Entering the stock market can be cost-prohibitive, and potential traders are dissuaded from even trying.

Many would-be investors are now wondering “can you borrow money to buy stocks?” The short answer is yes, but the long answer is much more fascinating.

For those who want to invest but don’t have adequate capital to make trades, it’s common to look for alternative ways to buy in.

Purchasing stock with borrowed money may sound like a strange (and possibly great) way to turn a profit, but it can result in big payouts or big losses, so you need to be careful.

Before you borrow money to buy stocks, do your homework on investing in the stock market, especially with debt.

Can You Borrow Money to Buy Stocks?

So, can you borrow money to buy stocks?

Yes, and this is certainly something they don’t teach in school — but with some important caveats.

Taking out a loan can mean fast access to money to invest in the stock of your choice; however, this type of investment is much more complicated than it seems on the surface.

Under some circumstances, it may make sense.

Under others, however, the risks exceed the rewards.

Before taking out a personal loan, ensure you understand the ins and outs of trading stocks with borrowed money – the good, the bad, and the ugly.

This is what you need to know to invest using leverage from a loan.

How Can You Buy Stocks with Borrowed Money?

There are a few different ways to invest in the stock of your choice with money borrowed from a bank.

But, before jumping into the deep end, you need to consider all of the borrowing options as well as the potential ramifications of each.

These include margin accounts, other forms of loans, loans from friends and family, and indirect loans.

Margin Accounts

For those serious about investing with adequate education in the market, purchasing investments with margin accounts can be a great opportunity to make the most of leverage.

These accounts, which exist specifically to invest on margin, are popular among those who favor debt to buy stocks.

This kind of debt is referred to as a margin loan.

More on Margins

Margin loans are only available through a margin account.

Opening a margin account is similar to opening up any other kind of investment account with a broker.

Many margin accounts have minimum investment thresholds, like $2,000 to open the account.

Once an account is open and active, brokers permit borrowing a certain percentage of a purchase, like 50%.

This allows investors to purchase investments above the amount of money within an account.

The cash or securities held within the account are collateral against the loan and are referred to as your “margin.”

Once stocks purchased on margin are sold, the loan amount, as well as any fees, are deducted from any profit made on the sale.

Margin Call

A margin call is a demand made from your brokerage to pay into your margin account because losses have dropped your balance below the account’s threshold.

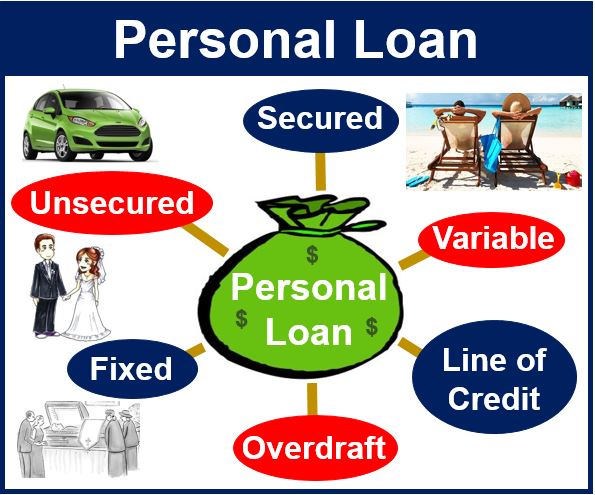

Other Loans

Loans come in all shapes and sizes.

For those who plan on investing without using a margin account, personal loans can be another way to secure capital.

Personal loans tend to be small.

Personal loans aren’t available to everyone, but for those with a good credit score and a strong credit history, this can help secure funding when no other form is available.

Due to the lack of collateral involved in this kind of loan, personal loans can have higher interest rates and shorter repayment terms, so borrowers are encouraged to only consider this option if loans could be repaid even in a loss situation.

There’s rarely room to negotiate with these kinds of loans, so if a loan’s term comes to an end, you still have to pay.

There’s no leeway in paying on a loan, especially for short-term loans from banks or other lenders.

Payday loans may seem convenient, but with high interest, predatory terms, and steep fees, these are never a good choice for investing.

Loans from Friends or Family

Not all loans come from a bank.

Instead, it’s possible to borrow money from friends or family and use this influx of cash to purchase stocks.

This method of obtaining a loan is safer in theory — there are no potential legal consequences of purchasing stock with friends and family, particularly if there are no repayment plans put in place — but the emotional and personal damages can be significant if repayment becomes a problem.

If you’re borrowing from friends or family with the intent to make financial investments, it’s best to be upfront about this.

Let them know you’re planning on investing, why you need help to invest, and how you plan to recoup the money necessary to make payments.

Sharing personal finance deals can also be beneficial.

Some family members may feel more comfortable with a contract in place to ensure lent money is repaid within an appropriate period, so be prepared to involve a lawyer if necessary.

Offer to pay interest as well, even a low-interest rate can make a loan to use to invest seem more appealing.

Indirect Loans to Invest in Stock

Indirect loans are loans that generate cash flow to be used for other purposes, like a mortgage and home equity.

Many people take on this kind of loan without even knowing it.

For example, if you have the cash to buy a new car but choose to take out a loan instead and then purchase securities, you’re technically buying stock with borrowed money.

In some cases, this can be very low risk and offer significant value.

Investing in a 401(k) while holding a home mortgage is something many people do without thinking about the potential ramifications, and there are generally few risks to be had.

Most 401(k) contributions come out of a paycheck and don’t count as disposable income.

These withholdings are always earmarked as money to invest.

However, those with lots of loans, like high credit card debt, medical debt, or student loan debt, may want to think twice before investing in the stock market.

Do People Borrow Money to Invest in Stocks?

Yes, some people do borrow money to buy stocks.

Whether taking out a loan is a good idea depends on many factors, with financial security being at the top of the list.

A loan that is hard to pay back could put your finances at risk under most circumstances.

Here are some considerations before taking on a loan; can you:

- Pay off this loan in the predetermined time?

- Handle another loan with your current financial situation?

- Take on this loan while not compromising your investment goals?

Asking these questions should set you on the right track toward determining if taking another loan out is right for you.

Those with limited spending money, variable income, steep monthly bills, poor credit, loans with high interest rates, and a lack of education in the stock market are most likely to put themselves in a risky situation.

What Are the Risks of Borrowing Money to Invest in the Stock Market?

Borrowing money under any circumstances can be a risk, but this is especially true when borrowing money simply to invest in stocks or other investment vehicles.

So investors should carefully assess potential risks before moving forward with a loan.

Systemic Debt Risk

Investment returns in the stock market are never guaranteed.

For some people, particularly those purchasing stock without a strong personal financial situation, may find themselves in hot water if their securities take a dive.

Buying any kind of risky securities could result in serious problems, both short-term and long-term, especially if the stock performs far below what is expected.

Payments are due to a lender on a predetermined schedule, even if an investment fails to yield a profit.

Don’t Take on a Loan to Trade if You Can’t Afford the Loss

If you don’t have cash on hand to make loan payments, you might need to sell stocks or liquidate additional assets to make up the difference.

If there are no other alternatives for repayment on a loan, this could lead to borrowing more money in an attempt to right the ship, creating a vicious cycle of losing money.

Systemic debt can be even more problematic if you have high-interest debt.

Risk of Loan Default Due to Investment Loss

Investment loss is among the biggest risks when it comes to investing in the stock market.

The temptation to make big and hasty purchases with the plan to sell for big gains can be intoxicating, but this perspective can be dangerous.

Securities purchases that carry too much risk aren’t a good idea for investors who aren’t experienced in researching funds and tracking market movement.

However, this isn’t exactly intuitive for anyone new to the stock market.

For example, a new investor may invest a large amount, like $10,000 on a stock they read about online, only for the price to plummet the next day.

While situations like this are extremely rare, using borrowed money to invest never guarantees gains and can lead to massive losses.

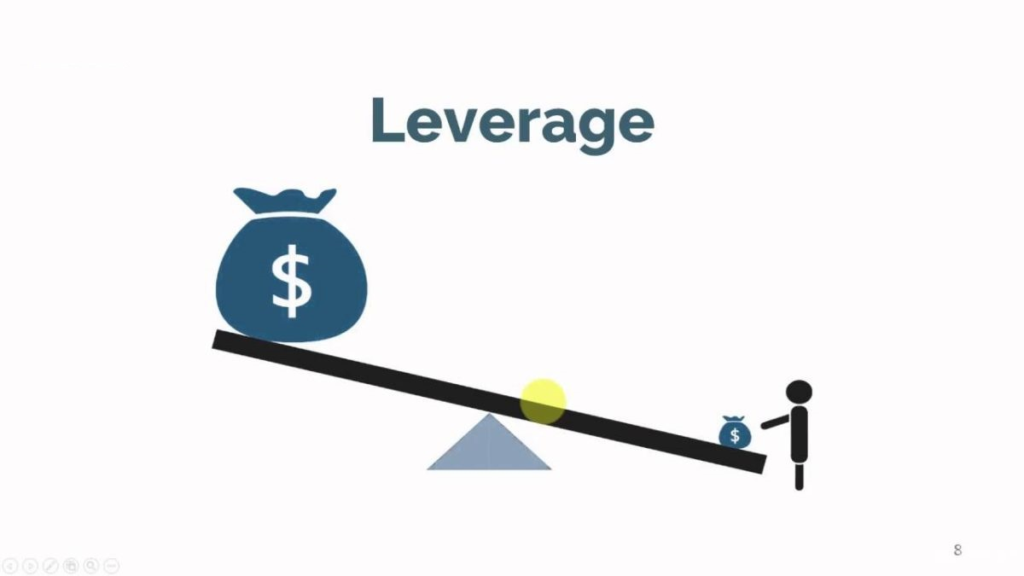

Risk of Leverage Addiction

In some ways, investing in the stock market is similar to gambling.

Making a good trade and generating a tidy profit can release endorphins in a similar manner to playing a great hand in blackjack or winning big in a poker game.

It’s also not uncommon for investors to feel as if they’ve beaten the system or that they’re smarter than the average person, leading to a desire to borrow more and make bigger, riskier investments.

When leverage addiction comes into play, it’s not uncommon for risky choices to feed into it.

More on Leverage Addiction

Addiction, leverage addiction included, generally leads to unhealthy behavior in investors, which is not a good way to build a strong portfolio.

Taking out a loan solely for the excitement of being an investor is never a good idea.

If leverage addiction is driving your motivations for pursuing a loan for an investment, this is a negative prospect, and you should stay away.

Should You Borrow Money to Buy Stocks?

Whether you should or shouldn’t borrow money to buy stocks largely depends on your financial situation and your goals in building a portfolio.

If you want to borrow money and understand the risks, borrowing may be a good way to buy into the market with plenty of available capital to invest.

For many people, taking on margin debt or any other kind of debt, particularly with a high interest rate, for the sake of investment is a bad idea.

Without enough liquid cash to make good on obligations, you may find yourself facing a lot of debt with no easy way to repay it.

Can You Borrow Money to Buy Stocks: Final Thoughts

As the adage goes, you have to spend money to make money.

However, spending borrowed funds to invest can be a risky proposition.

While there are smart, savvy ways to invest using money from a loan to purchase securities, there are also risky ways that could end in disaster.

You are the only one who can determine whether using borrowed money in the stock market is a wise decision.

Factors like time frame to pay back loans, personal debt tolerance, and investments available to purchase should all play a role in the decision to borrow.

However, you always need to make sure you’re investing with confidence rather than dreams of hitting it big.

It’s best to weigh the pros and cons accordingly before taking out a loan, opening a brokerage account, or making investments.

Tags:

Tags: