Special purpose acquisition companies, or SPACs, are a powerful investment opportunity in 2022. What is a SPAC, and what are the best SPACs to buy right now? Keep reading to find out.

What Is a SPAC?

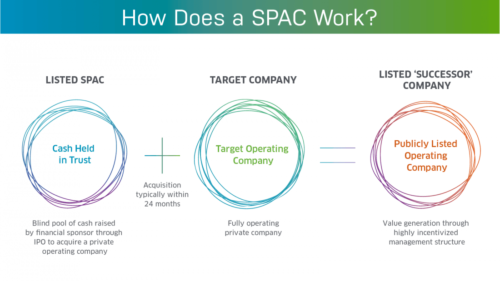

A special purpose acquisition company (SPAC) is essentially a shell corporation or “blank check company” whose sole purpose is to raise money to acquire one or more businesses or assets.

A SPAC, by definition, does not engage in commercial operations.

The acquisition target companies are usually privately held, and acquisitions happen through a reverse merger or a purchase agreement.

Often, SPACs are called blank check companies because they are just that: funds from investors sitting in escrow until a company is acquired.

What You Should Know About SPACs

In the past, many investors avoided SPACs, thinking they were too risky.

The SPAC process presents a scenario of reduced regulatory scrutiny compared to the traditional Initial Public Offering (IPO).

Because of this, many retail investors consider SPAC stocks to be a sneaky back door into the public markets.

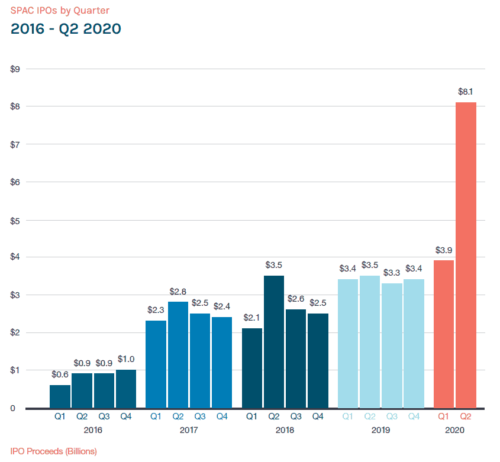

However, the year 2020 turned the concept of SPACs on its head.

Now, private companies in big tech are using this once shady vehicle to keep funds away from banks and hedge funds, primarily due to a costly IPO process.

Many large tech companies have felt like their loyal employees, some of whom have been around since the garage days, lose out when their company goes public.

This is where SPACs come in — after all, they are good enough for Bill Ackman and Richard Branson.

However, Jim Cramer recently told his viewers the SPAC era could be reaching an end. Is this really the case though? Or could this investment be something to add to your portfolio?

Best SPACs: How Does a SPAC Work?

As stated earlier, a SPAC is a public company created to acquire a private company.

It works like this: a group of investors or a sponsor with a set of expertise raises money to acquire a non-listed company.

In short, a special purpose acquisition company sponsor and investor might have no idea what company they will be buying at the outset.

The money raised exists in escrow for a certain period of time, usually two years.

The money in that account is distributed to either complete the acquisition for the private company on the merger agreement or when that money is returned to investors after time expires.

Once investors approve, the new company will start to trade on a public exchange.

What Is a SPAC Warrant?

A special purpose acquisition company holds investor money in escrow, and then those funds buy the targeted company.

After the IPO, SPAC units often get split into warrants and common stock.

This gives investors extra incentive as the warrants can also be traded in the open market.

These warrants represent the bonus for investors who have put their money into a blind pool.

For example, as stated above, units will often contain ½ warrant, a ¼ warrant, or a full warrant.

The warrant type will depend on the sponsor or the track record of who is leading/promoting the SPAC.

The SPAC warrants will be redeemable at certain trading price thresholds.

The strike price for most warrants is $11.50 per whole warrant, with adjustments for splits and other factors.

The warrants can be exercised only if the SPAC completes a deal before the specified date.

This date usually occurs 30 days after the de-SPAC transaction.

The Lifecycle of a Special Purpose Acquisition Company

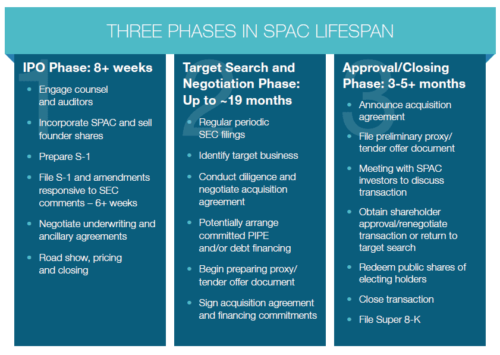

A special purpose acquisition company will go through the normal Initial Public Offering (IPO) registration process, which includes filing an S-1, communicating with SEC regulators, negotiating underwriting agreements along with the roadshow, pricing, and, finally, closing.

The IPO places funds in a trust account while the management team seeks a suitable takeover candidate.

The terms of the SPAC will vary from deal to deal, but management has a given time to find an acquisition and complete the deal (24-months is a standard timeframe).

Often, initial investors into SPAC’s will get units consisting of one share, plus a fraction (usually 1/3rd to 1/9th) of a warrant.

When the units split (usually 60 days after their IPO), investors get shares and warrants.

If the time expires, the capital returns to investors.

In many cases, special purpose acquisition companies will go public with a narrow or sector-specific focus in their search for an acquisition.

Following a successful acquisition, the SPAC will call a mandatory shareholder vote or tender offer.

If the shareholders vote in the negatory, they can get their money back (SPACs are usually priced at $10 per share, but this can vary).

Should the shareholders approve the deal, the combination will commence (called a “De-SPAC transaction“), and the target business will combine into the publicly traded company.

The Best SPACs to Buy

If you are sold on SPACs and want to check out some options to invest in, take a look at our top picks for the best SPACs to buy now.

Blue Owl Capital Inc (NYSE: OWL)

Although it is not a bank, Blue Owl Capital (OWL) makes direct loans to real estate companies, businesses, and private equity firms. The company projected $1.3 billion in sales in 2023 at the time of its SPAC merger. Presently, $1.8 billion in revenue is anticipated.

Blue Owl’s earnings per share are predicted by analysts to be 53 cents this year and 68 cents in 2023. Nevertheless, from the peak in November, the stock has dropped by about 48%.

Given that Blue Owl was trading at 36 times earnings, valuation may be more of a factor in this than fundamentals.

At present, the price of its shares is more reasonable at 14 times 2023 earnings, which is less than the S&P 500’s 15 times.

SoFi Technologies (NASDAQ:SOFI)

Perhaps the only SPAC offering by Chamath Palihapitiya that still has a chance is SoFi Technologies (NASDAQ:SOFI).

After establishing 12 SPACs with his company, Social Capital, Palihapitiya gained a reputation as the “SPAC King.”

He skillfully avoided the conventionally stringent IPO regulations by taking advantage of the risk tolerance provided by extra money during the pandemic.

He took many companies public thanks to weak SPAC regulations.

However, funding has since dried up, and nearly all of his SPAC stocks have failed because investors did not profit from them.

SoFi Technologies is the only business out of those SPACs that might succeed in the long run.

The online bank is growing rapidly and might approach breakeven pretty soon. Its revenue rose 37% in Q2, and has been growing steadily every quarter for several quarters.

Its cash flow position has also tightened in the last few quarters, even though its still losing money.

The stock saw a solid jump a couple of months ago when the Biden administration announced that the freeze on student loan repayments was going to get over.

Currently, the stock is trading nearly 25% higher than last year.

However, there are still a few hurdles for this stock to really breakout.

Trust in banks is a key component. Banks in general continue to be viewed with suspicion by the public, with particular attention being paid to digital banks like SoFI.

SoFi’s stock has the potential to rise this year if it can persuade depositors of its safety and highlight its cheaper status.

Horizon Acquisition II (NASDAQ: HZON)

Horizon Acquisition II is unsurprisingly the second SPAC from the Horizon Acquisition Corporation.

The corporation’s first SPAC merged with event ticket provider Vivid Seats in just October of last year.

Although Horizon Acquisition II is not limiting itself to any one industry, the SPAC hopes to pursue a business in entertainment and media just like its predecessor.

Horizon II was pursuing a merger with sports betting venture Sportradar, but talks fell through last summer.

The fallout did impact Horizon II’s stock slightly, but this could be an opportunity to pick up a SPAC stock for a little less than normal.

No merger is currently in the works for Horizon Acquisition II, but many speculate it’s not far off.

The parent company is already preparing for an IPO on its third SPAC in the entertainment sector and will want to merge Horizon Acquisition II before this happens.

Best SPACs to Buy: List of SPACs that Announced a Merger

If you’re interested in investing in SPACs that just announced a merger, take a look at the entries that made out the shortlist.

Forbion European Acquisition Corp (NASDAQ: FRBN)

Forbion European Acquisition Corp. was founded on August 9, 2021 and is headquartered in Wilmington, DE. FEAC. It is part of the Forbion Growth Fund.

FEAC shares have gone through the roof in the last few days after the firm announced a merger with EnGene, the Canadian gene therapy developer.

The deal is likely to go through by Oct. 31, and shares of the combined entity will likely trade on NASDAQ.

The patented DDX platform from enGene makes it possible to dose nucleic acid cargoes—like non-viral gene therapies—directly into mucosal tissue lumens.

DDX was created by enGene with the goal of delivering genes to mucosal epithelial cells through mucus barriers in a scalable, reversible manner that can be seamlessly incorporated into current clinical procedures.

The clinical-stage lead candidate detalimogene voraplasmid (EG-70), a non-viral gene therapy delivered by intravesical instillation, is one of the immune-oncology tools that enGene is developing further.

Detalimogene voraplasmid’s dual immune mechanism in a monotherapy is intended to produce long-term, organ-sparing outcomes in BCG-unresponsive NMIBC with CIS.

It does this by encoding two retinoic acid-inducible gene I (RIG-I) agonists to stimulate the innate immune system and interleukin-12 (IL-12) to stimulate the adaptive immune system.

Data from the ongoing Phase 1/2 LEGEND study of patients with high-grade BCG-unresponsive NMIBC with CIS show positive pharmacodynamic urinary biomarker data, an encouraging safety profile across all tested doses, and strong preliminary efficacy based on cytology, cystoscopy, and biopsy.

The extensive potential of enGene’s delivery platform to target and deliver non-viral gene therapy through mucosal tissues to treat additional oncological and non-oncological diseases, such as urogenital tumors and respiratory illnesses like cystic fibrosis, makes this stock a good candidate for SPAC enthusiasts.

Dune Acquisition Corp. (NASDAQ: DUNE)

Dune Acquisition Corp. is a SPAC formed in December of 2020.

The company was founded by Carter Glatt and is based out of Florida.

In October, the SPAC announced a proposed merger with TradeZero Holding Corp.

TradeZero is a commission-free stock trading platform that provides several market scanning tools.

This announcement has Dune Acquisition Corp.’s share prices trending upwards as investors look on in anticipation.

There’s no word on a closing date yet, but the process can take several months.

Dune stands out thanks to its redemption rights, where you can redeem your shares for a set price if the company fails to merge.

Its redemption price is almost identical to its current share price, which could add a nice safety net to your investment.

SPK Acquisition Corp (NASDAQ: SPK)

SPK Acquisition Corp is a Delaware-based SPAC that began its search for a merger in July of 2021.

While originally interested in the telecom space, SPK decided to throw its hat in the ring with Varian Biopharmaceuticals in February 2022.

Varian works to take the fight against cancer to the next level through new technology.

This tech will connect medical professionals through more intelligent data, solutions, and insights.

Tools can be used across the board as a part of cancer therapies, even extending to animals.

The company is also looking to small-molecule protein kinase inhibitors as an effective treatment in eliminating the disease altogether.

With a fresh merger announcement, no date has been announced to bring Varian public.

However, any announcement can boost SPK’s stock in the meantime.

Iron Spark I Inc. (NASDAQ: ISAA)

Iron Spark I has been on the prowl for a business dealing with commerce, technology, and culture.

The SPAC went live back in June 2021 with a $150 million initial public offering.

It is the first of its kind to pay shareholders a $0.05 quarterly dividend while working through the merger process.

In April 2022, Iron Spak announced a proposed merger agreement with Hypebeast Limited.

Hypebeast looks to combine contemporary culture with editorially-driven commerce and news.

The company works in several niches, including fashion, music, art, gaming, and technology.

Many big names have thrown their names into the ring as private investors, such as Jonah Hill, Tom Brady, and Tony Hawk.

Although there’s no time frame set for this merger, these investors may serve to expedite the process.

Breeze Holdings Acquisition Corp (NASDAQ: BREZ)

Breeze Holdings Acquisition Corp is a SPAC originally searching for a merger in the energy sector.

It went public in December 2020, entering in at just over $10 per share.

Instead, Breeze Holdings entered into a merger agreement with D-Orbit, a company that’s out of this world.

D-Orbit is an Italian venture specializing in space logistics and orbital transportation services.

Although not yet public, D-Orbit has already proven itself with successful launches since its inception in 2011.

Its latest mission traveled to space in January of this year.

The merger will help D-Orbit reach further into the heavens than ever before.

There’s been no announcement of a merger date, but Breeze share prices are already slowly increasing.

Any favorable news could cause share prices to jump considerably.

Best SPACs: Pros & Cons

Pros of SPACs

One of the most important characteristics of a Special Purpose Acquisition Company is its flexibility.

Even sponsorships shares can be adjusted from 20% to 0%.

In short, everything is negotiable.

The negotiations on shares and warrants are open, especially as the termination date approaches.

These issues are all up for grabs because there are many SPACs with different amounts of capital.

And here lies another bright spot of the SPAC, access to primary capital.

Lastly, timing is another crucial factor.

A traditional IPO or a direct listing will take an average of 6–7 months to begin trading, while a SPAC will take around 2–3 months.

Cons of SPACs

The vetting of a public company is a prolonged process to ensure the deal is a good one.

Transparent business practices are desirable, but a SPAC is not.

It is a quick-moving public offering where the paperwork process has been simplified, and transparency is low.

In short, one of the benefits of the SPAC can also be what actually makes it risky.

Moreover, no SPAC is a sure thing; a recent study by Renaissance Capital found that 89 SPACs that had gone public since 2015 posted an average loss of 18.5%.

Traditional IPOs booked an average gain of 37.2% over that time.

It’s also worth noting that, in August 2021, a Securities and Exchange Commission (SEC) advisory panel released a draft proposal proposing that the regulator increase oversight of SPACs.

This may indicate that stricter disclosure requirements are on the way, which would be good for transparency.

Lastly, promoters can often get sweetheart deals when it comes to SPAC listings.

The big names in the industry can ask for a lot of stock.

Similarly, many of the investors in SPACs are just looking for quick cash, meaning they don’t plan to buy the company long-term.

Should You Invest in a SPAC?

The short answer is it depends.

Are you willing to commit trading capital to a stock where you do not clearly know what you are buying?

For many investors, the mystery of SPACs is what makes them attractive.

Remember that you can always request your money back when a SPAC finally merges.

For this reason, SPACs offer speculative investors huge potential upside with limited downside risk.

Where Can I Buy SPAC Stocks?

Although somewhat unique, SPAC stocks are listed on the same exchanges you’ll find any other stock.

Robinhood is a great platform to use to access these listings.

It is very user-friendly and easy to find your way to the tickers you’re looking for.

If you’re looking for something a little more in-depth, consider Webull.

This platform has more complex tools and algorithms for uncovering lesser-known stocks that could break out at any time.

Both platforms search only the major exchanges such as NASDAQ and the NYSE, where tickers tend to be less volatile.

All the SPACs we’ve looked at today are listed on one of these two exchanges.

Best SPACs: Features To Look Out For

Keep these factors in mind when deciding which SPAC to invest in:

Sector Focus

Most SPACs target a specific sector when looking for a potential acquisition and rarely stray from that original plan. Studying that industry may provide insight into how it will fare after the merger.

If you’re not thrilled with a particular SPAC’s direction, it may be best to move to a different one that jives more closely with your investment strategy.

Stakeholder Backing

Stakeholders are the backbone of a SPAC and provide the funds to get it off the ground. These minds lead the charge in finding a startup to merge with, and its eventual success falls largely on their shoulders.

Make a point to research these names and any history they have of getting deals done in the past.

Know the Terms

Before investing in a SPAC, take the time to understand its structure. Management teams can eat up a lot of shares, leaving little everyone else to scoop up. Future warrants can dilute the share pool more.

Trading Price

SPACs almost always start off trading at $10 per share, largely because they have no valuation to base a price on. However, investor and market sentiment can cause this number to bend upward or downward.

These changes may not be extreme, but they can be a tell about how others feel about the blank check company represented.

Timeframe

Most SPACs enter the public eye with a timeframe in mind to complete a merger. Two years is the most common interval, but some opt for shorter periods. Shareholders must approve any changes to this goal.

If a SPAC fails to perform a merger, it’s usually liquidated with remaining funds distributed back to shareholders in proportion to investments.

Best SPACs To Buy: Final Thoughts

SPACs are undoubtedly the most popular “third door” on Wall Street right now, and, honestly, there are plenty of companies waiting in the wings.

CB Insights currently counts 474 unicorn companies worth over $1,535B.

Some of those names have already been on the tip of Wall Street’s tongue, like JUUL, DoorDash, SpaceX, and Airbnb, to name a few.

In short, SPAC Season is just beginning.

Best SPACs FAQ

Check out these answers to some of the most popular questions surrounding SPAC stocks.

Are SPACs Good Investments?

SPACs often depend on the success of the company they are merging with.

Like any other investment, research goes a long way toward identifying which SPACs are going to win.

There have been very successful SPACs such as DraftKings that are still doing well on the market.

Can SPACs Go Under $10?

SPACs can dance a bit above or below the initial IPO value of $10 without much concern.

However, SPACs can drop significantly below $10, raising a red flag for investors.

What Does SPAC Stand For?

SPAC is the acronym for special purpose acquisition company, also known as a blank check company.

Why Are SPACs So Popular?

Investors are drawn to SPACs for a number of reasons. Here are a handful of the top ones:

Speed to IPO

SPACs take a somewhat unconventional route to IPO, not having any operations of their own. Therefore, they dodge a lot of the regulatory scrutiny that can appear with other companies. This in turn delivers a faster approach to going public and gaining favor.

Getting In on the Ground Floor

By merging with startups, SPACs provide investors with a means to enter an investment at a very early stage. Should the new company flourish, you’re looking at a very long runway for growth.

Less Dilution

Stakeholders carefully control how many shares of a SPAC go out before an acquisition takes place. Less dilution favors the few owning shares when profits roll in.

Fresh Opportunities

Many innovative ideas would struggle to see light of day without a SPAC investment. Thanks to SPACs, we can all potentially benefit from life-changing products that wouldn’t get attention otherwise.

What If a SPAC Does Not Merge?

If a SPAC isn’t able to firm up a merger in the time allotted, funds are liquidated and returned to shareholders.

What Are the Most Successful SPACs?

Many SPACs have completed mergers, and some have done better than others.

The biggest successes from SPACs are DraftKings and Opendoor.

Tags:

Tags: