Overview

reAlpha Tech is a real estate technology company leveraging artificial intelligence to streamline the home-buying and property-investing experience.

It offers an integrated platform that covers real estate brokerage, mortgage services, and title management, all powered by AI-based tools for home-search, loan-matching, and closing-process optimization.

By embedding machine learning into the user workflow, it aims to reduce friction and cost in the U.S. real estate transaction ecosystem.

Growth Catalysts

The U.S. real estate services market is worth trillions of dollars, and there is growing demand for improved technology within home-buying and investing.

reAlpha’s AI-driven assistant functionalities, such as helping buyers refine property matches, pre-qualify for loans, and expedite closings, address visible pain points in the transaction process.

Its expansions into new states and the consolidation of brokerage, mortgage, and title services under one roof strengthen its platform potential.

As digital-first home-buying gains traction, a company that integrates end-to-end services powered by AI may gain market share.

Conclusion

reAlpha offers an engaging mix of AI technology and real-estate services – two large domains that rarely overlap.

While execution remains key, the company’s strategy of vertical integration across the property lifecycle and its listing on Nasdaq provide merit for speculative consideration.

Investors should monitor operational rollout, state-by-state growth and scalability, but for those willing to embrace an earlier-stage AI-play, it stands out comparatively in this list.

AI Penny Stocks Under $1

Blaqclouds Inc. (OTCMKTS: BCDS)

Overview

Blaqclouds is a technology company focused on software-as-a-service solutions that combine AI, blockchain, and cloud security in the tokenization of real estate assets.

Its product suite includes tools for business-database segmentation, staff monitoring, and digital marketing analytics.

The company has also announced a subsidiary aimed at property tokenization and fractional ownership via NFTs, to merge real estate, blockchain, and AI within one ecosystem.

Growth Catalysts

The convergence of AI analytics, blockchain tokenization, and cloud security places Blaqclouds at the intersection of several advanced technology themes.

As interest in fractional real-estate ownership grows and digital asset infrastructure expands, a firm that can integrate tokenization with AI-based asset analytics may carve out a niche.

Moreover, cloud security remains a critical area of enterprise spending, and combining AI threat detection with blockchain transparency may offer differentiated value.

Conclusion

Blaqclouds is among the most speculative names in the list, combining high-innovation themes rather than established business models.

Its concept is fascinating for investors drawn to frontier tech, but the path to scale and meaningful revenue is uncertain.

It should be treated as very high risk, with the potential for high reward if execution and market timing align.

Robotics Stocks Under $1

Actelis Networks Inc (NASDAQ: ASNS)

Overview

Actelis Networks is a U.S.-based technology company that builds hybrid fiber-copper networking systems designed to deliver secure, high-speed connectivity for smart cities, IoT applications, and defense infrastructure.

Its technology allows organizations to upgrade existing wiring to near-fiber performance without expensive or time-consuming replacements.

Recently, the company has taken its platform further by embedding artificial intelligence into its network management solutions.

This AI integration helps operators monitor, analyze, and optimize traffic in real time, reducing downtime and improving data security across connected environments.

Growth Catalysts

As cities, utilities, and enterprises move toward digital infrastructure, the demand for fast, reliable, and intelligent networks is surging.

Actelis’s AI-enhanced systems go beyond connectivity—they enable self-learning network optimization.

By analyzing patterns across vast data streams, the company’s software can predict congestion, identify anomalies, and recommend adjustments automatically.

This capability is particularly valuable for IoT and mission-critical networks, where even small disruptions can have major consequences.

Actelis is also expanding its footprint through partnerships in transportation, public safety, and defense communications, where AI-driven automation helps reduce operational costs and improve efficiency.

Its ability to retrofit existing infrastructure using machine learning tools positions it as a cost-effective solution for organizations seeking modern, cyber-hardened networks.

Conclusion

Actelis Networks is carving out a smart niche within the connectivity and infrastructure space by combining traditional networking with artificial intelligence.

The company’s hybrid technology approach and AI-powered performance analytics provide a bridge between old and new infrastructure—a rare advantage in a market focused on modernization.

For anyone looking at the intersection of AI, IoT, and smart-city development, Actelis offers an early but promising opportunity in a segment poised for long-term growth.

Should You Buy Artificial Intelligence Stocks?

Many retail investors are asking the same question, and the truth is that there’s no simple answer.

Whether you should buy artificial intelligence stock really depends on your investment goals and risk tolerance.

This is an emerging tech that’s beaming with potential, but many companies in their field need to prove themselves.

Still, with the rising importance of artificial intelligence, it’s definitely worth your consideration — especially if you can grab some of the best stocks at an affordable price point.

Artificial intelligence stocks are rarer than you might imagine right now.

Although many tech companies are gravitating toward AI initiatives and machine learning, few public artificial intelligence stocks exist.

Even so, stocks under $1 can be a great launching point for new traders if the odds look good.

Day traders who crave volatility will find some at these low share prices.

AI Market Outlook for 2025 & Beyond

The AI market continues to grow rapidly across nearly every sector. From enterprise automation to personal productivity, AI is driving efficiency gains that reshape business models.

Analysts expect the global AI industry to continue growing, thanks to increased demand for machine learning, cloud infrastructure, and generative applications.

For micro-cap and penny stocks, this growth represents both an opportunity and a challenge.

Companies with niche expertise, like robotics or AI-powered real estate, can carve out meaningful market positions, but only if they manage cash prudently and build partnerships.

Anyone interested in sub-$1 AI stocks should remain cautious, diversify holdings, and view these investments as speculative exposure to a long-term technological trend.

AI Penny Stocks Under $1: What to Look for

It might be challenging to determine which ones to invest in, especially if you’re looking at several AI penny stocks at once.

Individual equities may be a suitable alternative for your portfolio, but there are certain things you should look for when purchasing AI stocks.

Check the Company’s Market

When keeping an eye out for AI stocks, you should check if the company is in a growing market.

Make sure that the market they are in is competitive.

Furthermore, focus on companies that are using artificial intelligence to improve products or gain a strategic edge.

Research the Company’s Stock History

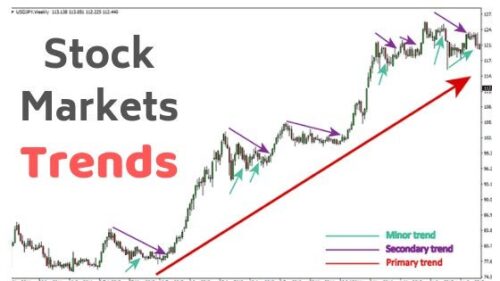

When buying AI stocks, you should always check their history by looking at their stock chart.

If the company is publicly traded and listed, the stock chart will appear at the top of the search results.

This is an excellent place to start if you are looking for stocks specifically for their volatility.

Check for Stock Trends

When analyzing a stock chart, check for a significant period where the price drop has slowed or drifted.

Also, take note of the current price.

Then find out how it has fared in the past weeks, months, and years.

This method will help you to identify patterns for the given stock.

Where to Buy Artificial Intelligence Penny Stocks Under $1

More and more investors are looking to AI penny stocks to diversify their portfolios, using them as an opportunity to earn solid gains in the short or long term.

However, many newcomers in the market for stocks valued at less than $1 are lost about where to find them.

This is understandable, as many stock screeners don’t even have an AI filter because the tech is so new.

If you’re interested in buying artificial intelligence stocks, check out some of these platforms.

eToro

eToro is a US-licensed and regulated online broker with multiple licenses from other international bodies across the world.

The platform serves over 20 million traders globally and has been rated the best social and copy trading system provider.

It was first established in Tel Aviv, Israel, where the company is currently headquartered, before being established in many other countries.

Currently, eToro operates in the US under SEC regulations and has licenses to operate in more than 100 countries worldwide.

eToro trades majorly in Tier 1 stocks ranging between $1 and $5.

Stash US Broker

Stash is a new school online broker that provides brokerage services to beginners in the US.

Like eToro, Stash offers Tier 1 stocks.

Trading on the Stash US Broker platform enables users to start their trading careers by taking small steps and increasing the size of their trades as they gain confidence.

When purchasing penny stocks through the online trading platform, individuals are charged $1 in fees, higher than other competitors in the US.

Robinhood

Robinhood is a US-regulated platform that offers commission-free brokerage services for stock trading, penny stocks, CFDs, options, and cryptos.

Unlike many brokers, the Robinhood platform abhors strict minimum deposit requirements, making it easy for investors to deposit any amount of money they need to buy penny stocks in the US.

We have seen how artificial intelligence will take over the world in the next few decades, so buying AI penny stocks could be a wise investment.

Artificial Intelligence Stocks Under $1: Final Thoughts

Artificial intelligence has remained a hot topic for a while now and will continue to make waves in years to come.

While the public markets have relatively few AI stocks to choose from, this will likely change when the space becomes more saturated with competing companies.

For now, $1 artificial intelligence stocks provide an affordable entry point into the industry.

The artificial intelligence sector’s rapid growth could be a profitable investment opportunity, and widespread adoption of this technology may come sooner than you think.

AI Stocks Under $1 FAQ

Read along for our answers to the most commonly asked questions about artificial intelligence stocks.

What Is AI?

Artificial intelligence is the process of programming a computer to make decisions for itself. This can be done through numerous methods, including but not limited to machine learning, natural language processing, and predictive modeling.

Why Are AI Penny Stocks So Popular?

AI penny stocks are popular because they offer investors the opportunity to get in on the ground floor of what could be the next big thing. Many believe that artificial intelligence is going to play a major role in the future of technology, and investing in AI penny stocks is a way to get exposure to that growth.

What Are the Advantages of Trading AI Stocks?

AI stocks are all the rage right now, and for good reason. Many companies and investors alike see the potential AI brings to the world, and they want to tap into the benefits for themselves.

Many of the top Fortune 500 firms have AI implementation plans on the radar. With such a rush coming down the pipe, new tech companies specializing in AI can rise up and enjoy some of the spoils.

These new AI companies open the door for trade opportunities in a space with just as much long-term growth potential. Everyone’s clamoring for a piece of the business, but not everyone will make it.

Following the hype surrounding a specific technology or business can send share prices to new heights. Following these trends can lead to the gains traders are always on the hunt for.

That said, it’s still crucially important to dodge the potholes along the way. Many AI startups with plans of grandeur will never make good on their word.

As with any other sector, check for solid use cases and a solid financial platform to stand on. Trade based on insights, patterns, and actually data instead of just speculation.

What Is the Best Artificial Intelligence Stock Under $1?

Artificial Intelligence Technology Solutions Inc. offers a great opportunity for investors seeking to invest in AI penny stocks. The company has a market capitalization of just over $85 million and has recently been making waves due to its consistent growth in revenue. Last year, the company recorded an 85% increase in sales.

Why Are AI Penny Stocks so Volatile?

AI penny stocks are volatile because they are still in their early stages of development. Many of these companies are still trying to prove their viability and may not have a proven track record. As a result, their stock prices can be quite volatile, rising and falling rapidly in response to news and speculation.

Is It Wise to Invest in AI Penny Stocks?

That depends on the individual investor. Some people may feel comfortable investing in AI penny stocks because they believe in the long-term potential of the industry and the high rewards that they will yield. Others may prefer to invest in more established companies that are less risky.

Tags:

Tags: