For several years, value investing has been a paradigm of investment methodology.

Big-name value investors like Warren Buffett have made the concept very popular.

But what about deep value investing, and where did the idea originate from?

Fewer people have heard of Buffett’s teacher and friend Benjamin Graham. Ben Graham is often credited with introducing the concept of deep value investing.

This concept originates from Graham’s original work on classical value investing.

Deep value investing is becoming a popular new investment paradigm, so we are giving you an in-depth breakdown of this strategy.

We will also review how deep value investing works and run down the benefits of this powerful investment methodology.

Deep Value Investing Definition

While Quantitative Value invests in the highest-quality inexpensive stocks, Deep Value invests in the cheapest stocks in the universe, regardless of quality.

Deep value investing is a quantitative investment methodology based on finding undervalued or “cheap stocks” that are priced well below the net current asset value (NCAV).

Deep Value is a quantitative investing approach that identifies the cheapest stocks in a universe of equities based on their valuation multiple and invests in them.

Investing in Deep Value is straightforward.

Stock prices don’t always correlate to their actual value as an investment

Deep value investors are not particularly interested in investing in stocks that will grow the most per se, but stocks whose growth gives you more value per dollar than you put into your investments.

Simply locate the stocks with the lowest market valuation multiples and construct a well-diversified portfolio.

You can select any valuation multiple that suits your preferences. The portfolio’s odds of doing well, very well, over time are good.

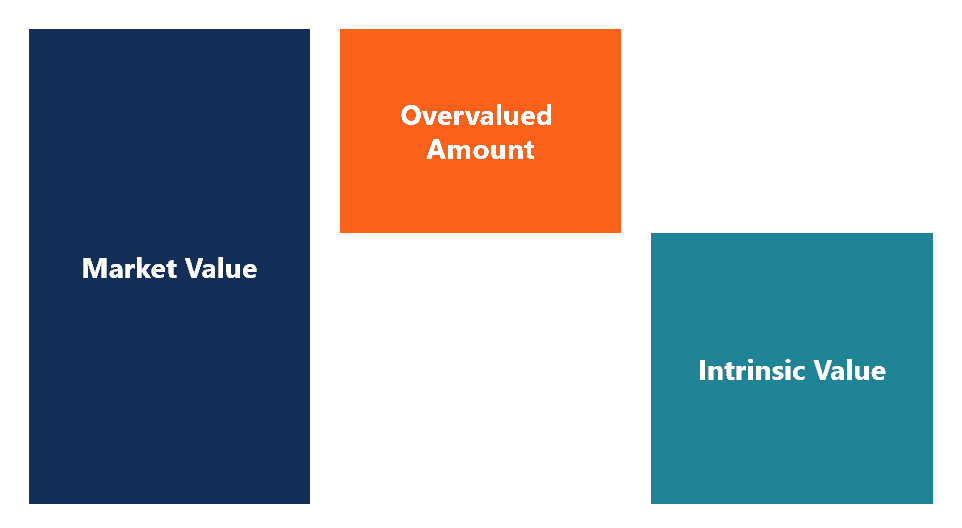

In other words, deep value investing is about finding deep value stocks that have a high intrinsic value relative to their market price.

Stocks with a high intrinsic value are more likely to have better future returns.

Intrinsic value can be calculated in several ways but commonly draws on facts such as total assets, earnings, dividends, risks, future cash flow, etc.

How Does Deep Value Investing Work?

Deep value investing is not so much a rigid formula for investing, but rather a general investment philosophy that can be helpful in several ways.

One of the key aspects of traditional value investing is the focus on quantitative metrics. Value investing is (at least as described by Graham) all about quantitative metrics.

The point is to find securities that are trading on the market at prices well below their calculated net asset value.

The Goal of Deep Value Investors

The basic goal behind deep investing is to get the most out of every dollar that you put into your investments.

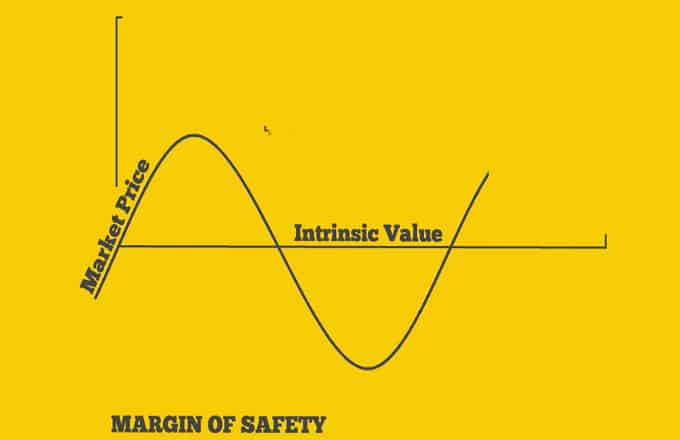

The general logic is that if you are buying stocks well below their intrinsic value, it’s likely the price will rise.

The greater the difference between estimated intrinsic value and market value, the more you would be getting out of every dollar you are investing.

Notice that this strategy does not necessarily mean that you want securities with the highest intrinsic value, but those that have a high ratio of intrinsic to market value.

How to Identify Deep Value Stocks

The idea behind finding deep value stocks is identifying stocks that have high intrinsic value.

But intrinsic value is a notoriously ambiguous term.

It can basically be understood as the valuation that a knowledgeable business person would place on a company.

In that sense, notions of intrinsic value will always be inherently subjective, as many investors weigh the value of metrics differently.

Exceptional Results

Deep value investing is the way to go if you’re new to value investing and want a relatively simple technique that yields great returns.

When deep value investment is combined with mechanical value investing, you can obtain both principle safety and a good likelihood of a good average yearly return.

To create a Graham-styled investment letter that the Dean of Wall Street would be proud of, we’ve worked hard to live up to this Ben Graham ideal.

Deep Value Stocks: Intrinsic Value

As a general rule of thumb, intrinsic value can be estimated based on a company’s net asset value.

Basically, if you add up all the assets, subtract all debts, and you are left with a big number, then the company has high intrinsic value.

Stocks that have an intrinsic value significantly above the market value are good deep value common stock candidates.

Who Are World Famous Deep Value Investors?

Benjamin Graham, recognized as the “Father of Value Investing,” pioneered deep value investing.

Graham and Jerome Newman founded the Graham-Newman partnership, which functioned from the 1930s until the 1950s and put his research and teaching into practice.

Over the course of two decades, Graham-Newman generated yearly returns of 17%.

Graham’s Success with Deep Value Investing

Graham-Newman purchased companies that were trading for less than their book value of equity, and in some cases, for less than cash.

They made a fortune in the process. Graham-Newman hired two of Graham’s students who went on to become two of the world’s most successful investors.

The first is Warren Buffett, who is well-known.

Walter Schloss, the second, is only known in the investor milieu.

Graham’s protege Warren Buffett takes advice from Graham’s classical approach, though he notably differs in some key areas.

Deep Value Investing: Graham’s Perspective

Graham did not care much about the more abstract aspects of companies, like their management, reputation, or public goodwill.

Instead, he argued that when it came to value investing, one should try to focus on purely objective metrics.

This point of contention is a major difference between Graham’s classical value approach and Buffett’s characteristic approach.

Buffett has long preached about the necessity of factoring in competitive advantages and management skill, but Graham’s methodology is mostly absent of these kinds of evaluation metrics.

Deep Value Investing Strategy

Like we said earlier, every deep value investor will have a different strategy based on how they interpret intrinsic value, but here is a basic skeleton of a strategy.

First, start by identifying the net current asset value of a company, then you can calculate NCAV with this formula:

NCAV = Total Assets – Total Liabilities – Preferred Shares

This is a rough schematic and modification can occur based on investment preferences. Once you come to a suitable calculation, take that number and divide it by the total number of outstanding shares.

The number you have will let you know the net asset value per share. The next step is to compare the market value per share to the net asset value per share.

This margin means providing a lot of safety as the company can essentially be up for liquidation; it can then pay off any debts and reimburse shareholders, and the greater the difference, the safer that you are.

Understanding Valuation Multiples

Deep investing relies on several statistical concepts, the most important is valuation multiples.

A multiple ratio is of great use when it comes to estimating intrinsic value and comparing it to stock price.

Valuation multiples can be understood in terms of price-to-earnings (P/E) ratios and is a way to roughly judge the intrinsic fair value of a particular security.

Example of Value Investing

For example, say that an analyst determines that they can earn $10 per share of company XYZ. Further, let’s say that company XYZ current market price to earnings ratio is 15.

Multiplying the ratio by the estimated earnings should give you a rough estimate of the fair value of a security. In our case, a fair value would be $10 x 15 = $150.

Other Valuation Multiples in Deep Value Investing

There are several other valuation multiples that you can use, depending on which investment factors you think are the most relevant.

Other common types of multiples used to assign market value include enterprise value (EV), which is essentially a measure of earnings before interest and taxes.

Graham himself was concerned primarily with the price-to-earnings ratios and market value to book value ratios — also known as price-to-book (P/B) ratios.

What Are the Risks of Deep Value Investing?

While deep value can be a boon to your portfolio, there are risks involved that should be taken into account before trying to beat the market with undervalued stocks.

Too mathematical

Some have criticized deep investing as too mathematical and not sensitive enough to other factors that determine stock growth.

A stock valuation should include metrics such as a company’s competitive advantage or management and leadership.

The argument is that ignoring these kinds of aspects ultimately kneecaps your growth potential in the future.

Company quality

Remember that deep value investing is should rely on quantitative metrics, sometimes to the exclusion of other factors.

This can lead to the situation where you buy into a company that, on paper, has great financials and fundamentals, but in practice, is just not very good.

For people like Graham, this did not matter, as the earnings ratio per share was the most important valuation metric that he focused on.

Subjectivity

All investing is subjective at the end of the day; however, deep value investing seems to rely heavily on subjective notions of intrinsic value.

The problem is different deep value investors will gauge intrinsic value differently, and many would say that judging intrinsic value is something you can only get good at through practice and refinement of your intuition.

Deep Value Investing Pros

The irony is that, despite the fact that most of these companies are having major financial troubles, deep value stocks as a group are quite a low risk.

When bad news arrives, depressed companies have a lesser decrease than high-flying companies.

Many deep-value strategies can even weather some market downturns, giving a decent return for your portfolio even if the index is down.

This is why Jeremy Grantham advises you to ignore yield curves and instead focus on buying deep value.

Market declines are also on average lower, and recoveries from such drops are far faster; so deep value investment, on the whole, is less risky than buying any other type of value stock.

What Is the Difference Between Value Investing and Deep Value Investing?

Deep value investing and value investing share a common core, but differ in a matter of degrees.

Deep value investing can be seen as a kind of value investing that focuses on getting deep discounts on stock — regardless of the current business status.

In many ways, deep value investing is an extremely contrarian investment philosophy, as it actively seeks to find a company’s stock that has great value compared to its current stock price.

Value investing, in contrast, is much more conservative in its judgments and tends to focus on companies that present a good margin of safety.

Stocks that value investors pick might not be optimal according to the rest of the market, however, those that deep value investors choose are even less popular.

Deep Value Investing: Final Thoughts

Despite the notoriety it received and the massive quantity of research conducted in the field, its overperformance has not decreased.

We believe that as long as humans make investment decisions, they will continue to overreact to negative news and short-term financial performance.

As long as institutions handle the majority of the public’s capital, they will continue to favor “reasonably priced good companies” and dump the cheapest (and ugliest) equities, generating the opportunity.

For more information on Graham’s perspective, he co-authored a book named Security Analysis that details how to make long-term gains through this investment strategy.

How to Use Deep Value Investing

Deep value investing is an interesting approach to the stock market.

Investors can use a deep value investments strategy to get a large financial discount when they buy a stock with massive potential at a low price.

An intelligent investor can leverage this strategy to their advantage, but there are still risks.

A multiple ratio is of great use when it comes to estimating intrinsic value and comparing it to stock price.

At the end of the day, investing in deep value investment strategies is a good way to take advantage of a business that is trading for less money than its book value.

Tags:

Tags: