The current climate of economic uncertainty has many investors eyeing alternative investments such as precious metals. Interest in one particular form of precious metals investing – a Gold IRA – has soared in the years since Gold IRAs were first approved by the federal government as part of the Taxpayer Relief Act of 1997.

Among the many factors driving Gold IRA investing are rapidly rising inflation and fear of a downside correction in the stock market.

As with any individual retirement account, there are government rules and regulations that govern how a Gold IRA must be set up and handled.

And as with any investment, there are both advantages and disadvantages of investing in a precious metals IRA.

This article will provide you with all the key “what you need to know about a Gold IRA” information – specifically, the seven things you should know before investing in a Gold IRA:

- Why to Invest in Gold

- What a Gold IRA is

- How to Invest in a Gold IRA

- IRS Rules for a Gold IRA

- Gold IRA investment costs

- Advantages of a Gold IRA

- Disadvantages of a Gold IRA

You can then make your own decision as to whether investing in a precious metals IRA is right for you.

Number One: Why Invest in Gold?

Going as far back as the beginning of recorded history, gold has been a treasured commodity, used as both a store of value and as a medium of exchange. Virtually every civilization and nation has minted gold and silver coins.

Gold is viewed as a more reliable store of value than the fiat currencies of today’s developed nations.

While a central bank such as the Federal Reserve Bank in the United States can print dollars at will, gold remains a scarce resource of which there is a limited supply.

A lesser-known fact about gold that has given it value since the industrial revolution is the fact that its electrical and thermal conductivity has made it a key ingredient in many different types of industrial production.

Investors have long used investments in gold as the preeminent hedge against inflation and also to hedge against stock market losses when a bear market hits.

It is widely used to diversify and balance an overall investment portfolio, as it has historically been negatively correlated with the overall stock market.

For example, when the overall stock market experienced a 38% drop between 2000 and 2002, gold rose in value by 18%.

Even more striking, when the 2008 financial crisis sent stocks tumbling approximately 20% over the next two years, the price of gold soared by nearly 80%.

Number Two: What is a Gold IRA?

A Gold IRA is a type of self-directed IRA that holds government-approved forms of gold bullion or gold coins.

It differs from other types of IRAs by holding physical assets, rather than paper assets such as stocks or bonds.

Like any other IRA, investors have to abide by the regulations set forth by the Internal Revenue Service (IRS) that govern things such as annual contribution limits and withdrawals.

It’s very important to follow all the IRS rules regarding precious metals IRAs in order to avoid tax penalties and to maintain the tax benefits afforded to IRA accounts.

A Gold IRA is the most popular kind of precious metals IRA. However, investors can also establish a precious metals IRA that holds silver, platinum, or palladium.

Number Three: How to Invest in a Gold IRA

Many major brokerage firms don’t offer self-directed IRAs.

Therefore, the most common method of investing in a Gold IRA is through a company that specializes in offering precious metals IRAs, such as Regal Assets.

These companies can guide you through the process of setting up your Gold IRA, and the vast majority are approved brokers through which you can purchase gold assets in the form of coins or bullion.

You can typically establish a Gold IRA and fund it (either with new investment capital or by rolling over funds from an existing IRA or other retirement account that you have) within just a matter of a few days.

Depending on the Gold IRA company you choose, they may be able to handle all the aspects of investing in a Gold IRA – purchasing gold coins and/or bullion, getting a custodian for the account, and setting up storage.

Regal Assets is such an “all in one” firm that can take care of all your Gold IRA needs in-house.

With other Gold IRA providers, you may need to contact third parties for custodial and/or storage services.

Directly, they may only offer IRS-approved forms of gold coins and bullion for you to purchase for your IRA.

Most Gold IRA companies have established partnerships with third-party service providers that they can refer you to if they don’t offer custodial or storage services in-house.

Number Four: The IRS Rules Governing Gold IRAs

Your Gold IRA must be carefully constructed and managed in order to qualify for the tax advantages that an IRA offers, to avoid possible tax penalties, and to be as tax efficient as possible.

There are IRS rules that govern contributions and withdrawals, required custodial services, gold storage, and types of gold that can be purchased for a Gold IRA.

- Contribution and Withdrawal Limits: First, there are annual contribution limits. As of 2022, the individual annual contribution limit is $6,000 for anyone age 49 or younger. If you’re age 50 or older, then you can contribute up to $7,000 per year to your Gold IRA. The withdrawal rules are the same as those for traditional IRAs. That is, any withdrawals prior to age 59 and a half are subject to a 10% tax penalty. Additionally, there are required annual minimum distributions (withdrawals) beginning at age 70 and a half.

- Requirement for a Custodian Trustee: The second requirement the IRS has is that you must use an approved custodian firm, which acts as a trustee on your behalf, to oversee the account. Since a Gold IRA is a self-directed IRA, you are the one who makes all buying, selling, or transfer decisions. The custodian is responsible for actually executing your decisions.

They also handle reporting and other administrative services. IRA custodian firms typically have partnerships established with precious metals coin and bullion dealers, financial advisors, and Gold IRA companies. You can either use in-house custodian services offered by your Gold IRA company, if available, or research precious metals IRA custodians on your own.

- Storage Regulations: The third IRS requirement is that your gold coins or bullion be stored in IRS-approved vaults or storage facilities. Two of the most widely used storage facilities are those provided by Brinks or by Delaware Depository. Again, your Gold IRA company may offer to set up storage for your gold directly, or they may refer you to an appropriate third party storage company.

- Approved Gold Investments: The fourth restriction that the IRS puts on Gold IRA accounts is that they can only hold coins or bullion that are on the IRS’ approved list. Essentially, the gold that you deposit into your Gold IRA must be at least 0.995 in purity. The same purity rule also holds true for platinum or palladium deposited in a precious metals IRA. The requirement for silver is even higher – minimum purity of 0.999. Gold IRA companies maintain a list of approved gold bullion and coins, as do many gold and bullion dealers even if they don’t handle Gold IRAs. You can also easily access online a current list of gold coins and bullion that are IRS-approved.

Number Five: Gold IRA Costs

You owe it to yourself to ensure that you keep your investment costs at a minimum and that you deal with trustworthy Gold IRA companies, custodians, and storage facilities.

Each aspect of setting up and maintaining a Gold IRA has its costs.

First, the Gold IRA company that you choose to work with to help you set up your IRA will charge setup and annual maintenance fees.

Gold coin and bullion dealers also charge fees, usually in the form of adding a small premium to the price of any coin or bullion that you buy.

They may also charge shipping fees.

IRA custodian firms charge setup and annual administrative fees. Some charge a flat-rate fee for their management services.

Other firms may charge a fee that represents a percentage of your holdings in your Gold IRA – which means that their fees would gradually increase, year by year, as the value of the gold in your account increases.

Finally, storage facilities that hold your gold also charge an annual fee for their services.

They also usually charge shipping fees when you make any withdrawals from your account.

Some Gold IRA companies that offer all Gold IRA services in-house – sales of gold bullion and coins, custodian services, and storage services. – may simply charge a setup fee and then a flat annual fee that includes custodian and storage services.

In any event, it pays to shop around for the best combination of high quality service with low fees, because transaction and maintenance fees add up over time, and whatever the total is reduces the net value of your precious metals investments.

Number Six: Advantages of a Gold IRA

There are several significant advantages that come with a Gold IRA.

- Tax Benefits: A key advantage to establishing a Gold IRA is that it offers a tax-advantaged means of investing in gold. The value gains in an IRA are tax-deferred until you make withdrawals.

- Portfolio Diversification: Other advantages a Gold IRA provides include the previously noted advantages that all gold investments offer. First, as an alternative asset, holding investments in gold diversifies your investment portfolio and, thus, offers some risk protection against downturns in other investments, such as equities.

- Inflation Hedge: Gold has a long-standing and well-established historical track record as a hedge against inflation. Through the centuries, gold has been the one asset that investors could rely on to increase in value as inflation erodes the purchasing power of fiat currencies.

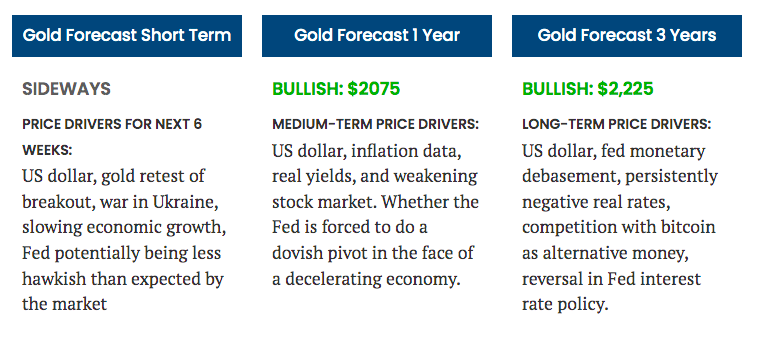

- High Investment Return Potential: Finally, market analysts predict that gold will likely enjoy a substantial increase in value within the next few years. Analyst projections for the price of gold per ounce average about $3,000, and many analysts predict a much higher price, in the range of $5,000 to $10,000.

Number Seven: Disadvantages of a Gold IRA

As with any investment choice you make, a Gold IRA has some disadvantages as well as advantages.

- Opportunity Cost: Opportunity cost is one potential disadvantage of investing in a Gold IRA – or any other IRA. Unless you’re willing to incur the tax penalties for early withdrawals from an IRA, then the funds you invest in your Gold IRA are tied up until age 59 and a half. If another, more promising investment comes along in the meantime, your Gold IRA represents capital that you can’t access to invest in any new investment opportunity.

- Doesn’t Provide Regular Income: Unlike stocks or bonds, investments in physical gold don’t offer the benefits of stock dividends or periodic interest payments.

- Investment Costs: Additionally, the administrative and storage fees charged with a Gold IRA may represent substantially higher transaction costs, as compared to some other investments.

Gold IRA Advantages and Disadvantages

|

Gold IRA Advantages |

Gold IRA Disadvantages |

| ✅ Tax Benefits | ❌ Opportunity Cost |

| ✅ Portfolio Diversification | ❌ No Regular Income |

| ✅ Inflation Hedge | ❌ Investment Costs |

| ✅ High Potential Return on Investment |

Summary

A Gold IRA is an increasingly popular retirement account investment choice.

It offers key advantages, including portfolio diversification and risk protection, exposure to investments that potentially offer very high returns, and tax benefits.

You may want to consult with your financial advisor for guidance on whether a Gold IRA, like one from Regal Assets, is a good investment option for you.

FAQ

Can I rollover money in an existing IRA to my Gold IRA?

Yes. In fact, that’s one of the most common forms of initially funding a Gold IRA. You can also rollover funds from a retirement account such as a 401(k) or an annuity.

Why is it important to only purchase IRS-approved gold coins or bullion for my account?

The reason it’s critically important to only purchase IRS-approved forms of gold is that it’s the only way to avoid being charged the much higher tax rate that applies to collectibles.

Author Bio: J.B. Maverick has followed one of the most diverse career paths in history – having worked as a commodities broker, a rape crisis counselor, a Zen meditation instructor, and a freelance writer. Since the turn of the century, in addition to being an active investor in stocks, futures, forex, and cryptocurrencies, he has concentrated his efforts on providing investor education. He has written hundreds of articles, blogs, and eBooks on personal finance and investing for dozens of different investor information websites, including Investopedia.com, and acted as an advisor and editor for the Financial Educators Council. Connect with J.B. Maverick on LinkedIn

Tags:

Tags: