Curious about cryptocurrency trading bots, how they work, and if they are worth using? Read on to learn everything you need to know!

Have you recently entered the world of cryptocurrency trading?

Despite the extreme volatility of cryptos, an increasing number of investors have joined the trend of crypto trading.

Nevertheless, after gaining a certain amount of experience in this field, most investors become aware of their inability to react quickly to price changes to achieve the best trades.

They cannot dedicate themselves entirely to this market, as achieving the most profitable trades requires 24/7 monitoring of global exchanges.

Nevertheless, cryptocurrency trading bots can conduct trades and execute transactions on behalf of investors.

Here is everything you need to learn about cryptocurrency trading bots if you are interested in making profits.

What are Cryptocurrency Trading Bots?

In order to better understand the concept of cryptocurrency trading bots, you should first get familiar with the function of a bot and how they form a type of bot and Bitcoin union, if you will.

It’s an automated program operating on the internet and performing repetitive tasks instead of humans.

According to some estimates, approximately half of the web traffic consists of bots interacting with web pages.

Cryptocurrency trading bots rely on the same principle of operation. They are basically software programs that automate the process of crypto trading on behalf of traders.

There is no need for individuals to enter each trade manually, as these programs place trades automatically by accessing data from the exchange account of users.

Computers are in charge of managing the process, thus offering incredible speed and precision, which isn’t the case with humans.

Additionally, the trading strategies implemented by trading bots are based on algorithms that the application developer creates.

These programs automatically interpret and analyze market data, calculate market risks, and purchase/sell crypto assets.

How do Cryptocurrency Trading Bots Work?

Cryptocurrency trading bots place orders and access data on the exchange after being provided with access to a user’s account.

Such access is provided through the API public key and API private key of users.

These two keys inform the exchange that a bot is authorized by you to get hold of your account information.

API keys are necessary for services and applications outside the exchange to gain access to the features and data inside it.

Through these keys, trading bots are allowed to request market data, gather information on account funds, place trades on behalf of users, etc.

Unless API keys are provided to applications, no access is granted. Users remain in control of their accounts by being able to delete the API keys at any time.

Moreover, cryptocurrency trading bots get the job done in three stages.

During the first stage, the signal generator takes the role of a trader by identifying and predicting potential trades by relying on technical indicators and market data.

In the course of the risk allocation stage, bots distribute risk in accordance with specific parameters related to capital allocation.

The ultimate execution stage is when cryptocurrencies are purchased and sold based on the generated signals.

These signals have to be converted into a format that the crypto exchange understands, referring to API key requests.

Find out more about the usage and security of Application Programming Interface (API) keys.

Types of Trading Bots

There are various types of cryptocurrency trading bots, which can be customized to short-term or long-term investment plans.

Arbitrage crypto bots are unquestionably the most popular type, examining prices across crypto exchanges in order to make the most profitable trades.

These tools take advantage of the discrepancies between prices by automating the buying/selling process whenever there is a chance for making profits.

In contrast, trend trading bots consider the momentary status of an asset prior to executing an order for buying or selling.

When a trend indicates a price increase, the bot triggers a long position. Conversely, when a trend indicates a drop in price, the program triggers a short position.

Coin lending bots allow traders to lend coins by depositing money with a broker as security.

The loan is later returned with interest.

These bots automate the process, helping traders spend less time on getting the best interest rates.

Benefits of Trading Bots

Traders stand to gain from using cryptocurrency trading bots for a number of reasons.

It’s estimated that almost 80% of the trading that takes place on the stock market is performed via automated programs.

For instance, emotionless trading is just one of the numerous benefits.

Given the volatility of cryptocurrencies, it’s no wonder many private traders make errors in judgment by letting their emotions cloud their judgment.

In addition, manual trades are highly influenced by the emotional states of individuals, which leads to an outcome of making irrational decisions.

Fortunately, cryptocurrency trading bots take a non-emotional approach to trading and help traders earn more money.

Another advantage of using these automated programs is the improvement in speed. In the world of trading, time equals money.

Bots are undoubtedly much faster than humans, as they perform innumerable transactions and computations across different time zones immediately without wasting valuable time.

It takes a fraction of a second for trades to occur, meaning a program is much faster in making profitable trades than humans.

Moreover, these automated software programs take advantage of historical data to assess the viability of a given trading strategy instead of making predictions.

By determining how a given strategy performed in the past, traders become more confident when it comes to investing their money.

Risk diversification is another important benefit of using crypto bots. They strive to minimize risk by putting the eggs of traders in different baskets.

Cryptocurrency markets are infamous for their volatility, which is why risk diversification is always welcome.

By running multiple bots, risk can be diversified. Diversified portfolios make sure risk is balanced, and exposure to assets is reduced.

Discipline is of essential importance in trading, which can be achieved by process automation.

In spite of the volatility of these markets, bots provide consistent discipline.

For instance, fear prompts individuals to sell even when such a decision isn’t profitable.

In contrast, luck usually stimulates people to make purchases even though they weren’t planning to do so.

Efficiency is among the most important characteristics of these programs.

Traders no longer have to worry about human errors or delays.

As long as the programs receive proper data, they are capable enough to trade assets with good chances of making profits. Also, they work 24/7.

The Difference Between Humans and Trading Bots

Humans and trading bots differentiate in several aspects, such as longevity, speed, emotions, and capacity.

Regarding longevity, the latter is capable of operating 24/7, whereas humans are required to sleep and take some rest.

These programs are also superior when it comes to speed.

The magnitudes at which they operate are faster when compared to the thinking and reaction time of humans.

Regarding emotions, robots are neither driven by fear nor by greed.

Their actions are always based on statistics when calculating the likelihood to win. The same goes for their capacity. Bots are capable of processing gigabytes of data per single second.

In contrast, the brain of humans isn’t programmed to process such an amount of information during that timeframe.

All in all, the skillset of trading bots is much different from the skills of humans.

They are monotonous and consistent, which are absolutely necessary qualities to achieve success in the world of cryptocurrency trading.

Nevertheless, in some cases, humans are believed to outperform bots, especially when subjective thinking is concerned.

For instance, when implications take place, lateral thinking is often necessary to understand a given implication.

However, when the automated program reaches a subjective state, it usually makes a decision not to invest at all.

When to Use Trading Bots?

The possibilities of using these automated programs are endless.

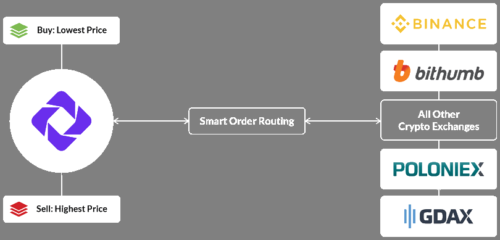

They can be used for managing portfolios, collecting data, smart order routing, rebalancing, etc.

The goal of traders should be to use such programs for completing complex, time-consuming tasks, which are too complicated or laborious to perform on their own.

Prior to looking for bots, you should consider the complexity of the trading tasks you perform on a daily basis.

Make sure to select the largest tasks that require automation in order to improve your performance.

For instance, repetitive tasks are the perfect assignments for cryptocurrency trading bots, as they have no problem with repetition.

Traders are exempt from performing repetitive tasks and have their portfolios automated.

Precision is another aspect in which these programs are considered superior to humans.

In trading, every move should be performed with utmost precision, which beginners don’t mind at first.

Inexperienced traders tend to move into and out of positions without making any special calculations.

Anyhow, as traders become more experienced, they start to understand the need to be precise.

Each trade is supposed to be selected carefully, as it has an impact on the overall performance of traders.

Let’s assume you plan to sell Dogecoin when Bitcoin’s price reaches exactly $80,000.

By doing this task manually, you are most likely to miss the mark and sell it when Bitcoin hits $80,010.

Although this strategy isn’t implemented badly, it still lacks the precision of bots.

These programs, on the other hand, have no issues when it comes to executing a precise strategy.

They monitor the market round the clock in order to execute trades when the moment is right. In terms of execution strategies, bots are the quickest, most reliable, and precise.

In addition, such automated programs are designed to perform time-consuming tasks.

Given the chaotic nature of life, individuals have no time to be at their computers every moment to ensure their portfolios are on track.

Portfolio rebalancing is performed every hour, taking at least fifteen minutes per rebalance or longer in the case of diversified portfolios.

Unlike humans, cryptocurrency trading bots have nothing better to do on their agendas.

Their job is to implement time-consuming strategies on behalf of traders.

They perform calculations and process trades in an instant, and most importantly, they never become tired of performing the same tasks all day long.

The most important thing to remember about the cryptocurrency market is that it never sleeps.

Exchanges don’t have a tendency to close down at nighttime. When a certain exchange goes down for updates and maintenance, hundreds of others are still performed online.

Consequently, traders aren’t able to monitor their portfolios 24/7.

The inability of traders to take action at any moment provides them with two alternatives, one of which is to handle the consequences of their inability to track their portfolios all the time.

The other one is automating their strategy with the help of trading bots.

The second option provides traders with greater peace of mind and helps them worry less about the potential scenarios.

As mentioned previously, complexity is another factor that prevents humans from implementing certain strategies.

Smart order routing can be taken as an example.

Each trading pair has to be monitored across the exchange to determine the optimal asset quantity, time, and trade price.

Also, time restrictions should be factored in to finish routing prior to the change in market conditions.

Then, trades are executed to complete the first order stage.

Cryptocurrency trading is a skill that gets developed through ongoing self-improvement and learning from past mistakes.

Nevertheless, even experienced traders find certain strategies too complicated to implement manually.

The most complex strategies have to be automated, as these are too complicated to perform manually.

Trading Algorithm Types

There are two types of algorithms used in cryptocurrency trades, momentum, and mean-reversion.

The momentum algorithm indicates prices are increasing, and they will most likely continue to do so.

In such scenarios, traders usually make purchases. The majority of momentum strategies don’t result in frequent wins. In case they do, the gains are relatively large.

Mean-reversion strategies mean prices have increased, but they are likely to decrease any time soon.

Selling assets is the logical decision traders make. The gains are more frequent but smaller.

Cryptocurrency Trading Bots: Final Thoughts

These automated programs facilitate the efforts of traders and increase their profit-making chances.

They can be extremely helpful when for more complex trading activities that may not be fully understood by the trader, but could prove to be lucrative.

There are plenty of reasons these bots have gained increased popularity in a short amount of time.

It doesn’t look like they are going anywhere anytime soon either.

Tags:

Tags: